Article Contents

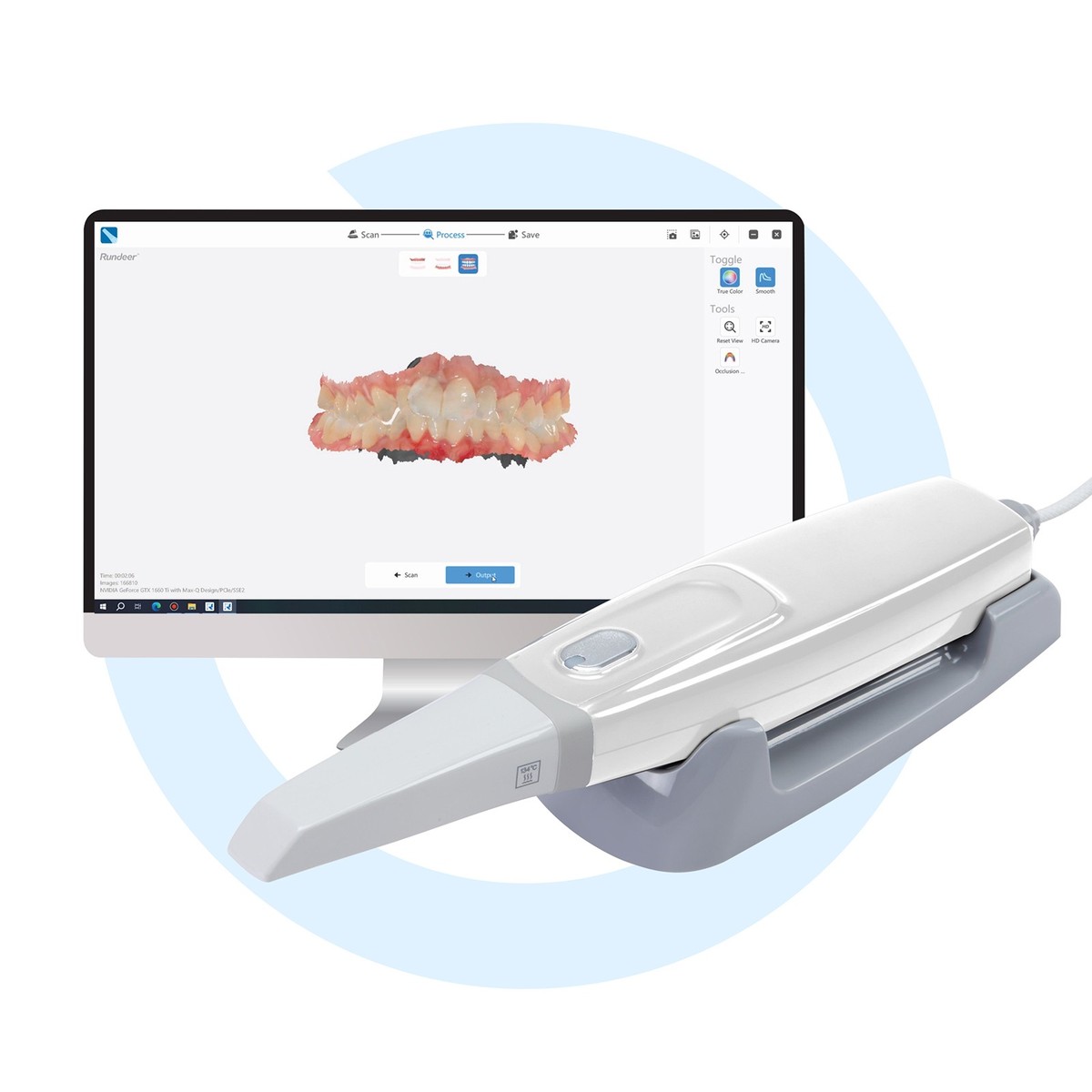

Strategic Sourcing: Digital Intraoral Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Digital Intraoral Scanners

The digital intraoral scanner (IOS) has transitioned from a niche innovation to the central nervous system of modern digital dentistry. As clinics globally accelerate their shift toward fully integrated digital workflows, IOS adoption is no longer optional but a strategic imperative. These devices eliminate traditional impression materials, reduce remakes by 35-50%, and serve as the critical data acquisition layer for CAD/CAM restorations, orthodontic treatment planning, and virtual articulation. The global IOS market is projected to reach $3.8B by 2026 (CAGR 14.2%), driven by rising demand for same-day dentistry, enhanced patient experience expectations, and seamless integration with AI-driven diagnostic platforms.

