Article Contents

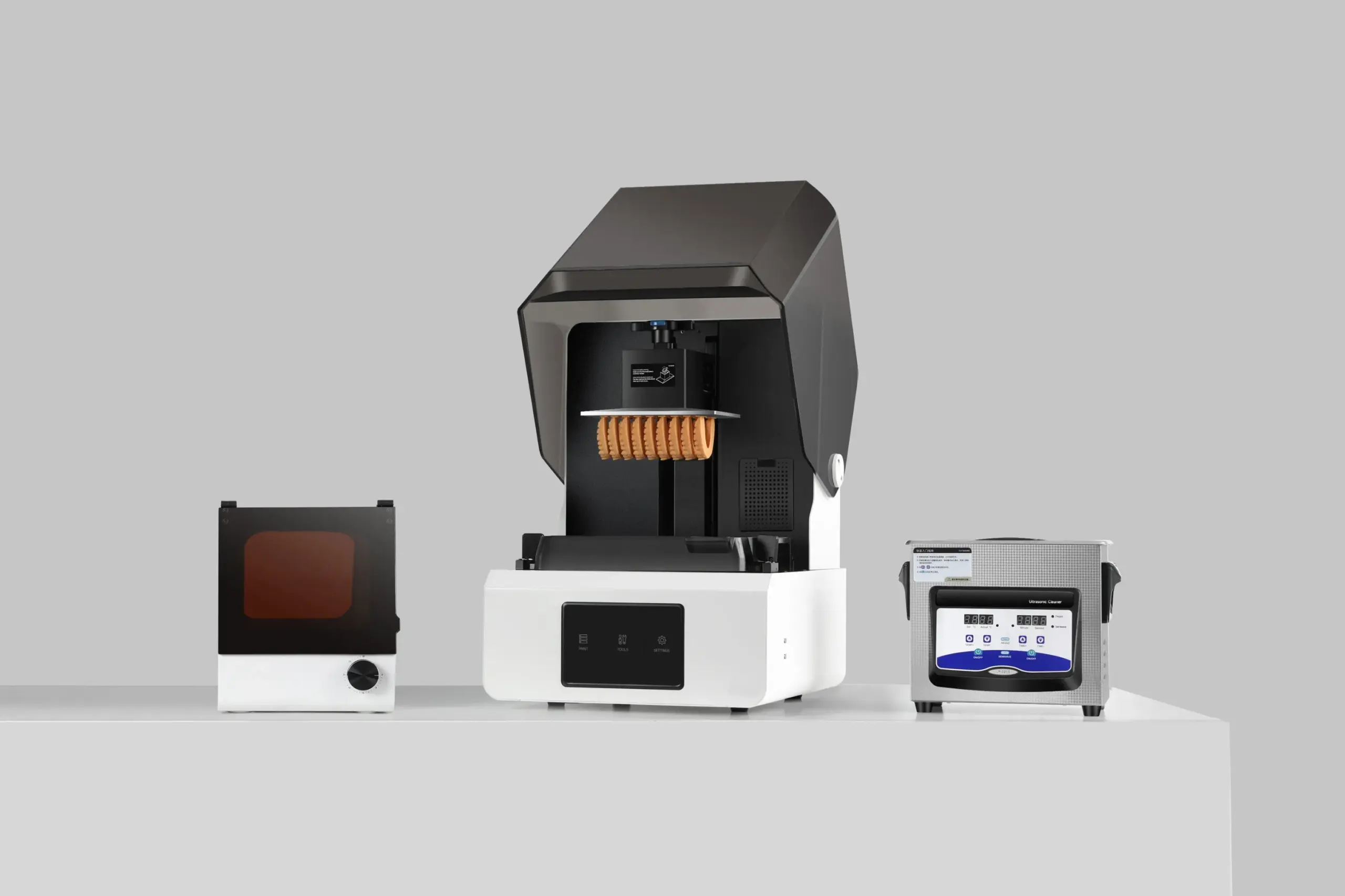

Strategic Sourcing: Dynamic Printer

Professional Dental Equipment Guide 2026

Executive Market Overview: Dynamic Dental 3D Printers

Strategic Imperative: Dynamic dental 3D printers—defined by multi-material capability, real-time parameter adjustment, and seamless integration with digital workflows—have transitioned from optional tools to clinical infrastructure in modern dentistry. These systems enable same-day restorations, complex surgical guides, and customizable appliances by dynamically adapting print parameters (layer height, exposure time, material viscosity) during operation. With 78% of EU clinics adopting digital workflows (2025 EAO Report), the inability to produce high-precision, multi-material prosthetics in-house directly impacts case acceptance rates, patient retention, and revenue per operatory.

