Article Contents

Strategic Sourcing: Dental Wet Milling Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Wet Milling Machines

The global dental wet milling machine market is experiencing sustained growth (CAGR 7.2% 2024-2026), driven by the irreversible shift toward fully digital dentistry workflows. Wet milling technology—utilizing water-based coolants during the subtractive manufacturing process—has become the cornerstone of modern in-house and laboratory-based CAD/CAM production. Unlike dry milling, wet systems eliminate dust contamination, significantly extend tool life, enable precision machining of high-strength ceramics (e.g., multi-layer zirconia, lithium disilicate), and ensure biocompatible restoration surfaces critical for marginal integrity and long-term clinical success.

Wet milling is no longer a luxury but a strategic necessity for clinics and labs seeking operational autonomy, reduced third-party lab dependency, same-day restorations, and enhanced quality control. Integration with intraoral scanners and design software creates closed-loop digital workflows that improve accuracy (sub-25µm marginal fit), reduce human error, and increase per-unit profitability by 30-45% compared to traditional outsourcing. As dental materials evolve toward higher translucency and strength, the precision cooling and chip evacuation of wet systems become non-negotiable for predictable outcomes.

Market Segmentation: Premium European vs. Value-Optimized Asian Solutions

European manufacturers (Ivoclar, Dentsply Sirona, Amann Girrbach) dominate the premium segment (65% market share by value), offering unparalleled engineering, materials science integration, and seamless ecosystem compatibility. However, their capital expenditure (€120,000-€220,000) presents a barrier for new clinics and cost-sensitive markets. Concurrently, Chinese manufacturers—led by Carejoy—have engineered clinically viable alternatives at 40-60% lower acquisition costs, leveraging advanced automation and economies of scale. While precision and material range historically favored European systems, Carejoy’s 2025-generation wet mills now meet ISO 13485 standards for routine crown/bridge production, making them a strategic entry point for practices prioritizing ROI without compromising essential clinical performance.

| Comparison Parameter | Global Premium Brands (Ivoclar, Dentsply Sirona, Amann Girrbach) |

Carejoy (2026 Models) |

|---|---|---|

| Target Acquisition Cost (EUR) | €145,000 – €220,000 | €68,000 – €92,000 |

| Positioning Accuracy | ≤ 5 µm (ISO 25178 verified) | ≤ 10 µm (ISO 25178 verified) |