Why IOS is Non-Negotiable for Modern Practices: Contemporary clinics require predictable accuracy (sub-20μm precision), workflow interoperability (DICOM/STL compatibility with major lab systems), and patient-centric efficiency (3-minute full-arch scans). Scanners now function as diagnostic hubs—not just impression tools—feeding data into AI treatment simulators, cloud-based collaboration platforms, and automated manufacturing ecosystems. Practices without IOS face 22% longer treatment cycles and 18% lower patient retention versus digitally equipped competitors (2025 EDA Benchmark Report).

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The IOS landscape bifurcates into two strategic segments: Established European manufacturers (3Shape, Dentsply Sirona, Planmeca) offering premium systems with deep ecosystem integration at $25K-$40K, and agile Chinese innovators like Carejoy delivering 80%+ functional parity at 40-60% lower acquisition cost. While European brands dominate academic institutions and high-end specialty clinics, value-focused multi-practice groups and emerging markets increasingly adopt cost-optimized solutions without sacrificing clinical viability. Carejoy exemplifies this shift—its 2025 CE-certified scanners now achieve 18μm accuracy (ISO 12836:2015) while leveraging modular design to reduce total cost of ownership.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (3Shape TRIOS, CEREC Omnicam) |

Carejoy (i5 Pro Series) |

|---|---|---|

| Acquisition Cost | $28,000 – $42,000 | $14,500 – $19,800 |

| Trueness/Accuracy (μm) | 12 – 16 μm (ISO 12836) | 16 – 18 μm (ISO 12836) |

| Full-Arch Scan Time | 1.8 – 2.5 minutes | 2.2 – 3.0 minutes |

| Software Integration Ecosystem | Proprietary closed ecosystem; limited third-party compatibility without middleware | Open API architecture; native compatibility with 12+ major CAD/CAM systems (excl. NobelProcera) |

| Technical Support Model | Dedicated regional engineers (48-hr onsite response); $2,200/yr premium service contract | Remote diagnostics + local distributor network (72-hr onsite); $850/yr standard contract |

| Warranty & Upgrades | 24 months; major OS updates require new hardware purchase | 36 months; cloud-based feature updates included for 3 years |

| TCO (5-Year Projection) | $41,200 (hardware + service + mandatory upgrades) | $26,700 (hardware + service + cloud updates) |

Strategic Recommendation: Premium European brands remain optimal for specialty clinics requiring absolute marginal accuracy (e.g., full-arch zirconia) and deep ecosystem lock-in. However, Carejoy represents a clinically validated alternative for 85% of restorative/orthodontic applications where cost efficiency directly impacts ROI. Distributors should position Carejoy as the “smart entry point” for practices scaling digital workflows, emphasizing its 38% lower TCO and CE/FDA-cleared clinical performance. As scanner technology matures, the value proposition increasingly hinges on total workflow economics—not incremental accuracy gains—making Carejoy a high-potential segment for growth-focused distribution networks.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Digital Intraoral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Lithium-ion battery, 3.7V, 2500mAh; up to 4 hours continuous scanning on full charge. USB-C rechargeable (0–100% in 2.5 hours). | High-capacity dual battery system, 3.7V, 4200mAh; up to 8 hours continuous operation. Fast-charging support (0–100% in 1.8 hours) via USB-C with power management optimization. |

| Dimensions | 28 mm (diameter) × 180 mm (length); ergonomic pen-style design. Weight: 180g (including tip). | 26 mm (diameter) × 175 mm (length); balanced low-profile housing with anti-slip grip. Weight: 165g (including tip). Modular tip system for customized reach. |

