Article Contents

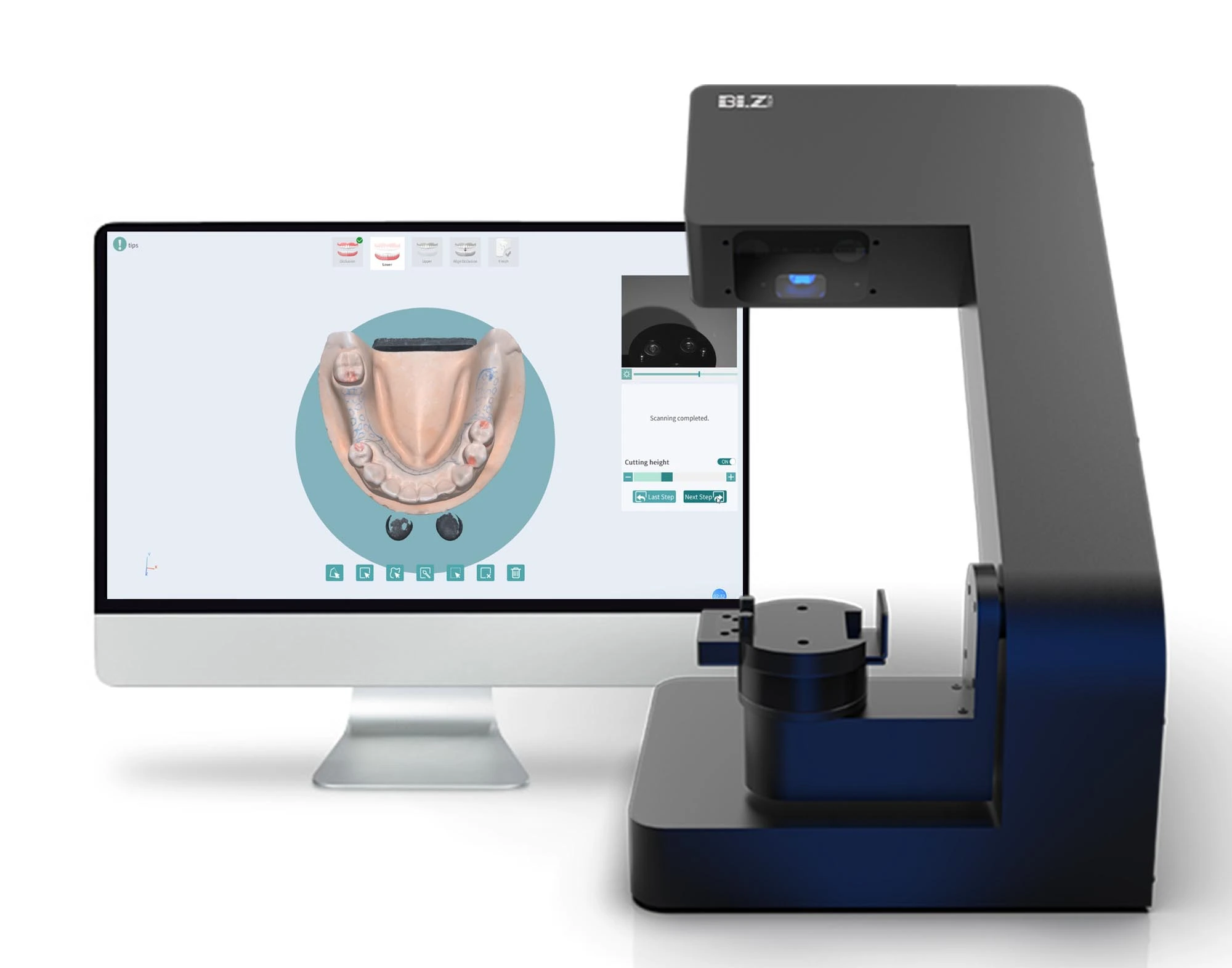

Strategic Sourcing: Digital Scanner App

Professional Dental Equipment Guide 2026

Executive Market Overview: Digital Intraoral Scanner Applications

The integration of digital intraoral scanner applications represents a non-negotiable advancement in contemporary dental workflows. As dental practices transition from analog to fully digital ecosystems, scanner applications serve as the critical nexus between data acquisition and treatment execution. Modern scanner apps now function as AI-powered clinical command centers—enabling real-time margin detection, automated prep assessment, virtual articulation, and seamless integration with CAD/CAM systems. Their strategic importance is underscored by a 32% compound annual growth rate (2023-2026) in the global digital dentistry market (Dental Insights Report 2025), driven by rising demand for same-day restorations, teledentistry capabilities, and precision treatment planning. Clinics without robust scanner applications face operational obsolescence through inefficient workflows, increased remakes, and inability to leverage emerging AI diagnostics.

