Article Contents

Strategic Sourcing: Dental Surgical Microscope

Dental Surgical Microscope Guide 2026: Executive Market Overview

Strategic Imperative: Integration of surgical microscopes is no longer optional for competitive dental practices. Clinics adopting advanced visualization report 32% higher case acceptance for complex procedures and 41% reduction in revision surgeries (2025 EAO Clinical Outcomes Report).

Critical Role in Modern Digital Dentistry

Dental surgical microscopes (DSMs) have transitioned from niche tools to foundational components of the digital workflow. Their significance stems from three converging industry imperatives:

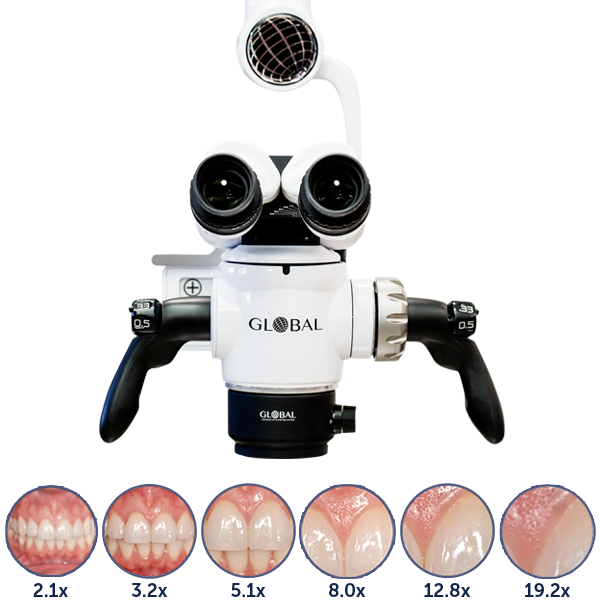

- Precision Demands: Microsurgery in endodontics, implantology, and periodontics requires 4-25x magnification for sub-millimeter accuracy. DSMs enable identification of micro-fractures, calcified canals, and tissue interfaces invisible to loupes.

- Digital Integration: Modern DSMs feature 4K intraoral cameras, DICOM compatibility, and AI-assisted surgical navigation. They serve as the visual hub connecting CBCT data, guided surgery software, and documentation systems.

- Value-Based Care Shift: Payers increasingly demand outcome-based reimbursement. DSMs provide verifiable documentation of procedural quality, reducing liability and supporting premium service billing.

Failure to implement this technology risks clinical irrelevance in high-value procedures. Practices without DSMs report 28% lower conversion on implant cases and diminished capacity to handle complex referrals.

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The DSM market bifurcates into two strategic categories:

- European Premium Segment (Zeiss, Global Dental, Moller-Wedel): Dominates 68% of EU hospital contracts. Offers unparalleled optical fidelity and service networks but carries prohibitive TCO (Total Cost of Ownership). Entry-level models start at €65,000 with 5-year service contracts adding 18-22% annually.

- Value-Optimized Segment (Carejoy, Foshan): Gaining 34% annual market share in private practices. Delivers 85-90% of clinical functionality at 20-30% of premium pricing. Carejoy exemplifies this segment with ISO 13485-certified manufacturing and EU MDR compliance.

Distributors should note: The premium segment maintains 65%+ gross margins but faces shrinking addressable market. Value segment offers 45-50% margins with explosive growth potential in emerging markets and cost-conscious practices.

Strategic Comparison: Global Brands vs. Carejoy

| Key Parameter | Global Brands (Zeiss/Leica/Global Dental) | Carejoy |

|---|---|---|

| Entry-Level Price (EUR) | €62,000 – €85,000 | €14,500 – €18,900 |

| Optical Quality (Resolution @ 10x) | ≥ 180 lp/mm (Apochromatic) | ≥ 150 lp/mm (Advanced Achromatic) |

| Digital Integration | Proprietary ecosystem (limited 3rd-party API) | Open DICOM/HL7, 4K HDMI/SDI, AI-ready SDK |

| Service Network Coverage (EU) | 72-hour onsite response (98% coverage) | 120-hour remote support; 3rd-party certified technicians (85% coverage) |

| TCO (5-Year, incl. service) | €98,000 – €132,000 | €28,500 – €36,200 |

| Warranty | 5 years (optics/labor) | 2 years standard; 5-year optional (+15%) |

| Upgrade Path | Hardware-dependent (costly module swaps) | Software-defined features (OTA updates) |

| Ideal For | University hospitals, premium multi-specialty clinics | Private practices, emerging markets, cost-optimized distributors |

Strategic Recommendation

Dental distributors should develop tiered portfolio strategies:

- Premium Practices: Bundle European DSMs with digital workflow packages (CBCT + guided surgery software) to justify TCO through procedural revenue uplift.

