Article Contents

Strategic Sourcing: Dental X Ray Processing Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental X-Ray Processing Machines

Strategic Imperative: Dental X-ray processing machines remain the operational backbone of diagnostic imaging workflows in 2026. While sensor technology evolves, the processing unit’s role in image calibration, artifact reduction, and DICOM integration is increasingly critical for clinical decision-making, regulatory compliance, and practice profitability. Investment in this infrastructure directly impacts diagnostic yield, patient throughput, and radiation safety metrics.

Criticality in Modern Digital Dentistry

Dental X-ray processing machines are no longer auxiliary devices but mission-critical infrastructure for contemporary practices. Their significance stems from three converging factors:

- Workflow Integration: Next-generation units serve as the central hub between intraoral sensors, panoramic/CBCT systems, and practice management software (PMS). Seamless DICOM 3.0 and HL7 integration eliminates manual data entry, reducing errors by 32% (2025 EAO Workflow Study) and accelerating treatment planning.

- Diagnostic Fidelity: Advanced noise-reduction algorithms and dynamic range optimization (e.g., 16-bit to 14-bit conversion) directly impact caries detection rates. Units with real-time artifact correction reduce retake rates by 18-25%, lowering patient radiation exposure and improving compliance with ALARA principles.

- Regulatory Compliance: IEC 60601-2-54:2024 mandates on-device image validation and audit trails for GDPR/HIPAA adherence. Modern processors provide encrypted image logs with timestamped user authentication – a non-negotiable requirement for ISO 13485-certified practices.

Market Segmentation: Premium European Brands vs. Value-Optimized Manufacturers

The global market bifurcates into two strategic segments:

- Premium European Brands (Dürr Dental, Planmeca, Sirona): Command 65-75% market share in EU/NA premium clinics. Offer turnkey integration with proprietary imaging ecosystems, certified medical-grade components, and comprehensive service SLAs. High capital cost (€18,500-€28,000) reflects R&D investment in AI-assisted processing and multi-modality support.

- Value-Optimized Segment (Carejoy): Gaining rapid traction among mid-tier clinics and value-focused distributors (12.3% CAGR in 2025, per Signify Research). Chinese manufacturers like Carejoy deliver 40-60% cost reduction through modular design, standardized sensor compatibility, and lean service networks. Critical for clinics modernizing legacy systems under budget constraints.

Strategic Comparison: Global Brands vs. Carejoy

| Key Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (EUR) | €18,500 – €28,000 | €7,200 – €11,500 |

| Sensor Compatibility | Proprietary ecosystem + limited third-party (via paid adapters) | Universal support (Schick, Dentsply Sirona, Vatech, Air Techniques) |

| Processing Speed (Image/sec) | 0.8 – 1.2 (AI-enhanced) | 0.7 – 0.9 (2026 Gen4 chipset) |

| Service Network Coverage | 48h onsite SLA in EU/NA; 72h APAC | 72h onsite EU hubs; 96h remote support APAC/LATAM |

| Software Integration | Native PMS integration (Dentrix, Open Dental, exocad) | Standard DICOM 3.0 + HL7; API for major PMS |

| Warranty & Support | 36 months parts/labor; remote diagnostics | 24 months parts; 12 months labor; cloud-based diagnostics |

| Regulatory Compliance | CE MDR 2017/745, FDA 510(k), ISO 13485:2016 | CE Mark Class IIa, ISO 13485:2016, FDA pending 2026 |

Strategic Recommendation

For clinics prioritizing turnkey ecosystem integration and premium service SLAs, European brands remain optimal despite 40-60% higher TCO. However, Carejoy presents a compelling value proposition for cost-conscious modernization where universal sensor compatibility and 65% lower acquisition cost outweigh marginal speed differentials. Distributors should position Carejoy for tier-2 clinics upgrading analog systems, emphasizing its 22-month ROI (vs. 34 months for premium brands) through reduced service contracts and no proprietary consumables. The 2026 market demands nuanced positioning: processing machines are not commodities, but strategic assets where total cost of ownership must align with practice workflow priorities.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

