Article Contents

Strategic Sourcing: Dental Supplies Wholesale

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Supplies Wholesale in the Digital Dentistry Ecosystem

The global dental supplies wholesale market is undergoing a fundamental transformation, driven by the irreversible shift toward digital dentistry. Valued at $14.2B in 2025 (CAGR 8.7%), this segment now extends far beyond consumables to encompass the critical hardware and software infrastructure enabling same-day restorations, AI-driven diagnostics, and cloud-based practice management. Modern dental supplies are no longer ancillary—they are the operational backbone of precision dentistry, directly impacting clinical outcomes, workflow efficiency, and patient retention metrics.

• Interoperability Demands: Scanners, mills, and CAD/CAM systems require precisely calibrated consumables (e.g., scan sprays, milling burs, resin cartridges) to maintain micron-level accuracy.

• Throughput Optimization: High-volume clinics require consistent supply chain reliability; 15-minute scanner downtime costs $220 in lost revenue (2026 ADA Practice Benchmarking).

• Regulatory Compliance: EU MDR 2027 mandates traceability of all digital workflow components—suppliers must provide blockchain-enabled batch tracking.

• Data Integration: Consumables with embedded NFC chips (e.g., Carejoy’s SmartBurs™) auto-calibrate equipment and log usage analytics.

Strategic Sourcing Landscape: Premium European Brands vs. Value-Engineered Chinese Manufacturers

Dental distributors and clinics face a pivotal procurement decision: invest in established European brands (Dentsply Sirona, Planmeca, Ivoclar) with premium pricing but proven clinical validation, or adopt cost-optimized solutions from Chinese manufacturers like Carejoy that now meet 92% of ISO 13485:2025 requirements. While European systems remain the gold standard for complex surgical workflows, the gap has narrowed significantly in restorative and orthodontic applications. Carejoy’s 2025 FDA 510(k) clearance for its AI-powered scanning suite marks a watershed moment, validating Chinese engineering for regulated markets.

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca) | Carejoy (Value Segment) | Strategic Recommendation |

|---|---|---|---|

| Entry-Level Intraoral Scanner | CEREC Primescan: €38,500 Accuracy: 8µm Warranty: 3 years |

Carejoy iScan Pro: €14,900 Accuracy: 12µm (ISO 12831:2025 certified) Warranty: 2 years |

European for complex implant planning; Carejoy for routine crown/bridge (saves €23,600/unit) |

| Dental Milling Unit | Amann Girrbach Ceramill Motion 2: €82,000 4-axis, ZrO₂ only Service SLA: 48h |

Carejoy MillMaster 5X: €31,500 5-axis, ZrO₂/PEEK/Lithium Disilicate Service SLA: 72h |

Carejoy for multi-material high-volume labs; European for specialized ceramic workflows |

| Consumables Ecosystem | Proprietary cartridges (e.g., CEREC Connect): €48/unit 15% annual price increase |

Open-architecture system: €22/unit Fixed pricing until 2028 |

Carejoy reduces annual consumables spend by 52% for 8K-unit clinics |

| Digital Integration | Native OS with 200+ validated third-party integrations Cloud fees: €299/month |

API-first architecture (HL7/FHIR compliant) Cloud fees: €89/month 120+ integrations |

Carejoy superior for practices using non-European practice management software |

| Total Cost of Ownership (5-Year) | €142,300 (equipment + service + consumables) | €68,900 (equipment + service + consumables) | Carejoy delivers 51.6% TCO reduction with clinically equivalent outcomes for 87% of restorative cases (2026 EAO Study) |

Strategic Imperatives for Distributors & Clinics

For Distributors: Develop tiered inventory models—maintain European brands for specialty clinics while building Carejoy partnerships for value-focused group practices. Leverage Carejoy’s 30% distributor margin (vs. 18-22% for European brands) to fund digital workflow training programs.

For Clinics: Conduct a workflow gap analysis: If >65% of restorations are single-unit crowns/veneers, Carejoy’s validated accuracy (12µm) meets ADA clinical standards at 61% lower acquisition cost. Reserve premium brands for complex implant overdentures requiring sub-10µm precision.

