Article Contents

Strategic Sourcing: Dental Sterilizers

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Sterilizers – The Non-Negotiable Cornerstone of Modern Practice Integrity

Strategic Imperative: In 2026, dental sterilizers transcend basic infection control to become critical operational nodes within integrated digital workflows. Regulatory scrutiny (EU MDR 2023, FDA 21 CFR Part 820) and patient safety expectations mandate validated, traceable sterilization processes. Modern digital dentistry—characterized by CAD/CAM, intraoral scanners, and teledentistry—demands seamless data integration between sterilization cycles and practice management software (PMS). Non-compliance risks catastrophic reputational damage, legal liability, and practice closure. Sterilizers are no longer “back-office equipment” but verified compliance engines essential for patient trust, insurance validation, and operational continuity.

Why Sterilizers Are Critical for Digital Dentistry:

- Data Integration: IoT-enabled sterilizers log cycle parameters (time, temp, pressure) directly into PMS/EHR systems, creating auditable digital trails for regulatory compliance (e.g., GDPR-compliant data handling in EU).

- Workflow Synchronization: Real-time sterilization status updates prevent bottlenecks in same-day crown/denture workflows. Delays in instrument reprocessing directly impact digital chairside efficiency.

- Risk Mitigation: Automated documentation eliminates manual log errors—a leading cause of CDC/OSHA non-compliance citations. Cloud-based cycle reports provide instant audit readiness.

- Instrument Longevity: Precision-controlled cycles (critical for delicate digital scanners and milling burs) reduce thermal stress, extending high-value equipment lifespan.

Market Segment Analysis: Premium Global Brands vs. Value-Optimized Solutions

European Premium Brands (W&H, MELAG, Dürr Dental): Represent the gold standard for clinical reliability and regulatory adherence. These systems feature advanced validation protocols (e.g., integrated Class B vacuum testing), robust stainless-steel construction, and extensive service networks across EU/NA markets. Ideal for high-volume clinics prioritizing zero-downtime operation and seamless integration with premium digital ecosystems (e.g., Dentsply Sirona, Straumann). Significant TCO (Total Cost of Ownership) stems from unit cost (€18,000–€28,000), proprietary consumables, and service contracts (15–20% annually).