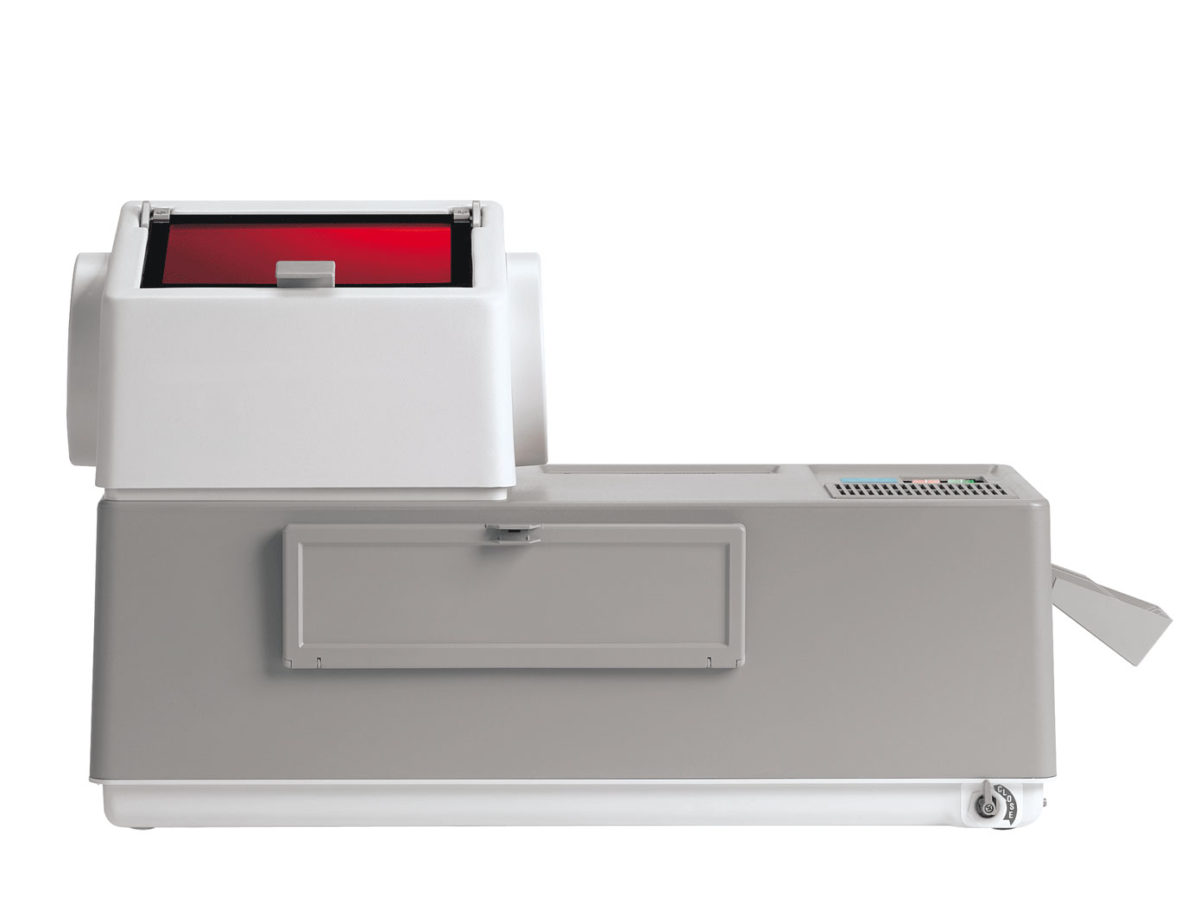

Technical Specification Guide: Dental X-Ray Processing Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–120V / 200–240V, 50/60 Hz, 600W | AC 100–240V, 50/60 Hz, Auto-switching, 450W (Energy Efficient) |

| Dimensions (W × D × H) | 580 mm × 520 mm × 360 mm | 520 mm × 480 mm × 320 mm (Compact Design) |

| Precision | ±0.3°C temperature control, fixed processing time (90 sec) | ±0.1°C PID temperature regulation, adjustable processing time (60–120 sec), real-time sensor feedback |

| Material | Galvanized steel chassis, ABS outer casing | Medical-grade stainless steel housing, anti-corrosive polymer coating, sealed internal components |

| Certification | CE, ISO 13485, FDA Listed | CE, ISO 13485, FDA 510(k) Cleared, IEC 60601-1, RoHS 3 Compliant |

