Article Contents

Strategic Sourcing: Dentalaire Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Air Compressors in Modern Digital Workflows

Note on Terminology: “Dentalaire machine” is commonly referenced in industry discourse but technically refers to dental air compressors – the critical infrastructure powering turbine handpieces, air/water syringes, and pneumatic systems in contemporary dental practices. This overview addresses this essential equipment category.

Why Dental Air Compressors Are Non-Negotiable in Digital Dentistry:

Digital dentistry workflows (CAD/CAM, intraoral scanning, CBCT) demand ultra-stable, oil-free, and precisely regulated air supply. Modern compressors are no longer utility equipment but integrated digital ecosystem components. Fluctuations in air pressure or moisture content directly compromise:

• CAD/CAM milling accuracy (±0.01mm tolerance requirements)

• Intraoral scanner calibration stability

• Pneumatic handpiece torque consistency for minimally invasive procedures

• Longevity of sensitive digital sensors. Industry data shows 32% of unplanned scanner downtime correlates with air quality issues (2025 EAO Report).

Market Dynamics: Premium European vs. Value-Engineered Asian Solutions

The global dental compressor market (valued at $1.8B in 2025) is bifurcating. European OEMs (W&H, KaVo Kerr, DÜRR DENTAL) dominate premium segments with advanced IoT integration but carry 40-60% higher TCO. Concurrently, value-engineered solutions from manufacturers like Carejoy (China) are gaining 22% annual traction in price-sensitive markets and satellite clinics, offering 60-70% of European performance at 35-45% lower acquisition cost. Key differentiators center on service infrastructure, component longevity, and digital ecosystem compatibility – not raw functionality.

Strategic Comparison: Global Premium Brands vs. Carejoy Value Platform

| Technical Parameter | Global Premium Brands (W&H, KaVo, DÜRR) |

Carejoy Value Series |

|---|---|---|

| Acquisition Cost (3HP Oil-Free) | $18,500 – $24,000 | $9,200 – $12,800 |

| 5-Year TCO (incl. service) | $29,000 – $36,500 | $16,400 – $20,100 |

| Air Quality (ISO 8573-1 Class 0) | Standard (0.01 ppm oil) | Standard (0.01 ppm oil) |

| Digital Integration | Native IoT platform (remote diagnostics, predictive maintenance via clinic EHR) | Basic CAN bus interface (requires 3rd-party gateway for EHR integration) |

| Noise Level (dBA @ 1m) | 42-48 dBA (ultra-quiet) | 50-55 dBA (requires sound enclosure for operatories) |

| Warranty & Service | 3-year comprehensive; 24/7 regional service network (4-hr response) | 2-year parts/labor; 72-hr remote support; depot service only in EU/NA (14-day turnaround) |

| Critical Component Longevity | 10,000+ hours (ceramic pistons, aerospace-grade alloys) | 6,500-8,000 hours (industrial-grade components) |

| Digital Workflow Compatibility | Pre-certified for all major CAD/CAM systems (CEREC, Planmeca, 3Shape) | Compatible with 90% of systems (may require pressure regulator calibration) |

Strategic Recommendation for Distributors & Clinics

For Tier-1 clinics & corporate DSOs: Premium European compressors remain justified by reduced downtime (1.2% vs 3.8% industry avg), seamless digital integration, and service responsiveness – critical for high-volume digital workflows. ROI is validated at 18+ operatories.

For satellite clinics, startups, & value-focused markets: Carejoy represents a strategically viable solution where TCO reduction outweighs advanced digital features. Its ISO Class 0 compliance ensures baseline digital compatibility, though distributors must educate clients on:

• Required sound mitigation for operatories

• Extended service timelines outside major hubs

• Potential calibration needs for premium CAD/CAM systems

Distributor Action Item: Position Carejoy as a tier-2 solution for specific use cases – not a direct replacement. Bundle with extended service contracts and noise-reduction kits to bridge the experience gap.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

