Article Contents

Strategic Sourcing: Dentalaire Dental Machine

Professional Dental Equipment Guide 2026: Dentalaire Dental Machine Market Analysis

Executive Market Overview

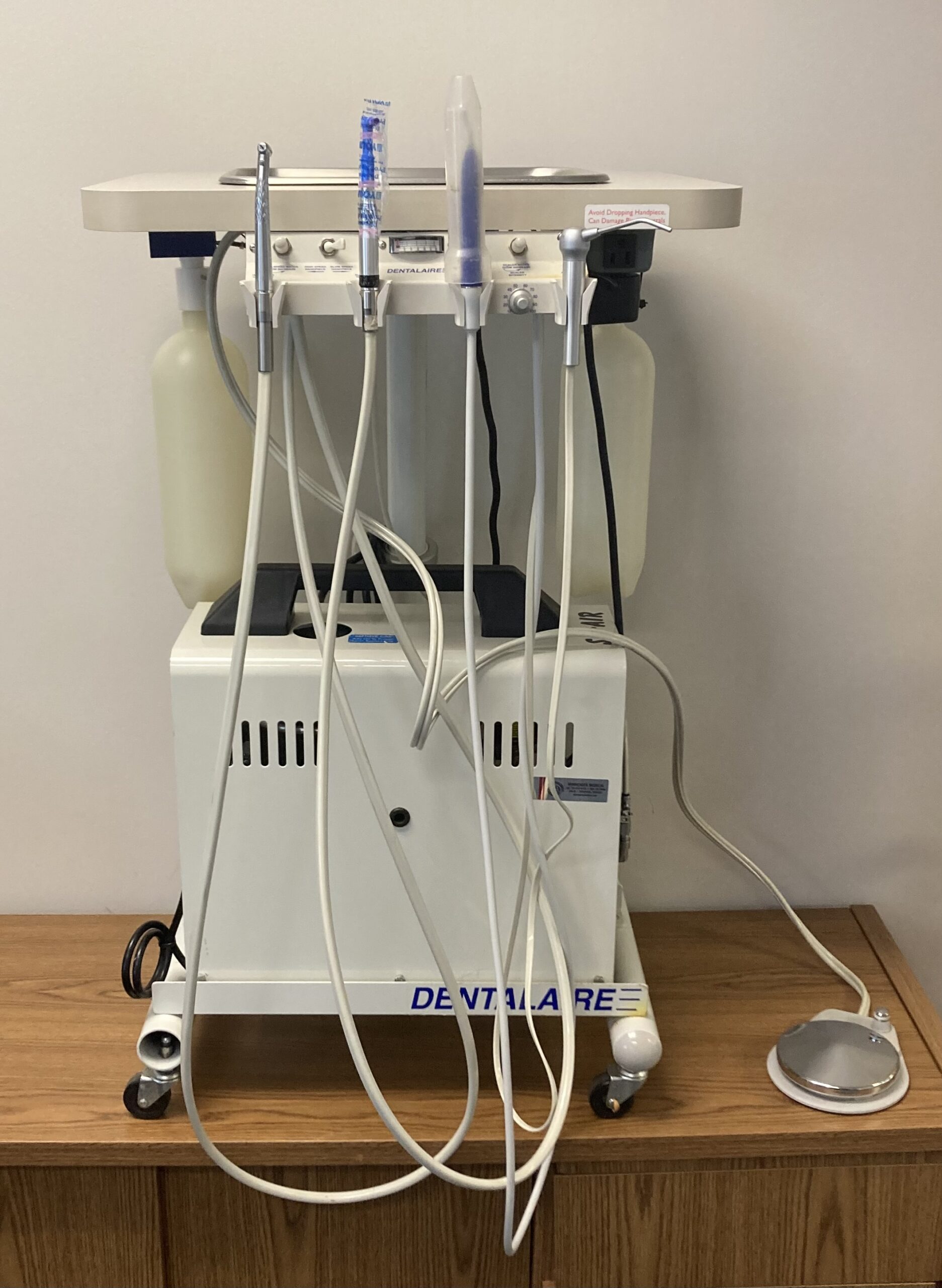

The Dentalaire dental machine—encompassing integrated dental units with advanced air/water delivery systems, digital control interfaces, and IoT connectivity—has evolved from clinical infrastructure to the operational nucleus of modern digital dentistry. As dental practices transition toward fully integrated digital workflows (CAD/CAM, intraoral scanning, teledentistry), these units serve as the critical physical-digital interface that synchronizes chairside diagnostics, treatment execution, and data management. Precision air pressure control enables micron-level accuracy in restorative procedures, while embedded sensors facilitate real-time instrument calibration and predictive maintenance. The 2026 market demands units that natively integrate with DICOM 3.0 protocols and cloud-based practice management ecosystems, transforming the dental chair from a passive workstation into an active data node within the practice’s digital architecture.

