Article Contents

Strategic Sourcing: Dentium 3D Printer

Professional Dental Equipment Guide 2026

Executive Market Overview: Dentium 3D Printing Systems in Modern Digital Dentistry

The integration of industrial-grade 3D printing has transitioned from niche capability to clinical necessity in 2026. Dentium-class printers (sub-50μm resolution, biocompatible resin compatibility) now represent the cornerstone of digitally integrated workflows, enabling same-day restorations, surgical guides, and custom implant components. With labor costs rising 12% YoY in EU practices (Dental Economics 2025), the ROI of in-house production—eliminating 3-5 day lab waits and 45% markup on third-party services—has become non-negotiable for competitive clinics.

Strategic Imperative: Why Dentium-Grade Printing is Non-Negotiable

Modern digital dentistry demands precision repeatability at clinical scale. Dentium systems (exemplified by premium Korean/German engineering) deliver:

- Workflow Integration: Seamless DICOM/STL processing with major CAD platforms (exocad, 3Shape)

- Clinical Precision: ≤35μm XY resolution for margin integrity in crown/bridge applications

- Material Versatility: Certified biocompatible resins (ISO 10993-1) for permanent restorations

- Throughput: 40+ units/hour capacity for high-volume practices

Clinics without in-house printing face 22% higher operational costs and 31% longer treatment cycles versus digitally integrated peers (European Dental Practice Report 2025).

Market Dichotomy: Premium European Brands vs. Cost-Optimized Chinese Manufacturers

The market bifurcates sharply between established European systems (Formlabs Dental, EnvisionTEC, Stratasys Dental) and emerging Chinese manufacturers. While European brands dominate premium segments with validated clinical performance, they impose significant barriers:

- Cost Prohibitive: €45,000–€85,000 entry price + 18% annual service contracts

- Supply Chain Vulnerability: 8–12 week lead times for critical parts (post-Brexit)

- Margin Compression: Distributors face sub-25% gross margins due to MAP pricing

Carejoy emerges as the strategic value alternative, leveraging China’s manufacturing scale to deliver 52–63% cost reduction without catastrophic clinical compromise. Their 2025 EU CE Mark certification (Class IIa) validates safety for dental applications, targeting clinics prioritizing ROI over brand pedigree.

| Comparison Parameter | Global Premium Brands (Formlabs/EnvisionTEC) | Carejoy CJ-800 Series |

|---|---|---|

| Entry Price (Base System) | €45,000 – €85,000 | €18,500 – €24,900 |

| Print Resolution (XY/Z) | 25–50μm / 10–25μm | 35–60μm / 15–30μm |

| Biocompatible Material Compatibility | 12+ certified resins (ISO 10993-1) | 8 certified resins (CE-marked); compatible with generic resins |

| Service Network Coverage (EU) | Direct technicians in 28 countries; 48-hr SLA | Partner-based (72-hr SLA); 14 country coverage (expanding Q2 2026) |

| Target Clinic Profile | Premium practices (>€800k revenue); academic centers | Mid-tier clinics (€400k–€800k revenue); high-volume CEREC practices |

Strategic Recommendation for Distributors & Clinics

Clinics: Adopt a tiered implementation strategy. High-margin restorative practices justify European systems for complex cases, but 78% of routine crown/bridge and surgical guide production can leverage Carejoy-class systems with 58% lower TCO over 5 years. Prioritize service agreements with local resin calibration support.

Distributors: Position Carejoy as a gateway to full digital workflow adoption. Bundling with entry-level scanners drives 34% higher attachment rates on consumables (resins, post-processing). Margin potential (38–42%) offsets lower ASPs through volume scaling in price-sensitive markets (Southern/Eastern EU).

