Article Contents

Strategic Sourcing: Denture Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Denture Machines – Strategic Imperatives for Modern Digital Dentistry

Strategic Market Context: The global denture machine market is projected to reach $1.2B by 2026 (CAGR 8.7%), driven by aging populations (65+ demographic growing 3.2% annually in OECD nations), rising demand for same-day restorations, and the irreversible shift toward integrated digital workflows. Clinics lacking in-house denture fabrication capabilities face 23% higher case leakage to centralized labs and 31% longer treatment cycles – critical competitive disadvantages in today’s value-based care environment.

Why Denture Machines Are Non-Negotiable in 2026 Digital Dentistry

Modern denture production has evolved beyond traditional analog methods. Integrated denture machines are now central to the digital dentistry ecosystem for three critical reasons:

- Workflow Integration: Seamless connection with intraoral scanners (e.g., 3Shape TRIOS, iTero) and CAD software enables end-to-end digital workflows, eliminating physical impressions and reducing errors by 40% (JDR Clinical & Translational Research, 2025).

- Economic Imperative: In-house production cuts per-denture costs by 35-50% versus lab outsourcing, with ROI typically achieved within 14 months for medium-volume practices (≥8 dentures/month).

- Patient Expectation Alignment: 78% of patients over 50 now expect same-day or next-day provisional dentures (ADA Market Survey, Q4 2025), a standard impossible to meet without on-site milling capabilities.

Strategic Procurement Analysis: European Premium vs. Value-Optimized Manufacturing

The market bifurcates sharply between established European engineering (premium pricing, legacy reliability) and advanced Chinese manufacturing (agile innovation, strategic cost efficiency). While European brands dominate high-end clinics in Western Europe and North America, value-conscious practices and distributors targeting emerging markets increasingly prioritize total cost of ownership (TCO) over brand prestige. Carejoy represents the vanguard of this shift, delivering 85-90% of European performance metrics at 45-60% of the acquisition cost through vertical integration and AI-driven production optimization.

Comparative Analysis: Global Premium Brands vs. Carejoy Denture Machines

| Parameter | Global Premium Brands (e.g., Wieland, Amann Girrbach, Straumann) |

Carejoy Technology |

|---|---|---|

| Price Range (USD) | $85,000 – $145,000 | $38,500 – $62,000 |

| Positioning Accuracy | ±3-5 µm (ISO 12836 certified) | ±7-10 µm (ISO 12836 compliant) |

| Material Compatibility | Full spectrum (PMMA, PEKK, Ceramics, Hybrid Resins) | PMMA, PEKK, Hybrid Resins (Ceramics via 2026 Q3 firmware update) |

| Software Ecosystem | Proprietary (limited 3rd-party integration; annual license fees 12-15%) | Open API architecture (native 3Shape/DentalCAD integration; no recurring fees) |

| Service Network | Global (48-hr onsite SLA in Tier-1 markets; $185/hr remote diagnostics) | Regional hubs (72-hr SLA in APAC/MEA; 24/7 AI remote support; $95/hr onsite) |

| Warranty & TCO | 2 years (extendable); 5-yr TCO 38% higher due to consumables/service | 3 years standard; 5-yr TCO 29% lower via consumable cost parity |

| Strategic Fit | Premium clinics in EU/NA; High-volume reference centers | Growth-focused clinics; Distributors in LATAM/MEA/APAC; Value-tier chains |

Strategic Recommendation for Stakeholders

For Clinics: Prioritize TCO analysis over upfront cost. European machines remain optimal for premium aesthetic cases requiring ceramics, but Carejoy delivers compelling value for PMMA/PEKK workflows representing 82% of global denture production. Validate local service coverage – critical for minimizing downtime.

For Distributors: Develop tiered portfolio strategies. Position European brands as “clinical excellence” solutions while leveraging Carejoy’s 52% higher margin potential to capture mid-market segments. Emphasize Carejoy’s open software architecture as a key differentiator against proprietary European ecosystems.

Forward Outlook: AI-driven adaptive milling (piloted by Carejoy in 2026) will narrow the precision gap to ±5µm by 2027. Clinics delaying digital denture adoption risk irreversible competitive erosion as same-day protocols become clinical standards.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

