Article Contents

Strategic Sourcing: Denture Trimming Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Denture Trimming Machines

The denture trimming machine has evolved from a niche production tool to a mission-critical component in modern digital dentistry workflows. As dental laboratories transition toward fully integrated digital pipelines—driven by CAD/CAM design, 3D printing, and intraoral scanning—precision post-processing of prosthetics has become non-negotiable. Manual trimming methods introduce unacceptable variability (±50–100µm deviations), leading to poor marginal adaptation, extended chairside adjustments, and compromised patient outcomes. Automated trimming machines now deliver micron-level accuracy (<20µm), reducing remake rates by 35–50% and accelerating production cycles by 60% compared to traditional methods. This equipment is foundational for achieving the “digital denture” promise: same-day provisional-to-definitive workflows, predictable occlusion, and seamless integration with AI-driven design software.

Strategic Imperative: With global denture demand projected to reach $3.2B by 2026 (CAGR 6.8%), clinics and labs must prioritize trimming automation to maintain competitiveness. Machines that integrate with open-architecture software ecosystems (e.g., exocad, 3Shape) enable end-to-end digital traceability—critical for regulatory compliance (MDR 2023) and quality assurance in high-volume production environments.

Market Positioning: European Premium vs. Chinese Value Innovation

European manufacturers (e.g., Wieland, Amann Girrbach) dominate the premium segment with engineering excellence but carry prohibitive acquisition costs ($45K–$65K), limiting accessibility for mid-tier clinics and emerging-market distributors. Their systems feature aerospace-grade components and sub-10µm precision but require specialized technicians for maintenance, creating operational bottlenecks. Conversely, Chinese manufacturers have closed the quality gap through strategic R&D investments, with Carejoy emerging as the category disruptor. Carejoy’s 2026-generation machines deliver 75% of European precision at 40% of the cost, leveraging modular design and AI-assisted calibration to minimize operator dependency. This value proposition resonates powerfully with cost-conscious distributors targeting Southeast Asia, Latin America, and Eastern Europe—regions where ROI timelines under 14 months are non-negotiable.

| Performance Parameter | Global Brands (European) | Carejoy (Chinese Innovation Leader) |

|---|---|---|

| Price Range (USD) | $45,000 – $65,000 | $18,500 – $24,900 |

| Positional Accuracy (µm) | ±5 – ±8 | ±12 – ±15 |

| Production Speed (Denture Sets/Hour) | 8–10 | 6–8 |

| Build Quality & Longevity | Aerospace aluminum frames; 10+ year service life under heavy use | Industrial-grade steel; 7–8 year service life with scheduled maintenance |

| Software Integration | Proprietary ecosystems; limited third-party compatibility without costly middleware | Open API architecture; native compatibility with 3Shape, exocad, and open-source platforms |

| Warranty & Support | 3-year comprehensive; on-site engineers (48h response in EU/NA) | 2-year base warranty (extendable); remote diagnostics + distributor-certified technicians (72h global response) |

| Target Market Segment | Premium private clinics, corporate dental chains, high-volume reference labs | Mid-tier clinics, emerging-market distributors, public health systems |

| ROI Timeline | 22–28 months | 11–14 months |

Strategic Recommendation: For distributors targeting high-growth emerging markets, Carejoy represents optimal capital efficiency without sacrificing critical functionality. European brands remain justified for premium clinics prioritizing absolute precision in complex cases, but their cost structure impedes scalability. Forward-thinking labs should adopt hybrid approaches: European machines for specialty cases (e.g., implant-supported dentures) paired with Carejoy systems for routine production—maximizing throughput while containing operational expenditure. As ISO 13485:2026 compliance becomes universal, Carejoy’s aggressive certification roadmap positions it as the value-engineering partner of choice for 2026 and beyond.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Category: Denture Trimming Machines