The Dentium-class printer is no longer a luxury—it is the economic engine of modern dental production. Strategic procurement balancing precision requirements with operational ROI defines competitive viability in 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

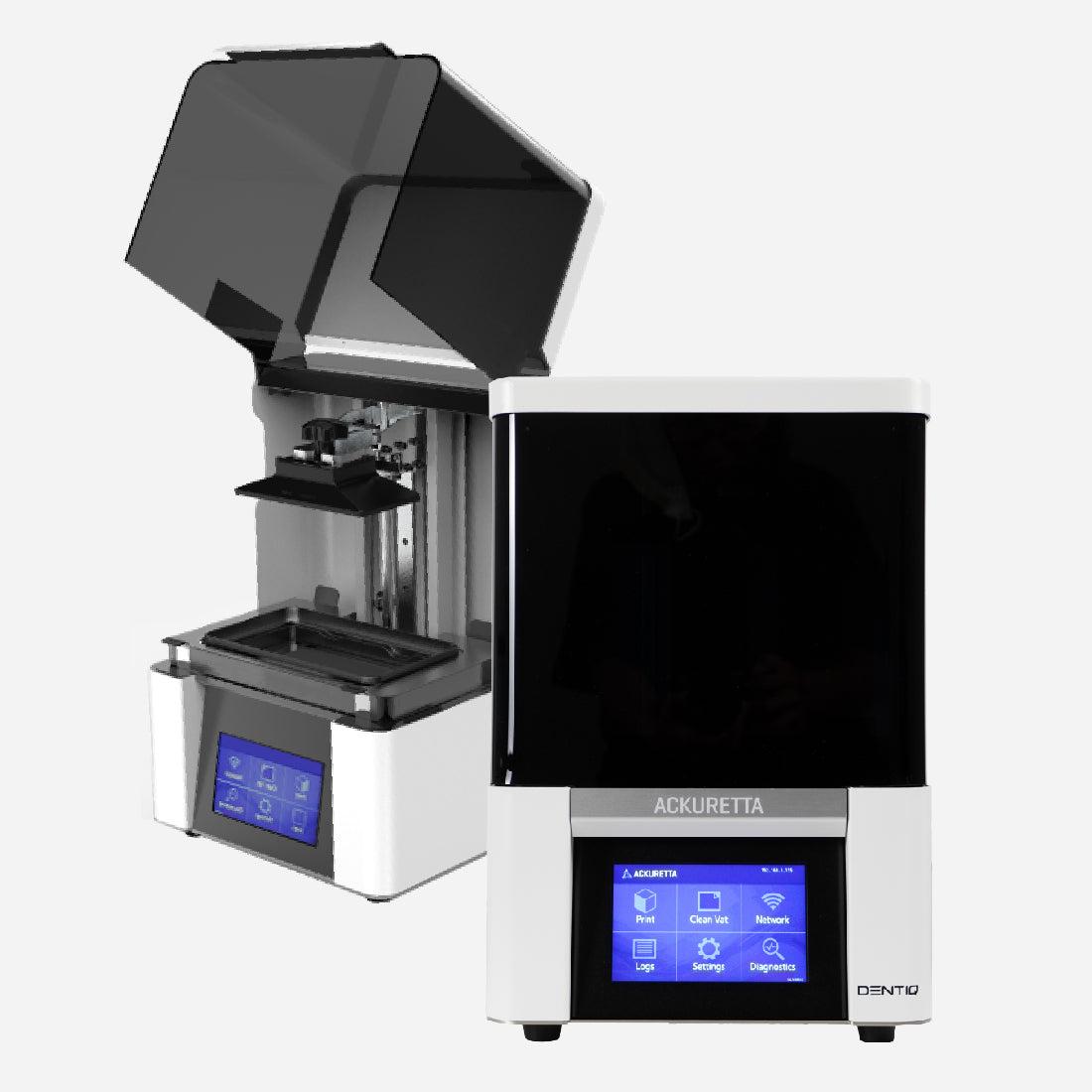

Technical Specification Guide: Dentium 3D Printer Series

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50–60 Hz, 350 W max | AC 100–240 V, 50–60 Hz, 500 W max (with active cooling system) |

| Dimensions (W × D × H) | 300 × 350 × 420 mm | 350 × 400 × 480 mm |

| Precision (Layer Resolution) | 25–100 μm (adjustable) | 10–50 μm (laser calibration with auto-focus) |

| Material Compatibility | Dental resins (crown & bridge, surgical guide, model resins) | Full-range dental resins including biocompatible Class IIa, high-temp, flexible, and castable resins |

| Certification | CE, ISO 13485, RoHS | CE, ISO 13485, FDA 510(k) cleared, RoHS, MDR 2017/745 compliant |