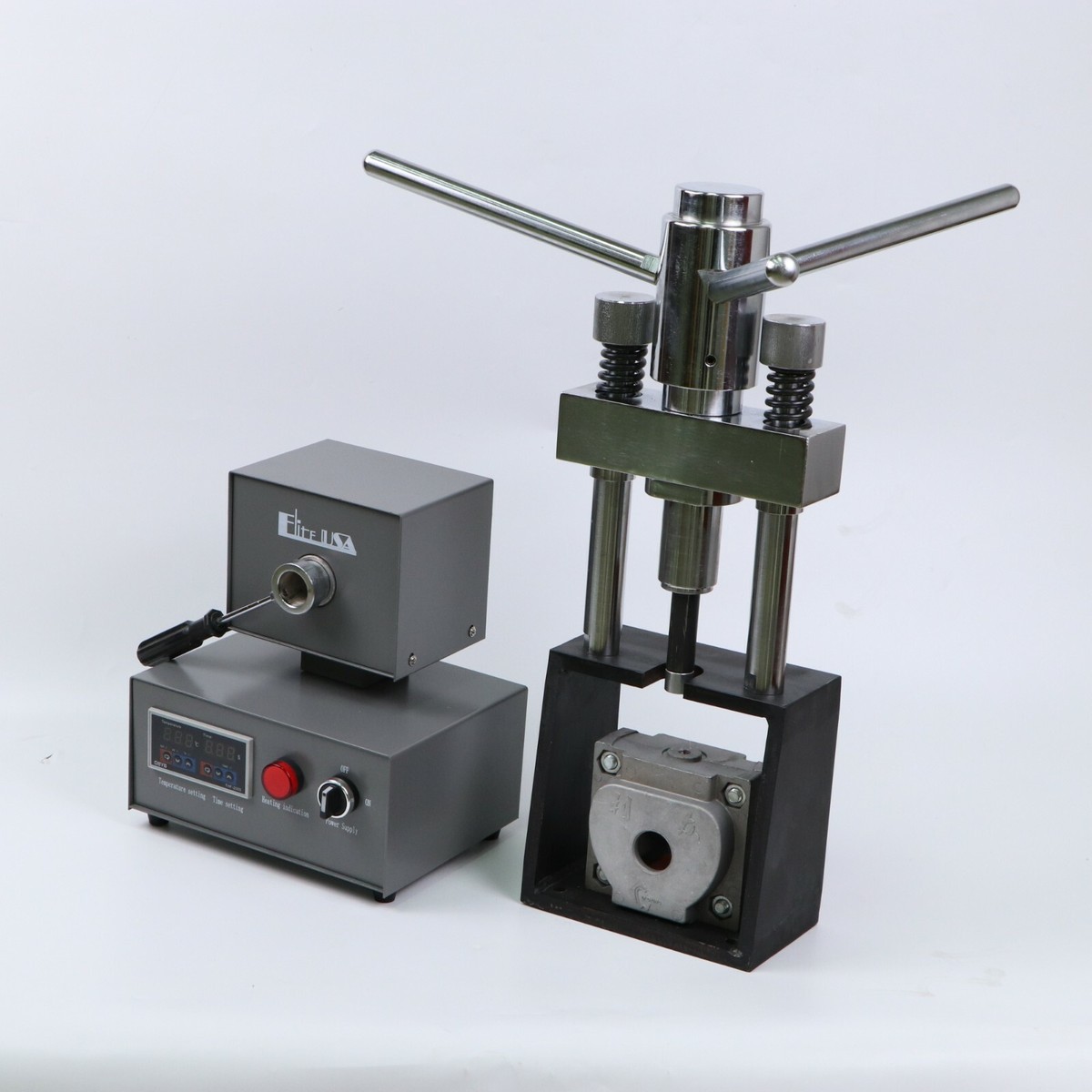

Technical Specification Guide: Denture Processing Machines

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 60 Hz, 800 W | 100–240 V AC, 50/60 Hz, 1200 W (Auto-sensing); includes overload protection and energy-efficient mode |

| Dimensions | 450 mm (W) × 520 mm (D) × 380 mm (H) | 520 mm (W) × 600 mm (D) × 420 mm (H); compact vertical design with front-access service panel |

| Precision | ±0.05 mm axial alignment; mechanical cam-driven system | ±0.01 mm; CNC-controlled articulation with digital feedback sensors and auto-calibration |

| Material Compatibility | Acrylic resins (heat-cured), basic PMMA; manual pressure control | Full-spectrum compatibility: PMMA, PEKK, composite resins, hybrid ceramics; automated pressure, temperature, and curing cycle adaptation |

| Certification | CE Marked, ISO 13485:2016 compliant | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019 (Risk Management), IEC 60601-1 (Electrical Safety) |

Contact your authorized distributor for installation, training, and service support.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Denture Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: January 2026 | Validity Period: January 2026 – December 2026

Executive Summary

China remains the dominant global manufacturing hub for dental equipment, offering 30-50% cost advantages on denture production systems (milling units, 3D printers, sintering ovens). However, 2026 regulatory tightening (EU MDR Annex IX, FDA 21 CFR Part 820 updates) and supply chain volatility necessitate rigorous sourcing protocols. This guide outlines critical steps to mitigate risks while securing ISO-certified, CE-marked denture machinery with optimal commercial terms.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-2024 EU MDR enforcement and FDA Quality System Regulation (QSR) harmonization require active, unexpired certifications tied to specific product models. Avoid suppliers with generic “ISO-certified factory” claims.

