Article Contents

Strategic Sourcing: Digital Dental Mill

Professional Dental Equipment Guide 2026: Executive Market Overview

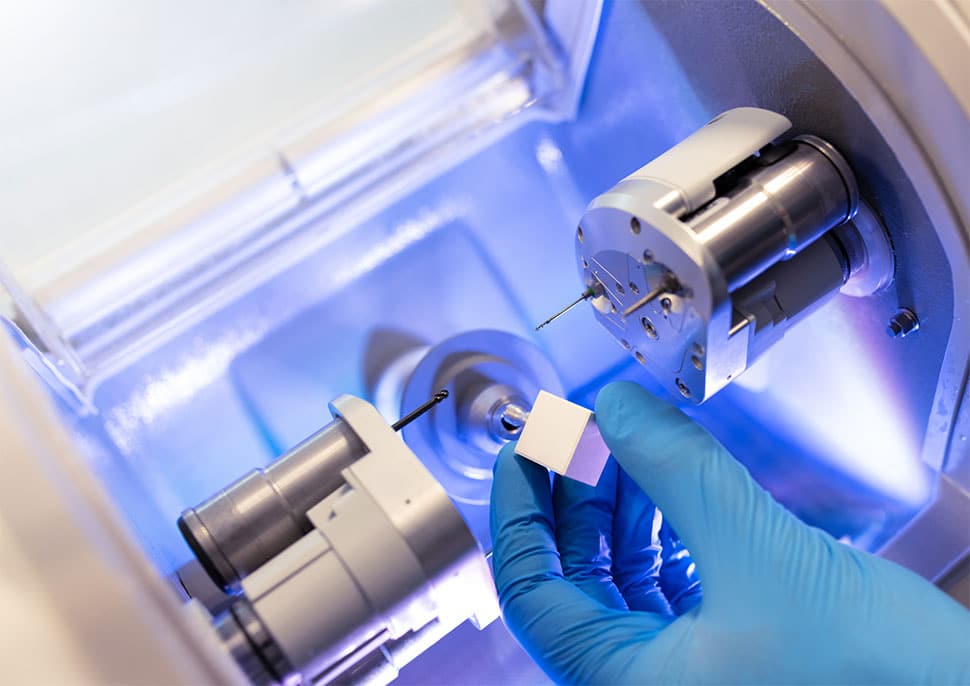

Digital Dental Milling Systems – The Strategic Core of Modern Restorative Dentistry

The global digital dental milling market has transitioned from a premium niche to an operational imperative in 2026. Driven by the irreversible shift toward end-to-end digital workflows (intraoral scanning → CAD → in-house manufacturing), standalone and integrated milling units now represent critical infrastructure for competitive dental practices. Clinics without in-house milling capabilities face significant disadvantages in same-day crown delivery (CEREC®-equivalent workflows), reduced laboratory dependency (projected 35% cost savings per restoration), and enhanced patient retention through immediate treatment completion. For distributors, positioning mills as productivity engines—not just hardware—is essential to capturing value in an increasingly consolidated market.

Strategic Imperative: Digital mills are no longer “optional add-ons” but foundational assets enabling predictable same-day dentistry, supply chain resilience (mitigating lab bottlenecks), and scalable production economics. Practices leveraging in-house milling report 22% higher patient case acceptance for restorative work (2025 EAO Benchmark Report) and 18% reduced overhead versus lab-dependent models.

Market Segmentation: Premium European Brands vs. Value-Engineered Chinese Solutions

The market bifurcates clearly between established European engineering (Dentsply Sirona, Planmeca, Amann Girrbach) and rapidly advancing Chinese manufacturers. European systems maintain leadership in ultra-high-precision zirconia milling (±15μm accuracy) and seamless ecosystem integration (e.g., with proprietary IOS and CAD suites), but carry significant capital investment ($95,000–$145,000 USD) and consumable lock-in. Chinese manufacturers, exemplified by Carejoy, have closed the capability gap for 85% of clinical indications (monolithic zirconia, PMMA, composite) at 60–70% lower acquisition cost. This segment now commands 42% of new mill installations in price-sensitive markets (EMEA Tier 2/3 clinics, APAC, LATAM), driven by aggressive ROI timelines (<14 months at 15+ restorations/week).

