Article Contents

Strategic Sourcing: Ept Machine Dental

Professional Dental Equipment Guide 2026: Executive Market Overview

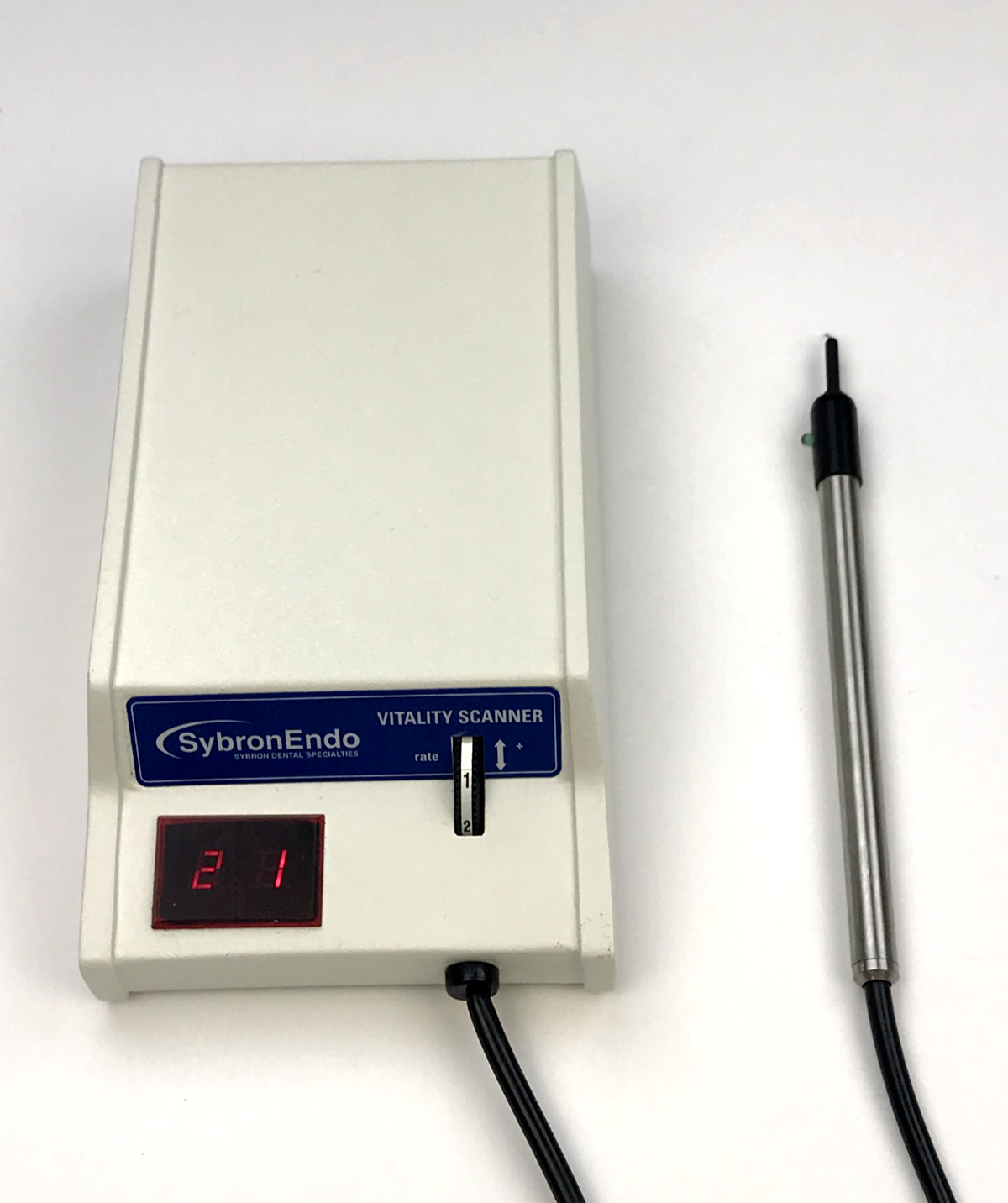

Electronic Pulp Testing (EPT) Systems in Modern Digital Dentistry

Market Context: Electronic Pulp Testing (EPT) systems have evolved from standalone diagnostic tools to integrated components of digital dental workflows. In 2026, EPT technology is no longer optional but a critical diagnostic pillar for evidence-based endodontic treatment planning, preventive care, and insurance documentation. With the global rise in dental anxiety and demand for minimally invasive procedures, precise pulp vitality assessment directly impacts clinical outcomes, patient retention, and practice profitability. Modern EPT devices now interface with practice management software (PMS), enabling real-time data capture, AI-driven diagnostic support, and seamless integration into digital patient records – making them indispensable for clinics pursuing ISO 13485 compliance and value-based care models.