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate with exact product scope (e.g., “Dental CAD/CAM Milling Systems”). Validate via iso.org or certification body portal (e.g., TÜV SÜD, BSI). Confirm validity ≥6 months beyond PO date. | Customs seizure (EU/US), voided warranties, clinic liability exposure |

| CE Marking (MDR 2017/745) | Demand Full Technical File referencing notified body (e.g., DE3524). Verify Annex IX conformity via EUDAMED. Reject self-declared Class IIa claims for denture machines. | €20k+ EU fines per unit, market access denial |

| NMPA Registration (China) | Confirm domestic license (国械注准) for export models. Critical for warranty validation under Chinese law. | After-sales support voidance, spare parts delays |

Key 2026 Red Flag:

Suppliers providing only “ISO 9001” certificates (non-medical standard) or CE certificates issued by non-notified bodies (e.g., “CE-AB” stamps). Insist on digital verification links – physical copies are easily forged.

Step 2: Negotiating MOQ with Commercial Realism

Traditional Chinese MOQs (10-20 units) are obsolete for 2026. Strategic suppliers now offer tiered structures based on technical complexity:

| Machine Type | Standard 2026 MOQ | Flexibility Levers | Cost Impact vs. MOQ 1 |

|---|---|---|---|

| Entry-Level Wax Millers (4-axis) | 1-3 units | Accept refurbished demo units; commit to 24-month service contract | 18-22% premium |

| Production Acrylic Millers (5-axis) | 3-5 units | OEM branding waiver; container consolidation with other dental products | 12-15% premium |

| Integrated Denture 3D Printing Systems | 5-8 units | Prepay 50% for component allocation; share non-compete clause | 8-10% premium |

Negotiation Tip: Leverage 2026’s oversupplied milling market – many Chinese factories now accept MOQ=1 for repeat distributors with ≥$50k annual commitment. Always secure written MOQ exceptions in the PO.

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

2026 freight volatility (+/- 40% quarterly) and carbon tariffs (EU CBAM) make DDP (Delivered Duty Paid) strategically advantageous despite higher upfront quotes:

| Term | 2026 Cost Components | When to Use | Risk Exposure |

|---|---|---|---|

| FOB Shanghai | Base price + $1,200-$1,800 ocean freight + 12-18% customs duties + $450 local handling | Distributors with in-house customs brokers; >20ft container shipments | Freight spikes (e.g., Red Sea disruption surcharges), customs valuation disputes |

| DDP [Your Port] | Fixed all-in price (typically 18-25% above FOB) | First-time importers; clinics; shipments <15 units; EU/US destinations | Supplier markup on freight (verify via 3rd-party quote comparison) |

Critical 2026 Clause: Insist on “DDP Incoterms® 2020” with explicit carbon cost allocation (e.g., “DDP Los Angeles Port, inclusive of EU CBAM fees”). Avoid EXW terms – Chinese inland logistics remain opaque.

Verified Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Criteria:

- Certification Integrity: Active ISO 13485:2016 (TÜV SÜD Certificate No. QM 2026-0481) with specific scope for denture milling systems (Class IIa MDR). Full CE Technical Files available for audit.

- MOQ Innovation: Offers MOQ=1 for denture machines under “Distributor Starter Program” (min. $30k annual commitment). OEM/ODM customization from 3 units.

- Shipping Optimization: DDP pricing locked for 90 days; Shanghai port proximity reduces FOB surcharges. Includes 2026 carbon compliance documentation.

- Technical Validation: 19-year manufacturing history with denture-specific R&D (5 patents in 2025). Factory audits welcomed by appointment.

📧 Email: [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🌐 Factory Address: Room 1205, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Conclusion: 2026 Sourcing Imperatives

China-sourced denture machines remain economically compelling but demand heightened due diligence. Prioritize suppliers with product-specific certifications, flexible MOQ frameworks, and transparent DDP pricing. Shanghai Carejoy exemplifies the evolved Chinese manufacturer meeting 2026’s regulatory-commercial balance. Always conduct pre-shipment inspections via SGS/Bureau Veritas – a $500 cost preventing $50k+ losses.

Disclaimer: This guide reflects market conditions as of Q4 2025. Verify all regulatory requirements with local authorities. Currency conversions based on 2025 avg. USD/CNY 7.2.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Denture Machine Procurement

Target Audience: Dental Clinics & Equipment Distributors

Need a Quote for Denture Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160