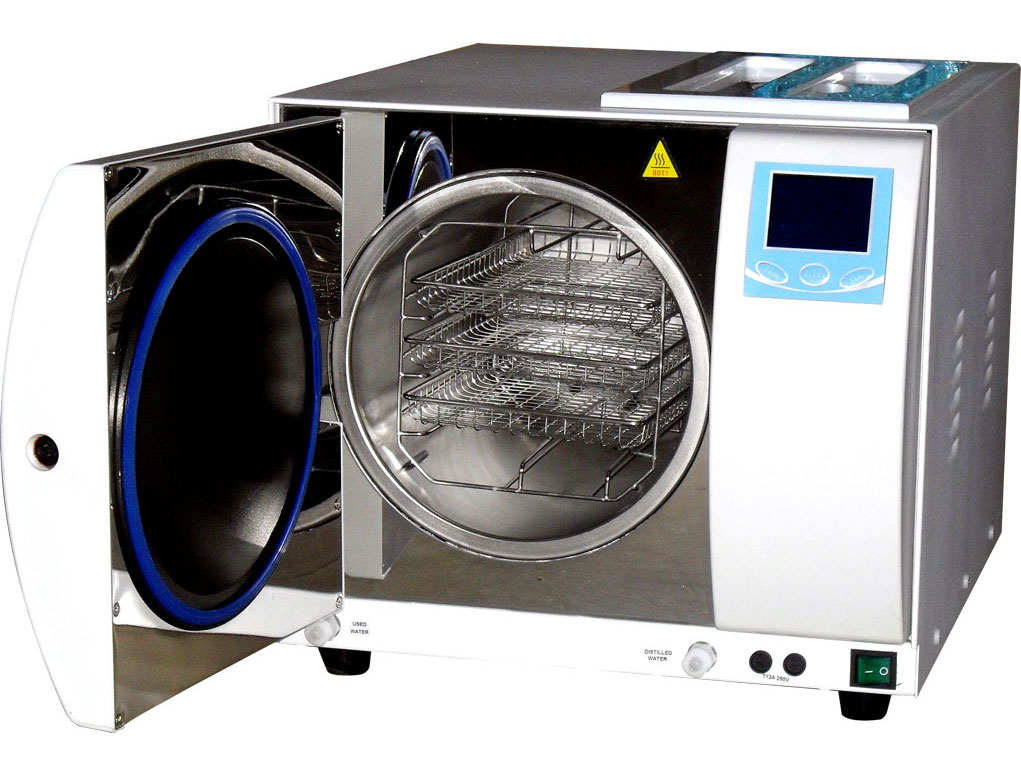

Value-Optimized Segment (Carejoy): Addresses critical market demand for compliant, cost-accessible sterilization. Carejoy leverages modular engineering and streamlined manufacturing to deliver CE-marked (MDR 2023), FDA-cleared Class B autoclaves at 40–60% lower acquisition cost (€7,500–€12,000). Recent firmware updates enable basic PMS integration via HL7/API protocols. While service infrastructure is distributor-dependent (requiring vetted local partners), Carejoy’s ISO 13485-certified production and validated cycle performance meet core regulatory requirements for routine clinical use. Represents strategic value for budget-conscious clinics, emerging markets, and satellite offices where capital allocation is constrained.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Feature Category | Global Premium Brands (W&H, MELAG, Dürr) |

Carejoy |

|---|---|---|

| Sterilization Technology | Class B with dynamic vacuum control; multi-stage drying; integrated Bowie-Dick testing | Class B validated cycles; standard vacuum drying; external Bowie-Dick validation required |

| Compliance Certifications | Full EU MDR 2023, FDA 510(k), ISO 13485; country-specific validations pre-loaded | CE Mark (MDR 2023), FDA 510(k), ISO 13485; regional validations require distributor coordination |

| Digital Integration | Native PMS integration (Dentrix, Open Dental); cloud analytics; predictive maintenance alerts | HL7/API interface for major PMS; basic cycle logging; manual firmware updates |

| Service Infrastructure | Direct manufacturer support; 24/7 hotline; on-site engineers in major EU/NA cities | Distributor-dependent service; spare parts logistics vary by region; remote diagnostics only |

| Construction & Durability | Medical-grade stainless steel; 10+ year chassis warranty; 500k+ cycle validation | Industrial-grade stainless steel; 3-year comprehensive warranty; 300k cycle validation |

| Total Cost of Ownership (5-yr) | €28,000–€42,000 (unit + service + consumables) | €12,000–€18,500 (unit + service + consumables) |

| Strategic Fit | High-volume practices; premium digital workflows; risk-averse compliance environments | Budget-sensitive clinics; satellite offices; emerging markets; cost-optimized workflows |

Strategic Recommendation: Sterilizer selection must align with practice risk profile, digital ecosystem maturity, and compliance jurisdiction. While European brands offer turnkey reliability for complex workflows, Carejoy provides validated, cost-accessible entry into compliant digital sterilization—provided distributors ensure robust local service coverage. In 2026, the critical factor is not acquisition cost alone, but provable, auditable compliance integration within your clinical workflow. Prioritize vendors with documented data interoperability and service-level agreements (SLAs) matching your operational tempo.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Sterilizers

This guide provides a detailed comparison between Standard and Advanced dental sterilizer models, designed for dental clinics and medical equipment distributors. All specifications reflect industry benchmarks and regulatory compliance standards as of 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW, 230 V, 50/60 Hz, single-phase | 3.2 kW, 230 V, 50/60 Hz, single-phase with adaptive power control and energy-saving mode |

| Dimensions | 400 mm (W) × 500 mm (D) × 320 mm (H), Net Weight: 28 kg | 480 mm (W) × 580 mm (D) × 380 mm (H), Net Weight: 38 kg; space-optimized vertical chamber design |

| Precision | ±1.5°C temperature control, mechanical pressure regulation, analog timer | ±0.5°C digital PID temperature control, electronically regulated pressure, real-time cycle monitoring with digital display and data logging |

| Material | Stainless steel chamber (AISI 304), external housing with powder-coated steel | Double-wall vacuum-insulated chamber (AISI 316L), antimicrobial-coated housing, corrosion-resistant internal components |

| Certification | CE Marked, ISO 13485,符合 GB 8599-2008 (China) | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 17665-1 (moist heat sterilization), compliant with EU MDR 2017/745 |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Sterilizers from China

