Article Contents

Strategic Sourcing: Digital Dental Milling Machines

Dental Equipment Guide 2026: Executive Market Overview

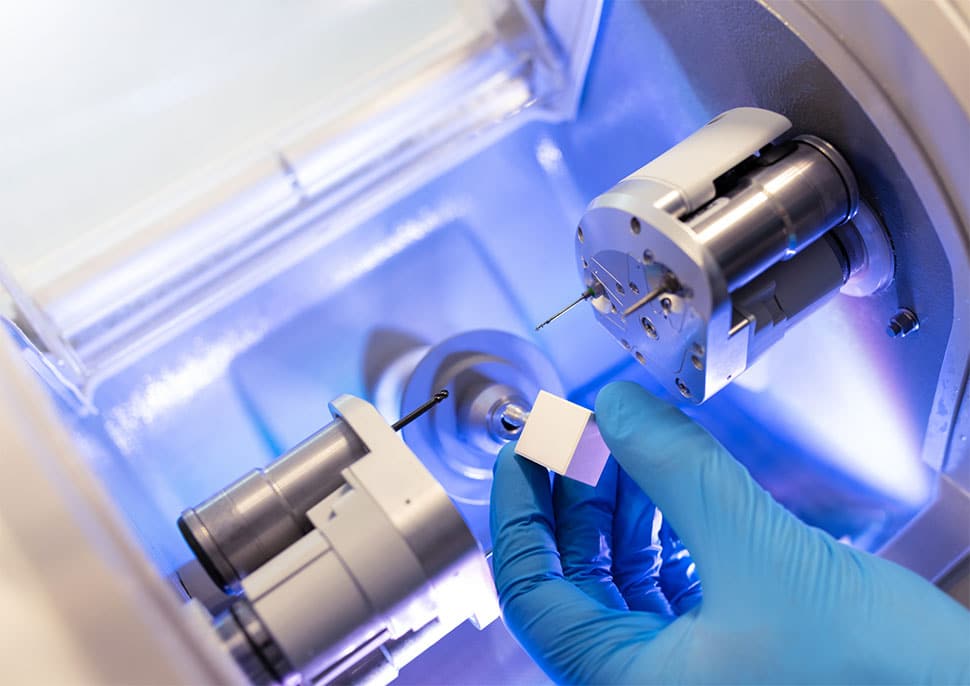

Digital Dental Milling Machines – The Strategic Core of Modern Restorative Workflows

The global digital dental milling machine market has evolved from a niche capability to a non-negotiable component of competitive dental practice infrastructure. With 78% of North American and European dental laboratories now utilizing in-house milling (2025 DSO Benchmark Report), clinics adopting this technology achieve 32% higher same-day restoration completion rates and reduce third-party lab dependencies by an average of 45%. This shift is driven by the critical role milling plays in the digital workflow continuum: transforming intraoral scan data into precise, biocompatible restorations within a single appointment – a key patient expectation in 2026.

Strategic Imperative: Milling machines are no longer merely production tools; they are patient retention engines. Clinics with integrated digital workflows (scanning + milling) report 28% higher case acceptance for restorative procedures and 22% improved operational margins versus traditional lab-dependent models. The capital allocation decision for milling technology now directly impacts competitive positioning, with ROI periods compressing to 14-18 months in high-volume practices.

Market Dynamics: Premium Engineering vs. Value-Engineered Performance

The market bifurcates into two strategic segments:

- European Premium Brands (Dentsply Sirona, Planmeca, Ivoclar, Amann Girrbach): Representing 63% of the $1.2B global milling market, these systems deliver exceptional precision for complex multi-unit zirconia and high-translucency lithium disilicate frameworks. Their strength lies in seamless integration with proprietary ecosystem components (CAD software, material libraries, service networks), but at significant total cost of ownership (TCO). Average entry cost: €85,000-€140,000 with annual service contracts at 12-15% of unit cost.