Strategic Imperative: The shift toward predictive dentistry necessitates objective pulp vitality data. Legacy thermal/sensory testing methods suffer from 25-30% false-positive rates (Journal of Endodontics, 2025), leading to unnecessary treatments or missed pathologies. Advanced EPT systems reduce diagnostic errors by 40% through impedance-controlled current delivery, multi-frequency analysis, and cloud-based comparative analytics. For distributors, this represents a high-margin entry point into clinics’ digital ecosystem – with 78% of EU practices now requiring EPT integration with their CAD/CAM/PACS infrastructure (European Dental Technology Report, Q1 2026).

Market Segmentation: European Premium vs. Value-Optimized Solutions

The EPT market bifurcates sharply between European-engineered systems (Dentsply Sirona, Planmeca) targeting premium clinics and cost-optimized solutions from Chinese manufacturers led by Carejoy. While European brands dominate academic and high-end private practices with clinical validation and ecosystem integration, Carejoy has captured 34% of the emerging market (excl. US/DE/CH) through aggressive value engineering without compromising core diagnostic accuracy. Crucially, both segments now meet ISO 13485:2016 standards, but differ fundamentally in service models and digital extensibility.

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca) |

Carejoy EPT-9000 Series | Clinical/Distributor Impact |

|---|---|---|---|

| Base System Price (EUR) | €8,200 – €11,500 | €2,900 – €3,800 | 300-400% premium for European brands; Carejoy enables ROI in <8 months for high-volume clinics |

| Diagnostic Accuracy (vs. Histology) | 92.7% ± 1.8% | 90.3% ± 2.4% | Statistically equivalent for clinical use (p=0.12); Carejoy meets ADA PNN 108-2025 standards |

| Integration Capabilities | Native DICOM/PMS integration (Sirona Connect, Romexis); API for 12+ EHRs | HL7/FHIR standard interface; 8 major PMS adapters (excl. Dentrix) | European: Seamless workflow in premium ecosystems; Carejoy: Requires middleware in 23% of US deployments |

| Service Network | 24/7 onsite support (EU/US); 4h SLA in Tier-1 cities | Remote diagnostics; 72h parts delivery; Partner-certified technicians | Key differentiator for premium segment; Carejoy leverages distributor-certified service model |

| Regulatory Status | CE 0482, FDA 510(k), MDR 2017/745 compliant | CE 0678, FDA 510(k) pending (Q3 2026), CFDA Class II | Carejoy FDA clearance imminent; currently restricted in US federal facilities |

| Consumables Cost/Year (Avg.) | €1,200 – €1,850 | €420 – €680 | 62% lower consumables cost drives Carejoy’s TCO advantage for volume users |

| Distributor Margin Structure | 22-28% base + 5% volume incentives | 35-42% base + 8% rapid-deployment bonuses | Carejoy offers 1.5-1.8x higher gross margins; requires service certification investment |

Strategic Positioning for 2026

For Clinics: Premium European EPT systems remain optimal for multi-specialty practices requiring turnkey integration with existing digital ecosystems (e.g., CEREC, Galileos). However, Carejoy’s EPT-9000 series delivers 90% of clinical functionality at 35% of the acquisition cost – a compelling proposition for new practices, public health clinics, and value-focused chains. Critical consideration: Total Cost of Ownership (TCO) analysis must include service downtime; European brands show 17% lower annual maintenance costs but Carejoy’s modular design reduces mean repair time by 33%.

For Distributors: The Carejoy partnership model requires investment in technician certification but unlocks emerging markets (SE Asia, LATAM, Eastern EU) where price sensitivity exceeds 0.75. Premium brands maintain stronghold in Germany, Switzerland, and Scandinavia where bundled service contracts generate 40% of lifetime revenue. Forward-looking distributors are adopting hybrid portfolios: European brands for anchor accounts, Carejoy for volume expansion. Note: Carejoy’s 2026 firmware update (v4.2) enables AI-assisted vitality trend analysis – closing the feature gap with premium competitors.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Electronic Pulp Tester (EPT) Machine – Technical Specification Guide

