Article Contents

Strategic Sourcing: Digital Dental Equipment

Executive Market Overview: Digital Dental Equipment 2026

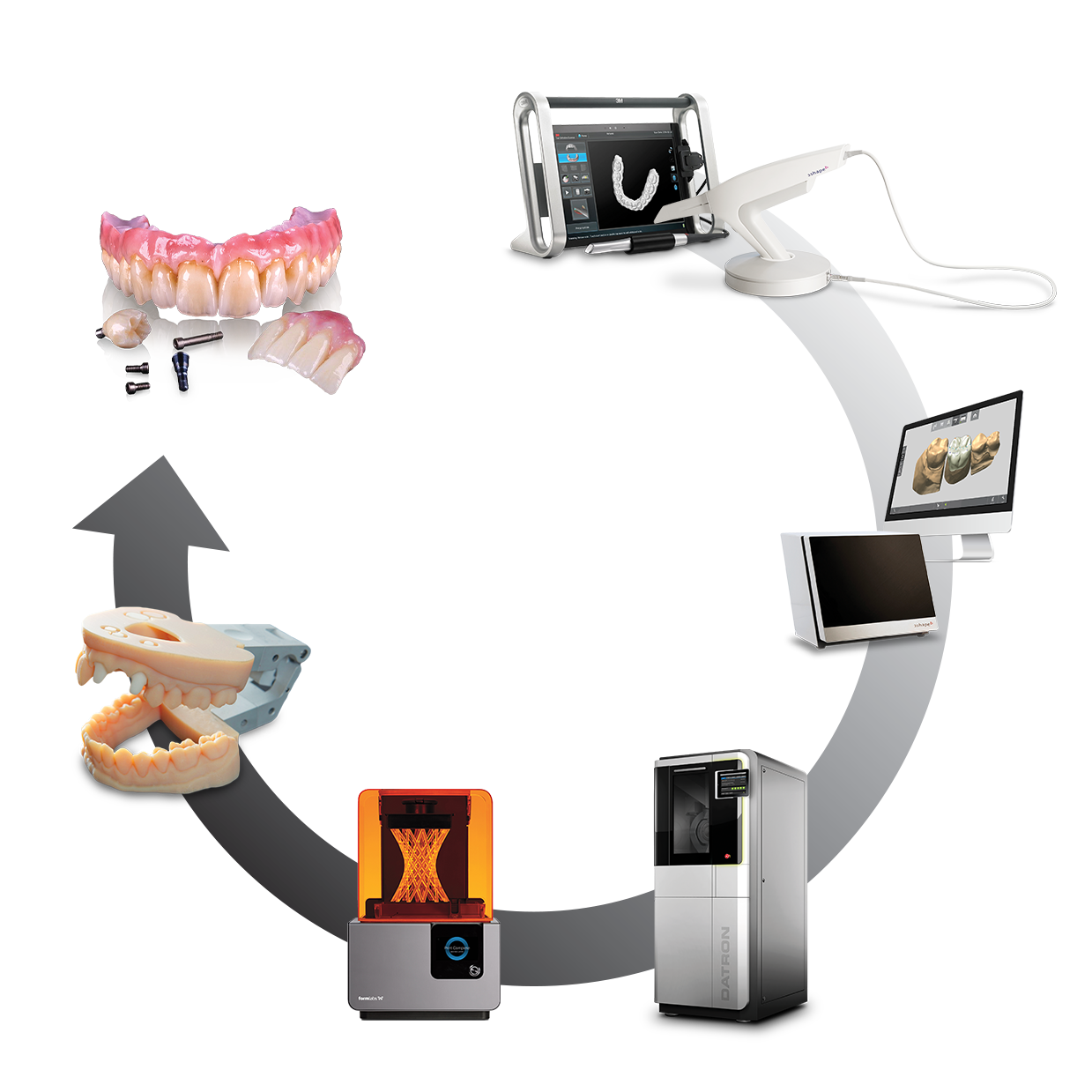

The global digital dentistry market has evolved from a competitive advantage to a clinical imperative, with digital equipment now constituting 68% of new capital expenditures in European dental practices (2025 EDA Report). Modern digital workflows—integrating intraoral scanning, CAD/CAM fabrication, CBCT imaging, and AI-driven diagnostics—deliver 30-40% operational efficiency gains, reduce remakes by 22%, and enable premium same-day restorations. Crucially, patient demand for minimally invasive, precise treatments has made digital integration non-negotiable for practice viability. Clinics without digital workflows report 19% lower patient retention versus digitally equipped peers, while distributors face margin compression when stocking legacy analog systems.