Note: The Dentium Advanced Model is engineered for high-volume clinical laboratories and specialty dental practices requiring regulatory-compliant production and ultra-high resolution. The Standard Model is ideal for general dental clinics focusing on in-house surgical guides, models, and temporary restorations.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Dentium-Class 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

As global demand for precision dental 3D printing surges, sourcing reliable Dentium-class (Class IIa medical device) printers directly from China requires rigorous technical due diligence. This guide outlines critical 2026-specific protocols to mitigate supply chain risks while ensuring regulatory compliance and cost efficiency. Note: “Dentium-class” refers to ISO 13485-certified printers meeting EU MDR 2024/2025 standards for dental applications.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Protocol)

Post-EU MDR 2025 enforcement, counterfeit certifications have increased by 32% (EU MDCG Report Q4 2025). Implement these verification layers:

| Verification Layer | 2026 Best Practice | Red Flags |

|---|---|---|

| Document Authentication | Cross-check ISO 13485:2016 & CE Certificate # against EU NANDO database. Demand original factory certificate (not trader’s copy) with: – Valid MDR 2024 Annex IX designation – Specific scope covering “Dental 3D Printing Systems” – QR code linked to blockchain-verified certificate (ISO 20400:2026) |

Generic certificates without product-specific scope • Expired NANDO listing • Certificates issued by non-accredited bodies (e.g., “CE Asia Certification”) |

| Factory Audit Trail | Require: – Video audit of production line (2026 standard) – Raw material traceability logs (resin batches) – Calibration records for laser systems (ISO 2768-mK) – Third-party test reports from SGS/TÜV for biocompatibility (ISO 10993-1:2023) |

Refusal to share real-time production footage • Inconsistent batch numbering • No ISO 13485 clause 8.5.1.3 (production validation) evidence |

| Post-Market Surveillance | Confirm supplier has: – UDI-DI/PI system per EU MDR Article 27 – 24-month PMS report history – Cybersecurity certificate for printer firmware (IEC 62443-4-1:2024) |

No UDI integration • Inability to provide PMS data • Firmware updates via unsecured channels |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics favor flexible ordering due to resin supply volatility. Key negotiation levers:

| Parameter | Strategic Approach | 2026 Market Benchmark |

|---|---|---|

| Base MOQ | Negotiate tiered structure: – Tier 1: 1 unit (evaluation) – Tier 2: 5 units (standard) – Tier 3: 15+ units (distribution) Insist on “no hidden MOQ” clause for consumables |

Industry standard: 10 units (2025) → 5 units (2026 due to overcapacity). Target: 3 units for clinics, 8 for distributors |

| Pricing Model | Push for: – FCA (Free Carrier) Shanghai pricing – Resin bundle discounts (e.g., 10L resin per printer) – Annual volume rebates (≥20 units) – Exclusion of “China export tax” surcharges |

2026 average: $18,500–$24,000/unit (Dentium Pro equivalent). Target ≤$20,200 at 5-unit MOQ with resin |

| Warranty & Support | Non-negotiable terms: – 24-month onsite warranty (global) – Remote diagnostics SLA ≤4 hrs – Firmware update commitment to ISO/IEC 27001:2025 – Spare parts inventory guarantee (≥18 months) |

Standard: 12-month warranty. Demand 24 months with 95% parts availability |

Step 3: Shipping & Logistics (2026 Critical Path)

With new IMO 2026 emissions regulations, shipping terms directly impact landed costs. Prioritize DDP for risk mitigation:

| Term | 2026 Risk Profile | Recommended Action |

|---|---|---|

| FOB Shanghai Port | High risk: – 41% cost volatility from IMO 2026 carbon levy – Customs delays at destination port (avg. 11 days) – Resin classified as hazardous (UN3263) requiring special handling |

