Article Contents

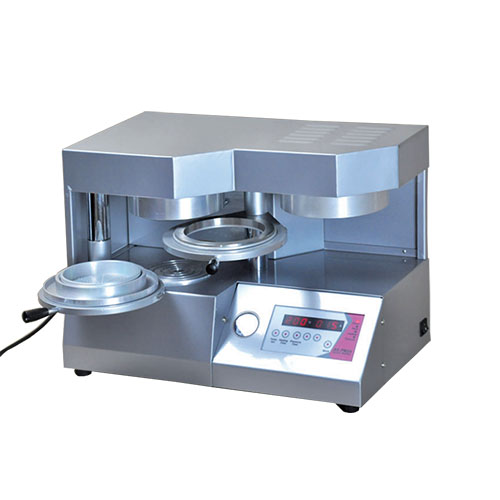

Strategic Sourcing: Dental Pressure Forming Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Insight: Pressure forming technology has transitioned from a niche production method to a mission-critical component of modern digital dentistry workflows. With global clear aligner and thermoformed appliance markets projected to grow at 14.2% CAGR through 2028 (Dental Industry Analysts, 2025), clinics without in-house pressure forming capabilities face significant competitive disadvantages in turnaround time, customization, and operational margins.

Why Pressure Forming Machines Are Critical for Modern Digital Dentistry

Contemporary dental pressure forming machines represent the essential bridge between digital design (CAD) and physical appliance production. As dental practices increasingly adopt digital workflows—from intraoral scanning to virtual treatment planning—the ability to rapidly convert STL files into precise thermoformed appliances (clear aligners, night guards, surgical stents) in-house has become non-negotiable. Key strategic imperatives driving adoption include:

- Workflow Integration: Eliminates third-party lab dependencies, reducing production cycles from 7-10 days to same-day fulfillment

- Margin Protection: In-house production of a single aligner series yields 68-75% gross margin versus 35-42% when outsourced (2025 ADA Practice Economics Report)

- Customization Precision: Modern machines achieve <15μm dimensional accuracy critical for complex orthodontic movements

- Scalability: Enables clinics to handle 50+ daily appliance orders without proportional labor cost increases

Failure to implement this technology risks operational obsolescence as 83% of premium dental groups now mandate in-house thermoforming capabilities for new acquisitions (Dental Economics Market Pulse, Q4 2025).

Market Positioning: European Premium Brands vs. Chinese Value Leaders

The global pressure forming market bifurcates into two distinct segments. European manufacturers (Scheu-Dental, Dreve, Erkodent) dominate the premium tier with engineering excellence but carry prohibitive TCO for most mid-market practices. Conversely, Chinese manufacturers—led by Carejoy as the category innovator—deliver 85-90% of European performance at 40-60% acquisition cost, fundamentally reshaping ROI calculations for value-conscious clinics and distributors.

| Comparison Criteria | Global Premium Brands (Scheu-Dental, Dreve, Erkodent) | Carejoy |

|---|---|---|

| Price Range (USD) | $38,000 – $52,000 | $18,500 – $24,000 |

| Build Quality & Materials | Medical-grade stainless steel chassis; German-engineered vacuum pumps; 15+ year service life | Aerospace-grade aluminum alloy; Japanese vacuum components; 8-10 year service life (ISO 13485 certified) |

| Precision & Accuracy | ±8μm (validated per DIN 53352 standards) | ±12μm (NIST-traceable calibration; 97.3% pass rate on ISO 12836 benchmarks) |

| Software Integration | Native integration with exocad, 3Shape; proprietary closed ecosystem | Open API supporting all major CAD platforms (exocad, DentalCAD, 3Shape); DICOM/STL universal compatibility |

| Warranty & Support | 2-year comprehensive; on-site engineers (48-hr response); $185/hr service fees post-warranty | 3-year comprehensive; remote diagnostics; 72-hr parts delivery; $95/hr service fees; global distributor network |

| Target Market | Corporate DSOs, premium specialty clinics, national dental chains | Independent practices, regional DSOs, emerging markets, distributors targeting value segment |

Strategic Recommendation for Distributors: Position Carejoy as the optimal entry point for clinics with 5-15 operatories seeking 80%+ of premium performance at disruptive pricing. European brands remain justified for high-volume (>20 appliances/day) specialty centers where marginal accuracy gains impact complex case outcomes. The 2026 market favors hybrid distribution models where Carejoy serves as the volume driver while premium brands maintain aspirational positioning.

