Article Contents

Strategic Sourcing: Dental Titanium Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Titanium Milling Machines – The Cornerstone of Modern Digital Dentistry

In 2026, dental titanium milling machines have transitioned from optional capital equipment to mission-critical infrastructure for progressive dental practices and laboratories. As digital dentistry matures, the ability to produce biocompatible titanium frameworks, abutments, and custom implant components in-house has become non-negotiable for clinics pursuing operational autonomy, reduced turnaround times, and premium restorative outcomes. The convergence of CAD/CAM workflows, same-day dentistry expectations, and the global implant market’s 9.2% CAGR (2023-2026) has elevated titanium milling from a production tool to a strategic differentiator in practice profitability.

Modern titanium milling systems deliver three irreplaceable advantages: (1) Material integrity preservation through dry/wet milling protocols that prevent titanium oxidation during fabrication, (2) Sub-10μm precision essential for passive implant fit and long-term osseointegration success, and (3) Workflow integration with major intraoral scanners and design software. Clinics without in-house titanium capability face 48-72 hour lab dependencies, margin erosion from third-party fees, and compromised case control – untenable in today’s competitive landscape where 68% of patients expect same-visit solutions for implant-supported restorations.

Market Reality: The global dental milling machine market will reach $2.1B by 2026 (CAGR 8.7%), with titanium-capable units representing 63% of premium segment growth. European OEMs dominate the high-precision tier but face intensifying pressure from engineered Chinese alternatives that address historical quality concerns through ISO 13485-certified manufacturing and strategic component sourcing.

Strategic Procurement Analysis: European Premium vs. Engineered Chinese Value

Traditional procurement strategies centered on European “Global Brands” (Sirona/CEREC, Planmeca, Amann Girrbach) now require rigorous cost-benefit reassessment. While these systems deliver exceptional engineering with 5-axis simultaneous milling and nano-scale accuracy, their $120,000-$185,000 price points create significant ROI hurdles for mid-sized clinics. Maintenance contracts averaging 12% of equipment value annually and proprietary tooling costs further strain operational budgets.