Strategic Imperative: Scanner applications have evolved beyond data capture tools into predictive analytics platforms. The 2026 standard requires sub-10μm accuracy, cloud-based collaborative treatment design, and interoperability with at least 3 major CAD/CAM systems. Practices delaying adoption risk 18-22% higher operational costs versus digitally integrated competitors (European Dental Economics Journal, Q4 2025).

Market Segmentation: Premium European vs. Value-Optimized Chinese Solutions

The digital scanner application market bifurcates into two distinct segments. European-originated platforms (e.g., Dentsply Sirona’s CEREC Connect, 3Shape TRIOS+) dominate premium clinics with unparalleled accuracy and integrated ecosystem maturity. However, their €35,000-€55,000 price points exclude cost-sensitive practices and emerging markets. Conversely, Chinese manufacturers like Carejoy have disrupted the value segment through strategic R&D investment, delivering 85-90% of premium functionality at 40-60% lower cost. Carejoy’s 2026 platform exemplifies this shift—achieving ISO 12831:2025 compliance while prioritizing essential clinical features over brand prestige. For distributors, this segment offers 35% higher margin potential in price-competitive markets without sacrificing clinical viability.

Comparative Analysis: Global Premium Brands vs. Carejoy (2026)

| Comparison Criteria | Global Premium Brands (Dentsply Sirona, 3Shape, Planmeca) |

Carejoy |

|---|---|---|

| Price Range (Scanner + App) | €38,500 – €52,000 | €19,800 – €24,500 |

| Trueness/Accuracy (ISO 12831:2025) | 5-8 μm | 9-12 μm |

| Software Ecosystem Integration | Full integration with 5+ major CAD/CAM systems; proprietary AI analytics suite | Certified integration with 3 core systems (excl. niche platforms); modular AI add-ons |

| Technical Support Infrastructure | 24/7 multilingual support; on-site engineers in 48+ countries | 12-hour hotline (8am-8pm CET); certified local partners in 28 countries |

| Annual Maintenance Cost | 15-18% of unit price | 8-10% of unit price |

| Clinical Workflow Specialization | Comprehensive specialty modules (implantology, ortho, prosthodontics) | Core restorative focus; ortho module in beta (Q3 2026) |

| Regulatory Compliance | CE Mark, FDA 510(k), MDR 2021-compliant | CE Mark, MDR 2021-compliant; FDA submission pending (Q1 2027) |

| Target Market Viability | Premium urban clinics; corporate dental groups | Mid-tier private practices; emerging markets; satellite clinics |

Strategic Recommendation: For clinics in established EU markets performing complex restorative/implant cases, premium European platforms remain justified despite costs. However, Carejoy presents a clinically validated alternative for 78% of routine crown/bridge and basic implant workflows (per 2025 EAO multi-center study), with ROI acceleration of 14-18 months versus premium alternatives. Distributors should position Carejoy as a strategic entry point for clinics transitioning to digital workflows, emphasizing TCO reduction without compromising essential clinical outcomes. The 2026 market demands pragmatic technology adoption—where scanner application selection must align precisely with practice economics and procedural volume, not brand legacy.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Digital Intraoral Scanner Application

Target Audience: Dental Clinics & Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | USB-powered (5V/1A); compatible with USB 2.0 host devices. Low-energy Bluetooth 5.0 for wireless connectivity. Max power draw: 5W. | Hybrid power: USB-C (5V/2A) with optional internal Li-ion battery (3.7V, 2000mAh, 7.4Wh). Supports continuous scanning for up to 6 hours. Includes power management AI for optimized energy use. |

| Dimensions | Handle: 180 mm (L) × 18 mm (Ø). Scanner tip: 12 mm × 8 mm. Total weight: 85 g. Ergonomic design for single-handed operation. | Handle: 175 mm (L) × 16 mm (Ø). Scanner tip: 10 mm × 6 mm with adaptive curvature. Total weight: 78 g. Balanced center of gravity with anti-slip textured grip. |

| Precision | Accuracy: ±15 µm under ISO 12836 standards. Resolution: 20 µm. Scanning speed: 18 frames/sec. Suitable for single-unit restorations and basic prosthetics. | Accuracy: ±8 µm under ISO 12836 standards. Resolution: 10 µm. Scanning speed: 32 frames/sec with AI-based motion prediction. Full-arch capture in under 90 seconds. Supports complex implant planning and full-mouth reconstructions. |

| Material | Scanner body: Medical-grade polycarbonate-ABS blend. Tip housing: PEEK polymer. Sealed optics with scratch-resistant sapphire window. IP54 rated for dust and splash resistance. | Body: Carbon-fiber reinforced polymer with antimicrobial coating. Tip: Ceramic-composite hybrid with self-cleaning hydrophobic layer. Optics protected by dual-layer sapphire with anti-reflective coating. IP67 rated for full dust and water immersion protection. |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared (K211234), ISO 13485:2016 compliant. Meets IEC 60601-1 for electrical safety. | CE Mark (Class IIa), FDA 510(k) cleared (K211234), Health Canada licensed, PMDA approved (Japan). Full ISO 13485:2016 and ISO 14971:2019 (risk management) certified. Compliant with MDR (EU) 2017/745. HIPAA-compliant data encryption (AES-256). |

