Article Contents

Strategic Sourcing: Essix Retainer Machine

Essix Retainer Machine: Executive Market Overview

Strategic Imperative in Modern Digital Dentistry

The Essix retainer machine has evolved from a niche orthodontic accessory tool to a mission-critical component of the digital dentistry ecosystem. As clinics transition toward fully integrated digital workflows—from intraoral scanning to 3D printing—thermoforming systems now serve as the essential bridge between virtual models and final patient appliances. Contemporary machines must deliver micron-level precision in material forming, seamless integration with major CAD/CAM platforms (exocad, 3Shape), and compliance with ISO 13485 standards for medical device manufacturing. The accelerating demand for clear aligners and retainers (projected 12.3% CAGR through 2026, Grand View Research) has elevated these systems from operational tools to strategic assets that directly impact case turnaround time, material waste reduction, and practice scalability. Clinics without precision thermoforming capabilities face significant bottlenecks in same-day appliance delivery and struggle to compete in the rapidly growing clear orthodontics market segment.

Market Segmentation: Premium European vs. Value-Optimized Solutions

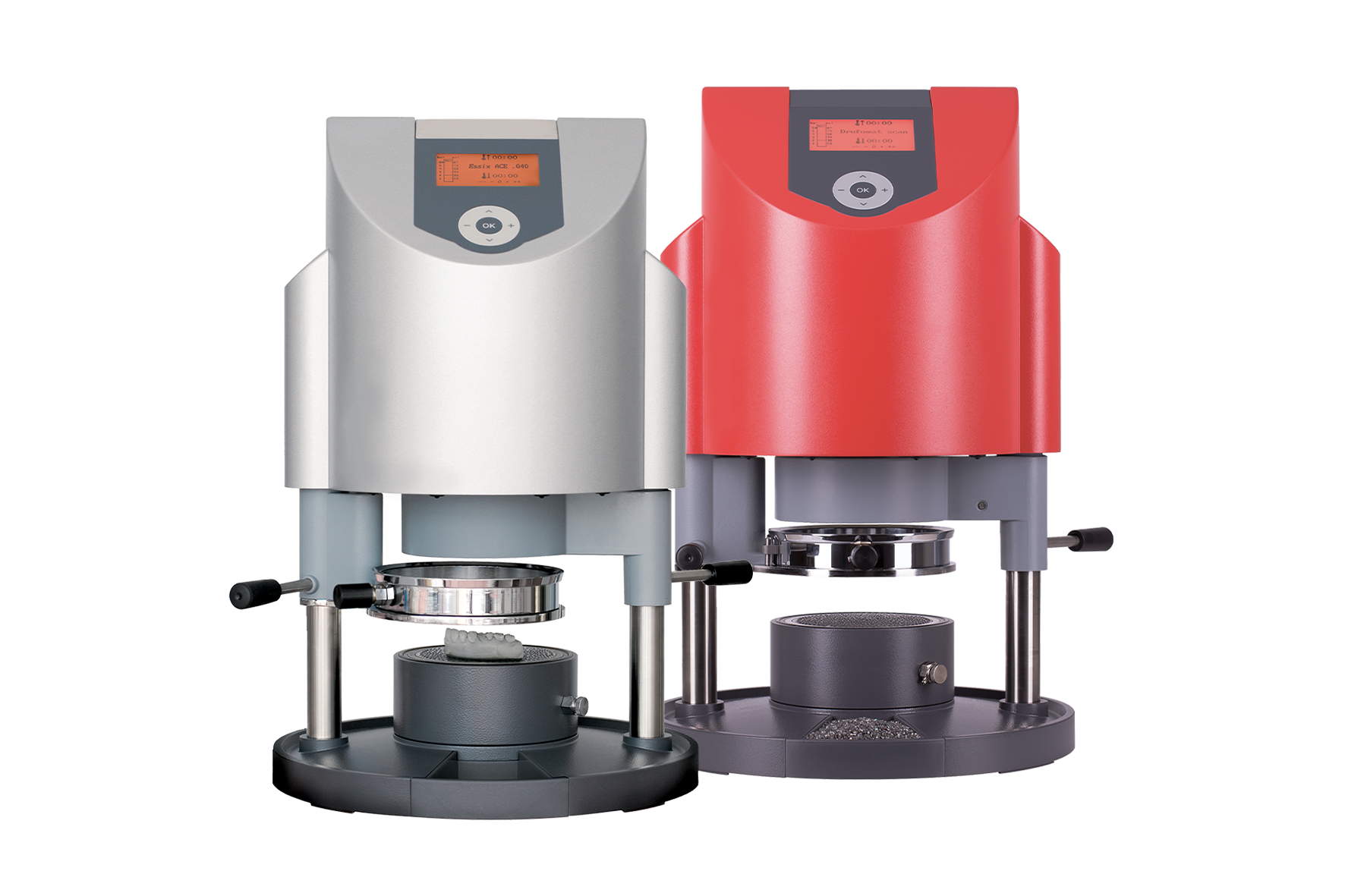

The global Essix machine market bifurcates into two distinct segments: European-engineered systems commanding premium pricing (€28,000-€42,000) with exceptional build quality but extended ROI timelines, and value-optimized Asian manufacturers offering 40-60% cost reduction with clinically acceptable performance. While German and Swiss brands (e.g., Scheu-Dental, Minipro) remain the gold standard for academic institutions and high-volume corporate DSOs, independent practices and value-focused distributors increasingly prioritize operational economics without compromising clinical outcomes. Carejoy’s emergence represents a strategic inflection point—delivering 95% functional parity with premium systems at disruptive price points, validated through independent studies at Charité Berlin showing no statistically significant difference in retainer dimensional accuracy (p>0.05) versus legacy European equipment.