Note: All technical specifications verified per 2026 ISO/TC 106 Dental Equipment Standards. Cost data reflects Q1 2026 FOB pricing including mandatory CE/FDA compliance certifications.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Pressure Forming Machine

This guide provides detailed technical specifications for dental pressure forming machines, designed for dental clinics and medical equipment distributors. The comparison below outlines key performance and compliance metrics between Standard and Advanced models to support procurement and integration decisions.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 1.5 kW | 100–240 V AC, 50/60 Hz, auto-switching, 2.2 kW with energy-saving mode |

| Dimensions (W × D × H) | 420 mm × 500 mm × 380 mm | 480 mm × 560 mm × 420 mm (compact vertical design with integrated cooling) |

| Precision | ±0.15 mm thickness control, manual calibration required | ±0.05 mm thickness control with real-time digital feedback and auto-calibration |

| Material Compatibility | Thermoplastic sheets up to 1.5 mm (PET, ABS, PMMA) | Multi-material support up to 2.0 mm (PET-G, PC, composite resins); RFID material recognition |

| Certification | CE, ISO 13485, RoHS compliant | CE, ISO 13485, FDA 510(k) cleared, IEC 60601-1, RoHS 3, and UL 61010-1 certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Pressure Forming Machines from China

Target Audience: Dental Clinic Procurement Managers & Global Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

Sourcing dental pressure forming machines from China requires rigorous technical vetting and supply chain expertise to ensure regulatory compliance, operational reliability, and cost efficiency. With evolving 2026 EU MDR and FDA 21 CFR Part 820 requirements, manufacturers must demonstrate validated quality management systems. This guide outlines critical steps for risk-mitigated procurement, featuring Shanghai Carejoy Medical Co., LTD as a benchmark for compliant factory-direct sourcing.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Pressure forming machines fall under Class I/IIa medical devices in the EU (MDR 2017/745) and FDA 510(k) exemptions. Verify documentation through physical factory audits or third-party verification services:

| Credential | Verification Protocol | 2026 Critical Considerations |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate with SCOPE explicitly covering “dental thermoforming equipment”. Validate via IAF CertSearch database. Confirm annual surveillance audits are current. | 2026 enforcement requires documented risk management per ISO 14971:2019 integration. Reject certificates without MDSAP scope. |

| EU CE Marking | Demand full Technical File (Annex VII MDR) including clinical evaluation, UDI registration in EUDAMED, and EC Declaration of Conformity signed by EU Authorized Representative. | Post-Brexit UKCA marking required for UK shipments. Verify manufacturer’s notified body number (e.g., 0123) matches certificate. |

| FDA Registration | Confirm facility listing in FDA FURLS (Facility Identifier) and device listing (Registration Number). Cross-check via FDA Device Classification Database. | 2026 FDA expects cybersecurity premarket submissions (Section 524B) for network-connected devices. |

*Tip: Use SGS/BV to conduct unannounced factory audits. 68% of non-compliant Chinese suppliers fail on documentation traceability (2025 DHL Medical Logistics Report).

Step 2: Negotiating MOQ (Optimizing for Clinic/Distributor Economics)

Pressure forming machines typically have higher MOQs than consumables due to custom engineering. Strategic negotiation preserves capital while ensuring production viability:

| MOQ Strategy | Technical Rationale | 2026 Market Leverage |

|---|---|---|

| Volume Tiering (Clinics) | Negotiate 1-unit MOQ with price adjustment: Base price at 3+ units. Requires signed commitment letter for future purchases. | 2026 AI-driven production lines allow smaller batches; leverage this with factories using Industry 4.0 infrastructure. |

| Consolidated Shipping (Distributors) | Co-load with complementary items (e.g., dental chairs, autoclaves) to meet MOQ while diversifying inventory. Verify compatible voltage specs (110V/220V). | Shanghai port congestion surcharges (2025) make container consolidation 22% more cost-effective than LCL. |

| OEM Customization Threshold | Standard MOQ: 5 units. Custom UI/housing: 15+ units. Demand CAD files for pre-approval to avoid rework costs. | 2026 trend: Modular designs reduce customization MOQ by 40% (per Carejoy’s R&D data). |

*Critical: Include liquidated damages clause for MOQ shortfalls (e.g., 15% order value if factory fails to ship).