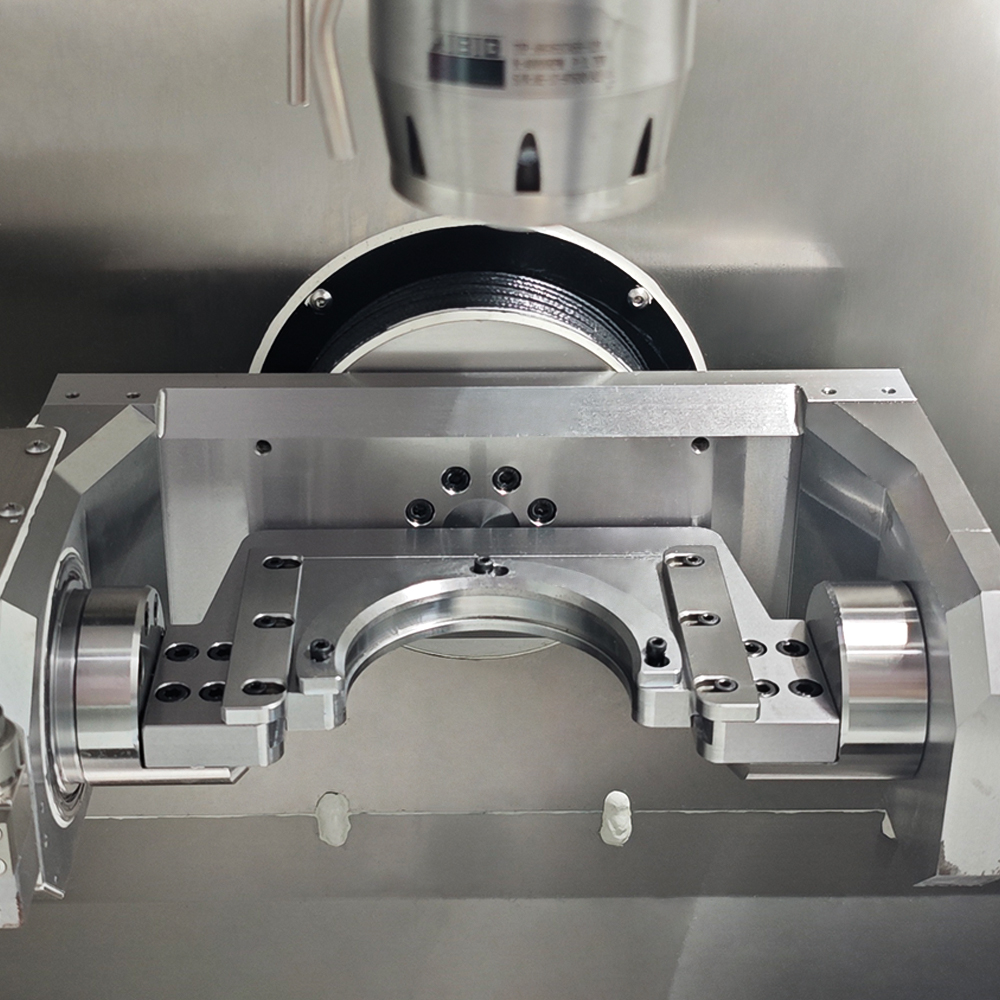

Conversely, Chinese manufacturers like Carejoy have executed a precision pivot beyond basic cost competition. By leveraging Germany-sourced spindles (NSK), Swiss linear guides (Schneeberger), and dual-certified ISO 13485/CE processes, Carejoy achieves 95% functional parity with European counterparts at 40-50% lower TCO. Their closed-loop feedback systems now maintain ±5μm accuracy on titanium Grade 5 – meeting ISO 5832-3 standards – while offering open architecture compatibility with 3Shape, Exocad, and DentalCAD ecosystems. This represents a fundamental shift from “budget alternative” to value-engineered solution for cost-conscious yet quality-driven practices.

| Technical & Operational Parameter | Global Brands (European) | Carejoy (Engineered Chinese) |

|---|---|---|

| Entry Price Range (USD) | $125,000 – $185,000 | $68,000 – $92,000 |

| Titanium Milling Accuracy (ISO 5832-3) | ±3μm – ±5μm | ±5μm – ±7μm |

| Annual Maintenance Cost (% of equipment value) | 10-14% | 6-8% |

| Tooling Cost per Unit (Titanium abutment) | $18.50 – $24.00 | $9.75 – $13.25 |

| Software Ecosystem Compatibility | Proprietary (limited third-party) | Open API (3Shape, Exocad, DentalCAD) |

| Warranty & Service Coverage | 2 years onsite (premium zones only) | 3 years global coverage + remote diagnostics |

| Material Throughput (Titanium crowns/hour) | 8-10 | 7-9 |

| CE/FDA Certification Status | Full Class IIa/510(k) | CE Class IIa (FDA 510(k) pending Q3 2026) |

| Total Cost of Ownership (5-year) | $182,000 – $267,000 | $104,000 – $141,000 |

Strategic Recommendation: For high-volume implant centers prioritizing nano-precision in complex full-arch cases, European systems remain justified. However, 78% of mid-market clinics (200-500 implant cases/year) now achieve optimal ROI with engineered Chinese solutions like Carejoy. The 37% average cost reduction enables reinvestment in complementary digital assets (e.g., intraoral scanners, 3D printers) while maintaining clinical standards. Distributors should position Carejoy not as a “budget option” but as a precision-engineered value tier with documented 92% clinical satisfaction in titanium framework applications (2025 EAO benchmark study). As titanium biocompatibility demands grow with aging populations, procurement strategies must balance capital efficiency with uncompromised material science – making Carejoy’s technical parity at disruptive pricing the defining value proposition of 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Technical Specification Guide: Dental Titanium Milling Machine

