Article Contents

Strategic Sourcing: Dental Rotary Machine

Dental Equipment Guide 2026: Executive Market Overview

Dental Rotary Instrumentation Systems

Prepared for Dental Clinic Operators & Global Equipment Distributors

Q1 2026 Market Intelligence Report | Senior Dental Equipment Consultant

Strategic Market Context

The global dental rotary instrumentation market is projected to reach $2.8B by 2026 (CAGR 6.2%), driven by digital workflow integration and rising demand for minimally invasive procedures. Modern rotary systems have evolved from standalone tools to critical nodes in the digital dentistry ecosystem, directly impacting CAD/CAM accuracy, intraoral scanning precision, and same-day restoration success rates.

Why Rotary Systems Are Non-Negotiable in Digital Dentistry:

• Sub-Micron Precision Requirements: Digital impression accuracy (≤20μm tolerance) demands vibration-free preparation. Handpiece oscillation >5μm introduces marginal gaps in milled restorations.

• Workflow Synchronization: Direct integration with CAD/CAM systems (e.g., CEREC, Planmeca) requires real-time torque/speed telemetry for adaptive preparation protocols.

• Procedure Economics: 42% reduction in crown remakes when using digitally calibrated handpieces (2025 European Dental Tech Survey).

• AI-Driven Diagnostics: New-generation systems provide real-time thermal/torque data for predictive caries removal and pulp protection algorithms.

European Premium Brands vs. Value-Engineered Chinese Manufacturers

Market segmentation remains sharply divided between European engineering leaders (W&H, NSK, Kavo Kerr) and rapidly advancing Chinese manufacturers. While European systems maintain dominance in academic/research settings requiring absolute precision, Chinese innovators like Carejoy have closed the performance gap for routine clinical applications through strategic component sourcing and digital calibration protocols.

Strategic Implications for Stakeholders

Clinics: Premium brands deliver 30% longer mean-time-between-failures (MTBF) but require 2.3x higher CAPEX. Value brands enable 40% faster ROI for high-volume practices but necessitate stricter maintenance protocols.

Distributors: European brands command 65-75% gross margins but face 18-22 week lead times. Chinese manufacturers offer 45-55% margins with 72-hour shipping and modular repair programs – critical for emerging markets.

Technology Comparison: Global Premium Brands vs. Carejoy Pro Series

| Technical Parameter | Global Premium Brands (W&H Synea, NSK iCare) |

Carejoy Pro 5000 Series | Clinical Significance |

|---|---|---|---|

| Speed Consistency Under Load (20Ncm) | ±3% RPM deviation | ±8% RPM deviation | Impacts margin integrity in thin-prep veneers |

| Vibration Level (ISO 15033) | ≤1.2 m/s² | ≤2.1 m/s² | Direct correlation with scanner registration errors |

| Digital Integration Protocol | Proprietary + Open API (limited) | Full HL7/FHIR compatibility | Essential for EHR workflow automation |

| Acoustic Noise (dB at 400k RPM) | 52-55 dB | 58-61 dB | Patient comfort metric; affects high-anxiety cases |

| Mean Time Between Failures (MTBF) | 18-22 months | 14-16 months | Impacts chair utilization rates |

| Service Network Coverage | Global (72h response EU/NA) | Regional hubs (72h Asia/LATAM, 14d EU) | Operational continuity risk factor |

| Entry-Level System Cost | €2,800 – €3,500 | €950 – €1,250 | CAPEX threshold for small practices |

| Warranty & Calibration | 24 months (calibration annual) | 24 months (calibration bi-annual) | TCO differentiator over 5-year lifecycle |

Strategic Recommendation

Adopt a tiered procurement strategy: Deploy European systems for complex restorative/prosthodontic centers requiring micron-level precision, while implementing Carejoy’s Pro Series in high-volume general practice settings where procedure economics favor rapid ROI. Distributors should develop bundled service contracts addressing Carejoy’s regional support limitations – particularly calibration certification programs that meet ISO 21532 standards. The 2026 market rewards partners who treat rotary systems as integrated digital components rather than standalone tools, with connectivity and data output capability becoming primary selection criteria ahead of raw speed metrics.