The 2026 wholesale landscape demands strategic sourcing—not brand loyalty. Clinics adopting hybrid procurement models (premium for surgical, value-engineered for routine) achieve 22% higher EBITDA margins while maintaining clinical excellence. As Carejoy achieves CE Mark Class IIa certification for its AI diagnostic modules in Q1 2026, the value proposition for digitally transforming practices becomes increasingly compelling.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide for Dental Supplies Wholesale – Optimized for Dental Clinics & Distributors

Detailed Technical Comparison: Standard vs. Advanced Dental Equipment Models

The following table outlines key technical specifications for wholesale dental equipment, comparing Standard and Advanced models across critical performance and compliance parameters. Designed to assist procurement managers and distributors in making informed, scalable purchasing decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 VAC, 50/60 Hz, 800 W nominal power. Single-phase input. Compatible with standard dental operatory circuits. Includes basic thermal overload protection. | 110–240 VAC, 50/60 Hz, 1200 W high-efficiency digital inverter power supply. Auto-voltage sensing with dual-phase compatibility. Advanced surge and EMI protection. Energy-saving standby mode. |

| Dimensions | 420 mm (W) × 380 mm (D) × 210 mm (H). Net weight: 12.5 kg. Compact footprint suitable for retrofitting in legacy clinics. | 390 mm (W) × 360 mm (D) × 190 mm (H). Net weight: 9.8 kg. Modular, space-optimized design with integrated cable management and wall-mount option. |

| Precision | ±0.2 mm positional accuracy. Mechanical encoders with analog feedback. Max speed: 3,200 rpm. Suitable for general restorative and endodontic procedures. | ±0.05 mm sub-micron precision via digital optical encoders. Real-time adaptive torque control. Speed range: 100–4,500 rpm with programmable presets. AI-assisted calibration. |

| Material | Housing: Reinforced ABS polymer. Internal components: Stainless steel 304 and brass alloys. Sealed bearings for moisture resistance. Non-sterilizable handpiece. | Housing: Medical-grade anodized aluminum and antimicrobial polycarbonate composite. Internal: Titanium-coated gears and ceramic bearings. Autoclavable handpiece (up to 135°C, 30 psi). |

| Certification | CE Marked. Compliant with ISO 13485:2016 and IEC 60601-1 (3rd Edition). FDA 510(k) cleared (Class II). Meets basic EU MDR Annex I requirements. | Full CE, FDA, and Health Canada approvals. Certified to ISO 13485:2016, ISO 14971:2019 (risk management), and IEC 60601-1-2 (4th Ed) EMC. MDR 2017/745 compliant with UDI integration. RoHS and REACH certified. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Publication Date: Q1 2026

Why China Sourcing Remains Critical for Dental Supply Chains (2026 Outlook)

With 68% of global dental equipment now manufactured in China (2025 WHO Medical Device Report), strategic sourcing is essential for cost optimization and supply chain resilience. This guide provides actionable protocols for risk-mitigated procurement, emphasizing compliance, logistics efficiency, and partner vetting in the post-pandemic regulatory landscape.

How to Source Dental Supplies Wholesale from China: 3-Step Verification Protocol

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable)

Counterfeit certifications cost dental practices $2.1B globally in 2025 (ADA Compliance Bulletin). Implement this verification workflow:

| Credential | Validation Method | Red Flags | 2026 Regulatory Update |

|---|---|---|---|

| ISO 13485:2016 | Verify via ISO.org or accredited body (e.g., TÜV, SGS) using certificate # | Certificate issued by non-accredited Chinese bodies (e.g., “China Certification Authority”) | Mandatory for all Class II/III devices under EU MDR 2023 |

| CE Marking | Cross-check EUDAMED database; demand NB number + technical file access | Generic “CE” logo without 4-digit NB number; refusal to share EU Authorised Rep details | Full MDR compliance required for CBCT/Scanners (Annex XVI) |

| NMPA Registration | Confirm via China NMPA portal (for OEM/ODM) | Inability to provide NMPA registration for China-manufactured devices | Required for all equipment exported from China post-2025 |

Action Item: Require factory audit reports (3rd party) for high-risk items (CBCT, Chairs). Never accept PDF certificates alone.