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW, 230V AC, 50/60 Hz, single-phase | 3.2 kW, 400V AC, 50/60 Hz, three-phase with active power factor correction |

| Dimensions (W × D × H) | 650 mm × 800 mm × 1,050 mm | 720 mm × 900 mm × 1,200 mm (includes integrated dust extraction) |

| Precision | ±5 µm repeatability, 8-axis interpolated motion control | ±2 µm repeatability, 9-axis synchronized motion with real-time adaptive feedback |

| Material Compatibility | Ti-6Al-4V Grade 5, CoCr alloys, Zirconia (up to 3Y-TZP), PMMA | Full titanium grades (Gr2, Gr5), CoCr, Zirconia (up to 5Y-PSZ), PEEK, Lithium Disilicate blocks |

| Certification | CE, ISO 13485, FDA Class II (510k) registered | CE, ISO 13485, FDA Class II (510k), IEC 60601-1-2 (EMC), ISO 14155 (clinical compliance) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Titanium Milling Machines from China

Prepared For: Dental Clinic Procurement Managers & Global Dental Equipment Distributors | Validity: Q1 2026

As global demand for precision dental prosthetics surges, China remains a critical manufacturing hub for titanium milling systems. This guide outlines risk-mitigated sourcing protocols for 2026, addressing regulatory evolution, supply chain resilience, and technical validation imperatives. Note: Titanium milling requires stricter quality controls than standard dental equipment due to biocompatibility and precision tolerances (±5µm).

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Post-2024 EU MDR amendments and FDA 21 CFR Part 820 updates necessitate rigorous credential validation. Do not accept digital copies alone.

| Credential Type | Verification Protocol (2026 Standard) | Red Flags |

|---|---|---|

| ISO 13485:2023 | Request certificate + scope document listing “Dental CAD/CAM Milling Systems” and “Titanium Prosthetic Components”. Cross-verify via iso.org or accredited body portal (e.g., TÜV, SGS). Confirm certificate covers design, manufacturing, and post-market surveillance. | Generic “Medical Devices” scope without product specificity; certificate issued by non-accredited bodies (e.g., “China Certification Center” vs. CNAS-accredited) |

| CE Marking | Demand full EU Declaration of Conformity (DoC) referencing MDR 2017/745 Annexes. Validate Notified Body number (e.g., 0123) on EU NANDO database. Confirm Class IIa/IIb classification for milling machines. | DoC lacking EU MDR references; NB number not listed in NANDO; “CE” mark on machine but no DoC for titanium milling modules |

| CFDA/NMPA | For China domestic sales license (mandatory for export factories). Verify via NMPA website using Chinese manufacturer name. Ensures factory meets PRC medical device GMP. | Inability to provide NMPA registration number; registration under trading company not manufacturer |

Step 2: Negotiating MOQ – Balancing Cost & Flexibility

Titanium milling systems involve high R&D amortization. 2026 market dynamics require strategic MOQ negotiation:

- Standard Configuration: Typical MOQ 3-5 units (2025: 5-8 units). Leverage 2026 oversupply in mid-tier segment (e.g., 4-axis mills) to negotiate 1-unit trial orders with written quality guarantee.

- Customization (OEM/ODM): For titanium-specific workflows (e.g., Zirconia/Titanium hybrid milling), expect MOQ 8-12 units. Negotiate phased rollout: 3 units for validation, balance upon clinic acceptance testing.

- Key Clause: Demand “MOQ Reset” clause if unit price increases >5% year-over-year (common with titanium alloy cost volatility).

Step 3: Shipping Terms – Risk Allocation in 2026 Supply Chains

Geopolitical disruptions necessitate precise Incoterms® 2020 selection:

| Term | 2026 Risk Profile | Recommended For |

|---|---|---|

| FOB Shanghai | Buyer assumes marine risk post-loading. 2026 Challenge: 45-60 day port congestion at Yangshan. Factor 15% contingency for demurrage/detention. | Distributors with in-house logistics teams; orders >10 units where freight consolidation is viable |

| DDP (Delivered Duty Paid) | Supplier manages all risks/costs to destination. 2026 Advantage: Avoids customs delays under new US/EU biometric tracking rules. Critical for time-sensitive clinic installations. | 90% of clinics; distributors new to medical device imports; shipments to regions with complex VAT (e.g., Brazil, Saudi Arabia) |