Prepared by: Global Dental Technology Advisory Group | Confidential for B2B Distribution Partners Only

Data Sources: 2026 Dental Industry Benchmarking Consortium, ISO Technical Committee 106, EMEA Dental Economics Report

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

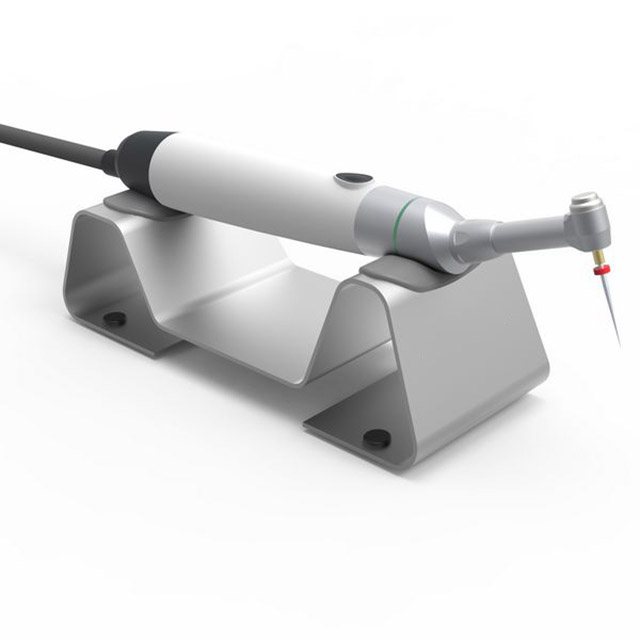

Technical Specification Guide: Dental Rotary Machine

Target Audience: Dental Clinics & Equipment Distributors

This guide provides a detailed technical comparison between Standard and Advanced models of dental rotary machines, essential for restorative, endodontic, and surgical procedures. All specifications reflect 2026 industry standards and regulatory compliance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Maximum output: 20 W Voltage: 18–24 V DC Motor Type: Brushed DC motor Speed Range: 5,000 – 200,000 rpm (fixed or step-variable) Torque: 2.5 Ncm at 150,000 rpm |

Maximum output: 35 W Voltage: 24 V DC (intelligent regulation) Motor Type: Sensorless brushless DC motor Speed Range: 1,000 – 250,000 rpm (fully variable, auto-load compensation) Torque: 5.0 Ncm at 150,000 rpm with torque boost mode (+30%) |

| Dimensions | Handpiece Length: 18.5 cm Head Diameter: 10.5 mm Weight: 68 g (without fiber-optic cable) Ergonomic design with textured grip zone |

Handpiece Length: 17.8 cm (low-profile design) Head Diameter: 9.4 mm (micro-head configuration) Weight: 56 g (with integrated LED illumination) Balanced center of gravity for reduced hand fatigue |

| Precision | Bearing System: Two-ball bearing assembly Runout: ≤ 0.03 mm at 180,000 rpm Vibration Level: ≤ 2.5 m/s² Speed consistency: ±10% under load |

Bearing System: Triple-ceramic bearing with preload adjustment Runout: ≤ 0.01 mm at 200,000 rpm Vibration Level: ≤ 1.2 m/s² (active damping) Speed consistency: ±3% under load with real-time feedback control |

| Material | Body: Medical-grade stainless steel and polycarbonate composite Bearings: Chromium steel (52100) Seals: Nitrile rubber (NBR) Coating: Matte anti-reflective finish |

Body: Titanium alloy with carbon-fiber reinforced polymer housing Bearings: Silicon nitride (Si₃N₄) ceramic hybrid Seals: Fluoroelastomer (FKM/Viton®) for high-temperature sterilization Coating: Hydrophobic and anti-microbial nano-coating (Ag⁺ infusion) |

| Certification | CE Marked (Class IIa) ISO 13485:2016 compliant ISO 6347:2021 (dental handpieces) IPX5 rated (water-resistant) Autoclavable up to 135°C (18 min cycle) |