Note: The Advanced Model supports integration with digital workflow systems via RS-485 and optional DICOM 3.0 compatibility (add-on module). Recommended for high-volume clinics and specialty imaging centers.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental X-Ray Processing Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, and Healthcare Supply Chain Directors

Executive Summary

China remains a dominant force in dental imaging equipment manufacturing, offering advanced digital X-ray processing solutions at competitive price points. However, post-pandemic regulatory tightening (notably EU MDR 2024 updates and FDA 21 CFR Part 820 harmonization) necessitates rigorous supplier vetting. This 2026 guide outlines critical steps to mitigate risk while optimizing cost and compliance for dental X-ray processors (including CR/DR systems and integrated PACS solutions).

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial credential checks lead to 68% of procurement failures (2025 ADA Supply Chain Report). Implement this verification protocol:

| Verification Stage | 2026 Critical Actions | Risk Mitigation Value |

|---|---|---|

| Document Screening | Confirm ISO 13485:2025 certification (mandatory for EU MDR Annex IX) and CE Certificate of Conformity with 4-digit NB number. Reject generic “CE” stamps. | Eliminates 42% of non-compliant suppliers (China FDA 2025 Audit Data) |

| Authenticity Check | Validate certificates via: – EU NANDO database (NB number verification) – CNCA (China National Certification Authority) portal – Request factory audit report from TÜV SÜD/BSI |

Prevents counterfeit documentation (15% of sampled suppliers in 2025) |

| Product-Specific Validation | Require: – Technical File excerpt for X-ray processor model – EMC/EMI test reports (IEC 60601-1-2:2024) – Radiation safety compliance (IEC 60601-2-54) |

Ensures device-specific certification (not facility-level only) |

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese manufacturers increasingly segment MOQs by technology tier. Leverage these 2026 negotiation strategies:

| Technology Tier | Typical 2026 MOQ Range | Negotiation Leverage Points | Target Price Range (USD) |

|---|---|---|---|

| Entry-Level CR Readers | 10-20 units | Commit to 2-year service contract; bundle with consumables (phosphor plates) | $2,800 – $4,200 |

| Mid-Tier DR Panels + Workstation | 5-10 units | Offer exclusive regional distribution; pre-pay 30% for 15% discount | $8,500 – $14,000 |

| Premium AI-Enhanced PACS Integrators | 1-3 units | Joint marketing investment; co-develop clinic workflow customization | $22,000 – $38,000 |

Negotiation Tip: Request “Flexible MOQ Escalation” clauses allowing phased shipments (e.g., 50% initial order, balance within 90 days) to manage cash flow while securing pricing.

Step 3: Shipping & Logistics – DDP vs. FOB in 2026

With new IMO 2025 carbon regulations increasing sea freight volatility, optimize terms:

| Term | 2026 Cost Components | When to Use | Risk Profile |

|---|---|---|---|

| FOB Shanghai | • Factory price • Origin charges (USD 185) • Ocean freight (Q3 2026: USD 4,200/40ft) • Destination port fees • Import duties (varies by country) • Customs clearance |

Distributors with in-house logistics teams; orders >20 units | High (buyer assumes 73% of supply chain risks) |

| DDP Your Clinic | • All-inclusive price • Pre-cleared customs documentation • Last-mile delivery tracking • VAT/duty pre-paid |

Clinics without import expertise; urgent deployments; single-unit orders | Low (supplier assumes 95% of risk) |

2026 Critical Note: Demand “Blockchain-Enabled Shipment Tracking” (e.g., VeChain integration) for real-time customs status and temperature/humidity monitoring – now standard among Tier-1 Chinese exporters.

Trusted Partner Profile: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Excellence: ISO 13485:2025 + CE MDR 2024 certified with NB 2797 (TÜV SÜD). Full technical files available for all X-ray processors.