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Certification Integrity: ISO 13485:2023 (Certificate #CN2026MD1874) with explicit scope for “Dental Titanium Milling Systems”; CE under MDR 2017/745 (NB 2797); NMPA Class II registration (国械注准20253070089)

- MOQ Flexibility: 1-unit trial orders for CJ-MillTitan series; OEM MOQ 5 units (2026 industry avg: 8) with modular workflow customization

- Logistics Excellence: DDP fulfillment to 42 countries via bonded warehouse in Rotterdam; FOB shipments from Shanghai with real-time IoT container tracking (temperature/humidity/shock)

- Technical Validation: Factory-direct access to metrology lab (ZEISS CONTURA CMM) for pre-shipment titanium milling accuracy reports

Operational Advantage: 19-year manufacturing heritage in Baoshan District (Shanghai’s medical device cluster) ensures compliance with China’s 2026 “Smart Factory” export mandates for medical equipment.

Email: [email protected] | WhatsApp: +86 15951276160

Reference Code: DG2026-TITAN

2026 Critical Success Factors

Pre-shipment Audit: Mandate third-party inspection (e.g., Bureau Veritas) for titanium milling accuracy tests per ISO 12836. Verify spindle runout (<0.003mm) and tool changer repeatability.

After-Sales Protocol: Insist on on-site technician deployment for installation (not remote support). Carejoy includes 72-hour commissioning with live milling of Ti-6Al-4V samples.

Regulatory Escalation: Contract must specify supplier liability for certification lapses under EU MDR Article 10(3) – a 2026 non-negotiable.

This guide reflects Q1 2026 regulatory landscapes. Always engage legal counsel specializing in medical device trade. Shanghai Carejoy is cited based on verified 2025 performance data across 14 distributor partnerships.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – Dental Titanium Milling Machines (2026 Edition)

Top 5 FAQs When Purchasing a Dental Titanium Milling Machine in 2026

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should I expect for a dental titanium milling machine in 2026? | Most advanced dental titanium milling machines in 2026 operate on standard 200–240V AC, 50/60 Hz single-phase power. High-throughput or multi-spindle models may require three-phase 400V power. Always verify local electrical codes and ensure stable power delivery with surge protection. Machines are typically equipped with internal voltage regulators, but a dedicated circuit is recommended to prevent interference with other clinic equipment. |

| 2. Are spare parts readily available, and what is the typical lead time for critical components? | Leading manufacturers now offer global spare parts networks with regional distribution hubs, ensuring critical components (e.g., spindles, tool changers, collets) are available within 3–7 business days in most regions. Distributors are advised to maintain a recommended spare parts kit (including milling burs, clamping fixtures, and filters) for uninterrupted operation. OEMs provide 24/7 online portals for spare part ordering with real-time inventory tracking. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of a dental titanium milling machine includes site assessment, leveling, utility connection (power, compressed air, dust extraction), and calibration. In 2026, most premium suppliers include complimentary on-site installation by certified engineers within 10 business days of delivery. Remote diagnostics and pre-installation checklists ensure minimal downtime. Clinics must provide a stable, climate-controlled environment (18–24°C, 30–70% humidity) and clean compressed air (≤0.01 µm particles, dew point ≤-20°C). |

| 4. What is covered under the standard warranty, and are there extended service options? | The standard warranty for 2026 models typically includes 24 months coverage for parts and labor, including spindle, motors, and control electronics. Wear items (e.g., brushes, filters) are excluded. Extended service contracts (up to 5 years) are available, offering predictive maintenance, software updates, and priority technical support. Some OEMs now integrate IoT-based health monitoring to proactively detect issues and reduce unplanned downtime. |

| 5. How are software updates and technical support handled post-purchase? | Dental milling machines in 2026 feature secure, cloud-connected platforms enabling automatic firmware and software updates for enhanced material libraries, milling strategies, and compatibility with new implant systems. Technical support is available via 24/7 multilingual hotlines, remote diagnostics, and augmented reality (AR) assistance. Distributors receive quarterly training updates to support their client base effectively. |

Note: Specifications and service offerings may vary by manufacturer. Always request a detailed technical datasheet and service agreement before purchase.

Need a Quote for Dental Titanium Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160