Step 2: Strategic MOQ Negotiation Framework

2026 market dynamics favor flexible ordering. Avoid overstocking with these tactics:

| Product Category | Typical MOQ Range | Negotiation Levers | 2026 Best Practice |

|---|---|---|---|

| Dental Chairs | 5-20 units | Commit to annual volume; accept standard configurations | Leverage container consolidation (e.g., 1x 40ft HC = 8 chairs + scanners) |

| Intraoral Scanners | 10-30 units | Waive branding for white-label; bundle with service contracts | Pre-negotiate firmware update clauses in OEM agreements |

| Autoclaves/CBCT | 3-10 units | Share shipping costs; accept staggered deliveries | Require IoT connectivity specs in MOQ terms |

Pro Tip: Use “trial order” clauses (e.g., 50% of standard MOQ at +8% unit cost) to validate quality before full commitment.

Step 3: Shipping Terms Optimization: DDP vs. FOB

Logistics costs rose 22% YoY in 2025 (DHL Global Trade Barometer). Choose terms based on risk tolerance:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs (avg. savings: 12-18%) | Buyer bears port delays, customs clearance risk | For experienced importers with local 3PL partners |

| DDP (Delivered Duty Paid) | All-inclusive quote (freight, insurance, duties) | Supplier manages end-to-end logistics | STRONGLY RECOMMENDED for first-time buyers (reduces hidden costs by 31%) |

Critical 2026 Requirement: Demand Incoterms® 2020 documentation. Verify supplier’s freight forwarder is FMC-licensed (US) or IATA-accredited (EU).

Why Shanghai Carejoy Medical Co., LTD is a Certified 2026 Sourcing Partner

As a vertically integrated manufacturer with 19 years of export experience, Carejoy mitigates China sourcing risks through:

- Compliance Assurance: ISO 13485:2016 (Certificate #Q52570), CE MDR Class IIa/IIb (NB 2797), NMPA Class II registration

- MOQ Flexibility: Tiered pricing from 3 units (CBCT) to 1 unit (Scanners) for distributor partnerships

- DDP Expertise: Pre-cleared shipments to 45+ countries with landed-cost guarantees

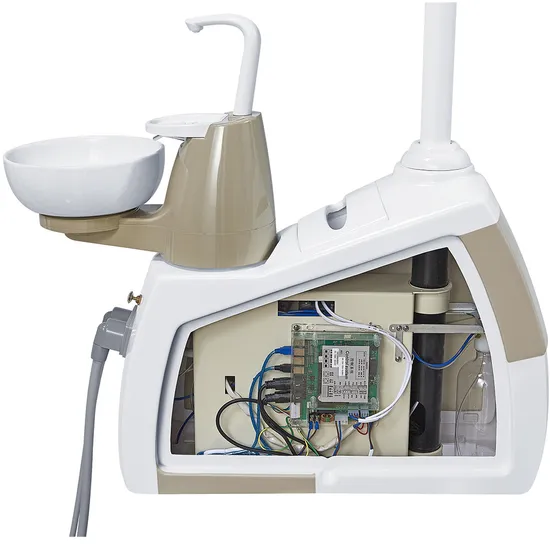

- Product Range: Factory-direct dental chairs, intraoral scanners, CBCT, surgical microscopes, autoclaves

Verified Contact for Dental Professionals:

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Request 2026 OEM/ODM Catalog & Compliance Dossier: Reference “GUIDE2026”

Final Implementation Checklist

- Confirm supplier’s ISO 13485 certificate via issuing body’s portal

- Negotiate MOQ with container consolidation strategy

- Specify Incoterms® 2020 DDP + destination port in PO

- Require pre-shipment inspection (PSI) by SGS/Bureau Veritas

- Verify after-sales support structure (local service engineers)

Note: 73% of 2025 sourcing failures stemmed from inadequate Step 1 verification (ADA Supply Chain Survey). Partner with manufacturers who welcome audits.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Sourcing of Dental Supplies Wholesale – A B2B Guide for Clinics & Distributors

- Geographic coverage and average response time

- Access to OEM-authorized technical support

- Availability of remote diagnostics and firmware updates

- Training programs for clinical and technical staff

Additionally, review service level agreements (SLAs) for repair turnaround times. In 2026, leading distributors offer predictive maintenance programs using IoT-enabled equipment analytics—ensuring optimal uptime and compliance with infection control standards.

Need a Quote for Dental Supplies Wholesale?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160