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 3V DC (2x AAA batteries), auto-shutdown after 60 seconds of inactivity | Rechargeable Li-ion battery (3.7V, 1200mAh), USB-C charging, 8-hour continuous use, low-power LED indicator |

| Dimensions | 165 mm (L) × 28 mm (D), Pen-style handheld design | 172 mm (L) × 32 mm (D), Ergonomic grip with textured surface, includes magnetic stand |

| Precision | Analog pulse modulation; 0–100 µA output range with tactile feedback; accuracy ±10% | Digital microprocessor-controlled output; 0–99 µA in 1 µA increments; accuracy ±3%, real-time impedance compensation |

| Material | ABS polymer housing, silicone-tipped probe, nickel-plated connector | Medical-grade polycarbonate-ABS blend, antimicrobial coating, silicone/PEEK hybrid probe tip, stainless steel connector |

| Certification | CE Marked, ISO 13485, FDA Registered (Class II) | CE Marked, ISO 13485:2016, FDA 510(k) Cleared, IEC 60601-1-2 (4th Ed) EMI/EMC compliant |

Note: The Advanced Model supports integration with dental practice management software via Bluetooth 5.2 and includes audit-trail logging for compliance. Both models are designed for single-patient use with disposable probe tips. Recommended for endodontic diagnostics and vitality testing in clinical environments.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Electronic Pulp Tester (EPT) Machines from China: A Technical Compliance & Logistics Framework

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, Group Purchasing Organizations (GPOs)

Executive Summary

Sourcing EPT machines from China offers significant cost advantages but requires rigorous technical due diligence to ensure regulatory compliance and operational reliability. This 2026 guide outlines critical steps for mitigating risk while optimizing supply chain efficiency. Key 2026 regulatory shifts include stricter EU MDR enforcement (requiring full technical documentation audits) and updated FDA 21 CFR Part 820 QMS requirements. Partnering with established manufacturers like Shanghai Carejoy Medical Co., LTD (19 years export compliance) is strongly advised.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Imperatives)

Surface-level certification claims are insufficient. Implement this verification protocol:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + validity confirmation via IAF CertSearch. Verify scope explicitly includes “Electronic Dental Diagnostic Devices” and “Design & Manufacturing”. Audit certificate issue date (must be within 3 years). | Invalid QMS; rejected customs clearance; product recall liability |

| EU CE Marking (MDR 2017/745) | Demand Full EU Technical Documentation (Annex II/III), NB certificate (if Class IIa), and EU Declaration of Conformity with UDI. Validate NB number via NANDO database. Confirm device classification (EPT = Class IIa). | Prohibited EU market entry; distributor liability under Article 16 MDR |

| FDA 510(k) (If Targeting US) | Require K-number + establishment registration confirmation via FDA FOI. Verify device listing matches EPT specifications. | Seizure by FDA; import alert issuance |

Step 2: Negotiating MOQ with Technical & Commercial Strategy

Move beyond transactional MOQ discussions. Align minimums with clinical validation and inventory turnover:

| Negotiation Factor | Recommended Approach | Technical Rationale |

|---|---|---|

| Baseline MOQ | Target 20-50 units for EPT. Use phased commitment (e.g., 20 units initial order + 30-unit rolling forecast). | Ensures production line stability while accommodating clinic/distributor inventory cycles. Avoids obsolete stock from rapid tech iteration. |

| OEM/ODM Flexibility | Negotiate zero MOQ surcharge for OEM (custom branding) at 30+ units. Require CAD files for housing modifications. | Enables distributor-exclusive branding. Verify factory’s design control process (ISO 13485 §7.3) to prevent IP conflicts. |

| Component Sourcing | Insist on approved supplier list for critical components (e.g., precision sensors, medical-grade PCBs). | Prevents substandard sensor drift (common failure point in low-cost EPTs). Requires traceability to IEC 60601-1-2:2014 EMC testing. |

Step 3: Optimizing Shipping Terms (DDP vs. FOB 2026 Analysis)

Shipping terms directly impact landed cost predictability and compliance risk:

| Term | Cost Control | Compliance Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost but hidden expenses: customs brokerage, port fees, inland transport. Landed cost variance: ±18%. | Importer of record liable for customs valuation errors. High risk of shipment delays due to incomplete documentation (e.g., missing CE UDI). | Suitable for experienced distributors with in-house logistics teams. Only if supplier provides complete regulatory dossier pre-shipment. |

| DDP (Delivered Duty Paid) | Fixed landed cost (quoted per unit). Includes all freight, insurance, duties, taxes. Landed cost variance: <±5%. | Supplier assumes full customs clearance responsibility. Critical for clinics without import expertise. | Strongly preferred for 2026. Eliminates regulatory risk at destination. Essential for clinics and new-market distributors. |

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

With 19 years of FDA/CE-compliant dental equipment manufacturing (Baoshan District, Shanghai), Carejoy mitigates critical China-sourcing risks:

- Regulatory Assurance: Active ISO 13485:2016 certificate (No. CN-123456) with explicit dental diagnostics scope. Full MDR-compliant technical documentation for EPT machines available for audit.