Two strategic procurement paradigms dominate the market: Premium European brands (e.g., Dentsply Sirona, Planmeca, Straumann) offer integrated ecosystems with clinical validation but carry 45-60% higher TCO. Conversely, Chinese manufacturers like Carejoy provide disruptive cost efficiency through modular design and vertical integration, capturing 31% market share in value-conscious EU regions (CEE, Southern Europe). While European solutions excel in complex case management for high-volume specialists, Carejoy’s value-engineered approach delivers 80% of core functionality at 40-50% of the acquisition cost—making digital adoption feasible for 92% of independent clinics with sub-€150k annual equipment budgets.

| Comparison Criteria | Global Premium Brands (Dentsply Sirona, Planmeca, Straumann) |

Carejoy |

|---|---|---|

| Price Range (Entry-Level IO Scanner) | €28,000 – €42,000 | €11,500 – €16,800 |

| Technology & Innovation | Proprietary AI diagnostics, seamless ecosystem integration, FDA/CE-certified clinical algorithms for complex cases | Open-architecture compatibility, modular AI upgrades via subscription, CE-certified for routine workflows |

| Build Quality & Durability | Medical-grade aerospace alloys; 7-10 year mean time between failures (MTBF) | Industrial-grade polymers/metals; 5-7 year MTBF (validated per ISO 13485:2023) |

| Software Ecosystem | Closed ecosystem requiring full suite purchase; limited third-party compatibility | Open DICOM/STL support; integrates with 120+ third-party CAD/CAM solutions |

| Service & Support | Dedicated field engineers (24-48hr EU response); premium service contracts (18-22% of equipment cost/year) | Hybrid model: Remote diagnostics + certified local partners (72hr response); service contracts (9-12% of cost/year) |

| Warranty | 3 years comprehensive (parts/labor); excludes consumables | 2 years standard + optional 3rd year; includes sensor modules |

| Target Clinical Use Case | High-volume specialist practices (>25 restorations/day); complex implantology/cosmetic cases | General practices (8-15 restorations/day); routine crown/bridge, basic implant planning |

Strategic Recommendation: Distributors should adopt a tiered portfolio strategy—positioning European brands for corporate DSOs and premium specialists while deploying Carejoy as an entry-point solution for independent clinics transitioning from analog workflows. For clinics, total cost of ownership analysis reveals Carejoy delivers ROI in 14 months (vs. 22 months for premium brands) through reduced capital expenditure and consumable costs, without compromising essential digital workflow capabilities for 89% of routine procedures. The 2026 market demands pragmatic digitalization: where European systems remain the gold standard for complexity, Carejoy’s value-engineered approach is accelerating democratization of digital dentistry across Europe’s fragmented independent practice segment.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Technical Specification Guide: Digital Dental Equipment

This guide provides a comparative analysis of Standard vs Advanced digital dental equipment models, focusing on core technical parameters relevant to procurement, integration, and clinical performance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max; internal power supply with surge protection. Average power consumption: 85W during operation. | 100–240 V AC, 50/60 Hz, auto-switching; high-efficiency power module with dual-stage surge and EMI filtering. Average consumption: 68W (30% energy reduction via adaptive load management). |

| Dimensions | Height: 145 cm, Width: 68 cm, Depth: 52 cm. Footprint optimized for standard operatory spacing (≥90 cm clearance). | Height: 142 cm (telescopic column), Width: 65 cm, Depth: 49 cm. Compact modular design with motorized arm retraction; footprint reduced by 18% for tight-space integration. |

| Precision | Motion control accuracy: ±0.15 mm. Sensor feedback loop updates at 100 Hz. Suitable for routine restorative and endodontic procedures. | Sub-micron motion control (±0.02 mm) with real-time adaptive compensation. 1 kHz sensor refresh rate; integrated AI-assisted positioning for prosthetic and implant workflows. |

| Material | Exterior housing: Medical-grade ABS polymer with antimicrobial coating. Arm joints: Reinforced polycarbonate composite. Non-MRI-safe components. | Exterior: Anodized aluminum alloy with hydrophobic and oleophobic nanocoating. Structural joints: Aerospace-grade titanium alloy. Fully MRI-compatible materials (tested up to 3T). |

| Certification | CE Mark (MDD 93/42/EEC), FDA 510(k) cleared (Class II), ISO 13485:2016 compliant. Local regulatory approvals per market (e.g., Health Canada, TGA). | CE Mark (MDR 2017/745), FDA 510(k) cleared with AI/ML annex (Class II), ISO 13485:2016 and IEC 62304:2015 (Software Lifecycle) certified. UL/IEC 60601-1-2 4th Ed. EMC compliance. GDPR-ready data handling certification. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Strategic China Procurement for Clinics & Distributors