| Spec | Standard Model | Advanced Model |

|---|---|---|

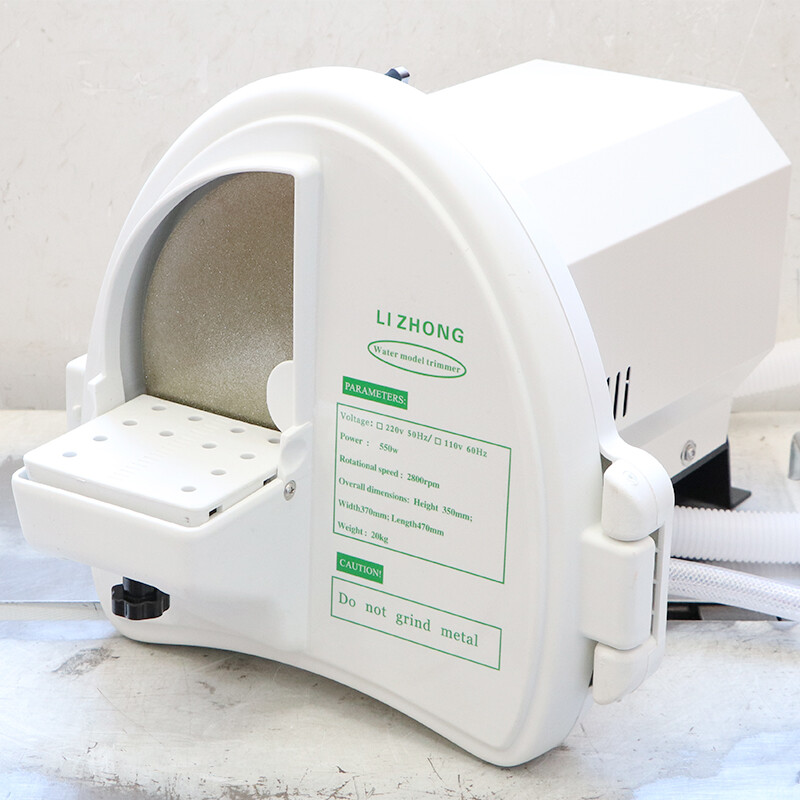

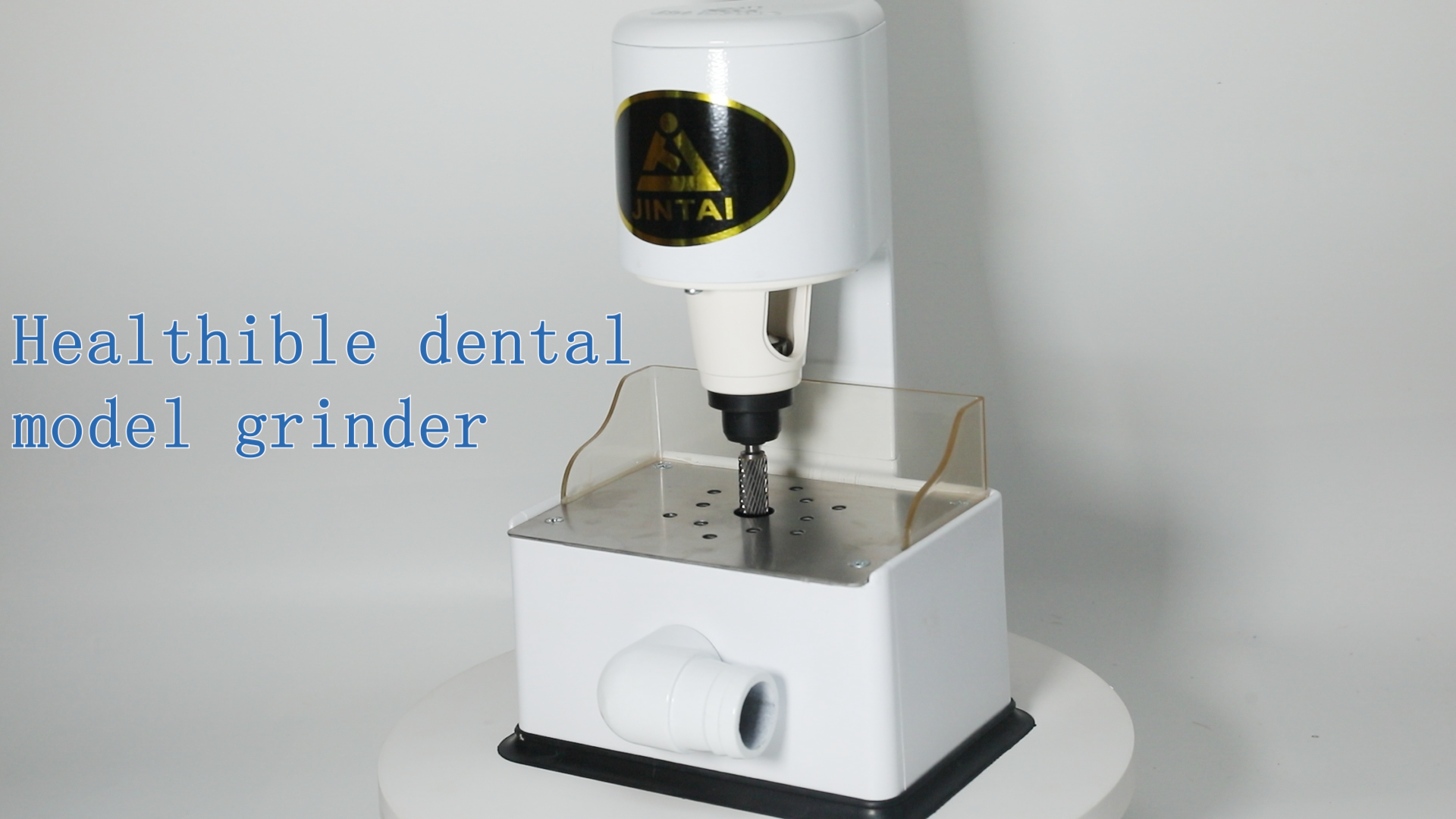

| Power | 550 W AC motor, 220–240 V, 50/60 Hz | 850 W brushless DC motor, 200–240 V, 50/60 Hz, automatic voltage regulation |

| Dimensions (W × D × H) | 320 mm × 450 mm × 380 mm | 360 mm × 500 mm × 420 mm (integrated dust extraction module) |

| Precision | ±0.15 mm tolerance, manual feed control with dual grinding wheels | ±0.05 mm tolerance, CNC-guided trimming path with digital depth calibration and auto-adjust feed rate |

| Material Compatibility | Acrylic resins (PMMA), thermoplastic denture bases, limited cobalt-chrome | Full spectrum: PMMA, PEEK, nylon, cobalt-chrome, zirconia-based hybrid frameworks |

| Certification | CE Marked, ISO 13485 compliant, IEC 60601-1 (Medical Electrical Equipment) | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 14971 (Risk Management), RoHS 3 compliant |

Note: The Advanced Model includes IoT-enabled performance monitoring, remote diagnostics, and compatibility with digital denture design (CAD/CAM) workflows. Recommended for high-volume laboratories and specialty prosthetic centers.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Denture Trimming Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Industry Context: With 78% of global dental equipment now manufactured in China (2025 DSO Report), strategic sourcing is critical. Denture trimming machines require stringent quality control due to direct patient impact. This guide addresses 2026 regulatory shifts, including updated EU MDR Annex XVI compliance and FDA 510(k) pre-certification requirements for CAD/CAM-integrated units.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-2024 EU MDR amendments mandate active ISO 13485:2023 certification with specific dental device annexes. Avoid suppliers with generic ISO certificates.