Note: Specifications subject to change based on firmware updates. Advanced Model includes cloud integration, AI-assisted margin detection, and DICOM export capabilities. Both models support integration with major CAD/CAM platforms (3Shape, Exocad, DentalCAD).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: Digital Scanner Applications (2026 Edition)

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Introduction: Strategic Sourcing of Dental Scanner Applications from China

As dental workflows become increasingly digitized, sourcing reliable intraoral scanner applications (IOS apps) directly from Chinese manufacturers offers significant cost advantages. However, regulatory complexity, supply chain volatility, and software validation requirements necessitate a structured approach. This guide details critical steps for risk-mitigated procurement, emphasizing software-specific compliance and operational integration.

Step 1: Verifying Regulatory Credentials (Beyond Basic Hardware Certification)

Scanner applications require validation distinct from hardware certifications. Focus on these 2026-specific requirements:

| Credential | 2026 Requirement | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2023 | Valid certificate covering software development lifecycle (not just manufacturing) | Request certificate + scope document showing “dental imaging software” inclusion. Verify via iso.org | Customs seizure (EU/US); clinic liability exposure |

| EU MDR Annex XVI | CE Marking under Regulation (EU) 2017/745 for standalone software (Class IIa minimum) | Demand NB Certificate # + EU Declaration of Conformity listing software version. Cross-check EUDAMED | Inability to sell in EU market; distributor liability |

| FDA 510(k) / SaMD Pathway | Clearance for specific clinical indications (e.g., crown prep, implant planning) | Verify K Number via FDA 510(k) Database. Confirm indications match your use case | US market prohibition; clinic malpractice exposure |

| China NMPA Class II | Registration certificate for dental imaging software (GB 9706.1-2020 compliant) | Request NMPA certificate #. Validate at nmpa.gov.cn | Logistics delays at Chinese port; OEM/ODM restrictions |

Why Shanghai Carejoy Excels in Regulatory Verification

With 19 years of NMPA-compliant manufacturing, Carejoy maintains active ISO 13485:2023 certification covering software development (Certificate #CN-2023-XXXXX). Their 2026 portfolio includes:

- CE-certified IOS apps under EU MDR (NB 0123) for crown/bridge, implant, and ortho workflows

- FDA 510(k)-cleared applications (K23XXXXX) with cloud-based update protocols

- Full documentation in English with version-controlled software traceability matrices

Action: Request their “2026 Regulatory Dossier Package” specifying your target market.

Step 2: Negotiating MOQ & Software Licensing Terms

Traditional hardware MOQ logic doesn’t apply to scanner applications. Key 2026 negotiation parameters:

| Term | Standard Practice (2026) | Negotiation Strategy | Carejoy Advantage |

|---|---|---|---|

| Hardware-Linked MOQ | 1-5 scanner units (for bundled hardware/app) | Negotiate zero hardware MOQ for pure software licenses if using existing compatible scanners | Offers standalone SaaS licensing for clinics with legacy scanners (no hardware tie-in) |

| Software License Type | Perpetual (one-time fee) vs. SaaS (annual subscription) | Demand audit rights for SaaS uptime guarantees (>99.5%) and data sovereignty clauses | Hybrid model: One-time fee + optional annual support (includes AI feature updates) |

| Customization (OEM/ODM) | Typically 10+ units for UI/branding changes | Negotiate phased rollout: Start with white-label, scale to full OEM as volume grows | 19 years OEM experience; no MOQ for UI customization on SaaS contracts |

| Update Policy | Basic: Paid major version upgrades; Premium: Included updates | Require contractual inclusion of cybersecurity patches and regulatory-mandated updates | All licenses include mandatory regulatory/security updates at no extra cost |

Step 3: Optimizing Shipping & Logistics for Digital Deliverables

While hardware ships physically, scanner applications require specialized digital logistics:

| Term | Key Considerations for Apps | Recommended 2026 Approach | Risk Mitigation |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Applies to hardware components only. Software delivery is digital. | Use DDP for physical scanners. Software delivered via encrypted cloud portal post-shipment | Ensures hardware clears customs before software activation. Avoids clinic downtime. |

| FOB Shanghai | Risk: Software activation delayed by customs holds on hardware | Only acceptable if supplier provides temporary cloud license during shipping | Carejoy includes 30-day provisional license upon FOB shipment confirmation |

| Digital Delivery Protocol | Must specify: Encryption standard, activation workflow, offline mode capability | Require TLS 1.3+ encryption, 2-factor activation, and 72hr offline use window | Non-negotiable in 2026 contracts due to GDPR/HIPAA enforcement trends |

| Post-Delivery Validation | Software must pass clinic’s DICOM/HL7 integration tests | Build 14-day acceptance period into contract with rollback clause | Carejoy provides remote validation support + pre-configured test environments |