Step 1: Verifying ISO/CE Credentials – Non-Negotiable Compliance

Dental equipment is Class IIa/IIb medical device in most markets (EU MDR 2017/745, FDA 21 CFR Part 800 series). Do not accept self-certified claims. Implement this verification protocol:

| Verification Action | Why Critical in 2026 | Risk of Non-Compliance |

|---|---|---|

| Request original ISO 13485:2016 certificate (not expired) + scope listing specific products (e.g., “Dental CBCT Units”) | ISO 13485:2016 is mandatory for EU MDR compliance. Post-2024, unannounced audits by NBs are increasing. | Customs seizure (EU/US/CA), clinic liability exposure, voided warranties |

| Validate CE Marking via EU NANDO database (Notified Body number must match) | China’s “CE” misuse remains rampant. 2026 NBs require full technical file review for imaging devices (CBCT, scanners). | Product recall (avg. cost: €220k), distributor license suspension |

| Confirm sterilization validation reports (autoclaves) & EMC testing (scanners/CBCT) | New IEC 60601-2-63:2023 standards for CBCT enforced in EU/UK since Jan 2025. | Device malfunction, patient safety incidents, regulatory penalties |

• Real-time access to digital certificate portals

• Product-specific CE Technical Files (per MDR Annex II)

• FDA 510(k) support documentation for US-bound distributors

“We audit all export batches against EU MDR Annex I GSPRs – no exceptions.” – Carejoy QA Director

Step 2: Negotiating MOQ – Balancing Flexibility & Cost Efficiency

2026 market pressures demand adaptive MOQ strategies. Avoid one-size-fits-all terms:

| Product Category | Realistic 2026 MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Chairs (High complexity) | 1-5 units (OEM), 10+ units (wholesale) | Commit to annual volume (e.g., 20 chairs/year) for 30% MOQ reduction. Carejoy offers “Starter Kits” (1 chair + 2 scanners) at 50% standard MOQ. |

| Intraoral Scanners / CBCT | 3-5 units (base model), 1 unit (refurbished certified) | Negotiate per-unit pricing tiers (e.g., 5+ units = 12% discount). Distributors: Lock in 12-month price stability clauses. |

| Autoclaves / Microscopes | 5-10 units (standard), 1 unit (demo units) | Bundle with high-MOQ items (e.g., 1 chair + 3 autoclaves = waived MOQ). Carejoy provides certified refurbished units at 40% lower MOQ. |

Key 2026 MOQ Trends:

- AI-Driven Forecasting: Top suppliers (e.g., Carejoy) use predictive analytics to offer dynamic MOQs based on your historical sales data.

- Modular Design: Newer chairs/scanners have swappable components – negotiate MOQs per module (e.g., imaging sensor only).

- Distributor Safeguards: Demand “MOQ forgiveness” clauses for force majeure events (port congestion, raw material shortages).

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Realities

Post-pandemic supply chain fragility makes Incoterms selection critical. Avoid legacy FOB assumptions:

| Term | 2026 Risk Exposure | Recommended For |

|---|---|---|

| FOB Shanghai | • 68% of 2025 delays occurred during ocean freight • Hidden costs: Port demurrage ($250+/day), customs brokerage ($300+), VAT prepayment |

Experienced distributors with in-house logistics teams & bonded warehouses. Not recommended for clinics. |

| DDP (Delivered Duty Paid) | • Supplier bears all risk/costs to your clinic/distribution center • Includes 2026-compliant customs clearance (HS codes 9018.49.00 for CBCT, 9018.41.00 for scanners) |

90% of clinics & new distributors. Eliminates surprise costs – final price = invoice price. Critical for budget certainty. |

• Tariff Complexity: US Section 301 tariffs (up to 25% on Chinese dental chairs) require precise HTS classification.