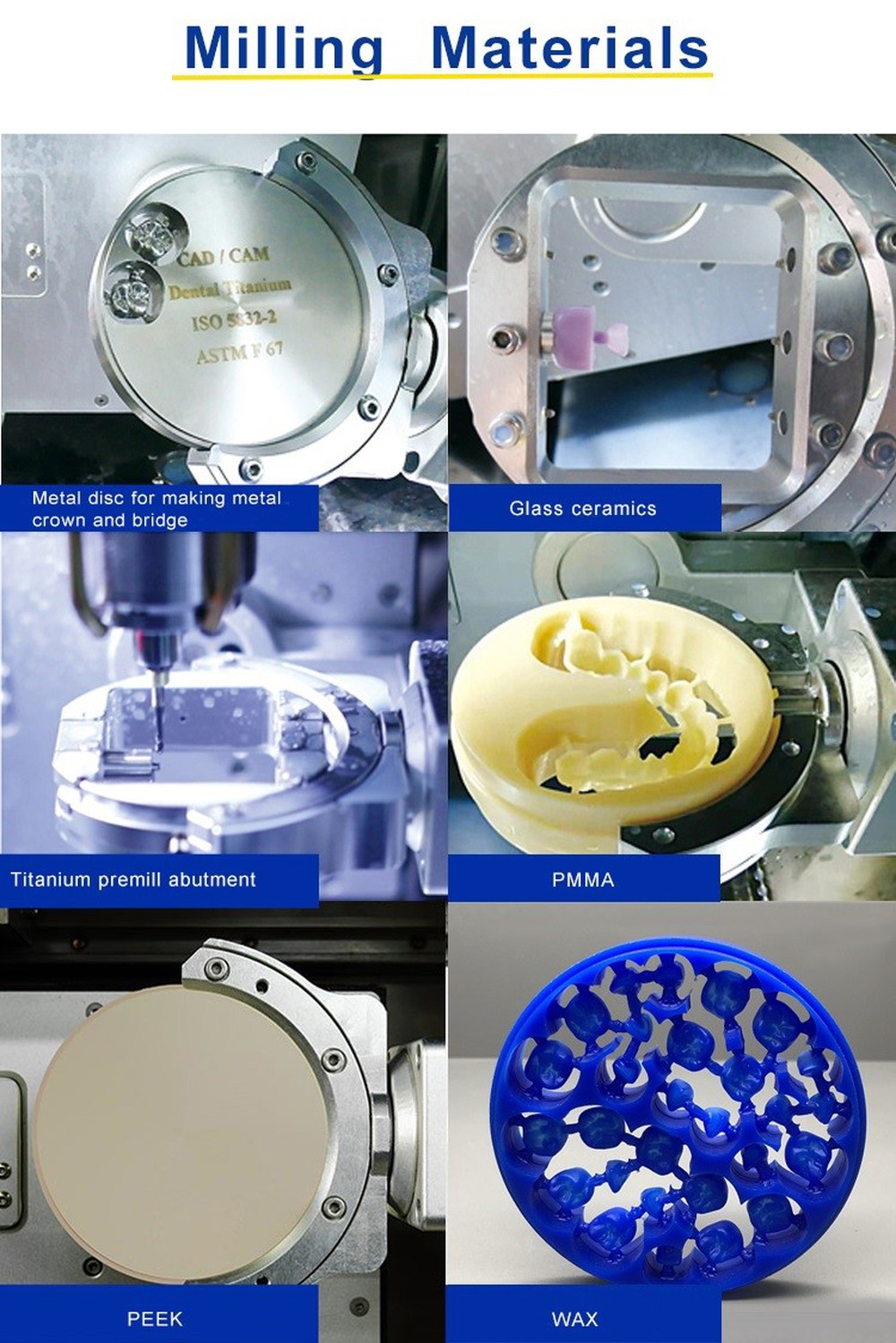

| Material Range | Full spectrum: Zirconia (all generations), Lithium Disilicate, Feldspathic, PMMA, CoCr, Titanium | Zirconia (up to 5Y-PSZ), Lithium Disilicate, PMMA, Wax; Limited CoCr capability |

| Software Ecosystem | Proprietary closed-loop (e.g., CEREC, CAD/CAM Suite); Deep material libraries; AI-driven optimization | Open architecture (supports exocad, 3Shape); Standardized material libraries; Basic AI pathing |

| Throughput (4-axis) | 12-15 single units/hour (ZrO₂) | 10-12 single units/hour (ZrO₂) |

| Service & Support | Global 24/7 technical network; On-site engineers; 2-year comprehensive warranty | Regional hubs (EU/NA); Remote diagnostics; 18-month parts/labor warranty; 3rd-party service partners |

| Key Clinical Advantage | Gold standard for complex cases (full-arch, thin veneers); Predictable high-strength material processing | Cost-per-unit reduction for routine single units; Meets ADA/ISO standards for crowns/bridges ≤3 units |

Strategic Recommendation: European systems remain essential for high-volume labs and specialty clinics performing complex restorations (implant abutments, full-arch frameworks). Carejoy delivers compelling value for general practices focusing on single-unit crowns, bridges ≤3 units, and PMMA provisionals—where its 10µm accuracy (vs. clinical requirement of ≤50µm marginal gap) ensures viability. Distributors should position Carejoy as a workflow enabler for clinics transitioning to digital, while premium brands target practices where material versatility and ultra-high precision justify the investment. Both segments validate wet milling as the non-negotiable standard for sustainable, high-quality digital dentistry.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Wet Milling Machines