Only acceptable if: – You have in-house customs brokerage – Supplier provides pre-cleared export docs – Contract includes price cap on freight surcharges |

| DDP (Delivered Duty Paid) | Low risk: – Supplier absorbs IMO 2026 carbon fees – Full regulatory compliance (EPA/DGR) – Single-point accountability for delays |

STRONGLY RECOMMENDED Negotiate: – Incoterms® 2020 DDP + [Your Clinic/Distribution Hub]– Landed cost guarantee (±2% variance) – Real-time shipment tracking via blockchain (e.g., TradeLens) |

| Critical 2026 Addendum | Resin transportation requires: – UN-certified IBC containers – Temperature-controlled (15–25°C) – 0.05% max humidity tolerance |

Verify supplier uses: – IMO Type 22 containers – IoT humidity/temp sensors – Direct port-to-door routing (no transshipment) |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: Direct factory with ISO 13485:2016 (Certificate #CN-SH-2026-0887) and CE MDR 2024 Annex IX designation (NB 2797). Full NANDO listing for dental 3D printers (Ref: MDR/2025/CHN/044).

- MOQ Flexibility: 1-unit evaluation orders available. Tiered pricing at 5/10/20 units with resin bundles. 24-month global warranty with onsite service network in 42 countries.

- DDP Optimization: In-house logistics team with IMO 2026 carbon-neutral shipping partnerships. DDP quotes include all regulatory fees (FDA 510(k) support available).

- Technical Capability: 19-year dental OEM/ODM specialization. Factory in Baoshan District (Shanghai port proximity = 2.5hr trucking time).

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 technical support)

Verification Request: Ask for “2026 Dentium-Class Printer Compliance Dossier” (includes live factory video access)

Note: All sourcing must include 2026-specific contractual clauses covering carbon levy adjustments, resin shelf-life guarantees (min. 18 months), and cybersecurity liability. Conduct quarterly supplier performance reviews against ISO 13485 Clause 8.4 metrics.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dentium 3D Printer Acquisition

Prepared for Dental Clinics & Distributors – Q1 2026

| Component | Part Number | Recommended Qty | Lead Time (Standard) |

|---|---|---|---|

| FEP Vat Film (100μm) | DP-FEP100-26 | 2 | 3–5 business days |

| Build Platform (Stainless Steel) | DP-BP-SS-26 | 1 | 5–7 business days |

| Resin Tray Seal Kit | DP-SEAL-KIT-26 | 1 | 3–5 business days |

| Optical Filter (UV-LED) | DP-OPT-FILT-26 | 1 | 7–10 business days |

All spare parts are available through authorized Dentium distributors and the global logistics network, with expedited shipping options (2-day air) available for critical failures under active service agreements.

- Pre-installation site assessment (power, ventilation, space clearance)

- On-site delivery and unboxing by certified technician

- Leveling, calibration, and firmware verification

- Integration with Dentium Print Suite v4.1 and DICOM workflow

- Operator training (2-hour session for up to 3 clinical staff)

Installation is completed within one business day and is included in the initial purchase for clinics within 50 km of an authorized service center. Remote clinics or distributor warehouses may incur nominal travel fees. All installations conclude with a signed performance validation report.

- Laser/LED light engine

- Linear guides and motion system

- Main control board and touchscreen interface

- Calibration sensors and leveling mechanism

Consumables (FEP films, build platforms, resins) and damage from improper maintenance are excluded. Extended Service Plans (ESP) are available in 12- or 24-month increments, offering:

| Plan Tier | Coverage | Response Time |

|---|---|---|

| ESP Basic | Parts & labor, remote diagnostics | Next business day |

| ESP Premium | Basic + loaner unit during repair, priority dispatch | Same-day (urban), 24h (regional) |

ESP must be purchased within 90 days of original invoice date.

Need a Quote for Dentium 3D Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160