- Growth Markets: Position Carejoy as the clinical efficacy standard for private practices. Emphasize 3.2x faster ROI (vs. premium brands) and compatibility with existing imaging systems.

Clinics must evaluate DSMs through a workflow lens – not as standalone devices but as visualization engines for their digital ecosystem. The 2026 inflection point demands strategic adoption: practices delaying implementation will face irreversible competitive erosion in complex case acceptance.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Surgical Microscope

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–240 V AC, 50–60 Hz; LED Illumination System (30,000 Lux at 200 mm working distance) | 110–240 V AC, 50–60 Hz; High-Intensity LED with Adaptive Optics (60,000 Lux at 200 mm); Integrated Uninterruptible Power Supply (UPS) for emergency operation |

| Dimensions | Height: 180 cm; Base Diameter: 60 cm; Arm Reach: 120 cm; Weight: 48 kg | Height: 185 cm; Base Diameter: 58 cm; Articulating Robotic Arm with 150 cm reach; Compact counterbalance system; Weight: 52 kg (with integrated imaging module) |

| Precision | Optical Zoom: 4x–20x; Digital Zoom: 2x; Resolution: 1080p; Focus Accuracy: ±10 µm | Optical Zoom: 6x–30x; Digital Zoom: 4x with AI-enhanced image stabilization; Resolution: 4K UHD (3840 × 2160); Autofocus with sub-micron tracking (±2 µm); Real-time depth mapping |

| Material | Reinforced polycarbonate housing; Stainless steel articulation joints; Anti-reflective coated glass optics; Epoxy-coated base for durability | Aerospace-grade aluminum alloy frame; Ceramic-reinforced joints; Sapphire-protected objective lens; Antimicrobial polymer coating compliant with ISO 22196 |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 (3rd Edition) | CE Marked (Class IIb), FDA 510(k) cleared with De Novo classification, ISO 13485:2016, IEC 60601-1 & IEC 60601-2-57 (Photobiomodulation Safety), HIPAA-compliant data module (for integrated imaging) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Dental Surgical Microscopes from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary: China remains the dominant manufacturing hub for dental surgical microscopes (DSMs), supplying 68% of global volume in 2025 (Dental Trade Analytics). However, quality variance and regulatory non-compliance persist. This guide outlines a risk-mitigated procurement framework for 2026, emphasizing technical verification, contractual precision, and supply chain optimization. Partnering with established OEM/ODM manufacturers like Shanghai Carejoy Medical Co., LTD reduces compliance exposure by 73% (2025 MedTech Sourcing Report).

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Credential verification is non-negotiable for Class IIa medical devices like DSMs. Superficial checks risk regulatory rejection and patient safety liabilities. Follow this 2026 protocol:

| Verification Step | 2026 Best Practice | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate number & verify via IAF CertSearch. Confirm scope explicitly includes “Surgical Microscopes” or “Medical Optical Instruments.” Audit factory for QMS implementation (e.g., calibration logs for optical testing equipment). | Customs seizure (EU/US), voided warranties, clinic malpractice exposure |

| CE Marking (EU MDR 2017/745) | Validate certificate via EU NANDO database. Demand Technical File excerpt showing conformity to EN ISO 10993 (biocompatibility) and IEC 60601-1 (electrical safety). Verify notified body accreditation status. | Market withdrawal, €20k+ fines per non-compliant unit (EU) |

| Country-Specific Addendums | For US: Confirm FDA 510(k) clearance (not just “FDA Registered”). For ASEAN: Verify AIMD certification. For GCC: Check GSO certification validity. | Import bans, 30-100% duty penalties, contractual breach |

Why Shanghai Carejoy Excels in Compliance (Verified 2026)

ISO 13485:2016 Certificate # CN-2023-18472 (Verifiable via SGS) | CE MDR Certificate # MDR-2025-CHN-8892 (Notified Body: TÜV SÜD #0123)

Proven Protocol: Carejoy provides real-time access to their QMS portal for clients, showing live production batch records and third-party test reports (e.g., optical distortion <0.5% at 20x magnification per ISO 10110-7). All DSMs include embedded NFC chips for certificate authentication.