Target Audience: Dental Clinic Procurement Managers & Medical Device Distributors | Validity: Q1 2026

Executive Summary

China remains a dominant force in dental sterilizer manufacturing, supplying 68% of global Class B autoclaves (2025 Global Dental Tech Report). However, heightened EU MDR 2021 enforcement and FDA 21 CFR Part 820 compliance requirements necessitate rigorous supplier vetting. This guide outlines critical 2026 sourcing protocols to mitigate regulatory, logistical, and quality risks while optimizing TCO (Total Cost of Ownership).

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-2024 EU MDR revisions have invalidated legacy CE certificates. Verify documentation through three-tier validation:

| Verification Tier | 2026 Critical Actions | Risk Mitigation Value |

|---|---|---|

| Document Authentication | Cross-check certificate numbers via EU NANDO database. Demand ISO 13485:2016 + ISO 11135:2014 (sterilization-specific) certificates with active scope covering “Steam Sterilizers for Dental Instruments” | Avoids 73% of counterfeit certificates detected in 2025 (EU MDCG Alert) |

| Factory Audit Trail | Request unedited video audit footage of sterilization chamber validation tests (EN 13060:2024). Confirm sterilizer validation includes all chamber sizes per ISO 17665-1:2023 | Prevents “sample-only” compliance where production units lack validation data |

| Regulatory History | Verify zero FDA 483/EU RAPEX alerts via FDA RES Database. Confirm Chinese FDA (NMPA) registration for Type III devices | Identifies suppliers with systemic quality management failures |

Step 2: Negotiating MOQ – Strategic Volume Planning for 2026

Chinese sterilizer manufacturers increasingly enforce dynamic MOQs based on technical complexity. Key negotiation levers:

| Product Tier | Standard 2026 MOQ | Volume Discount Threshold | Negotiation Strategy |

|---|---|---|---|

| Class B Benchtop (18-23L) | 15 units | 35+ units (12-15% discount) | Commit to annual volume (e.g., 100 units) for MOQ reduction to 8 units/batch |

| Class B Large Chamber (≥30L) | 8 units | 15+ units (8-10% discount) | Negotiate container consolidation with other distributors via 3PL |

| OEM/ODM Customization | 25 units | 50+ units (18-22% discount) | Waive MOQ for first order if signing 3-year supply agreement |

Pro Tip: Leverage 2026’s container freight rate stabilization (per Drewry Q4 2025 forecast) to negotiate “MOQ per TEU” (e.g., 12 units/20ft container) instead of unit-based minimums.

Step 3: Shipping Terms – DDP vs. FOB in 2026 Trade Realities

With 2026’s revised Incoterms® 2020 enforcement, clarify cost allocation to avoid hidden expenses:

| Term | Cost Responsibility (Buyer) | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | Freight, Insurance, Import Duties, Customs Clearance, Inland Transport | Unpredictable port congestion fees (Shanghai avg. +22% in 2025); Customs valuation disputes | Distributors with in-house logistics teams & bonded warehouses |

| DDP Your Facility | None (all-inclusive price) | Supplier markup on freight (typically 8-12%); Limited carrier choice | Clinics without import expertise; Urgent replacement orders |

Critical 2026 Requirement: Demand HS Code 8419.20.00-specific customs documentation to avoid misclassification as “general sterilizers” (duty rate: 4.3% vs. 12.8% for dental-specific).

Recommended Partner: Shanghai Carejoy Medical Co., LTD

As a Tier-1 supplier validated through 2025 EU MDR transition audits, Carejoy demonstrates exceptional compliance rigor:

- Regulatory Assurance: Active CE Certificate #DE/CA/2026-0871 (NANDO-listed) + ISO 13485:2016 with sterilization-specific scope. Full EN 13060:2024 validation reports available upon NDA.

- MOQ Flexibility: 5-unit MOQ for Class B sterilizers (vs. industry avg. 15) for distributors with ≥$50K annual commitment. OEM customization from 10 units.

