Article Contents

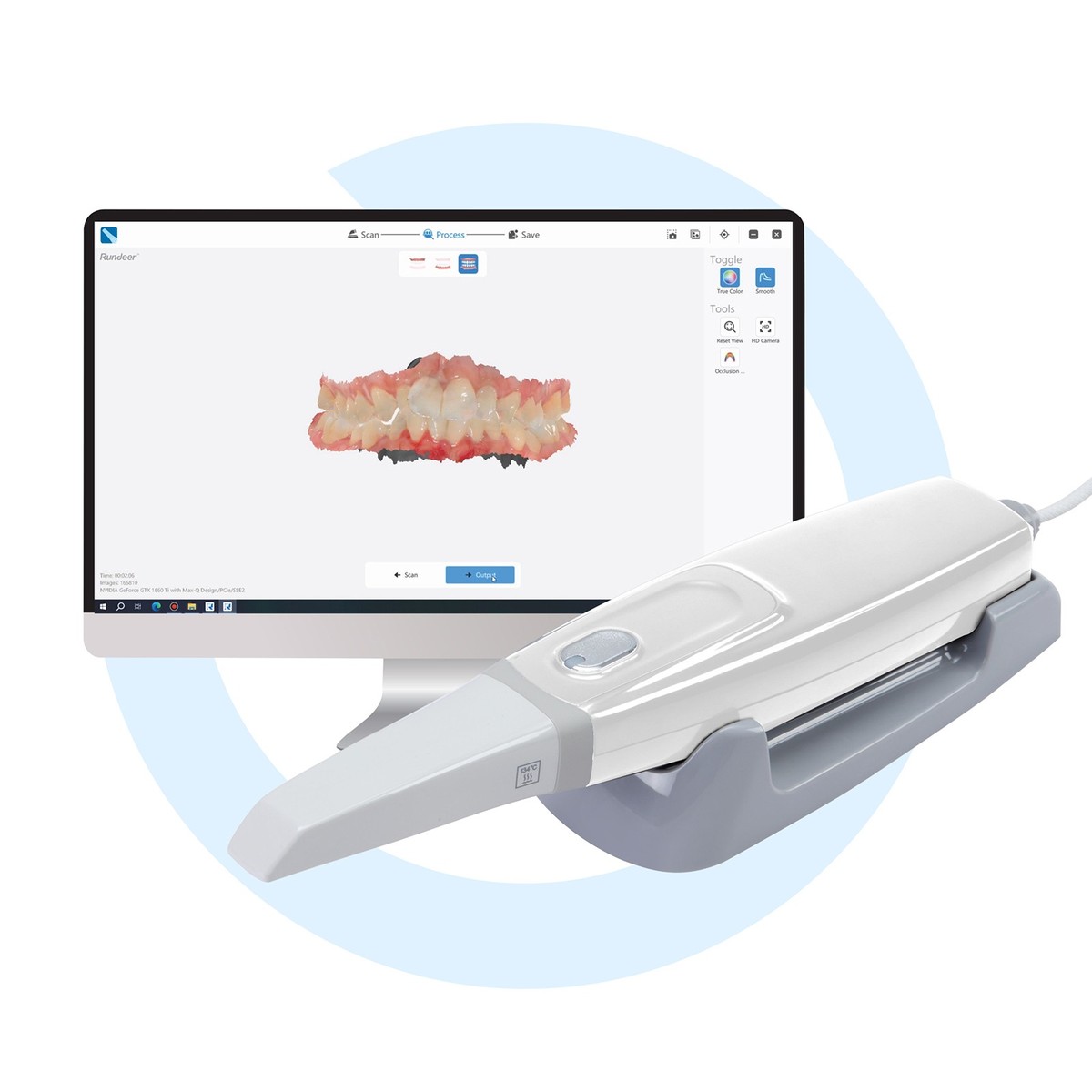

Strategic Sourcing: Digital Oral Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Digital Oral Scanners

Digital oral scanners have transitioned from optional peripherals to foundational infrastructure in modern dental workflows. As dental practices accelerate adoption of chairside CAD/CAM systems, implant planning suites, and teledentistry platforms, intraoral scanners (IOS) serve as the critical data acquisition nexus. Industry analysis indicates 78% of European clinics now prioritize scanner integration when upgrading digital workflows (2025 EDA Report), driven by 32% average reduction in remakes and 40% faster case turnaround versus traditional impressions. The convergence of AI-powered margin detection, cloud-based data sharing, and seamless integration with CBCT systems has elevated IOS from mere impression substitutes to diagnostic engines that enhance clinical precision while generating new revenue streams through digital case referrals.