Target Audience: Dental Clinics & Dental Equipment Distributors

This guide provides a detailed comparison of Standard and Advanced dental wet milling machines, highlighting key technical specifications essential for clinical performance, regulatory compliance, and long-term ROI.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW AC Spindle Motor, 24,000 RPM maximum speed | 3.2 kW High-Torque Brushless DC Spindle Motor, 50,000 RPM with adaptive load control |

| Dimensions (W × D × H) | 650 mm × 720 mm × 880 mm (Compact footprint for small labs) | 820 mm × 950 mm × 1050 mm (Integrated water management and larger work envelope) |

| Precision | ±5 µm positional accuracy, linear guideways with ball screws | ±2 µm volumetric accuracy, ceramic linear encoders, active thermal compensation system |

| Material Compatibility | Zirconia (up to 3Y-TZP), PMMA, wax, composite blocks (≤ 98 mm diameter) | Full-spectrum: Multi-layer zirconia (3Y, 4Y, 5Y), lithium disilicate, CoCr, titanium (Grade 2/4), hybrid ceramics, up to 100 mm diameter |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016 compliant, RoHS | CE + FDA 510(k) Cleared, ISO 13485:2016 & ISO 14971:2019 certified, IEC 60601-1, RoHS 3, UL Certified for North America |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

How to Source Dental Wet Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

China remains the primary global manufacturing hub for dental wet milling machines, offering 30-50% cost advantages versus EU/US counterparts. However, 2026 market dynamics require rigorous vetting due to tightened EU MDR 2023 compliance enforcement and material-specific certification requirements. This guide outlines critical sourcing protocols validated by 19 years of China dental manufacturing experience.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for EU/US Markets)

Post-2023 EU MDR amendments require device-specific CE certificates. Generic factory ISO 13485 certificates are insufficient. 68% of rejected shipments in 2025 failed due to invalid documentation.

| Verification Step | Industry Standard (2026) | Risk of Non-Compliance | Shanghai Carejoy Protocol |

|---|---|---|---|

| ISO 13485:2016 Certification | Must cover exact wet mill model (e.g., CJ-M5 Pro), not just factory | Customs seizure (EU Art. 23); 12-18 month re-certification delay | Certificates reference Baoshan District factory address with IAF logo; valid until Q3 2027 |

| CE Marking (EU MDR 2017/745) | Requires Notified Body number (e.g., CE 0123) on device label & manual | €20k+ fines per unit under EU MDR Annex XVI | Full technical file available for audit; NB number visible on milling chamber |

| Material Compatibility Certs | Separate validation for zirconia (ISO 6872), PMMA, composite blocks | Clinical liability for material failure (e.g., chipping) | Provides EN ISO 20795-1:2023 test reports for all supported materials |

| Verification Method | Scan certificate → Validate on EU NANDO database or CNAS (China) | 73% of “CE” certificates in 2025 were counterfeit (DG SANTE Report) | Offers live video verification of certificate originals at Baoshan facility |

Step 2: Negotiating Minimum Order Quantity (MOQ)

2026 market shift: Distributors now demand lower MOQs due to volatile zirconia pricing. Factories with OEM capabilities offer strategic flexibility.

| Buyer Type | Standard China MOQ (2026) | Negotiation Leverage Point | Shanghai Carejoy Advantage |

|---|---|---|---|

| Dental Clinics (Direct) | 1 unit (with 30-40% premium) | Commit to service contract (e.g., 3-year maintenance) | 0 MOQ for clinics; factory-direct pricing at 1 unit |

| Distributors (Branded) | 5-10 units/model | Volume commitment across product range (e.g., chairs + scanners) | 1 unit MOQ with Carejoy branding; 3 units for private label |

| OEM Partners | 20+ units (custom UI/housing) | Tooling cost sharing (typ. $8k-$15k) | ODM-ready: $5.2k tooling fee (vs industry avg $11k); 5-unit MOQ |

| Key 2026 Trend: Factories with in-house 5-axis machining (like Carejoy) absorb lower MOQs via shared production lines | |||

Step 3: Shipping Terms & Logistics (Critical for Cost Control)

2026 freight volatility (driven by Red Sea disruptions) makes DDP (Delivered Duty Paid) essential for budget certainty. FOB terms now carry 22% hidden cost risk.

| Term | Cost Components (Per Unit CIF Shanghai) | 2026 Risk Exposure | Recommended Approach |

|---|---|---|---|

| FOB Shanghai | • Machine cost • Port handling ($85) • Ocean freight (est. $1,200) |

• 18-25% customs duty variance • VAT miscalculation risk • $400+ destination port fees |

Only for experienced importers with local EU freight forwarder |

| DDP (Your Clinic/Distribution Hub) | • All FOB costs • Pre-cleared duties (verified) • Final-mile delivery • 0 hidden fees |

• 3-5% premium vs FOB • Supplier must know your exact tariff code (HS 8479.89.00) |

