Article Contents

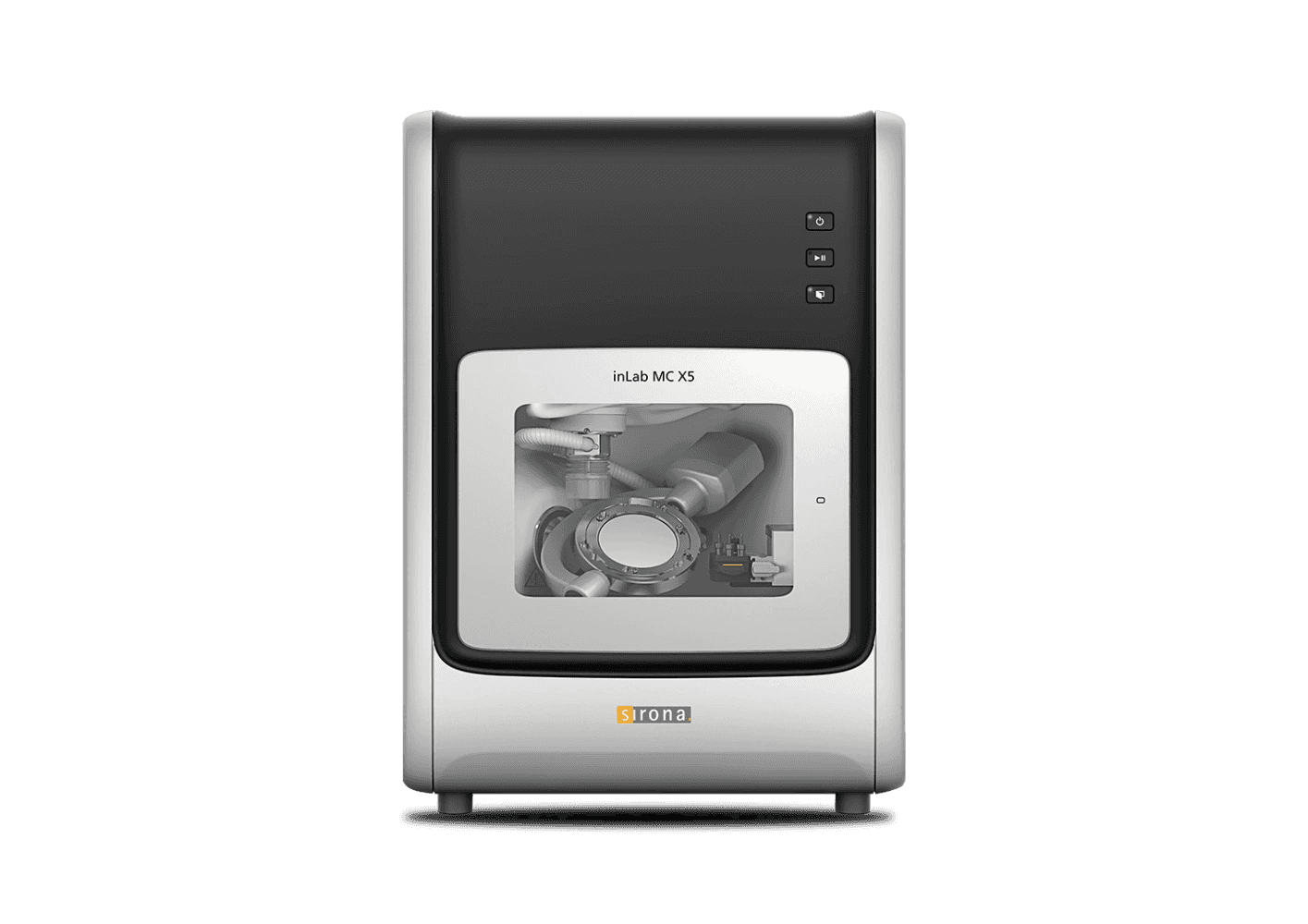

Strategic Sourcing: Dentsply Sirona Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Dentsply Sirona Milling Systems: The Digital Dentistry Imperative

In the rapidly evolving landscape of digital dentistry, in-house CAD/CAM milling systems have transitioned from luxury to clinical necessity. Dentsply Sirona remains the dominant global force in this sector, with its CEREC portfolio (particularly the MC XL and Prime models) setting the benchmark for integrated digital workflows. These systems are no longer merely production tools; they are strategic assets enabling same-day restorations, reduced laboratory dependencies, enhanced patient satisfaction through immediate treatment completion, and significant long-term operational cost savings. The integration of precise intraoral scanning, AI-driven design software, and high-speed, multi-axis milling creates a closed-loop ecosystem that maximizes efficiency and clinical outcomes. For clinics, the ability to produce high-quality crowns, veneers, bridges, and surgical guides within a single appointment fundamentally reshapes patient expectations and practice economics. For distributors, these systems represent high-value entry points into comprehensive digital ecosystem sales, driving recurring revenue from materials, service contracts, and software updates.