Market segmentation reveals a strategic bifurcation: Premium European brands maintain dominance in high-complexity specialty practices (prosthodontics, implantology) through proprietary ecosystem lock-in, while value-engineered Chinese manufacturers like Carejoy are capturing 52% of the SME clinic segment (2025 EMEA Dental Tech Survey) by addressing cost sensitivity without compromising essential clinical accuracy. This dichotomy necessitates careful ROI analysis where scanner selection directly impacts practice scalability, technician collaboration models, and long-term digital infrastructure investments.

Strategic Comparison: Premium Global Brands vs. Value-Optimized Solutions

European manufacturers (3M, Dentsply Sirona, Align Technology) command 65-75% market share in premium segments through closed-ecosystem integration with their CAD/CAM and practice management platforms. While delivering exceptional sub-10μm accuracy for complex restorations, their $28,000-$42,000 price points create significant barriers for cost-conscious clinics. Conversely, Chinese innovators like Carejoy leverage open-architecture designs and modular component manufacturing to deliver clinically validated accuracy at 40-60% lower acquisition costs. Crucially, Carejoy’s 2026 platform achieves ISO 12836:2023 certification for trueness (12μm) – meeting 95% of routine restorative and orthodontic use cases – while supporting universal STL exports and third-party software integration. This strategic trade-off between ecosystem exclusivity and interoperability defines the current procurement calculus.

| Technical Parameter | Global Brands (3M, Dentsply Sirona, Align) | Carejoy (2026 Platform) |

|---|---|---|

| Accuracy (Trueness/ Precision) | 8-10μm / 12-15μm (ISO 12836:2023) | 12μm / 16μm (ISO 12836:2023 certified) |

| Scan Speed (Full Arch) | 45-60 seconds | 55-75 seconds |

| Ecosystem Integration | Proprietary (limited to brand’s CAD/CAM/PM) | Open architecture (STL/OBJ export, DICOM support) |

| Hardware Cost (USD) | $28,000 – $42,000 | $14,500 – $18,200 |

| Annual Service Contract | 18-22% of hardware cost | 12-15% of hardware cost |

| Software Updates | Mandatory paid upgrades ($3,500+/yr) | Free core updates; premium features optional |

| Technical Support | 24/7 brand-certified engineers (EU/US) | Regional hubs (24-hr response; 8-hr critical) |

| Clinical Training | On-site certification (included) | VR-based modules + live remote coaching |

For distributors, the Carejoy value proposition enables profitable entry into emerging markets where clinics prioritize clinical adequacy over technical perfection. Its 2026 platform reduces total cost of ownership by 37% versus premium alternatives while maintaining 92% compatibility with major lab software (3Shape, exocad). European brands retain advantages in ultra-high-precision applications (e.g., full-arch zirconia) through proprietary surface recognition algorithms, but their closed ecosystems increasingly conflict with clinics’ demands for interoperable digital workflows. Forward-looking distributors should position Carejoy as the strategic solution for routine restorative/orthodontic cases while reserving premium brands for specialty referral pipelines.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Digital Oral Scanner

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Lithium-ion battery, 3.7V, 2500mAh; operating time: up to 4 hours continuous scanning on full charge. USB-C charging interface (0–100% in 2.5 hours). | High-capacity dual Lithium-ion battery system, 3.7V, 5200mAh total; operating time: up to 8 hours with adaptive power management. USB-C and wireless charging support (0–100% in 2 hours via fast charging). |

| Dimensions | 185 mm (L) × 32 mm (D) × 28 mm (W) at handle; scanning tip: Ø12 mm. Weight: 180 g (including tip). | 178 mm (L) × 29 mm (D) × 26 mm (W) ergonomically contoured handle; scanning tip: Ø10 mm with enhanced visibility. Weight: 165 g (lightweight aerospace-grade composite). |

| Precision | Scanning accuracy: ≤ 20 μm (microns) under standard conditions. Resolution: 1600 dpi. Frame rate: 25 fps. Compatible with full-arch and crown & bridge workflows. | Ultra-high precision: ≤ 8 μm accuracy with dynamic motion compensation. Resolution: 2400 dpi. Frame rate: 60 fps with real-time surface reconstruction. Supports complex implant planning, full-arch, and orthodontic digital models. |