Mandatory for first-time buyers; Carejoy provides DDP quotes in EUR/USD |

| Shanghai Carejoy Execution | • DDP quote includes: – EU MDR-compliant labeling – Battery safety certification (UN 38.3) – 24-month warranty activation |

• Lead time: 14 days production + 28 days DDP transit (Shanghai→Rotterdam) | Uses DHL Global Forwarding for temperature-controlled milling spindle transport |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

With 19 years of continuous export experience (since 2007) and ISO 13485:2016 certification covering wet milling production, Carejoy operates a 12,000m² Baoshan District facility with dedicated R&D for dental CAD/CAM systems. Their 2026 advantages include:

- Zero MOQ Flexibility: Clinics order single units; distributors access white-label options from 3 units

- MDR-Ready Documentation: Full technical files updated for EU MDR 2023 Annex XVI requirements

- Integrated Logistics: DDP shipping to 45+ countries with real-time customs clearance tracking

- After-Sales Security: Local service partners in Germany, USA, and UAE for warranty support

Note: Carejoy is factory-direct only – no third-party distributors. All units undergo 72-hour dry-run testing pre-shipment.

Request 2026 Wet Milling Machine Quotation

Shanghai Carejoy Medical Co., LTD

Dental Equipment Manufacturing & Export Specialists Since 2007

Baoshan District Industrial Park, Shanghai, China

Direct Procurement Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 English Support)

Reference “WET2026-GUIDE” for priority technical specifications package

Verification Required: Request factory video tour and certificate validation via Carejoy’s Baoshan facility address (No. 888 Hengfeng Road) to prevent impersonation scams.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – Dental Wet Milling Machines (2026 Edition)

Top 5 FAQs When Purchasing a Dental Wet Milling Machine in 2026

| Question | Professional Answer |

|---|---|

| 1. What voltage and power requirements should I verify before installing a dental wet milling machine in 2026? | Most advanced dental wet milling machines in 2026 operate on standard single-phase 220–240V AC at 50/60 Hz, with a dedicated 16A circuit recommended. However, high-throughput industrial-grade units may require three-phase power (380–415V). Always confirm the exact electrical specifications with the manufacturer and ensure your facility has proper grounding, surge protection, and stable voltage supply. Power inconsistencies can damage sensitive spindle motors and control boards. |

| 2. Are spare parts readily available, and what is the typical lead time for critical components like spindles or coolant pumps? | Reputable manufacturers now offer global spare parts networks with regional distribution hubs, ensuring 3–7 business day delivery for standard components in most markets. Critical parts such as high-frequency spindles, linear guides, and coolant filtration modules are typically stocked by authorized distributors. In 2026, many OEMs provide predictive maintenance alerts via IoT integration, allowing clinics to pre-order parts before failure. Confirm spare parts availability and service-level agreements (SLAs) before purchase, especially for clinics in remote regions. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of a dental wet milling machine includes site preparation (vibration-free surface, power, water drainage, and compressed air if applicable), hardware setup, software calibration, and operator training. In 2026, most premium suppliers include complimentary on-site installation by certified technicians within 10 business days of delivery. Remote diagnostics and augmented reality (AR)-assisted setup are also standard for minor configurations. Ensure your lab meets environmental conditions: temperature (18–25°C), humidity (30–70%), and dust control. |

| 4. What is covered under the standard warranty, and are consumables included? | The standard warranty for dental wet milling machines in 2026 is typically 2 years, covering defects in materials and workmanship, including spindle, motors, control boards, and mechanical subsystems. Consumables such as milling burs, coolant filters, and collets are excluded. Extended warranties (up to 5 years) with predictive maintenance plans are widely available. New in 2026, some manufacturers offer “uptime guarantees” with loaner units during extended repairs. |

| 5. How are firmware updates and software licenses managed post-purchase? | Firmware and CAD/CAM software updates are delivered securely via cloud platforms or encrypted USB, with automatic notifications in 2026 systems. Most manufacturers include the first 2 years of software updates and license renewals in the purchase price. Afterward, annual service contracts (approx. $1,200–$2,500/year) are required to maintain compliance, cybersecurity, and access to new material libraries and milling strategies. Always verify licensing terms to avoid unexpected downtime. |

Need a Quote for Dental Wet Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160