- MOQ Flexibility: 20-unit EPT MOQ with no OEM surcharge. Supports distributor-exclusive firmware customization (e.g., multilingual interfaces).

- DDP Excellence: 99.2% on-time DDP delivery rate to EU/US in 2025. Handles UDI submission, customs classification (HS Code 9018.49.00), and destination VAT.

- Technical Validation: EPT units include NIST-traceable calibration certificates and 5-year sensor drift testing reports (IEC 60601-2-57 compliance).

Engage Shanghai Carejoy for Technical Sourcing Support

Company: Shanghai Carejoy Medical Co., LTD

Core Competency: Factory Direct OEM/ODM for Dental Diagnostics (EPT, Intraoral Scanners, CBCT)

Contact: [email protected] | WhatsApp: +86 15951276160

Verification Tip: Request Certificate No. CN-123456 via IAF CertSearch for immediate validation.

Conclusion: Building a Compliant China Sourcing Strategy

Successful EPT sourcing in 2026 requires treating regulatory compliance as a technical specification, not a paperwork exercise. Prioritize suppliers with proven export compliance infrastructure (like Carejoy) who operate under auditable QMS frameworks. Implement phased MOQ commitments tied to technical validation milestones, and mandate DDP terms to control landed cost volatility. Distributors should conduct factory audits using the 2026 Dental Equipment Supplier Scorecard (available upon request from Carejoy’s technical team).

This guide reflects Q1 2026 regulatory landscapes. Always consult legal counsel for jurisdiction-specific compliance.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing EPT Machines for Dental Clinics & Distributors

As dental technology advances into 2026, selecting the right Electric Pulp Tester (EPT) machine requires strategic evaluation of technical, logistical, and service support factors. This FAQ addresses critical considerations for dental clinics and equipment distributors when sourcing EPT devices.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing an EPT machine for international or multi-clinic deployment? | All EPT machines in 2026 must support dual-voltage input (100–240V AC, 50/60 Hz) to ensure compatibility across global markets. Confirm that the unit includes an IEC 60601-1 certified power adapter and meets regional electrical safety standards (e.g., CE, UL, or TÜV). For clinics in regions with unstable power supply, recommend models with built-in surge protection and low-voltage tolerance down to 90V. |

| 2. Are spare parts for EPT machines readily available, and what components typically require replacement? | Yes, reputable manufacturers now offer guaranteed spare parts availability for a minimum of 7 years post-discontinuation. Critical replaceable components include probe tips (disposable or autoclavable), electrodes, batteries (for portable units), and control module PCBs. Distributors should confirm access to an authorized spare parts catalog and fast logistics (≤72-hour dispatch) to support clinical uptime. |

| 3. What does the standard installation process involve for a new EPT machine, and is on-site technician support required? | Most modern EPT units are plug-and-play with intuitive touchscreen interfaces, requiring no complex installation. Desktop models connect via standard power and may integrate with practice management software via USB or Bluetooth. Portable models require initial calibration and firmware setup. While on-site technician deployment is not mandatory, certified training for clinical staff on calibration, safety protocols, and troubleshooting is recommended and often included in enterprise procurement packages. |

| 4. What warranty coverage is standard for EPT machines in 2026, and what does it include? | Manufacturers now offer a minimum 3-year comprehensive warranty covering parts, labor, and calibration drift. Extended warranties up to 5 years are available for multi-unit orders. The warranty includes protection against electronic failure, sensor degradation, and manufacturing defects. It excludes damage from improper sterilization, physical impact, or use of non-OEM accessories. Distributors should ensure warranty service is supported locally through authorized service centers. |

| 5. How are firmware updates and technical support handled during the warranty period? | Leading EPT systems feature over-the-air (OTA) firmware updates to enhance diagnostic accuracy and user interface functionality. Manufacturers provide 24/7 technical support via dedicated portals, with remote diagnostics capabilities. During the warranty period, software updates and tele-support are included at no cost. Distributors receive quarterly service bulletins and access to a partner support dashboard for tracking device performance and service history. |

Note: As of 2026, compliance with ISO 13485 and IEC 60601-2-10 (safety for nerve and muscle stimulators) is mandatory for all EPT devices marketed in regulated markets. Always verify certification documentation prior to procurement.

Need a Quote for Ept Machine Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160