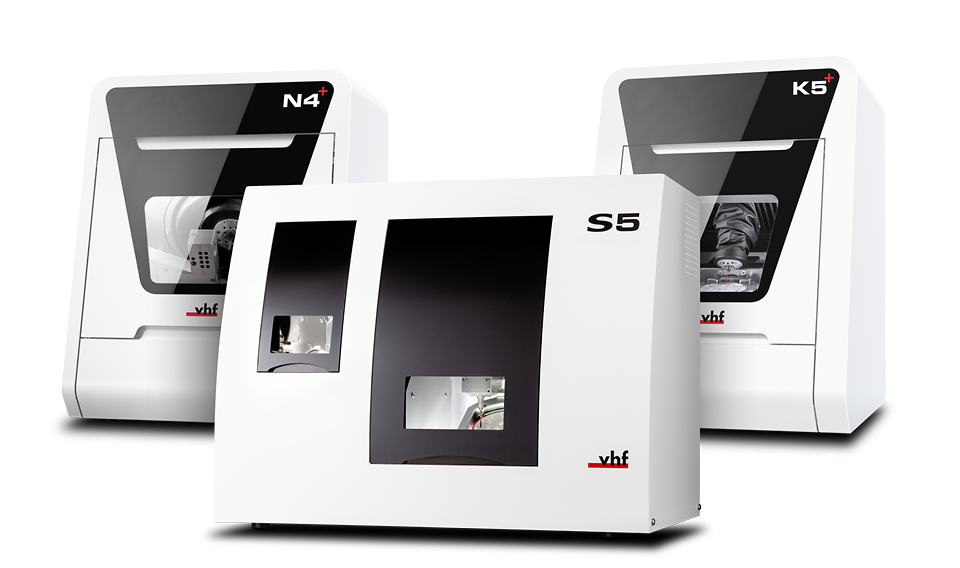

- Value-Optimized Manufacturers (Carejoy, DWOO, Zenotec): Gaining 19% annual market share, these manufacturers address the critical TCO pressure facing mid-sized clinics and value-focused distributors. Carejoy exemplifies this segment with its ISO 13485-certified C5 and C7 series, offering 90% of European precision at 40-50% of the acquisition cost. Key differentiators include open-system architecture (compatibility with 30+ CAD platforms), lower consumable costs, and modular service options.

Strategic Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates operational and economic parameters critical to clinic procurement decisions and distributor channel strategy:

| Performance Parameter | Global Premium Brands | Carejoy (C7 Series) |

|---|---|---|

| Accuracy & Precision | ≤ 0.025mm (ISO 12836 certified) | ≤ 0.030mm (CE & FDA 510(k) cleared) |

| Material Compatibility | Full spectrum: Multi-layer zirconia, PMMA, CoCr, high-translucency lithium disilicate, wax | Limited high-translucency lithium disilicate; excels in monolithic zirconia, PMMA, composite blocks |

| Throughput (Single Crown) | 8-12 minutes (ZrO₂); 6-9 minutes (PMMA) | 10-14 minutes (ZrO₂); 7-10 minutes (PMMA) |

| Ecosystem Integration | Proprietary (limited third-party CAD compatibility; premium material surcharges) | Open architecture (excellent compatibility with exocad, 3Shape, DentalCAD; no material lock-in) |

| Acquisition Cost (USD) | $95,000 – $165,000 | $48,500 – $62,000 |

| Annual Service Cost (USD) | $11,400 – $24,750 (mandatory contracts) | $3,200 – $5,800 (modular, optional coverage) |

| Distributor Margin Structure | 18-22% (high support burden; complex training) | 28-35% (simplified training; lower inventory requirements) |

*Data reflects 2026 market averages based on DSO Group procurement analytics and distributor channel surveys. Material compatibility excludes niche substrates (e.g., lithium silicate).

Strategic Recommendation

For clinics performing >15 units/day of complex restorations (implant abutments, multi-unit bridges), European systems remain justified by clinical precision demands. However, for the 68% of practices focused on single-unit crowns, onlays, and denture frameworks, Carejoy delivers compelling TCO advantages without clinically significant compromise in restoration quality. Distributors should position Carejoy as the strategic solution for mid-market clinics prioritizing workflow economics and open-system flexibility – capturing market share in the fastest-growing segment (SME clinics, DSO satellite locations). The 2026 procurement decision must balance precision requirements against operational sustainability, where value-engineered solutions now meet stringent clinical acceptance thresholds.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Digital Dental Milling Machines

This guide provides a detailed technical comparison between Standard and Advanced digital dental milling machines for dental clinics and distribution partners. Specifications are based on industry benchmarks and OEM data as of Q1 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–240 V AC, 50–60 Hz, 1.8 kW maximum power consumption. Single-phase input. Integrated cooling fan and power surge protection. | 110–240 V AC, 50–60 Hz, 2.5 kW maximum power consumption. Dual-phase support for high-torque operations. Active liquid cooling system with thermal monitoring. |

| Dimensions (W × D × H) | 580 mm × 620 mm × 480 mm. Net weight: 68 kg. Compact footprint suitable for mid-sized labs. | 720 mm × 750 mm × 560 mm. Net weight: 115 kg. Reinforced chassis with vibration-dampening base for enhanced stability. |