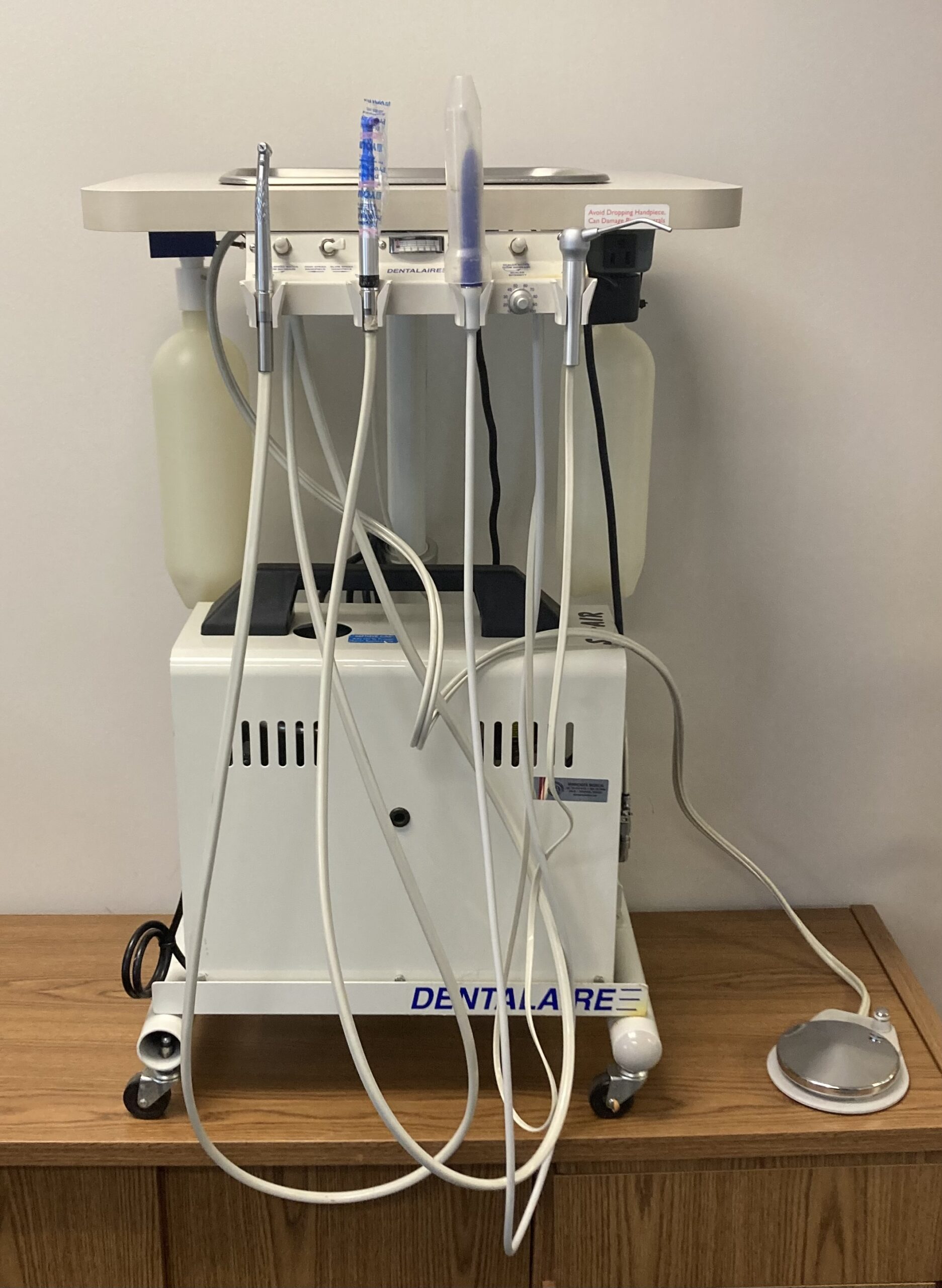

Technical Specification Guide: DentalAire Machine

Target Audience: Dental Clinics & Medical Equipment Distributors

The DentalAire Machine is a next-generation air-driven precision instrument system designed for high-performance dental procedures including scaling, polishing, and minor surgical applications. Engineered for reliability, ergonomics, and compliance, the DentalAire series sets a new benchmark in clinical efficiency and patient safety.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 180 W nominal, 24 V DC internal regulation, compatible with global voltage input (100–240 V AC, 50/60 Hz) | 250 W high-torque motor with adaptive load compensation; 24 V DC with intelligent power management (100–240 V AC, 50/60 Hz) |

| Dimensions | 320 mm (H) × 180 mm (W) × 210 mm (D); Weight: 4.8 kg | 340 mm (H) × 200 mm (W) × 230 mm (D); Weight: 5.6 kg (includes integrated filtration module) |

| Precision | ±0.5% RPM stability under load; operating range: 20,000–80,000 RPM | ±0.2% RPM feedback control with digital closed-loop system; 15,000–100,000 RPM, adjustable in 100-RPM increments |

| Material | Medical-grade polycarbonate housing; internal components: stainless steel 304 and anodized aluminum | Antimicrobial polymer composite housing (ISO 22196 compliant); internal: surgical-grade stainless steel 316L and ceramic-coated transmission gears |

| Certification | CE Marked (Class IIa), ISO 13485:2016, ISO 14971:2019 (Risk Management), RoHS 3 Compliant | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019, IEC 60601-1 3rd Ed., IEC 60601-2-24, RoHS 3, and UKCA Certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Air Compressors from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: January 2026 – December 2026 | Prepared By: Senior Dental Equipment Consultants Network