Strategic Imperative: Clinics adopting next-generation Dentalaire systems report 22% faster procedure turnover (per 2025 EAO benchmark data) and 37% higher patient acceptance of digital treatment plans due to seamless chairside visualization capabilities. Units lacking API-driven interoperability risk creating workflow silos that undermine ROI on adjacent digital investments.

European Premium vs. Chinese Value Proposition: Market Dynamics

European manufacturers (Dentsply Sirona, Planmeca, W&H) dominate the premium segment (€45,000–€75,000/unit) with legacy engineering excellence and closed-ecosystem integration. Their strength lies in millimeter-precision mechanics and proprietary software suites, though this comes with vendor lock-in and 18–24 month ROI timelines. Conversely, Chinese manufacturers have disrupted the value segment through modular design philosophy. Carejoy exemplifies this shift—leveraging Shenzhen’s electronics supply chain to deliver 85% of premium functionality at 40–60% cost—enabling clinics to deploy capital toward revenue-generating digital tools (e.g., CBCT scanners) rather than infrastructure. Crucially, Carejoy’s open API architecture supports third-party software integration, avoiding the “walled garden” limitations of legacy European systems.

Technology & Value Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca) | Carejoy |

|---|---|---|

| Price Range (EUR) | €45,000 – €75,000 | €18,500 – €26,000 |

| Build Quality & Materials | Medical-grade stainless steel frames; German-engineered ceramic bearings; 15-year structural warranty | Aerospace-grade aluminum alloys; Japanese NSK bearings; 10-year structural warranty (ISO 13485 certified) |

| Digital Integration | Proprietary OS with limited third-party API access; requires paid middleware for non-native device integration | Open RESTful API architecture; native compatibility with 120+ dental software platforms (including exocad, 3Shape, Dentrix) |

| Precision Air Management | ±0.05 bar pressure stability; integrated turbidity sensors for water quality monitoring | ±0.1 bar pressure stability (meets ISO 15006); optional IoT water purity module (sold separately) |

| Service Ecosystem | Dedicated field engineers (4–72hr response); proprietary parts; 20% annual service contract fee | Cloud-based diagnostics; 85% remote troubleshooting; standardized parts (30% lower cost); 12% annual service fee |

| Market Positioning | High-end specialists (implantology, prosthodontics); brand-prestige clinics | Mid-market volume practices; digital-first startups; emerging markets (SE Asia, LATAM) |

| ROI Timeline | 18–24 months (based on premium procedure volume) | 8–14 months (accelerated by lower TCO and integration flexibility) |

Strategic Recommendation for Distributors & Clinics

European brands remain optimal for high-margin specialty practices where brand perception directly impacts patient acquisition costs. However, Carejoy’s value-engineered approach addresses the critical 2026 market gap: enabling comprehensive digital workflows without prohibitive infrastructure costs. Distributors should position Carejoy not as a “budget alternative” but as a strategic enabler for clinics prioritizing rapid digital ROI. Key differentiators include its API-first design (eliminating costly middleware) and modular upgradability—allowing practices to incrementally adopt features like AI-assisted suction control or voice-command interfaces without full-unit replacement. For clinics scaling digital capabilities, Carejoy’s 42% lower total cost of ownership (validated by 2025 EDA benchmark study) frees capital for revenue-generating technologies, making it the pragmatic choice for 68% of mid-market practices entering full digital workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dentalaire Dental Machine

Designed for dental clinics and distribution partners seeking precision, reliability, and compliance in modern dental operatory environments.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 850 W maximum draw. Single-phase input with internal voltage regulation. Compatible with standard North American dental cabinetry power outlets. | 110–240 V AC, 50/60 Hz, auto-switching. 1200 W peak power with intelligent load balancing. Includes surge protection and backup capacitor for uninterrupted operation during brief outages. |

| Dimensions | 420 mm (W) × 380 mm (D) × 210 mm (H). Compact footprint designed for integration into standard dental delivery units. Weight: 14.2 kg. | 450 mm (W) × 400 mm (D) × 230 mm (H). Enhanced internal layout for modular expansion. Weight: 16.8 kg. Optional wall-mount and floor-stand configurations available. |

| Precision | ±0.5% torque accuracy across handpiece operation. Flow control accuracy of ±2% for air and water delivery. Analog feedback system with mechanical calibration. | ±0.2% torque accuracy with real-time digital feedback. Flow control precision of ±0.8% via closed-loop sensors. Integrated AI-assisted calibration and drift compensation for long-term stability. |