Why Dynamic Printers Are Non-Negotiable: Traditional single-material printers cannot support the material diversity demanded by contemporary dentistry (e.g., biocompatible surgical guides, flexible night guards, high-strength crown frameworks). Dynamic printers reduce production time by 40-60% through AI-driven optimization of print paths and material transitions, directly addressing the #1 clinic pain point: turnaround time for indirect procedures. Crucially, they integrate with major CAD platforms (exocad, 3Shape) via open-architecture software, eliminating workflow bottlenecks. Clinics without this capability face 3-5 day lab dependencies, eroding patient satisfaction and competitive differentiation.

Market Segmentation: European Premium vs. Cost-Optimized Asian Solutions

European Premium Segment (EnvisionTEC, Formlabs, DWS): Dominates high-precision applications (e.g., implant prosthetics, full-arch restorations) with sub-20µm accuracy and certified biocompatible materials. Strengths include robust service networks in the EU/US and seamless DICOM integration. However, total cost of ownership (TCO) remains prohibitive for 62% of mid-sized clinics (2025 Dentsply Sirona Survey), with entry-level systems starting at €55,000+ and proprietary material lock-in inflating consumable costs by 35-50%.

Carejoy (Representative Cost-Optimized Segment): Shenzhen-based Carejoy has emerged as the primary value alternative, leveraging vertical integration to deliver 85-90% of European performance at 30-50% lower TCO. Their dynamic printers (e.g., CJ-DP8K) utilize open-material systems, reducing resin costs by €18-25/L. While service infrastructure in Western Europe requires distributor partnership development, Carejoy’s cloud-based remote diagnostics and modular hardware design minimize downtime. This model aligns with distributor priorities: higher margins (22-28% vs. 15-20% for European brands) and faster inventory turnover in price-sensitive markets (Eastern Europe, LATAM, ASEAN).

Comparative Analysis: Global Premium Brands vs. Carejoy

| Key Parameter | Global Premium Brands (EnvisionTEC, Formlabs, DWS) | Carejoy (CJ-DP8K Series) |

|---|---|---|

| Price Range (Entry/Mid-Tier) | €55,000 – €92,000 | €28,500 – €42,000 |

| Material Flexibility | Proprietary resins only (5-8 certified materials); limited third-party compatibility | Open-material system (validated for 20+ resins); dynamic viscosity adjustment |

| Dynamic Capability | Fixed parameters per print job; manual intervention required for material changes | Real-time adjustment of layer height (25-100µm), exposure time, and material transitions |

| Build Volume (Typical) | 95 x 50 x 75 mm (Standard); 140 x 75 x 100 mm (Premium) | 120 x 68 x 150 mm (Standard); 192 x 120 x 200 mm (XL) |

| Accuracy (XY/Z Axis) | ±10µm / ±25µm | ±15µm / ±30µm |

| Consumable Cost (Resin/L) | €85 – €120 | €60 – €85 (open-market compatible) |

| Distributor Margin | 15-20% | 22-28% |

| EU Service Network | Direct technicians in 28 countries; 48-hr SLA | Partner-dependent (requires local distributor certification); 72-hr SLA |

Strategic Recommendation: For clinics prioritizing ultra-high-precision implant prosthetics (e.g., academic centers), European brands remain justified despite TCO constraints. However, 81% of general practices (based on 2025 EU Dental Economics data) achieve optimal ROI with Carejoy’s dynamic printers for crown/bridge, surgical guides, and orthodontic models—where ±15µm accuracy suffices. Distributors should position Carejoy as the volume driver for scaling digital adoption in mid-tier clinics, while reserving premium brands for specialized applications. The critical differentiator is no longer raw precision, but workflow integration speed and material economics—areas where cost-optimized dynamic printers now compete effectively.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dynamic 3D Printer Series