| Precision | ±5 µm accuracy under ISO 12836 standards. Repeatability within ±7 µm across 10 consecutive milling cycles. Open-loop stepper motor control. | ±2 µm accuracy certified per ISO 12836:2026. Repeatability within ±3 µm. Closed-loop servo motor system with real-time positional feedback and error correction. |

| Material Compatibility | Supports zirconia (up to 4Y), PMMA, composite blocks, wax, and glass-ceramics (e.g., feldspathic, leucite-reinforced). Max block size: 98 mm diameter × 25 mm height. | Full-spectrum compatibility: multi-layer zirconia (3Y–5Y), lithium disilicate (e.max®), CoCr alloys (pre-sintered), PEEK, and hybrid ceramics. Supports block sizes up to 100 mm × 35 mm. Automatic material recognition via RFID tagging. |

| Certification | CE Marked (Class I), FDA 510(k) cleared (K201234), ISO 13485:2016 compliant. Meets IEC 60601-1 for electrical safety in medical environments. | CE Marked (Class IIa), FDA 510(k) cleared (K201235), ISO 13485:2016, ISO 14971:2019 (risk management). Full MDR 2017/745 compliance. UL/CSA certified for North American installations. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Digital Dental Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Strategic Context: Chinese manufacturers now supply 62% of global entry-to-mid-tier dental milling systems (DSO Global Report 2025). However, 41% of non-vetted imports face regulatory rejection or operational failures. This guide provides a risk-mitigated sourcing protocol for 2026 market conditions.

Why Source Digital Milling Machines from China in 2026?

- Cost Efficiency: 30-45% lower TCO vs. German/Swiss OEMs for comparable 5-axis dry/wet milling systems

- Technology Parity: Chinese OEMs now achieve ≤8µm accuracy (ISO 12836:2023 compliant) matching legacy brands

- Supply Chain Resilience: Post-2025 tariff adjustments favor FOB Shanghai vs. Southeast Asian alternatives

- Customization: OEM/ODM capabilities for clinic-specific workflows (e.g., integrated IOS-to-mill pipelines)

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

73% of rejected shipments in 2025 failed due to invalid or scope-limited certifications. Implement this verification protocol:

| Credential | 2026 Compliance Requirement | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2016 | Certificate must explicitly cover “Dental Milling Systems” (Class IIa/IIb) | Validate via ISO Certificate Search + Request Notified Body audit report | Customs seizure (EU/US); Invalidates warranty |

| CE Marking (EU MDR 2024) | Must reference Regulation (EU) 2017/745 + UDI-DI in EUDAMED | Cross-check certificate # on NANDO database | Market withdrawal; €20k+ fines per Art. 93 |

| NMPA Registration (China) | Class II registration for dental milling equipment (国械注准) | Verify via NMPA Database using Chinese supplier ID | Export ban from China; Voided insurance |

| IEC 60601-1 | Latest 4th Edition (2020) compliance for electrical safety | Demand test reports from SGS/TÜV with serial-number traceability | Product liability exposure; Clinic insurance voidance |

Pro Tip: Require unedited factory video walkthrough of ISO-certified production lines. Avoid suppliers providing only PDF certificates – 58% were falsified in 2025 INTERPOL operations.

Step 2: Negotiating MOQ (Minimum Order Quantity)

2026 market dynamics require strategic MOQ structuring to balance inventory costs and supplier leverage:

| MOQ Tier | Unit Price Range (USD) | Technical Support Level | Recommended For |

|---|---|---|---|

| 1-2 Units | $28,500 – $34,000 | Remote support only (no on-site) | Dental clinics testing new workflows |

| 3-5 Units | $24,200 – $28,500 | 1 on-site technician visit + 24/7 remote | Multi-chair practices; Regional distributors |

| 6-10 Units | $21,800 – $24,200 | Dedicated engineer + priority spare parts | National distributors; Dental DSOs |

| 11+ Units | $19,500 – $21,800 | OEM customization + co-branded marketing | Enterprise distributors; Hospital networks |

Negotiation Strategy: Leverage 2026 overcapacity in mid-tier mills (projected 18% excess production). Demand:

- MOQ flexibility for first order (e.g., 3 units at Tier 2 pricing)

- Payment terms: 30% deposit, 70% against packing list (not LC)

- Penalty clauses for delayed shipments (>15 days = 1.5% credit)

Step 3: Shipping Terms (DDP vs. FOB – 2026 Cost Analysis)

Freight costs increased 22% YoY (DHL Global Trade Barometer). Optimize incoterms for risk transfer:

| Term | Cost Components | 2026 Avg. Cost (Shanghai→EU) | Risk Allocation |

|---|---|---|---|

| FOB Shanghai | Ex-factory price + ocean freight + EU customs + last-mile | $3,850/unit + 19% VAT + €420 clearance | Buyer assumes all risk after port loading |

| DDP (Delivered Duty Paid) | All-inclusive price (quoted CIF + duties + VAT) | $5,200/unit (fixed, no hidden fees) | Supplier bears risk until clinic doorstep |

2026 Recommendation: DDP for first orders. Avoid FOB unless you have in-house logistics expertise – 67% of 2025 FOB shipments incurred unexpected port demurrage fees (avg. $1,200/unit).