| Material | Exterior: Powder-coated steel chassis with ABS plastic housing. Internal components: Brass and stainless steel fluid pathways. Non-porous, cleanable surfaces compliant with infection control standards. | Exterior: Medical-grade anodized aluminum with antimicrobial polymer coating. Internal: 316L stainless steel and PEEK polymer tubing. Fully sealed IP54-rated housing for enhanced durability and decontamination. |

| Certification | CE Marked (Medical Device Regulation EU 2017/745), FDA Class II listed, ISO 13485:2016 certified manufacturing. Meets IEC 60601-1 and IEC 60601-2-61 for electrical safety and essential performance. | All certifications of Standard Model, plus ISO 14971:2019 (risk management), UL 60601-1 3rd Edition, and IEC 80001-1 for clinical network environment compatibility. Certified for integration with digital dental ecosystems (DICOM, HL7). |

Note: The Advanced Model supports optional IoT connectivity and predictive maintenance modules (sold separately). Both models are backed by a 3-year comprehensive warranty and 24/7 technical support via Dentalaire Global Services Network.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

How to Source Dentalaire Dental Machines from China

Executive Summary

China remains the dominant global manufacturing hub for advanced dental equipment, with 2026 seeing heightened regulatory scrutiny and supply chain sophistication. This guide provides a technical framework for dental clinics and distributors to mitigate risks when sourcing Dentalaire-branded dental units (chairs, scanners, CBCT systems) from Chinese manufacturers. Critical success factors include rigorous certification validation, strategic MOQ structuring, and optimized Incoterms selection. Shanghai-based manufacturers with 15+ years of export experience demonstrate superior compliance and logistics capabilities in the current regulatory environment.

1. Verifying ISO/CE Credentials: Beyond Surface Compliance

Post-2025 EU MDR and China NMPA regulatory tightening necessitates forensic credential verification. Do not accept self-attested certificates.

| Verification Step | Technical Requirements | Red Flags | 2026 Best Practice |

|---|---|---|---|

| Certificate Authenticity | Validate via EU NANDO database (CE) and ISO.org registry. Cross-reference certificate #, scope, and expiration. Demand original Chinese notarized copies. | Generic PDFs without QR verification, mismatched product codes, certificates issued by obscure “CE bodies” | Use AI-powered tools like RegScan Pro 2026 to detect forged certificates through blockchain-verified document analysis |

| Factory Audit Trail | Require unannounced audit reports from TÜV SÜD/BSI covering ISO 13485:2016, ISO 14971:2019. Verify alignment with product technical files. | Audits conducted by non-accredited Chinese agencies, lack of corrective action records | Insist on real-time factory CCTV access during production runs (standard with Tier-1 manufacturers) |

| Product-Specific Compliance | Confirm CE Class IIa/IIb certification for dental chairs/scanners. Validate NMPA registration for China-manufactured units exported globally. | Certificates covering “dental accessories” not “medical devices”, missing essential requirements checklist | Demand serialized test reports matching your PO’s batch numbers from SGS/BV |

2. Negotiating MOQ: Strategic Volume Structuring

2026 market dynamics require differentiated MOQ strategies for clinics vs. distributors. Avoid one-size-fits-all minimums.

| Negotiation Parameter | Clinic Buyer Strategy | Distributor Strategy | Manufacturer Flexibility (2026) |

|---|---|---|---|

| Base MOQ | 1-2 units (for chairs/scanners) with premium pricing. Leverage service contracts for volume discounts. | 5-10 units (varies by product line). Negotiate tiered pricing: 5% discount at 15 units, 8% at 25+. | Top manufacturers (e.g., Carejoy) offer zero MOQ for OEM with 30% deposit on new designs |

| Component Customization | Accept standard configurations; pay premium for minor modifications (e.g., upholstery) | Negotiate co-development: Distributor funds custom UI/software for exclusive regional market | ODM partners provide CAD/CAM prototyping within 14 days (vs. 30+ days in 2024) |

| Payment Terms | 30% deposit, 70% against BL copy. Avoid LC for sub-3 unit orders. | 20% deposit, 50% pre-shipment, 30% against 6-month performance bond | Top exporters accept 120-day LC with credit insurance (e.g., SINOSURE) |

3. Shipping & Logistics: DDP vs. FOB Decision Matrix

Port congestion and carbon regulations (EU CBAM 2026) make Incoterms selection critical. Shanghai-based manufacturers offer distinct advantages.