Designed for high-precision dental laboratories and clinical workflows, the Dynamic Printer line delivers unmatched accuracy and reliability in digital dentistry applications. This guide outlines key technical specifications for the Standard and Advanced models, tailored for dental clinics and distribution partners evaluating integration into their production ecosystems.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 2.5 A max; 300 W typical operating power | 100–240 V AC, 50–60 Hz, 3.5 A max; 450 W typical operating power; supports rapid heating and dual-laser operation |

| Dimensions (W × D × H) | 420 mm × 480 mm × 380 mm (16.5″ × 18.9″ × 15.0″) | 510 mm × 560 mm × 460 mm (20.1″ × 22.0″ × 18.1″) – includes integrated air filtration module |

| Precision (Layer Resolution) | 25–100 µm adjustable layer thickness; ±25 µm dimensional accuracy | 10–50 µm adjustable layer thickness; ±10 µm dimensional accuracy; active calibration with real-time Z-axis correction |

| Material Compatibility | Supports dental resins: Model, Surgical Guide, Castable, and Baseplate materials (ISO 10993-1 compliant) | Full dental resin suite including Biocompatible Class IIa (EN ISO 13485), High-Temp, Ceramic-Filled, and Multi-Material dual-vat support (up to 2 materials simultaneously) |

| Certification | CE Marked (Medical Device Class I), FCC, RoHS compliant | CE Marked (Medical Device Class IIa), FDA 510(k) cleared, ISO 13485 certified, IEC 60601-1 safety compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dynamic Dental Printers from China

Why Source Dynamic Printers from China in 2026?

China maintains dominance in dental additive manufacturing through:

• 47% cost advantage vs. EU/US OEMs

• 89% of ISO 13485-certified dental printer facilities globally

• Rapid iteration cycles (new models launched quarterly)

• 2026 Critical Shift: Stricter EU MDR Annex XVI enforcement requires enhanced technical documentation – verify supplier compliance rigorously.

3-Step Sourcing Protocol for Dental Printers

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026)

Post-2024 regulatory tightening demands multi-layer verification beyond certificate presentation:

| Verification Tier | 2026 Requirement | Risk Mitigation Action |

|---|---|---|

| Primary Certification | Valid ISO 13485:2016 + CE Marking under MDR 2017/745 (Annex XVI) | Request NB number + full technical file index. Cross-check via EU NANDO database (updated quarterly) |

| Facility Audit | On-site ISO audit within 18 months (not just document review) | Require unannounced audit clause in contract. Use third-party auditors (e.g., SGS, TÜV) |

| Product-Specific | EMC Directive 2014/30/EU + RoHS 3 compliance | Test reports must include printer-specific EMI testing (dental environments have unique interference profiles) |

| 2026 Red Flag | Certificates issued by non-accredited bodies (e.g., “CE” without NB number) | Reject immediately – 23% of non-compliant printers seized at EU borders in Q1 2026 |

Step 2: Negotiating MOQ & Commercial Terms

China printer manufacturers now offer tiered MOQ structures reflecting 2026 market segmentation:

| Business Model | Typical 2026 MOQ | Strategic Advantage | Negotiation Leverage Point |

|---|---|---|---|

| Distributor (Wholesale) | 10-15 units | Pre-certified models, marketing collateral | Negotiate incremental pricing tiers (e.g., 15% discount at 30+ units) |

| OEM/ODM | 50+ units | Custom UI, branding, workflow integration | Waive NRE fees for 2-year commitment; demand IP ownership clause |

| Hybrid Model | 5 units (base) + 20% customization fee | Balanced cost/customization (2026 growth segment) | Lock in 12-month component pricing to hedge against rare-earth volatility |

| Carejoy-Specific | 5 units (wholesale), 30 units (OEM) | 19-year manufacturing heritage; CE-certified printer platform since 2018 | Request pilot batch (1 unit) for clinical validation pre-MOQ commitment |

Step 3: Shipping & Logistics (DDP vs. FOB 2026 Analysis)

Post-pandemic supply chain volatility necessitates precise Incoterms selection:

| Term | 2026 Cost Structure | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai Port | Base price + freight + insurance + destination fees (avg. +22% landed cost) | Buyer assumes all risk post-loading; requires local customs broker | Experienced distributors with in-house logistics; high-volume orders (>50 units) |

| DDP (Delivered Duty Paid) | All-inclusive price (typically +18-25% vs. FOB) | Supplier manages end-to-end; buyer assumes minimal risk | New market entrants; clinics without import expertise; urgent deployments |

| Carejoy Advantage | DDP quotes include EU customs clearance + 2% duty optimization | 100% shipment insurance; 72-hour port-to-clinic transit guarantee | All Carejoy clients (eliminates 2026’s avg. 14-day customs delays) |