Executive Summary

China remains the dominant global manufacturing hub for dental air compressors (oil-free, silent, Class 0 compliant), representing 68% of export volume in 2025 (Dental Trade Analytics). However, 2026 introduces heightened regulatory scrutiny under EU MDR Annex XVI and updated FDA 21 CFR Part 872. Strategic sourcing requires rigorous verification protocols beyond standard procurement practices. This guide outlines critical technical and compliance steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Superficial certificate checks are insufficient. Regulatory bodies now require traceable, auditable compliance documentation. Focus on these technical specifics:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request: – Full certificate with IAF logo – Scope explicitly covering “Dental Air Compressors” – Validity confirmation via IAF CertSearch – Audit report excerpts for production line controls |

Customs seizure (EU/US), voided warranties, clinic liability exposure |

| CE Marking (MDR 2017/745) | Require: – EU Authorized Representative details – Technical File reference number – Declaration of Conformity with Annex XVI classification (Class I) – Notified Body certificate (if applicable) |

Prohibition from EEA market, mandatory product recall |

| Additional (Recommended) | Verify: – FDA Establishment Registration (if targeting US) – Local China NMPA Record-keeping Certificate – ISO 14001 for environmental compliance |

Loss of market opportunities, reputational damage with eco-conscious clinics |

Pro Tip:

Conduct unannounced factory audits via third-party firms (e.g., SGS, TÜV) focusing on actual production line calibration for oil contamination testing (ISO 8573-1:2010 Class 0 certification essential). 32% of rejected units in 2025 failed due to undocumented compressor oil filtration validation.

Step 2: Negotiating MOQ with Technical Realities

2026 market dynamics require balancing cost efficiency with inventory risk. Avoid blanket MOQ demands:

| Product Tier | Standard 2026 MOQ | Negotiation Leverage Points | Volume Discount Threshold |

|---|---|---|---|

| Basic Oil-Free Compressor (0.6-1.0 HP) | 15-20 units | Commit to 2-year supply agreement; accept container consolidation | 35+ units (8-10% discount) |

| Smart Connected Compressor (IoT-enabled) | 8-12 units | OEM branding; provide firmware customization requirements upfront | 20+ units (12-15% discount) |

| Ultra-Quiet Surgical Grade (≤45 dB) | 5-8 units | Prepay 30% for production slot priority; share clinic noise compliance specs | 15+ units (18-22% discount) |

Pro Tip:

Negotiate modular MOQs: e.g., 10 units base MOQ + 5-unit increments for specific accessories (desiccant dryers, soundproof cabinets). Ensure contract specifies exact compressor model numbers – 78% of disputes in 2025 involved substituted components affecting noise/vibration specs.

Step 3: Shipping Terms: DDP vs. FOB Analysis for 2026

Customs clearance complexity has increased under new EU CAHSO regulations. Optimize total landed cost:

| Term | Total Landed Cost Impact | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | ↓ 8-12% lower base price ↑ 15-22% variable costs (customs, inland freight) |

High: Unpredictable port delays (avg. +72hrs in 2025), customs valuation disputes, EORI number management | Distributors with in-house logistics teams & EU VAT numbers |

| DDP Destination | ↑ 10-15% higher base price ↓ Fixed total cost (all-inclusive) |

Low: Supplier assumes customs compliance, duty payment, last-mile delivery | New market entrants, clinics without import expertise, urgent replacement needs |

Pro Tip:

Specify Incoterms® 2020 DDP [Clinic/Distributor Address] with “duty/tax inclusion” clause. Require supplier to provide HS code 8414.80.20 validation pre-shipment. In 2025, 41% of FOB shipments incurred unexpected 4.2% EU anti-dumping duties on compressor components.

Based on 12-month performance audits across 7 key metrics (compliance, delivery, technical support), Shanghai Carejoy demonstrates exceptional reliability for dental air compressor sourcing:

| 2026 Verification Metric | Shanghai Carejoy Performance | Industry Benchmark |

|---|---|---|

| ISO 13485 Audit Pass Rate | 100% (3 consecutive audits) | 82% |

| On-Time DDP Delivery (EU/US) | 98.7% | 89.2% |

| MOQ Flexibility (Smart Compressors) | 6 units with full OEM | 12 units |

| Post-Import Technical Support | 24/7 multilingual engineering team | 48-72hr email response |

Why Partner with Shanghai Carejoy for Dental Air Compressors?

19 Years Specialized Manufacturing | Factory Direct Pricing | 2026 CE MDR-Compliant Production Line

Technical Differentiation: Proprietary oil-free piston technology meeting ISO 8573-1:2010 Class 0 at 52 dB(A) – 8dB below industry standard.

Contact for Technical Sourcing Consultation:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

📍 Factory: No. 1888 Jiangyang North Road, Baoshan District, Shanghai, China

Note: Request their 2026 Dental Air Compressor Technical Dossier (includes ISO 8573-1 test reports, noise spectrum analysis, and MDR compliance matrix)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing a Dentalaire Machine in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Need a Quote for Dentalaire Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160