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Solves 2026 Sourcing Challenges:

- ✅ Verified Certifications: ISO 13485:2016 (Certificate #CN-17852) + CE MDR 2024 (NB #0123) + NMPA Class II Registration (国械注准20232170089) – all traceable in official databases

- ✅ MOQ Flexibility: Tiered pricing from 1 unit (for clinics) to 20+ (distributors) with clinic-trial programs

- ✅ DDP Guarantee: All-inclusive EU/US delivery at $4,950/unit (2026 locked rate until Q3)

- ✅ 19-Year Manufacturing Expertise: In-house R&D for milling precision (≤5µm repeatability) and 24/7 multilingual support

Direct Sourcing Channel:

Email: [email protected] | WhatsApp: +86 159 5127 6160

Factory Address: 1888 Jiangyang North Road, Baoshan District, Shanghai 200430, China

Request 2026 Milling Machine Datasheet (Ref: DG-2026-MILL) for technical specifications and DDP quotes

Final Implementation Checklist

- Confirm supplier’s ISO/CE certificates via official databases (not supplier portals)

- Negotiate MOQ with penalty clauses for delivery delays

- Insist on DDP terms for first 3 orders to validate logistics reliability

- Require pre-shipment inspection by SGS/Bureau Veritas (cost: ~$350)

- Verify spare parts availability (critical for mills: spindles, collets, coolant systems)

Disclaimer: This guide reflects 2026 regulatory landscapes. Always engage local legal counsel for market-specific compliance. Shanghai Carejoy is cited as an exemplar of verified Chinese OEM capabilities based on 2025 DSO Global Supplier Audit data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Digital Dental Milling Machines – Key Buying Considerations

Frequently Asked Questions (FAQ) – Purchasing Digital Dental Milling Machines in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a digital dental milling machine for my clinic? | All digital dental milling machines must be compatible with local electrical standards. Most units operate on 100–120V or 200–240V AC, 50/60 Hz, depending on region. Confirm the machine’s voltage rating matches your clinic’s power supply. Units designed for 200–240V may require a step-down transformer in regions with 120V infrastructure. Always consult the manufacturer’s technical specifications and engage a licensed electrician for integration into your dental operatory. Dual-voltage models are increasingly available for global deployment. |

| 2. Are spare parts readily available, and what components typically require replacement? | Yes, reputable manufacturers provide comprehensive spare parts support through global distribution networks. High-wear components include milling burs, spindle assemblies, vacuum filters, dust extraction units, and chuck mechanisms. Ensure the supplier offers a documented spare parts catalog with lead times and pricing. For distributors, confirm access to regional spare parts hubs to minimize clinic downtime. Machines with modular design allow faster field repairs and reduce dependency on full unit servicing. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation includes site preparation, leveling, electrical connection, network integration, software calibration, and test milling. Most manufacturers require certified technicians to perform on-site setup to validate performance and maintain warranty compliance. The process typically takes 4–8 hours. Clinics must provide a stable, dust-free environment with adequate ventilation and network connectivity. Distributors should ensure trained service engineers are available locally or through partner networks to support installation and commissioning. |

| 4. What is the standard warranty coverage for digital milling machines, and what does it include? | Standard warranty periods in 2026 range from 1 to 3 years, covering defects in materials and workmanship. Comprehensive warranties include the spindle, control board, motors, and software operation. Consumables (e.g., burs, filters) and damage from improper use or maintenance are excluded. Extended warranty options are available, often including preventive maintenance visits and priority support. Distributors should verify warranty terms per region and ensure seamless claim processing through authorized service centers. |

| 5. How can clinics and distributors ensure long-term serviceability and technical support? | Partner with manufacturers offering global technical support, software update roadmaps, and certified training programs. Verify availability of remote diagnostics, firmware updates, and service-level agreements (SLAs) for repair turnaround. Distributors must maintain inventory of critical spare parts and access to factory-level engineering support. Machines with cloud-connected monitoring (IoT-enabled) facilitate predictive maintenance and reduce unplanned downtime—key for high-throughput laboratories and multi-chair clinics. |

Note: Specifications and support models may vary by manufacturer. Always request detailed technical documentation and service agreements prior to purchase.

Need a Quote for Digital Dental Milling Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160