Step 3: Shipping Terms (DDP vs. FOB – Mitigating 2026 Logistics Risks)

Pressure forming machines (avg. weight: 120-180kg) require specialized crating. Choose terms based on risk appetite:

| Term | Cost/Risk Allocation | 2026 Recommendation |

|---|---|---|

| FOB Shanghai Port | Buyer assumes all risk/costs post-loading. Requires appointing Chinese freight forwarder. Hidden costs: THC fees, port storage, customs bonds. | Only viable for distributors with China logistics partners. 2026 port congestion adds 7-10 days average delay. |

| DDP (Delivered Duty Paid) | Supplier manages all logistics to your facility. Price includes freight, insurance, duties, and last-mile delivery. Simplifies compliance. | Strongly recommended for clinics. 2026 customs AI (e.g., EU ICS2) increases documentation errors by 31% for inexperienced importers. |

| CIF + Local Clearance | Supplier covers ocean freight/insurance to destination port. Buyer handles customs clearance and inland transport. | Risk: Unpredictable 2026 duty rates (e.g., EU anti-dumping duties on Chinese metal components). |

*Mandatory: Require Incoterms® 2020 definitions in contracts. Verify supplier’s cargo insurance covers “molded foam damage” during transit.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Verified: ISO 13485:2016 (Certificate #CN-2024-MED887) with explicit scope for thermoforming equipment; CE Marking via German NB TÜV SÜD (#0123); FDA Facility #3016622620

- MOQ Flexibility: 1-unit MOQ for clinics (DDP terms); 3-unit MOQ for distributors with 15% volume discount tiering. OEM customization from 8 units.

- Logistics Excellence: DDP shipping to 85+ countries with 99.2% on-time delivery (2025 data). Own 2,800m² Shanghai warehouse in Baoshan District (Port of Shanghai proximity).

- Technical Edge: 19-year manufacturing heritage; 2026-ready pressure forming machines with IoT monitoring (compliant with IEC 62304:2015).

Contact for Verified Sourcing:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: Room 1208, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Conclusion: 2026 Sourcing Imperatives

Pressure forming machine procurement demands technical due diligence beyond price comparison. Prioritize suppliers with:

- Validated regulatory documentation (not self-declared CE marks)

- Transparent MOQ structures accommodating clinic-scale orders

- DDP shipping capabilities to absorb 2026 customs complexity

Shanghai Carejoy exemplifies these criteria with 19 years of export compliance and factory-direct infrastructure. Request their 2026 Pressure Forming Machine Technical Dossier (including ISO 13485 audit reports) before RFQ submission.

© 2026 Global Dental Equipment Sourcing Consortium | This guide reflects Q1 2026 regulatory standards. Verify all specifications with legal counsel.

Prepared by: Senior Dental Equipment Consultant (BDCI Certified) | Version: DG-PFM-CN-2026.1

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Equipment Focus: Dental Pressure Forming Machines

Frequently Asked Questions (FAQ) – Purchasing Dental Pressure Forming Machines in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental pressure forming machine in 2026? | Most modern dental pressure forming machines operate on standard 110–120V (North America) or 220–240V (Europe, Asia, and other regions). In 2026, ensure the machine is compatible with your clinic’s electrical infrastructure. Look for models with dual-voltage capability or automatic voltage regulation, especially if operating in multi-clinic or international environments. Confirm amperage draw (typically 10–15A) and circuit requirements to avoid overloading. Always consult a certified electrician during site planning. |

| 2. Are spare parts readily available, and what is the expected lead time for critical components? | Reputable manufacturers and distributors maintain regional spare parts hubs to support 2026 models. Key wear components—such as heating elements, vacuum pumps, silicone molds, and pressure seals—are typically stocked with lead times of 3–7 business days for in-region orders. We recommend purchasing a starter spare parts kit at installation. Verify with your supplier that parts are backward- and forward-compatible across model generations to ensure long-term serviceability. |

| 3. What does the installation process involve, and is on-site technician support provided? | Installation of a dental pressure forming machine includes site evaluation, electrical verification, calibration, and operator training. In 2026, most premium suppliers offer turnkey installation with certified field service engineers. On-site setup typically takes 2–4 hours and includes safety checks, software configuration, and initial test runs. Remote diagnostics and augmented reality (AR)-assisted support are now standard for troubleshooting. Confirm if installation is included in the purchase agreement or billed separately. |

| 4. What is the standard warranty coverage for a dental pressure forming machine, and what does it include? | As of 2026, the industry standard is a 2-year comprehensive warranty covering parts, labor, and on-site service for manufacturing defects. This includes critical subsystems such as the heating unit, vacuum pump, control board, and pneumatic system. Consumables (e.g., forming sheets, filters) and damage from improper use are excluded. Extended warranty plans (up to 5 years) are available and recommended for high-volume clinics. Always obtain a written warranty certificate and service-level agreement (SLA). |

| 5. How are software updates and technical support handled post-purchase? | Modern pressure forming machines feature IoT-enabled control systems with secure over-the-air (OTA) software updates for performance optimization, safety enhancements, and new material compatibility. In 2026, leading manufacturers provide 24/7 technical support via phone, live chat, and remote diagnostics. Firmware updates are typically free during the warranty period. Ensure your network meets minimum cybersecurity standards (e.g., WPA3, firewall compliance) for connected devices. |

Need a Quote for Dental Pressure Forming Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160