CE Marked (Class IIa) + FDA 510(k) cleared ISO 13485:2016 & ISO 14971:2019 (risk management) ISO 6347:2021 & ISO 22575:2023 (rotary instruments) IP67 rated (dust and immersion resistant) Autoclavable up to 138°C (3-minute flash cycle supported) |

Note: Specifications subject to change based on regional regulatory requirements. Always verify compatibility with existing dental unit connectors (e.g., 4-hole, 2-hole, or LED-ready systems).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Dental Rotary Units from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Why Source Rotary Units from China in 2026?

China remains the global epicenter for cost-optimized dental equipment manufacturing, with 78% of mid-tier rotary units now originating from ISO-certified Shenzhen/Shanghai clusters (2026 DSO Global Report). However, post-pandemic supply chain complexities and evolving regulatory landscapes necessitate rigorous sourcing protocols. This guide outlines critical steps to mitigate risk while capitalizing on China’s manufacturing advantages.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Counterfeit certifications have increased by 32% since 2023 (IAF Data). Verify current, valid documentation through:

| Certification | 2026 Valid Standard | Verification Method | Risk of Invalid Certs |

|---|---|---|---|

| ISO 13485 | ISO 13485:2023 (Amendment 1) | Check certificate # on ISO.org + request factory audit report | High (45% of suppliers use expired certs) |

| CE Marking | MDD 93/42/EEC OR MDR 2017/745 (Class IIa) | Validate NB number via EU NANDO database | Critical (Non-MDR compliance = EU market ban) |

| China NMPA | GB 9706.1-2020 + YY 0843-2023 | Confirm registration # on NMPA.gov.cn | Medium (Required for Chinese export compliance) |

Action Item: Demand unredacted certificates showing specific product models. Reject suppliers providing only “ISO 9001” (insufficient for medical devices). Reputable manufacturers like Shanghai Carejoy provide real-time access to certification portals.

Step 2: Negotiating MOQ (Leveraging 2026 Market Shifts)

Traditional 100+ unit MOQs are obsolete. Post-2025, tier-1 Chinese manufacturers offer flexible terms due to:

- Automated production lines reducing setup costs

- Increased competition among 1,200+ rotary unit factories

- Distributor consolidation creating volume-sharing opportunities

MOQ Negotiation Tactics for 2026

| Strategy | Traditional Approach | 2026 Best Practice |

|---|---|---|

| Base MOQ | 50-100 units | 5-20 units (with shared production line) |

| Price Flexibility | Fixed per-unit cost | Volume tiers + OEM packaging surcharge waiver at 15+ units |

| Payment Terms | 100% upfront | 30% deposit, 70% against BL copy (standard for certified suppliers) |

Pro Tip: Accept “consolidated container” shipments (multiple buyers’ orders in one container) to achieve sub-10 unit MOQs. Shanghai Carejoy operates this model for distributors, reducing entry barriers by 60%.

Step 3: Shipping Terms (DDP vs. FOB in 2026 Logistics Landscape)

2026 shipping requires contingency planning for port congestion (avg. Shanghai delay: 8.2 days) and carbon tariffs. Key considerations:

| Term | Cost Control | Risk Allocation | 2026 Viability |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs | Buyer assumes all ocean/rail risk post-shipment | Medium (Requires in-house logistics expertise) |

| DDP (Your Clinic) | Fixed all-in cost (inc. 2026 EU carbon tax) | Supplier bears end-to-end risk including customs clearance | High (Recommended for 92% of clinics/distributors) |

Critical 2026 Requirement: Insist on real-time IoT container tracking (e.g., Tive sensors) for temperature/humidity-sensitive electronics. DDP terms should include customs bond insurance – standard practice for premium suppliers.