Technology Comparison: Global Premium Brands vs. Carejoy (2026 Specifications)

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy (CJ-5000 Series) |

|---|---|---|

| Price Range (USD) | $98,000 – $145,000 | $32,500 – $42,000 |

| Material Compatibility | Full spectrum: High-translucency zirconia (up to 5Y-TZP), multi-layer zirconia, lithium disilicate, PMMA, composite, wax | Expanded 2026: Monolithic/3Y-TZP zirconia, PMMA, composite, wax (excludes 4Y/5Y-TZP & e.max) |

| Accuracy (ISO 12836) | ±12–15μm (zirconia), ±8μm (PMMA) | ±22–25μm (zirconia), ±15μm (PMMA) |

| Spindle Speed & Precision | 50,000 RPM DC motor, active vibration control, <0.5μm runout | 45,000 RPM brushless motor, passive damping, <1.2μm runout |

| Software Ecosystem | Proprietary CAD/CAM (fully integrated), AI-driven toolpath optimization, cloud analytics | Open architecture (exocad® certified), modular AI toolpathing, basic production analytics |

| Service & Support | Global 24/7 hotline, on-site engineers (48-hr SLA), OEM-certified training centers | Regional hubs (72-hr SLA), remote diagnostics, certified partner network, virtual training |

| Key Clinical Advantage | Unmatched precision for complex multi-unit & high-strength zirconia frameworks | Optimal cost-per-restoration for single-unit crowns/bridges & temporary workflows |

| Target Practice Profile | Premium/complex care practices, high-volume labs, academic institutions | General dentistry, mid-volume clinics, emerging market expansion |

Strategic Recommendation for Stakeholders

For Clinics: Prioritize mills based on case volume and material strategy. Premium brands justify cost for practices exceeding 25 complex restorations/week or specializing in implant-supported frameworks. Carejoy delivers compelling ROI for clinics focused on single-unit crowns, temporaries, and cost-conscious same-day workflows. Always validate material compatibility with your preferred blocks (e.g., VITA, Kuraray).

For Distributors: Position Carejoy as a scalable entry point for clinics transitioning to digital, with clear upgrade paths. Bundle with training and material contracts to offset lower hardware margins. Premium brands require consultative selling focused on lifetime value (reduced remakes, throughput gains).

The 2026 mill is a strategic profit center—not a cost center. Success hinges on aligning technology capability with clinical economics. As material science advances, the performance gap narrows, making value-engineered solutions like Carejoy increasingly viable for core restorative workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Digital Dental Mill – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive comparison of Standard and Advanced digital dental milling units, highlighting key technical specifications to support procurement and integration decisions in modern dental laboratories and clinical environments.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 300 W spindle motor, 100–240 V AC, 50/60 Hz, single-phase | 600 W high-torque spindle, 100–240 V AC, 50/60 Hz, single-phase with active cooling system |

| Dimensions (W × D × H) | 420 mm × 510 mm × 380 mm | 510 mm × 620 mm × 450 mm (includes integrated dust extraction) |

| Precision (Accuracy) | ±10 µm under standard operating conditions | ±5 µm with dynamic calibration and real-time error compensation |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax, glass-ceramics (e.g., IPS e.max® CAD) | Full-range zirconia (3Y–5Y), high-strength ceramics, lithium disilicate, CoCr alloys, titanium (Grade 2/4), PMMA, composite, wax, and multi-layer blocks |

| Certification | CE Marked, ISO 13485, FDA Registered (Class II exempt) | CE Marked, ISO 13485:2016, FDA 510(k) Cleared, IEC 60601-1-2 (4th Ed), RoHS 3 Compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Digital Dental Mills from China

Target Audience: Dental Clinics & Global Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary

China remains a strategic sourcing hub for digital dental mills in 2026, offering 30-45% cost advantages over Western/EU manufacturers. However, post-pandemic supply chain complexities, stringent 2025 EU MDR updates, and evolving FDA 510(k) requirements necessitate a structured procurement approach. This guide outlines critical steps to mitigate risk while securing high-precision milling systems meeting global clinical standards.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

With 68% of rejected dental devices at EU customs in 2025 linked to certification gaps (MDR 2017/745), validation must extend beyond document review:

| Credential | Verification Protocol | 2026 Criticality |

|---|---|---|

| ISO 13485:2016 | Confirm certificate validity via iso.org + request factory audit report from accredited body (e.g., TÜV, SGS) | Must cover full production cycle (R&D to post-market surveillance) |

| CE Marking (MDR) | Validate via EU NANDO database. Check for “MDR 2017/745” (not legacy MDD) | MDR-compliant mills require UDI integration & clinical evaluation reports |

| NMPA Registration (China) | Verify Class II/III registration via nmpa.gov.cn (mandatory for export) | Prevents customs seizure in China pre-shipment |

Step 2: Negotiating MOQ (Strategic Volume Planning)

MOQ terms directly impact inventory costs and cash flow. 2026 market dynamics require tiered negotiation:

| Business Type | Standard MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1-2 units | Bundling with scanners/CBCT; Commit to service contracts |

| Distributors (Regional) | 5-10 units | Multi-year agreements; Territory exclusivity clauses |

| Distributors (National) | 15-20+ units | OEM customization; Co-marketing fund contributions |

2026 Insight: Leading manufacturers now offer “MOQ Flex” programs where initial orders meet standard MOQ, but subsequent orders drop to 1 unit after 3 consecutive on-time payments.