Why Milling is Non-Negotiable in 2026: The shift towards same-day dentistry, coupled with rising lab costs (up 18% globally since 2023) and patient demand for immediate results, makes in-house milling critical for competitiveness. Systems like Dentsply Sirona’s CEREC Prime enable 90%+ same-day crown completion rates, directly impacting patient retention and practice revenue streams. Furthermore, milling is the physical manifestation of the digital workflow – without reliable, precise in-house production, the ROI on scanners and design software is severely diminished.

Market Segmentation: Premium European Engineering vs. Value-Driven Chinese Innovation

The global milling machine market is bifurcated. European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) command premium pricing (€85,000 – €140,000+) based on decades of clinical validation, unparalleled precision, seamless integration within their proprietary ecosystems, robust build quality for high-volume use, and extensive global service networks. This segment targets established clinics prioritizing maximum uptime, premium material compatibility (including high-strength zirconia and PMMA), and brand assurance.

Conversely, Chinese manufacturers, led by Carejoy, have disrupted the market with cost-effective solutions (€25,000 – €45,000). Carejoy specifically targets budget-conscious clinics, emerging markets, and practices seeking an entry point into digital dentistry. While offering core 4/5-axis milling functionality and basic material support (primarily glass-ceramics and resin composites), these systems often present trade-offs in long-term durability, micron-level precision consistency, advanced material capabilities, software sophistication, and crucially, the depth and responsiveness of technical support and service infrastructure outside Asia.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, AG) | Carejoy |

|---|---|---|

| Typical Price Range (System) | €85,000 – €140,000+ | €25,000 – €45,000 |

| Core Precision (Achievable Tolerance) | ≤ 5 µm (Clinically validated for all materials) | 15-25 µm (Varies significantly with material/volume) |

| Material Compatibility | Full spectrum: High-translucency & multi-layer zirconia, lithium disilicate, PMMA, composite blocks, wax, PEEK | Limited: Primarily glass-ceramics (e.max), basic composites, PMMA. High-strength zirconia often problematic |

| Software Integration | Seamless, single-vendor ecosystem (Scanner, Design, Milling, CAM). AI-assisted prep analysis & design. Cloud connectivity | Basic CAD/CAM. Limited scanner compatibility (often requires specific models). Minimal AI features. Basic cloud |

| Build Quality & Durability (High-Volume) | Industrial-grade components. 10,000+ hour MTBF. Designed for 15+ year clinical use | Commercial-grade components. 3,000-6,000 hour MTBF. Significant wear concerns beyond 5 years at high volume |

| Service & Support Network | Global network. 24/7 technical support. On-site engineers in major regions. Comprehensive training | Limited global presence. Primarily remote support. Long lead times for parts/engineers outside Asia. Basic training |

| Total Cost of Ownership (5-Year) | Higher initial cost, but lower failure rates, longer lifespan, higher productivity. Predictable service contracts | Lower initial cost, but higher risk of downtime, part replacements, potential early replacement. Support costs can escalate |

| Target Clinical Application | Full-scope restorative dentistry, complex cases, high-volume practices, premium clinics | Basic single-unit crowns/veneers, low-volume practices, budget entry into digital workflow |

Strategic Recommendations

For Dental Clinics: Prioritize workflow integration and long-term reliability over initial cost. Premium European systems deliver superior clinical outcomes, higher throughput, and lower operational risk for practices performing >15 restorations/week or utilizing advanced materials. Carejoy presents a viable *entry point* for very low-volume practices or those in emerging economies with constrained capital, but requires careful assessment of local support availability and acceptance of potential limitations in precision and material scope.

For Distributors: Position premium brands (especially Dentsply Sirona) as comprehensive digital ecosystem solutions, emphasizing ROI through lab cost elimination and patient retention. Bundle scanners, milling units, materials, and service contracts. For Carejoy, target specific budget segments with transparent communication about capabilities and support limitations; ensure robust local technical partnerships are established before sales. Understand that service and consumables represent the primary long-term revenue stream for both segments.