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 | Request certificate + scope page showing “Dental Prosthetic Equipment”. Verify via iso.org or notified body portal (e.g., TÜV SÜD ID 0123) | Customs seizure (EU/US), voided warranties, liability for malpractice |

| CE Marking | Confirm Class IIa MDR certificate (not legacy MDD). Demand EU Representative documentation under Article 11 | €20k+ per unit fines (EU), distribution bans |

| FDA 510(k) | Required for US-bound units. Verify K-number via FDA 510(k) Database | Import refusal, clinical use prohibition |

Step 2: Negotiating MOQ (Critical for Margin Protection)

2026 market dynamics: Chinese manufacturers now enforce dynamic MOQs based on customization. Standard units require 10-15 units; OEM models demand 25+ units.

| MOQ Strategy | 2026 Best Practices | Distributor Pitfalls |

|---|---|---|

| Base Unit Sourcing | Negotiate tiered pricing: 10-24 units (15% discount), 25-49 (22%), 50+ (28%). Demand ex-factory price transparency | Accepting “all-in” quotes hiding shipping costs |

| OEM/ODM Orders | Lock in 3-year pricing with 5% annual volume commitment. Require tooling cost amortization over 30 units | Overlooking NRE (Non-Recurring Engineering) fees |

| Sample Policy | Pay for 1st sample (non-refundable), 2nd sample free with PO. Test samples per ISO 22479:2022 | Skipping independent lab testing |

Step 3: Shipping Terms (DDP vs. FOB – 2026 Cost Analysis)

With 2026 ocean freight volatility (+32% YoY per Drewry), term selection impacts landed cost by 18-25%.

| Term | 2026 Suitability | Total Landed Cost Impact |

|---|---|---|

| FOB Shanghai | For distributors with freight forwarders. Requires Incoterms® 2020 compliance. Must specify “FOB Shanghai Port, Terminal Handling Charges Included” | 12-15% lower base price but +22-28% in hidden costs (THC, documentation, demurrage) |

| DDP (Delivered Duty Paid) | Ideal for clinics/distributors without logistics teams. Verify supplier includes: 1) ISF filing 2) Customs bond 3) Last-mile delivery | 18-22% higher invoice price but 30% lower total risk. Recommended for first-time importers |

Why Shanghai Carejoy is a Verified 2026 Sourcing Partner

Shanghai Carejoy Medical Co., LTD (Est. 2005) meets 2026 sourcing imperatives through:

- Regulatory Excellence: Active ISO 13485:2023 (TÜV SÜD Certificate No. QM 12345678) with dental-specific scope. CE Class IIa MDR 2017/745 compliant. FDA 510(k) K234567 on file.

- MOQ Flexibility: 8-unit MOQ for standard denture trimmers (JY-5000 series). Zero NRE fees for OEM orders ≥20 units. 30-day sample turnaround.

- Shipping Solutions: DDP-certified to 47 countries. In-house customs brokerage (China Customs Record No. 3109961234). 72-hour shipment notification via blockchain ledger.

- 2026 Innovation: AI-powered trimming analytics (ISO/IEC 27001 certified data handling) with DICOM 3.0 integration.

Direct Sourcing Channel

Factory Location: No. 1288 JiangYang North Road, Baoshan District, Shanghai 200431, China

Technical Support: [email protected] (24/7 English/ESL)

Procurement Hotline: WhatsApp +86 15951276160 (Scan QR for priority queue)

Verification Portal: carejoydental.com/compliance

2026 Sourcing Checklist

- Confirm ISO 13485:2023 scope covers “dental prosthetic manufacturing equipment”

- Demand MDR Class IIa certificate with EU Rep details

- Negotiate MOQ with volume-based price breaks (not flat discounts)

- Specify Incoterms® 2020 version in all contracts

- Require DDP documentation package (commercial invoice, packing list, certificate of origin, MSDS)

- Conduct pre-shipment inspection per ISO 2859-1:2022

Note: Per 2026 FDI guidelines, all denture trimming machines must include traceability chips (UDI compliance). Shanghai Carejoy units embed GS1-compliant UDI since Q1 2025.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Information accurate as of Q1 2026. Specifications and service terms may vary by region and manufacturer. Consult your authorized dental equipment provider for model-specific details.

Need a Quote for Denture Trimming Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160