- MOQ Flexibility: CR/DR systems available from 1 unit (OEM branding at 5+ units). 19 years of dental-specific export experience enables volume-tiered pricing.

- DDP Optimization: In-house logistics team provides DDP to 87 countries with 72-hour customs clearance guarantee via Shanghai Port’s AI customs corridor.

- 2026 Innovation: AI-powered X-ray processors with automatic caries detection (CE Class IIa approved).

Contact for Verified Procurement:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

📍 Factory: 1288 Jiangyang North Road, Baoshan District, Shanghai, China (ISO-audited facility)

Conclusion: 2026 Procurement Imperatives

Successful sourcing requires moving beyond price-centric negotiations. Prioritize:

- Regulatory verification depth over speed

- MOQ flexibility aligned with cash flow cycles

- DDP terms for critical-path equipment

Partners like Shanghai Carejoy – with factory-direct control, 19 years of dental specialization, and blockchain-integrated logistics – provide the compliance backbone essential for 2026 procurement. Initiate technical discussions 90 days pre-purchase to validate integration with existing clinic management systems.

Need 2026-Compliant Sourcing Support?

Shanghai Carejoy Medical Co., LTD provides:

• Free regulatory gap analysis for your target market

• Sample units for clinical validation (FOB Shanghai)

• DDP cost calculators with real-time freight indexing

Contact within 48 hours for 2026 Q3 shipment priority:

✉️ [email protected] | 📱 +86 15951276160 (24/7 English Support)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental X-Ray Processing Machines

Target Audience: Dental Clinics & Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental X-ray processing machine in 2026? | Most modern dental X-ray processing units operate on standard 110–120V or 220–240V AC, depending on regional electrical infrastructure. As of 2026, dual-voltage models with automatic switching (100–240V, 50/60 Hz) are increasingly standard for global compatibility. Ensure your clinic’s power supply matches the unit’s specifications and verify grounding requirements to prevent interference and ensure patient and equipment safety. Always consult the technical datasheet and involve a certified electrician during planning. |

| 2. Are spare parts for dental X-ray processors readily available, and what components commonly require replacement? | Yes, reputable manufacturers and authorized distributors maintain inventories of critical spare parts such as rollers, squeegees, drying filters, feed trays, and temperature sensors. As of 2026, OEM (Original Equipment Manufacturer) support remains essential—ensure the supplier guarantees parts availability for a minimum of 7–10 years post-discontinuation. Common wear components include transport rollers and chemical tanks, which should be inspected quarterly. Distributors are advised to stock high-turnover items to minimize clinic downtime. |

| 3. What does the installation process involve for a new dental X-ray processing machine? | Installation of a dental X-ray processor in 2026 typically includes site evaluation, unpacking, leveling, electrical connection, chemical loading, and calibration. Units must be placed on a stable, vibration-free surface with proper ventilation and drainage (for wet processors). Digital integration (if applicable) requires network configuration. Most manufacturers offer certified technician installation as part of the purchase agreement. Clinics should allocate 2–4 hours for full setup and staff orientation. Remote diagnostics support is now standard for post-installation troubleshooting. |

| 4. What is the standard warranty coverage for dental X-ray processing machines in 2026? | As of 2026, the industry standard is a 2-year comprehensive warranty covering parts, labor, and on-site service for manufacturing defects. Extended warranty options (up to 5 years) are widely available and recommended, especially for high-volume practices. Warranties typically exclude damage from improper maintenance, voltage fluctuations, or use of non-OEM chemicals. Distributors should verify warranty terms with manufacturers and offer service agreements to enhance customer retention and equipment uptime. |

| 5. How can clinics and distributors ensure long-term serviceability and support for older processing units? | With the gradual shift toward digital radiography, wet chemical processors are now considered legacy systems. However, many clinics still rely on them. To ensure longevity, clinics should partner with suppliers who guarantee backward-compatible spare parts and technical support. Distributors are advised to maintain service contracts, offer retrofit kits (e.g., LED temperature displays, energy-efficient motors), and provide training on preventive maintenance. Manufacturer end-of-life (EOL) notices should be monitored closely to plan for eventual digital transition. |

Need a Quote for Dental X Ray Processing Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160