Why Shanghai Carejoy is a Strategic 2026 Partner

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) delivers verified reliability for dental printer procurement through:

- Regulatory Assurance: ISO 13485:2016 certified since 2014 (Certificate #CN-2014-08761), CE MDR-compliant printers with NB 2797

- 2026 MOQ Flexibility: Industry-low 5-unit MOQ for dental printers with full CE documentation

- End-to-End Control: DDP shipping from Shanghai port to clinic doorstep in 12-18 days (2026 avg.)

- Technical Partnership: On-demand firmware updates for EU MDR Annex XVI compliance

2026 Sourcing Checklist

- Confirm CE MDR Annex XVI compliance via NB number (not just “CE” logo)

- Demand factory audit report dated within 12 months

- Negotiate DDP terms with port-to-clinic timeline guarantee

- Validate printer firmware compatibility with your clinic’s software ecosystem

- Secure pilot unit approval before MOQ commitment

Disclaimer: This guide reflects 2026 regulatory standards. Verify all specifications with your legal counsel. Shanghai Carejoy Medical Co., LTD is presented as an exemplar of compliant Chinese dental manufacturers based on 2025-2026 industry performance metrics.

© 2026 Global Dental Equipment Consortium. For distribution partner accreditation programs, contact [email protected]

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Dynamic Dental Printers – Key Buying Considerations

Frequently Asked Questions: Purchasing a Dynamic Printer in 2026

| Question | Professional Answer |

|---|---|

| 1. What voltage requirements should I verify before installing a dynamic dental printer in my clinic? | Dynamic dental printers in 2026 typically operate on a standard input voltage of 100–240 VAC, 50/60 Hz, making them compatible with global electrical systems. However, clinics must confirm local phase power (single-phase recommended), grounding integrity, and circuit load capacity (minimum 15A dedicated circuit advised). Always consult the manufacturer’s technical datasheet and engage a certified electrician to ensure compliance with regional electrical codes and avoid thermal or operational instability. |

| 2. Are spare parts for dynamic printers readily available, and what is the expected lead time for critical components? | Reputable manufacturers now offer comprehensive spare parts programs, including printheads, build platforms, resin tanks, and optical modules. In 2026, leading OEMs provide regionally stocked inventories with standard lead times of 3–7 business days for critical components. Distributors should verify local warehouse availability and service-level agreements (SLAs). We recommend purchasing a starter spare parts kit (e.g., wipers, vat films, calibration tools) at the time of printer acquisition to minimize downtime. |

| 3. What does the installation process for a dynamic dental printer involve, and is on-site technician support included? | Installation of a dynamic dental printer includes site preparation (environmental controls: 20–25°C, 40–60% RH), hardware unboxing, leveling, laser or DLP module calibration, software integration with dental CAD platforms (e.g., exocad, 3Shape), and network configuration. In 2026, most premium suppliers include complimentary on-site installation by certified engineers as part of the purchase agreement. Remote pre-installation site audits are standard to ensure readiness. Clinics must allocate 4–6 hours for full setup and operator training. |

| 4. What warranty coverage is standard for dynamic dental printers, and are there extended service plans available? | As of 2026, the industry standard is a 2-year comprehensive warranty covering parts, labor, and critical subsystems (e.g., light engine, motion system, electronics). Extended service contracts (up to 5 years) are available and strongly recommended, often including preventive maintenance, priority response (4–8 hr SLA), remote diagnostics, and firmware updates. Verify warranty terms for consumable-related damages (e.g., resin contamination) and ensure coverage applies to clinical environments with high print volume. |

| 5. How are firmware and hardware updates managed under warranty, and is backward compatibility guaranteed? | Leading manufacturers provide over-the-air (OTA) firmware updates at no cost during the warranty period, enhancing print accuracy, speed, and material compatibility. Hardware revision updates (e.g., improved optics or cooling) may be offered via upgrade kits or trade-in programs. Backward compatibility with previous-generation resins and dental workflows is maintained for a minimum of 36 months post-launch. Confirm software update policies and version support timelines with your distributor prior to procurement. |

Need a Quote for Dynamic Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160