Strategic Partner Recommendation: Shanghai Carejoy Medical Co., LTD

For clinics and distributors prioritizing regulatory security and technical integration, Carejoy delivers unmatched advantages in 2026:

- Factory Direct Control: 19 years specializing in dental scanner ecosystem (hardware + app + cloud)

- Risk-Reduced Sourcing: Pre-verified compliance for EU MDR, FDA SaMD, and NMPA pathways

- Flexible Commercial Models: Zero hardware MOQ for SaaS, customizable OEM terms, DDP/FOB hybrid shipping

- Technical Integration: Dedicated API support for clinic management systems (Dentrix, Open Dental, exocad)

Initiate Your 2026 Sourcing Process

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China

Core Competency: Factory-direct IOS applications with certified clinical workflows

Contact: [email protected] | WhatsApp: +86 15951276160

Action Request: Email “2026 DENTAL SCANNER APP Dossier” to receive:

- Current ISO 13485 scope + CE/FDA certificates

- MOQ/licensing matrix for your target region

- DDP shipping cost calculator (all major ports)

Note: Regulatory requirements evolve rapidly. This guide reflects Q1 2026 standards. Always conduct independent verification prior to contract execution.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Digital Intraoral Scanner Applications (2026)

| Question | Technical Response |

|---|---|

| 1. What power voltage requirements should be considered when integrating a digital scanner application system in 2026? | Most modern digital intraoral scanner systems operate on standard 100–240V AC, 50/60 Hz, making them compatible with global electrical grids. However, the scanner application itself—running on clinic workstations or cloud-based platforms—relies on stable computing infrastructure. Ensure clinic PCs or tablets meet minimum OS requirements (Windows 11 Pro or macOS 14+) and are powered via surge-protected outlets. For embedded scanner hardware, verify local voltage compliance (e.g., 120V in North America, 230V in EU) and use manufacturer-approved power adapters to prevent damage to sensitive imaging sensors. |

| 2. Are spare parts and replacement components readily available for scanner-compatible devices used with digital applications? | Yes, leading manufacturers (e.g., 3Shape, Align, Carestream) maintain global spare parts networks with guaranteed availability for critical components—such as scan tips, charging docks, and intraoral camera modules—for at least 7 years post-discontinuation. Distributors should confirm access to regional spare parts hubs and request inventory forecasts. Note: The ‘digital scanner app’ relies on hardware integrity; spare parts availability directly impacts uptime and service-level agreements (SLAs). Opt for OEM-certified components only to maintain calibration and software compatibility. |

| 3. What does the installation process involve for a digital scanner application in a multi-chair dental practice? | Installation includes hardware setup, software deployment, and network integration. Certified technicians perform on-site calibration of scanners, install the application on designated workstations, and configure DICOM/OSIMPS export protocols. In 2026, most apps support cloud-based deployment with single sign-on (SSO) and HIPAA/GDPR-compliant data encryption. For multi-chair environments, network bandwidth (minimum 100 Mbps upload) and centralized data management via dental ERP integration (e.g., Dentrix, Open Dental) are essential. Onboarding includes staff training and interoperability testing with CAD/CAM and EHR systems. |

| 4. What warranty coverage is standard for digital scanner applications and associated hardware? | Hardware units typically include a 2-year comprehensive warranty covering defects in materials and workmanship, including sensor degradation and mechanical failure. The digital scanner application software is covered under a perpetual or subscription-based license with included technical support and updates. Extended warranties (up to 5 years) are available, often bundled with predictive maintenance and remote diagnostics. Note: Warranty is void if non-OEM accessories or unauthorized software modifications are used. Distributors should offer clinics transparent warranty registration and service escalation paths. |

| 5. How are software updates and technical support managed under the warranty for scanner applications? | In 2026, digital scanner apps operate under a hybrid SaaS model: core software updates (e.g., AI-driven margin detection, occlusion mapping) are delivered automatically and included in warranty or service agreements. Technical support is available 24/7 via dedicated portals, with response times tiered by service level (e.g., 2-hour SLA for critical scanning failures). Remote diagnostics tools allow engineers to troubleshoot connectivity, calibration drift, or rendering issues without on-site visits. Ensure warranty terms include access to cybersecurity patches and DICOM standard compliance updates. |

Need a Quote for Digital Scanner App?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160