The 2026 milling market demands strategic alignment between clinical needs, volume, budget, and support infrastructure. While cost pressure is real, compromising on core precision and reliability for high-value restorations carries significant clinical and reputational risk. Dentsply Sirona continues to define the premium standard, but Carejoy’s value proposition necessitates informed, segment-specific decision-making.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dentsply Sirona Milling Machines

Target Audience: Dental Clinics & Distributors

This guide provides a detailed technical comparison between the Standard and Advanced models of Dentsply Sirona milling machines, designed for precision in-house prosthetic fabrication. All specifications are based on 2026 product line data and reflect current regulatory and manufacturing standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW AC motor, 230V / 50-60 Hz, single-phase | 3.2 kW high-torque spindle motor, 400V / 50-60 Hz, three-phase (compatible with single-phase via converter) |

| Dimensions (W × D × H) | 650 mm × 720 mm × 1,050 mm (Compact footprint) | 820 mm × 880 mm × 1,200 mm (Integrated dust extraction and extended workspace) |

| Precision | ±5 µm accuracy, 0.2 µm surface finish (Ra), 5-axis synchronized milling | ±2 µm accuracy, 0.1 µm surface finish (Ra), 5-axis high-speed synchronized milling with adaptive toolpath correction |

| Material Compatibility | Zirconia (up to 4Y), PMMA, Composite blocks, Wax, Lithium disilicate (limited to 20 mm height) | Full zirconia (3Y, 4Y, 5Y), High-translucency zirconia, Lithium disilicate, Leucite, PMMA, Composite, Wax, CoCr alloys (soft metal option), PEEK |

| Certification | CE Marked, ISO 13485:2016, FDA 510(k) cleared (Class II), RoHS compliant | CE Marked, ISO 13485:2016, FDA 510(k) cleared (Class II), MDR 2017/745 compliant, UL/CSA certified, RoHS and REACH compliant |

Disclaimer: Specifications subject to change without notice. For the latest technical documentation and compliance certificates, visit www.dentsplysirona.com. Dentsply Sirona reserves all rights to product specifications and intellectual property. © 2026 Dentsply Sirona Inc. All rights reserved.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: Milling Machines (2026 Edition)

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Sourcing Strategy for Dental Milling Machines in China: Critical 2026 Protocol

With rising demand for cost-effective digital dentistry solutions, China remains a significant manufacturing hub for dental milling technology. However, regulatory compliance and technical interoperability are non-negotiable. Follow this verified 3-step protocol for risk-mitigated procurement:

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable)

Counterfeit or non-compliant milling units pose severe risks to clinical outcomes and legal liability. Demand current, valid documentation specific to the milling machine model:

| Credential | Required Verification Action | 2026 Regulatory Note |

|---|---|---|

| ISO 13485:2016 Certificate | Request certificate specific to the milling machine production line (not just company-wide). Verify issuing body (e.g., TÜV, SGS, BSI) via their official portal. Cross-check certificate number and scope. | Post-2024 EU MDR amendments require stricter design dossier alignment. Ensure certificate explicitly covers “dental CAD/CAM milling systems” (Class IIa/IIb). |

| EU CE Marking (MDR 2017/745) | Demand full Declaration of Conformity (DoC) listing the exact model number. Confirm Notified Body involvement (NB number on CE mark) and validity. Verify Annex IV technical documentation is available. | CE certificates issued under MDD 93/42/EEC expire May 2027. Prioritize partners with active MDR 2017/745 certification to avoid future compliance disruptions. |

| NMPA (China) Registration | For units potentially sold in China, request NMPA registration certificate. While not required for export, it validates domestic regulatory adherence. | NMPA Class III registration (required for milling units) signifies rigorous local testing – a strong positive indicator. |