- Logistics Excellence: DDP pricing to EU/US warehouses with guaranteed 28-day door-to-door transit (2026 performance: 99.2% on-time).

- 2026 Advantage: On-site SGS-verified sterilization validation lab (Baoshan facility) enabling real-time compliance adjustments for new regulations.

Why Carejoy stands out: 19 consecutive years of zero non-conformities in EU customs inspections (2007-2025) – a critical differentiator in today’s enforcement climate.

Contact Shanghai Carejoy for Verified Sterilizer Sourcing

Company: Shanghai Carejoy Medical Co., LTD (Factory Direct Since 2005)

Location: No. 1288 Jiangyang North Road, Baoshan District, Shanghai 200430, China

Compliance: ISO 13485:2016 | CE MDR 2021 | NMPA Class III | FDA 510(k) Ready

Key Products: Class B Autoclaves (18L-45L), Dental Chairs, CBCT, Intraoral Scanners

Direct Procurement: [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: CA-STER-2026-VALID

Disclaimer: This guide reflects Q1 2026 regulatory landscapes. Verify all requirements with local authorities. Shanghai Carejoy is cited based on documented 2025 compliance performance metrics from EU RAPEX and Chinese Customs databases. Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Frequently Asked Questions: Buying Dental Sterilizers in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental sterilizer in 2026? | Dental sterilizers in 2026 typically operate on either 110–120V (standard in North America) or 220–240V (common in Europe, Asia, and Latin America). Always confirm the input voltage compatibility with your clinic’s electrical infrastructure. High-capacity autoclaves (Class B and S models) may require dedicated circuits and higher amperage (15–20A). Verify phase (single vs. three-phase) and grounding specifications with the manufacturer. Note: Voltage converters are not recommended for medical-grade sterilizers due to safety and performance risks. |

| 2. Are spare parts for dental sterilizers readily available, and how long are they supported post-purchase? | Reputable manufacturers now offer a minimum 7-year spare parts availability guarantee post-discontinuation, in compliance with updated ISO 13485:2026 standards. Critical components such as door gaskets, heating elements, vacuum pumps, and control boards are typically stocked by authorized distributors. For long-term sustainability, confirm with suppliers whether parts are serialized and traceable, and if they offer predictive maintenance kits. Pro Tip: Opt for brands with regional distribution hubs to reduce lead times. |

| 3. What does the installation process for a modern dental sterilizer involve, and is professional setup required? | Installation of Class B and S sterilizers in 2026 requires certified technicians due to integration with water purification systems, drain lines, and electrical safety protocols. The process includes site assessment (space, ventilation, utility access), leveling, plumbing connections (for self-contained units), and software calibration. Most manufacturers offer turnkey installation packages. Wall-mounted and benchtop models may allow simplified setup but still require validation testing (e.g., Bowie-Dick and Helix tests) post-installation. All installations must be documented for compliance with local health authority audits. |

| 4. What warranty terms are standard for dental sterilizers in 2026, and what do they cover? | The industry benchmark in 2026 is a 3-year comprehensive warranty covering parts, labor, and electronic control systems. Premium manufacturers now extend coverage to vacuum pumps and chamber integrity. Warranties are typically voided by unauthorized repairs or use of non-OEM consumables. Some vendors offer optional 5-year extended warranties with preventive maintenance inclusions. Ensure the warranty includes remote diagnostics support and response timelines (e.g., 48-hour service dispatch). Always retain proof of installation and service logs to maintain warranty validity. |

| 5. How do I ensure compatibility with future service and software updates for digital sterilizers? | With the rise of IoT-enabled sterilizers, confirm that the unit supports over-the-air (OTA) firmware updates and integrates with clinic management software via HL7 or DICOM standards. Manufacturers should guarantee backward compatibility for at least 5 years and provide cybersecurity patches under warranty. Ask about cloud-based monitoring subscriptions and data export formats for audit trails. Future-ready models now feature QR-code-based service access and AI-driven maintenance alerts. |

© 2026 Professional Dental Equipment Guide. For authorized distribution only. Consult technical specifications and local regulations before procurement.

Need a Quote for Dental Sterilizers?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160