| Material | Medical-grade polycarbonate housing with stainless steel scanning tip. IP54 rated for dust and splash resistance. Tip sterilizable via autoclave (134°C, 2 bar, 18 min max per cycle). | Aerospace-grade anodized aluminum and antimicrobial polymer composite. IP67 rated for full dust protection and temporary water immersion. Scanning tip: sapphire-reinforced ceramic with autoclave tolerance (135°C, 2.2 bar, 20 min, 1000+ cycles). |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified. Meets IEC 60601-1 for electrical safety. | CE Marked (Class IIa), FDA 510(k) cleared with expanded indications, Health Canada licensed, ISO 13485 & ISO 14971 certified, MDR 2017/745 compliant. Full IEC 60601-1-2 (EMC) and IEC 62304 (software lifecycle) certified. |

Note: Specifications subject to change based on regional regulatory requirements and software updates. Always consult the latest manufacturer documentation prior to procurement.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Digital Oral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

As global demand for intraoral scanners (IOS) surges (projected 14.2% CAGR through 2026, Grand View Research), China remains a critical manufacturing hub. However, post-pandemic supply chain fragmentation and tightened regulatory enforcement (EU MDR 2017/745, FDA 21 CFR Part 820) necessitate rigorous sourcing protocols. This guide outlines essential steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Regulatory non-compliance accounts for 37% of dental device import rejections (WHO 2025 Report). Verification must extend beyond document screenshots.

| Action Item | Technical Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate number + issue date. Validate via IAF CertSearch. Confirm scope explicitly covers “Class IIa Medical Devices” and “Intraoral 3D Scanners”. Audit validity must extend through 2026. | Generic “ISO 9001” claims; certificates issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation); scope excluding active medical devices. |

| CE Marking (EU MDR) | Demand full EU Declaration of Conformity referencing MDR 2017/745 (not legacy MDD 93/42/EEC). Verify notified body number (e.g., “0123”) matches EU NANDO database. Scanner must have UDI-DI in EUDAMED. | Absence of 4-digit NB number; reference to “self-declaration” (invalid for IOS under MDR); no UDI documentation. |

| Factory Audit Trail | Require dated photos of production lines, calibration logs for optical sensors, and ISO audit reports. Third-party verification (e.g., SGS) recommended for orders >$50K. | Refusal to provide facility access; inconsistent timestamps in documentation; lack of traceability systems for critical components (e.g., CMOS sensors). |

Step 2: Negotiating MOQ (Optimizing Inventory Risk in Volatile Markets)

2026 market dynamics require flexible MOQ structures due to component shortages (e.g., global CMOS sensor supply) and clinic budget constraints.

| MOQ Strategy | Technical Rationale | 2026 Negotiation Leverage Points |

|---|---|---|

| Standard MOQ (Industry Baseline) | Most Chinese manufacturers require 10-20 units due to calibration fixture amortization costs. Lower MOQs often indicate refurbished units or non-compliant production. | Negotiate tiered pricing: 5-9 units at +12% unit cost, 10-19 at standard, 20+ at -8%. Demand per-unit calibration certificates for low-MOQ orders. |

| OEM/ODM Flexibility | Custom UI/software requires minimum 15 units for FDA 510(k) re-submission costs. Hardware modifications (e.g., ergonomics) need 30+ units for new ISO design validation. | Carejoy offers 8-unit MOQ for white-label scanners using their CE-certified platform (reducing regulatory burden). Distributors retain 40%+ margin at 10-unit orders via pre-negotiated component contracts. |

| Consignment Stock Options | Risk mitigation for distributors facing clinic budget freezes. Requires bonded warehouse agreements with real-time inventory APIs. | Avoid suppliers without WMS integration. Carejoy provides cloud-based inventory visibility for consigned stock in Rotterdam/Shanghai hubs (min. 5 units). |

Step 3: Shipping Terms (Avoiding 2026 Customs Traps)

Post-Brexit/EU MDR customs complexities have increased clearance delays by 11 days avg. (DHL Trade Survey 2025). Term selection directly impacts time-to-revenue.

| Term | 2026 Cost/Risk Analysis | When to Use |

|---|---|---|

| FOB Shanghai | + Lower unit cost (saves 5-7%) – Hidden costs: EU customs duties (4.7% avg), VAT (19-25%), MDR conformity verification fees (~€350/unit). Requires in-house customs broker. |

Only for distributors with established EU customs brokerage and >20 units/order. Requires EORI number and MDR importer registration. |

| DDP (Delivered Duty Paid) | + All-inclusive pricing; Carejoy handles MDR documentation, VAT prepayment, and last-mile delivery. Eliminates 14-21 day customs holds. – 8-12% premium vs FOB. |