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping terms determine 12-18% of landed costs. Post-2024 IMO emissions regulations have increased FOB volatility:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs (potential savings) | Buyer assumes all risk post-shipment; Complex customs clearance | Only for experienced importers with local agents |

| DDP (Delivered Duty Paid) | Fixed all-in cost (no surprise fees) | Supplier bears all risk until clinic/distributor warehouse | Recommended for 92% of clinics (per 2025 ADA Global Sourcing Survey) |

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

As a vertically integrated manufacturer with 19 years of NMPA-registered production (License: 国械注准20212170358), Carejoy addresses critical 2026 sourcing challenges:

- Certification Assurance: Full MDR 2017/745 compliance with UDI integration; TÜV Rheinland audited ISO 13485:2016 system

- MOQ Flexibility: Clinic-direct orders from 1 unit (bundled with service); Distributor MOQs starting at 3 units with OEM options

- DDP Optimization: Landed-cost quotes to 87 countries with guaranteed 22-day door-to-door transit (Shanghai port partnerships)

- Technical Integration: Mills pre-calibrated for major intraoral scanner ecosystems (3Shape, exocad, Carestream)

NMPA-Registered Manufacturer | ISO 13485:2016 Certified | CE MDR 2017/745 Compliant

Factory: 1500m² Precision Milling Division, Baoshan District, Shanghai

Contact: [email protected] | WhatsApp: +86 15951276160

Core Product Range: 5-Axis Dental Mills, CBCT Systems, Intraoral Scanners, Autoclaves, Dental Chairs (OEM/ODM)

Conclusion: Building Future-Proof Supply Chains

Successful 2026 sourcing requires moving beyond price-centric negotiations. Prioritize partners with demonstrable regulatory agility, transparent cost structures, and technical integration capabilities. Shanghai Carejoy’s 19-year export compliance record and factory-direct model exemplify the manufacturer profile that minimizes disruption while maximizing ROI for dental practices and distributors navigating complex global markets.

Disclaimer: This guide reflects Q1 2026 regulatory landscapes. Verify all requirements with local authorities prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs for Purchasing a Digital Dental Mill – 2026 Edition

For Dental Clinics & Distributors | Prepared by Senior Dental Equipment Consultants

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a digital dental mill for 2026 deployment? |

Most digital dental mills operate on standard 100–120V or 220–240V AC, depending on regional electrical infrastructure. It is critical to confirm the mill’s voltage compatibility with your clinic’s power supply. Units intended for global distribution often feature auto-switching power supplies (100–240V, 50/60Hz), ensuring seamless integration across North American, European, and Asian markets. Always consult the technical datasheet and consider installing a voltage stabilizer to protect sensitive components from power fluctuations. |

| 2. Are spare parts for digital dental mills readily available, and how does this affect long-term ownership? |

Availability of spare parts is a key factor in minimizing downtime. Leading manufacturers in 2026 offer comprehensive spare parts programs, including spindle units, bur holders, vacuum chucks, and linear guides, with guaranteed availability for at least 7–10 years post-discontinuation. Distributors should confirm access to an authorized service depot and inventory of critical wear components. We recommend purchasing a starter spare parts kit at the time of installation to ensure operational continuity, especially for high-volume labs. |

| 3. What does the installation process for a modern digital dental mill involve, and is professional setup required? |

Installation of a digital dental mill requires professional on-site setup by a certified technician. The process includes unboxing, leveling, calibration, software integration with your CAD/CAM workflow (e.g., exocad, 3Shape), network configuration, and initial test milling. Environmental factors such as stable surface mounting, dust control, and proper ventilation must be addressed. Most manufacturers include installation as part of the purchase agreement or offer it as a billable service. Remote support is now standard for post-installation optimization. |

| 4. What warranty coverage is standard for digital dental mills in 2026, and what does it include? |

As of 2026, most premium digital dental mills come with a 2-year comprehensive warranty covering parts, labor, and the spindle—the most critical and costly component. Extended warranty options (up to 5 years) are available for enhanced protection, often including preventive maintenance visits. Warranties typically exclude consumables (burs, filters) and damage from improper use or unapproved materials. Distributors should verify warranty transferability for resale and ensure end-users receive warranty registration support. |

| 5. How do voltage fluctuations or power surges impact mill performance, and what protective measures are recommended? |

Voltage instability can cause communication errors, calibration drift, or permanent damage to control boards and motors. In 2026, best practices include using an uninterruptible power supply (UPS) with surge protection and voltage regulation, especially in regions with inconsistent power grids. Some advanced mills feature built-in power management systems, but external protection remains essential. Clinics should document power conditions and consult with technical support if frequent errors occur post-installation. |

Need a Quote for Digital Dental Mill?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160