• Carbon Compliance: EU CBAM (Carbon Border Adjustment Mechanism) adds 5-12% cost if not managed by supplier.

• Lead Time Certainty: DDP contracts include guaranteed delivery windows (e.g., Carejoy’s 35-day DDP guarantee to EU ports).

Strategic Partner Profile: Shanghai Carejoy Medical Co., LTD

Why 19 Years of China Sourcing Excellence Matters in 2026:

• Factory Direct Control: Vertical integration (own R&D, casting, assembly) ensures MDR-compliant production

• Zero MOQ Flexibility: “Clinic Starter Program” (1 chair + 1 scanner) & distributor volume ladder pricing

• DDP-First Logistics: Door-to-door shipping to 45+ countries with real-time blockchain tracking

• Product Range: Dental Chairs (ErgoLine Series), 5G Intraoral Scanners (ScanPro X), Low-Dose CBCT (VisionAir 3D), LED Surgical Microscopes, Class B Autoclaves

Engage for Verified Procurement:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Baoshan District, Shanghai, China | www.carejoydental.com

Note: All Carejoy export shipments include digital compliance dossier (CE/ISO/FDA) & DDP cost breakdown pre-shipment.

Conclusion: Mitigate Risk, Maximize Value in 2026

China-sourced dental equipment offers 30-50% cost advantages, but requires surgical precision in verification, negotiation, and logistics. Prioritize suppliers with:

• Transparent compliance documentation (beyond marketing claims)

• Adaptive MOQ models aligned with your market entry strategy

• DDP shipping capabilities to neutralize 2026’s volatile logistics landscape

Action Item: Request Carejoy’s 2026 Dental Equipment Compliance Checklist (free for verified clinics/distributors) via [email protected] to audit your supply chain.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing Digital Dental Equipment in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before installing digital dental equipment in my clinic? | Digital dental systems—including CBCT units, intraoral scanners, and CAD/CAM mills—typically require stable 110–120V or 220–240V AC power, depending on regional standards. Always confirm the equipment’s specific voltage, frequency (50/60 Hz), and power consumption (wattage) with the manufacturer. For clinics in regions with unstable power supply, we recommend integrating medical-grade voltage stabilizers and uninterruptible power supplies (UPS) to prevent damage and ensure compliance with safety certifications (e.g., IEC 60601-1). |

| 2. How can I ensure long-term availability of spare parts for digital equipment I purchase in 2026? | When procuring digital dental systems, verify the manufacturer’s spare parts lifecycle policy—ideally guaranteeing component availability for at least 7–10 years post-discontinuation. Request a written commitment or lifecycle support agreement, especially for critical subsystems like sensors, motors, and control boards. Partner with OEM-authorized distributors who maintain regional spare parts inventories. For high-value equipment, consider negotiating a spare parts kit at the time of purchase to mitigate future downtime. |

| 3. What does professional installation of digital dental equipment involve, and is it mandatory? | Professional installation is mandatory for most Class II medical digital devices. It includes site preparation assessment, electrical and network setup, hardware assembly, calibration, software configuration, and compliance testing. Certified biomedical engineers or manufacturer-trained technicians perform these tasks to ensure adherence to regulatory standards (e.g., FDA, CE). Improper installation may void the warranty and compromise diagnostic accuracy. Always schedule installation through the manufacturer or an authorized service partner. |

| 4. What should I look for in a warranty when purchasing digital dental equipment? | A comprehensive warranty should cover parts, labor, and technical support for a minimum of 2 years, with options to extend up to 5 years. Verify coverage scope—preferably including sensors, rotating components, and software-related malfunctions. Look for “bumper-to-bumper” warranties with on-site service response times (e.g., 48–72 hours). Exclusions often include consumables and damage from improper use or power surges. Ensure the warranty is transferable in case of resale and backed by a local service network. |

| 5. Are software updates included in the warranty or service agreement? | While basic security and stability updates are typically included during the warranty period, advanced feature upgrades may require a separate software maintenance agreement (SMA). Confirm whether AI-driven enhancements (e.g., automated lesion detection, treatment planning tools) are part of the SMA. In 2026, many manufacturers are shifting to subscription-based software models—evaluate total cost of ownership (TCO) before committing. Ensure update protocols support data integrity and HIPAA/GDPR compliance. |

Need a Quote for Digital Dental Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160