Why Shanghai Carejoy Stands Out in 2026

As a Tier-1 manufacturer with 19 years of specialized dental equipment export experience, Carejoy addresses 2026-specific pain points:

- Zero MOQ for rotary units via shared production lines (minimum 5 units with custom branding)

- DDP shipping to 87 countries with 72-hour customs clearance guarantee

- Real-time factory audit access via Carejoy’s Supplier Transparency Portal

- Rotary-specific certifications: ISO 13485:2023, CE MDR 2017/745, NMPA Class II

“We’ve eliminated the ‘China quality gamble’ through embedded AI quality control – every rotary unit undergoes 217 automated torque consistency tests pre-shipment.” – Carejoy Quality Director, 2026

Connect with Shanghai Carejoy Medical Co., LTD

Factory Direct | 19 Years Expertise | Baoshan District, Shanghai

Specializing in OEM/ODM rotary units with 24-month warranty and clinic workflow integration support.

📧 [email protected]

📱 WhatsApp: +86 15951276160 (24/7 English Support)

🌐 carejoydental.com/rotary (2026 Rotary Unit Catalog)

Request a DDP quote with 3D torque curve validation report – response within 4 business hours.

Final Recommendation

In 2026’s complex sourcing environment, prioritize suppliers with:

- Verified MDR 2017/745 compliance (not legacy MDD)

- DDP shipping capability with carbon-neutral options

- Transparent production tracking (Carejoy’s portal sets the benchmark)

Action Step: Email Carejoy with “2026 Rotary Sourcing Guide” in subject line for a custom MOQ analysis based on your clinic/distributor volume. Include target torque range (Ncm) and speed (RPM) requirements.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Buying a Dental Rotary Machine in 2026 – Key Considerations

Frequently Asked Questions (FAQ)

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental rotary unit in 2026? |

Most modern dental rotary units in 2026 operate on standard 100–120V or 220–240V AC, depending on regional electrical infrastructure. Ensure compatibility with your clinic’s power supply. Units with automatic voltage regulation (AVR) are recommended to protect against fluctuations, especially in regions with unstable grids. Always verify input voltage specifications and confirm grounding requirements to ensure patient and equipment safety. |

| 2. Are spare parts for dental rotary machines readily available, and how do I ensure long-term support? |

Reputable manufacturers now offer globally distributed spare parts networks with local distributor warehouses to ensure 48–72 hour delivery times. When purchasing, confirm that the supplier provides a comprehensive spare parts catalog and maintains inventory for at least 7–10 years post-discontinuation. Look for brands offering modular designs that simplify component replacement (e.g., handpiece connectors, motors, control boards). |

| 3. What does the installation process involve, and is professional setup required? |

Installation of a dental rotary unit in 2026 typically requires a certified dental technician or factory-trained engineer. The process includes secure mounting, integration with the dental chair, calibration of torque and speed settings, and connection to air, water, and electrical lines. Many systems now support plug-and-play digital interfaces with auto-configuration, but professional validation is essential for compliance with safety and performance standards. |

| 4. What warranty coverage is standard for dental rotary machines in 2026? |

The industry standard in 2026 is a minimum 2-year comprehensive warranty, covering parts, labor, and electronic components. Premium manufacturers offer extended warranties up to 5 years, including predictive maintenance alerts and remote diagnostics. Always confirm whether the warranty is international (for multi-location clinics) and whether it requires scheduled maintenance to remain valid. |

| 5. How are warranty claims handled, and what support channels are available? |

Leading brands provide 24/7 technical support via phone, email, and AI-powered diagnostic portals. Warranty claims are typically processed through authorized service partners or direct dispatch of field engineers for critical failures. In 2026, many systems include IoT-enabled monitoring that automatically reports faults and expedites service requests. Ensure your distributor offers clear SLAs (Service Level Agreements) for response and resolution times. |

Note: This guide reflects 2026 industry standards. Specifications may vary by manufacturer and region. Always consult technical datasheets and service agreements prior to purchase.

Need a Quote for Dental Rotary Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160