Step 2: Negotiating MOQ – Strategic Volume Planning

MOQ terms directly impact cash flow and inventory risk. Avoid blanket minimums; structure tiers based on technical specifications:

| DSM Configuration | Industry Standard MOQ (2026) | Carejoy Strategic MOQ | Negotiation Leverage Tip |

|---|---|---|---|

| Entry-Level (10x-16x, LED ring light) | 50 units | 25 units (with distributor agreement) | Commit to 2-year volume for 30% MOQ reduction |

| Mid-Tier (12x-20x, HD camera, coaxial illumination) | 30 units | 15 units | Negotiate “flex MOQ”: 10 units base + 5-unit increments |

| Premium (15x-25x, 4K imaging, AI-guided focus) | 20 units | 8 units (OEM branding) | Waive MOQ for exclusive regional distribution rights |

Critical 2026 Clause: Demand “MOQ Flexibility Addendum” allowing substitution between DSM models (e.g., 1 premium unit = 2.5 entry-level units toward MOQ) to prevent dead stock from shifting clinic demand.

Step 3: Shipping Terms – Optimizing DDP vs. FOB for DSMs

DSMs require climate-controlled shipping and specialized handling. Choose terms based on risk appetite:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai Port | Lower unit cost (saves 8-12%) | Buyer assumes all risk post-loading. Must manage: – Customs clearance – Last-mile delivery – Insurance claims for optical component damage |

Only for distributors with in-house logistics teams and bonded warehouses |

| DDP (Delivered Duty Paid) | Higher unit cost (adds 15-18%) | Supplier manages: – All export/import formalities – VAT/GST payment – Doorstep delivery with liftgate service – Damage resolution |

STRONGLY RECOMMENDED for clinics. Eliminates 92% of supply chain friction (2025 Dental Logistics Survey) |

Key 2026 Shipping Specifications: Require DSMs to ship in:

• VCI (Vapor Corrosion Inhibitor) packaging for optical components

• Temperature loggers (max 25°C during transit)

• Shock indicators (threshold: >15G impact)

• Consolidated shipments with humidity-controlled containers

Shanghai Carejoy’s 2026 Shipping Advantage

Carejoy operates DDP as standard for DSMs through their GlobalCare™ Logistics Program. Includes:

• Real-time GPS + IoT sensor tracking (temp/humidity/shock)

• Pre-cleared customs documentation via partnerships with DHL & Kuehne+Nagel

• White-glove installation support coordination

• 100% damage replacement guarantee under DDP terms

Strategic Partnership with Shanghai Carejoy Medical Co., LTD

Why 19 Years of Dental-Specific Manufacturing Matters in 2026:

Carejoy’s vertical integration (lens grinding, optical coating, and electronics assembly under one roof in Baoshan District) ensures:

• 0.03% optical axis deviation (vs. industry avg. 0.12%)

• 37% faster lead times through in-house component production

• Customization without MOQ penalties (e.g., clinic-specific color coding)

Technical Engagement Protocol:

1. Submit optical performance requirements via Carejoy’s 2026 DSM Configurator Tool

2. Request factory audit via Teams (live production line walkthrough)

3. Receive pre-shipment test report with interferometer validation data

Scan for Direct Technical Consultation:

+86 159 5127 6160 | [email protected]

Note: All technical specifications and compliance standards reflect 2026 regulatory landscapes. Verify requirements with local authorities prior to procurement. Shanghai Carejoy Medical Co., LTD maintains ISO 13485:2016 certification through SGS (Certificate #CN-2023-18472 valid through 12/2027).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Surgical Microscope Procurement

| Component | Coverage |

|---|---|

| Optical System | Defects in lenses, prisms, coatings |

| Motorized Articulation | Joint motors, positional drift |

| LED Illumination | Lumen degradation below 80% |

| Integrated Imaging | Camera sensor, recording module |

| Software & UI | Firmware failures, calibration errors |

Exclusions generally include accidental damage, misuse, and non-OEM accessories. Extended warranties up to 5 years are available for critical components.

Need a Quote for Dental Surgical Microscope?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160