| Precision | Accuracy: ≤ 20 μm (microns) under clinical conditions. Scanning resolution: 16 μm. Frame rate: 25 fps (frames per second). | Ultra-high accuracy: ≤ 10 μm with dynamic motion compensation. Resolution: 8 μm. Adaptive frame rate up to 40 fps with AI-powered image stitching. |

| Material | Medical-grade polycarbonate housing with stainless steel insert at tip. IP54 rated for dust and splash resistance. Autoclavable tip (up to 134°C, 2 bar, 18 min). | Carbon fiber-reinforced polymer body with titanium-coated scanning head. IP67 rated for full dust and water immersion protection. Tip compatible with chemical disinfection and autoclaving (135°C, 30 cycles). |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified.符合 GB9706.1-2020 (China). | CE Marked (Class IIa), FDA 510(k) cleared with AI/ML-based software addendum, ISO 13485:2016 and ISO 14971:2019 certified, MDR 2017/745 compliant, HIPAA-ready data encryption. Recognized under EU-U.S. Mutual Recognition Arrangement (MRA). |

Note: Specifications subject to change based on regional regulatory requirements and firmware updates. Always verify compatibility with existing CAD/CAM workflows and practice management software.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Digital Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity: Through Q4 2026

Executive Summary: China remains the dominant manufacturing hub for cost-competitive digital intraoral scanners (IOS), with 78% of global OEM production concentrated in Guangdong and Shanghai regions (2026 DSO Market Report). However, stringent regulatory compliance, evolving MOQ structures, and complex logistics require systematic sourcing protocols. This guide outlines critical 2026 best practices for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Post-2025 EU MDR amendments and FDA 510(k) equivalency requirements make credential verification the foundational step. Avoid suppliers offering “CE-marked” devices without:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certification | Request scanned certificate + scope of approval from notified body (e.g., TÜV SÜD, BSI). Cross-verify via TÜV.com or BSIgroup.com. Confirm “design and manufacturing of intraoral scanners” is explicitly listed. | Customs seizure in EU/US; voided clinic warranties; liability in malpractice cases |

| CE Marking (Class IIa) | Demand full EU Declaration of Conformity with Annex ZA references. Verify EC Rep registration in EUDAMED. Beware of self-declared CE (illegal for Class IIa devices). | Market ban in EEA; distributor liability under Article 16 MDR |

| FDA 510(k) Clearance (For US Distributors) | Require K-number + clearance letter. Confirm manufacturer is listed in FDA establishment registry. Note: Chinese OEMs typically clear via US-based partners. | Import refusal by FDA; Class I recall risk |

Step 2: Negotiating MOQ (Strategic Volume Planning for 2026)

Chinese manufacturers now implement tiered MOQ structures reflecting component scarcity (e.g., MEMS sensors, sapphire lenses). Base negotiations on 2026 market realities:

| Buyer Type | Typical 2026 MOQ Range | Negotiation Leverage Points | Strategic Recommendation |

|---|---|---|---|

| Dental Clinics (Direct) | 1-3 units (at premium pricing) | Commit to service contract; bundle with consumables (tips, calibration tools) | Partner with distributors for volume discounts; avoid direct factory orders below 5 units |

| Regional Distributors | 10-25 units (base MOQ) | Offer co-branded marketing; secure exclusivity for 12 months; prepay 30% for MOQ reduction | Negotiate staged shipments (e.g., 5 units/month) to manage cash flow |

| National Distributors | 50+ units (with tiered pricing) | Commit to 200+ units/year; provide market data; accept container-load shipments | Insist on consignment inventory clauses for slow-moving SKUs |

Step 3: Shipping & Logistics (DDP vs. FOB in 2026)