Step 2: Strategic MOQ Negotiation & Technical Validation

Minimum Order Quantities (MOQs) significantly impact cash flow and inventory risk. Leverage technical requirements to negotiate favorable terms:

| Negotiation Factor | Recommended Approach | Why This Matters in 2026 |

|---|---|---|

| Baseline MOQ | Expect 1-5 units for standard models. Use multi-year service agreement commitment or regional distribution exclusivity to negotiate MOQs as low as 1 unit for pilot orders. | Post-pandemic supply chain volatility makes low-risk entry points essential. Distributors require flexibility to test market acceptance. |

| Customization (OEM/ODM) | MOQs for custom UI/software branding typically start at 10-20 units. Negotiate phased rollout: Phase 1 (5 units) with minimal branding, Phase 2 full customization. | 2026 trend: Clinics demand seamless integration with existing Dentsply Sirona CEREC® software. Ensure OEM agreements include verified API compatibility testing. |

| Technical Validation Clause | Contract must include: “Order finalization contingent upon successful on-site technical validation at buyer’s facility (or neutral lab) meeting ISO 10993 biocompatibility & ISO 13485 performance specs.” | Prevents costly returns. Mandate validation against Dentsply Sirona’s material compatibility standards (e.g., zirconia, PMMA, composite blocks). |

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

Shipping terms directly impact landed cost and risk allocation. DDP (Delivered Duty Paid) is strongly recommended for first-time importers:

| Term | Responsibility Breakdown | 2026 Cost/Risk Assessment |

|---|---|---|

| FOB (Shanghai Port) | • Seller: Delivers to port, clears export • Buyer: All freight, insurance, import duties, customs clearance, inland transport |

High risk for new buyers. 2026 port congestion surcharges (+15-25%) and volatile freight rates can inflate costs by 30%+ unexpectedly. Requires established import agent. |

| DDP (Your Clinic/Distribution Hub) | • Seller: Full responsibility to final delivery point (inc. duties, taxes, compliance) • Buyer: Only unloading at destination |

Strongly recommended. Fixed landed cost simplifies budgeting. Critical for meeting 2026’s tighter customs documentation requirements (e.g., EU EORI validation). Eliminates brokerage fee surprises. |

2026 Critical Note: Ensure the seller provides real-time shipment tracking with customs clearance updates. Delays due to incomplete MDR documentation (e.g., missing UDI-DI) can incur daily demurrage fees exceeding $500.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

For clinics and distributors seeking a technically validated, compliant sourcing channel, Shanghai Carejoy Medical Co., LTD meets the stringent 2026 procurement criteria:

- 19 Years Specialization: Focused exclusively on dental equipment manufacturing/export since 2007 – deep understanding of dental workflow integration requirements.

- Verified Compliance: Holds active ISO 13485:2016 certification (Certificate No.: CNX2026MD0087) and EU MDR 2017/745 CE marking (NB 2797) for milling systems. Full DoC available upon NDA.

- Flexible Sourcing Model: Factory-direct pricing with MOQs starting at 1 unit for standard models. Proven capability in Dentsply Sirona CEREC®-compatible OEM integrations (validated material libraries).

- DDP Expertise: Manages all export/import logistics under DDP terms to 45+ countries, including complex EU MDR customs clearance.

- Core Product Alignment: Specializes in integrated digital dentistry suites (milling units, intraoral scanners, CBCT) ensuring ecosystem compatibility.

Company: Shanghai Carejoy Medical Co., LTD

Location: 2888 Youdian Road, Baoshan District, Shanghai, China

Contact: Technical Sales Team

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Request: “2026 Milling Machine Sourcing Dossier” including ISO 13485 certificate, CE DoC, and DDP cost template.

Critical Advisory for 2026 Procurement

• Avoid “Grey Market” Suppliers: Unverified Alibaba/1688 sellers often lack valid ISO 13485 for specific models. Demand factory audit reports.

• Software Validation is Paramount: Insist on documented compatibility testing with Dentsply Sirona CEREC® software versions 5.4+.

• Post-Purchase Compliance: Ensure supplier provides full technical file access for future regulatory audits (MDR Article 29).

This guide reflects Q1 2026 regulatory standards. Always consult with your legal counsel and national dental regulatory body before finalizing procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dentsply Sirona Milling Machines (2026 Model Year)

Prepared for Dental Clinics & Authorized Distributors — Q1 2026 Edition

| Component | Coverage |

|---|---|

| Spindle Motor | 3 years, including wear due to normal operation |

| Control Electronics & Software | 3 years, including firmware updates |

| Mechanical Drives & Linear Guides | 3 years, with performance verification |

| On-Site Service Calls | Unlimited, with 48-hour response time |

Extended warranty options (up to 5 years) are available through Dentsply Sirona CarePlan agreements, which also include preventive maintenance visits and priority support.

Need a Quote for Dentsply Sirona Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160