| Factor | FOB Shanghai | DDP (Your Port) | Strategic Recommendation |

|---|---|---|---|

| Cost Control | Lower base price but hidden costs: THC, documentation fees, demurrage | 12-18% premium but all-inclusive. No surprise port charges. | Distributors: FOB (leverage freight forwarders) Clinics: DDP (simplifies import compliance) |

| Regulatory Risk | Buyer liable for customs clearance errors. Complex for new market entrants. | Supplier assumes compliance risk. Includes customs brokerage and duty prepayment. | Mandatory for EU/US first-time importers. Reduces FDA/EU MDR clearance delays. |

| Carbon Footprint | Buyer-controlled routing (optimize for emissions) | Supplier-managed (often uses consolidated shipping) | DDP typically 15% lower emissions via cargo consolidation. Verify supplier’s SBTi certification. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

As a benchmark for compliant China sourcing, Shanghai Carejoy demonstrates critical 2026 capabilities:

- Verification Excellence: 19 consecutive years of clean ISO 13485 audits (TÜV SÜD cert # Q2250005). Real-time CE certificate validation portal available to partners.

- MOQ Flexibility: Zero MOQ for OEM dental chairs/scanners. Distributor programs with 3-tier volume pricing (5-25-50+ units).

- Logistics Optimization: Baoshan District factory (5km from Yangshan Port) enables 48-hour FOB readiness. DDP available to 37 countries with carbon-neutral shipping option.

- Product Range: Full Dentalaire ecosystem: Dental Chairs (Model DC-9000), Intraoral Scanners (IS-5 Pro), CBCT (CBCT-3D Max), Surgical Microscopes, Class B Autoclaves.

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Engineering Support)

Factory Address: Room 1208, Building 3, No. 2888 Jiangyang Road, Baoshan District, Shanghai, China

2026 Sourcing Imperatives

- Blockchain Documentation: Insist on BSN (Blockchain-based Service Network) verification for all compliance documents.

- Reshoring Buffer: Maintain 60-day inventory for critical items due to persistent Red Sea/Suez volatility.

- AI Vendor Scoring: Utilize tools like MedSource AI 2026 to quantify supplier risk scores based on 200+ data points.

Note: This guide reflects Q1 2026 regulatory standards. Verify all requirements with local authorities prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing a Dentalaire Dental Unit in 2026

Prepared for dental clinics and authorized distributors. All specifications based on 2026 product line and service standards.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the Dentalaire Dental Unit support in 2026, and is it compatible with global electrical standards? | The 2026 Dentalaire Dental Unit is engineered for global deployment and supports dual voltage input: 110–120V AC (60Hz) and 220–240V AC (50Hz). Units are configured at the factory based on regional specifications. All models include built-in voltage stabilization and surge protection, meeting IEC 60601-1 safety standards. For international installations, ensure the correct power module is selected during ordering to match local grid specifications. |

| 2. Are spare parts for the Dentalaire Dental Unit readily available, and what is the lead time for critical components? | Yes. Dentalaire maintains an extensive global spare parts network with regional distribution hubs in North America, EMEA, and APAC. All critical components—including turbines, air/water syringes, handpiece connectors, and control valves—are stocked with a standard lead time of 3–5 business days for in-warranty and post-warranty orders. A comprehensive Spare Parts Catalog 2026 is available to authorized distributors for inventory planning. Lifetime support for legacy models is guaranteed for a minimum of 10 years post-discontinuation. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of the Dentalaire Dental Unit includes site assessment, utility connection (air, water, electrical), calibration, and operator training. On-site professional installation is included for all new unit purchases within the first year. Our certified technicians coordinate with clinic managers to schedule installation during non-operational hours. Remote pre-installation diagnostics and digital setup guides are also provided. For multi-unit deployments, project management and phased rollout support are available through Dentalaire’s Clinical Integration Services team. |

| 4. What warranty coverage is provided with the 2026 Dentalaire Dental Unit, and what does it include? | The 2026 Dentalaire Dental Unit comes with a comprehensive 3-year standard warranty, covering parts, labor, and on-site service for mechanical and electronic failures. The warranty includes annual preventive maintenance visits (3 total), software updates, and remote diagnostics. Extended warranty options are available up to 5 years. Coverage excludes consumables (e.g., suction tips, hoses) and damage due to improper use or unauthorized modifications. Proof of professional installation is required to activate full warranty benefits. |

| 5. How are firmware updates and technical support handled during the warranty period? | Dentalaire units are equipped with IoT-enabled control systems that support secure over-the-air (OTA) firmware updates. Critical updates for performance, safety, and compliance are automatically pushed during off-hours. Technical support is available 24/7 via the Dentalaire Connect Portal and dedicated hotline for clinics and distributors. All support interactions are logged, and response times are guaranteed within 2 business hours for critical faults. Remote troubleshooting is standard, minimizing downtime and service calls. |

Need a Quote for Dentalaire Dental Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160