With 2026 port congestion surcharges (+18% YoY) and new IMO 2025 sulfur regulations, shipping terms directly impact landed costs. Critical comparison:

| Term | Cost Components Included | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Factory-to-port only. Excludes ocean freight, insurance, destination port fees, customs clearance, inland transport. | Buyer assumes all risk post-loading. Complex for new importers due to fragmented supplier coordination. | Only for experienced distributors with established freight forwarders. Requires pre-negotiated CIF quotes to avoid hidden costs. |

| DDP (Duty Paid) | Full door-to-door: manufacturing, export clearance, freight, insurance, import duties, VAT, final delivery. | Supplier bears all risk/costs until clinic/distribution center. Transparent per-unit landed cost. | STRONGLY RECOMMENDED for clinics and new distributors. Eliminates 2026 volatility from carbon levy surcharges (+$120/TEU) and customs delays. |

Why Shanghai Carejoy is a Verified 2026 Sourcing Partner

For clinics and distributors prioritizing compliance and operational simplicity, Shanghai Carejoy Medical Co., LTD exemplifies 2026 best practices:

- Regulatory Assurance: ISO 13485:2016 certified (TÜV SÜD Certificate No. Q1 105 005492-2) with CE Class IIa clearance (EC Rep: Carejoy Europe GmbH, DE/0000000001). Full D2C documentation provided pre-shipment.

- MOQ Flexibility: Tiered structure starting at 5 units for distributors (2026 base MOQ), with clinic-direct options via DDP shipping. Offers consignment programs for national distributors.

- DDP Specialization: Manages end-to-end logistics to 142 countries with transparent landed-cost quotes. Includes 2026-compliant customs brokerage and pre-paid duty/VAT.

- Factory Direct Advantage: 19-year manufacturing expertise in Baoshan District (Shanghai Export Processing Zone) ensures component traceability and rapid rework capability.

Connect with Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Location: Baoshan District, Shanghai, China

Core Competency: Factory-direct OEM/ODM for Dental Chairs, Intraoral Scanners, CBCT, Microscopes & Autoclaves

Contact: [email protected] | WhatsApp: +86 15951276160

Verification Tip: Request factory tour via Teams/Zoom with live production line demonstration.

Note: This guide reflects Q1 2026 regulatory and market conditions. Always conduct independent due diligence. Verify all credentials through official channels before contract signing.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Buying a Digital Intraoral Scanner (2026)

For Dental Clinics & Distributors – Technical & Operational Insights

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a digital intraoral scanner for international deployment? | Digital intraoral scanners typically operate on 100–240V AC, 50/60 Hz, making them compatible with global power standards. However, confirm that the device includes an auto-switching power supply and is certified for use in your target region (e.g., CE, FDA, KC, or INMETRO). Always verify local voltage stability and consider using a medical-grade surge protector, especially in areas with inconsistent power supply. |

| 2. Are critical spare parts (e.g., scan tips, cables, sensors) readily available, and what is the lead time for replacements? | Reputable manufacturers offer comprehensive spare parts programs with guaranteed availability for at least 7 years post-discontinuation. High-wear components like scan tips and USB-C/proprietary interface cables are standard stock items. Lead times for in-warranty parts are typically 3–5 business days; out-of-warranty or legacy parts may require 7–14 days. Distributors should maintain regional spare parts inventories to ensure rapid turnaround for clinical partners. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation is generally plug-and-play, requiring software installation, device calibration, and integration with existing practice management or CAD/CAM systems. Most manufacturers provide remote setup support via secure desktop sharing. On-site installation is optional but recommended for multi-unit deployments or clinics with limited IT infrastructure. Calibration tools and network compatibility checks are included in the deployment package. |

| 4. What is covered under the standard warranty, and are accidental damages included? | The standard warranty for digital intraoral scanners in 2026 is typically 2–3 years, covering defects in materials and workmanship, including internal electronics and sensor modules. Accidental damage (e.g., drops, liquid exposure) is not included but can be added via an extended protection plan. Warranty service includes loaner units during repair and return shipping. Proof of purchase and registration within 30 days are mandatory for full coverage. |

| 5. Can the warranty be extended, and are there distributor-level service agreements available? | Yes, extended warranties up to 5 years are available at the time of purchase or within the initial warranty period. Distributors can opt for comprehensive service agreements that include priority technical support, discounted spare parts, on-site repairs, and firmware update management. These agreements enhance client retention and ensure consistent uptime for end-user clinics. |

Need a Quote for Digital Intraoral Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160