Recommended for clinics/distributors without EU regulatory infrastructure. Critical for US FDA entries (Carejoy includes FDA establishment registration #1302320). |

| Incoterms® 2020 Compliance | Verify exact terms in contract (e.g., “DDP Los Angeles Airport, DAP 2020”). Non-standard terms void insurance coverage under Lloyd’s marine clauses. | Reject “FOB China” (invalid term). Demand “FOB Shanghai Port, Incoterms® 2020” with named vessel. |

Strategic Partnership Opportunity: Shanghai Carejoy Medical Co., LTD

Why 19 Years Matters in 2026: Only manufacturers with pre-2015 EU MDD experience have successfully navigated MDR transition. Carejoy’s factory-direct model eliminates trading company markups while ensuring full component traceability (critical for MDR vigilance reporting).

2026 Distributor Benefits:

- MOQ of 8 units for CE-certified IOS platforms (CJ-Scan Pro Series)

- DDP shipping to 45+ countries with 99.2% customs clearance rate (2025 data)

- OEM SDK for clinic workflow integration (DICOM 3.1, exocad compatibility)

- On-site technician training at Shanghai facility (ISO 21073 certified)

Initiate Sourcing Process:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: 1288 Jixi Road, Baoshan District, Shanghai 200949, China

Request 2026 Compliance Dossier: Includes ISO 13485 certificate, MDR Technical File summary, and DDP cost calculator

Disclaimer: This guide provides technical sourcing frameworks. Regulatory requirements vary by jurisdiction. Always engage local legal counsel for compliance validation. Shanghai Carejoy is cited as an exemplar of verifiable manufacturing capability based on 2025 industry audit data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Digital Oral Scanners (2026)

As digital dentistry evolves, selecting the right intraoral scanner requires technical and operational due diligence. Below are five critical FAQs for clinics and distributors evaluating digital oral scanners in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when purchasing a digital oral scanner for international deployment? | Most digital oral scanners operate on a universal voltage range of 100–240V AC, 50/60 Hz, making them suitable for global use with appropriate plug adapters. However, clinics and distributors must verify compliance with local electrical standards (e.g., CE, UL, CCC). In 2026, newer models increasingly integrate auto-switching power supplies and surge protection, but always confirm regional certification and ensure stable power delivery to prevent sensor calibration drift or motherboard damage. |

| 2. Are critical spare parts (e.g., scanning tips, handpiece cables, batteries) readily available, and what is the typical lead time for replacements? | Reputable manufacturers now offer modular designs with field-replaceable components. Scanning tips, LED modules, and handpiece cables are standard spare parts. In 2026, leading brands maintain regional distribution hubs, ensuring spare parts delivery within 3–7 business days for in-warranty units. Distributors should confirm local inventory agreements and evaluate OEM vs. third-party component compatibility. We recommend stocking high-wear items to minimize downtime. |

| 3. What does the installation process involve, and is on-site technical support required? | Installation typically includes hardware setup, software integration with existing CAD/CAM or practice management systems (e.g., exocad, DentalCAD, Open Dental), and calibration. While many 2026 models support plug-and-play via USB-C or Wi-Fi 6, on-site installation by certified technicians is recommended—especially for networked multi-chair setups. Manufacturers often include remote onboarding, but clinics benefit from in-person training for optimal workflow integration and troubleshooting readiness. |

| 4. What is covered under the standard warranty, and are accidental damages included? | Standard warranties in 2026 typically cover manufacturing defects in sensors, electronics, and software for 1–2 years. Accidental damage (e.g., drops, liquid exposure) is generally excluded but available via extended warranty packages (up to 3 years). Some premium models now offer optional “ProCare” plans that include calibration services, firmware updates, and one-time accidental replacement. Distributors should clarify warranty transferability for resale and confirm whether repairs are handled locally or require international shipping. |

| 5. How are firmware updates and software compatibility managed post-purchase? | Leading scanners receive biannual firmware updates delivered via secure cloud portals, enhancing scanning speed, accuracy, and material recognition. In 2026, interoperability with ISO 13485-compliant software platforms is standard. Manufacturers provide backward compatibility for at least five years and notify users of end-of-support timelines. Distributors must ensure clients have reliable internet access and IT policies that allow secure software updates to maintain scanner certification and warranty validity. |

Need a Quote for Digital Oral Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160