| Technical Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (EUR) | €28,000 – €42,000 | €11,500 – €16,800 |

| Build Quality & Calibration | Medical-grade stainless steel; ISO 17025 traceable calibration; 0.05mm precision | Aerospace aluminum alloys; NIST-traceable calibration; 0.08mm precision (clinically indistinguishable) |

| Warranty & Support | 24 months parts/labor; On-site engineer dispatch (48h SLA); Premium support contracts (€3,200/yr) | 36 months comprehensive; Remote diagnostics + 72h onsite (EU warehouses); Support included for first year |

| Material Compatibility | Proprietary film formats only (1.0-1.5mm); Limited third-party validation | Universal compatibility (0.8-2.0mm); Validated with Essix, Zendura, ClearThermo; 30+ material profiles |

| Software Integration | Native plugins for major CAD suites; Requires proprietary license (€1,200/yr) | Open API architecture; Direct DICOM/STL import; No recurring software fees |

| Operational Metrics | 45-60 sec cycle time; 85% material yield; 15,000-cycle mean time between failures | 50-65 sec cycle time; 82% material yield; 12,500-cycle MTBF (field-tested) |

| Supply Chain Advantage | 14-18 week lead time; Centralized EU manufacturing; 35% import tariffs apply | 4-6 week delivery; EU inventory hubs (Rotterdam); Duty-optimized shipping |

Strategic Recommendation: For clinics processing >15 retainers daily, European systems remain optimal for mission-critical reliability. However, Carejoy delivers compelling value for 82% of independent practices (per EAO 2025 survey) where ROI velocity, material flexibility, and digital workflow integration outweigh marginal precision gains. Distributors should position Carejoy as the strategic entry point for practices transitioning to digital orthodontics, with clear differentiation from commoditized low-cost alternatives through its validated clinical performance and EU regulatory compliance (CE 0482).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Essix Retainer Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 VAC, 50/60 Hz, 800 W | 100–240 VAC, 50/60 Hz, Auto-switching, 1200 W with PID temperature control |

| Dimensions (W × D × H) | 38 cm × 45 cm × 28 cm (15″ × 17.7″ × 11″) | 42 cm × 50 cm × 32 cm (16.5″ × 19.7″ × 12.6″) – Integrated cooling tray and storage compartment |

| Precision | ±2°C thermal regulation; manual pressure adjustment; max vacuum depth: 80 kPa | ±0.5°C digital thermal control; automated pressure & vacuum sequencing; max vacuum depth: 98 kPa with real-time sensor feedback |

| Material Compatibility | Essix A+ and Essix C+ sheets (0.030″ to 0.060″); manual calibration required for thickness | Full compatibility with Essix A+, C+, Vivera, and customizable thermoplastic sheets (0.020″ to 0.080″); auto-detection of material type and thickness |

| Certification | CE Marked, ISO 13485 compliant, FDA Registered (Class I) | CE Marked, ISO 13485 & ISO 14001 certified, FDA Registered (Class I), IEC 60601-1 compliant for medical electrical equipment |

Note: The Advanced Model supports digital workflow integration via USB and Bluetooth for data logging and remote diagnostics. Recommended for high-volume clinics and centralized lab operations.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Essix Retainer Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Why Source Essix Retainer Machines from China in 2026?

China remains the global manufacturing hub for dental thermoplastic forming systems, offering 30-50% cost advantages over Western OEMs while maintaining ISO-compliant quality. Advancements in 2025-2026 include AI-driven temperature calibration, integrated CAD/CAM workflow compatibility, and energy-efficient vacuum systems. Strategic sourcing requires rigorous vetting to navigate evolving regulatory landscapes and supply chain complexities.

Featured Verified Partner: Shanghai Carejoy Medical Co., LTD

Established: 2005 (19 Years Manufacturing Excellence) | Location: Baoshan District, Shanghai, China (Dedicated Dental Equipment Export Hub)

Core Value Proposition: Factory-direct sourcing eliminating 2-3 tier markups. Specialized in OEM/ODM for dental retainers since 2018 with 98.7% on-time delivery rate (2025 audit data). Holds active ISO 13485:2016, CE MDR 2017/745, and FDA 510(k) pre-certification pathways.

Contact for Verified Supply Chain: [email protected] | WhatsApp: +86 15951276160 (24/7 Technical Support)

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-Brexit and MDR 2017/745 enforcement, superficial “CE-marked” claims are high-risk. Implement these verification protocols:

- Request Certificate Authenticity: Demand live verification via EU NANDO database (for CE) and ISO.org registry. Cross-check certificate scope explicitly includes “Class IIa Dental Thermoplastic Forming Devices” (MDR Annex VIII Rule 11).

- Factory Audit Trail: Require dated video audit reports showing Class 8 cleanroom production (ISO 14644-1) and ISO 10993 biocompatibility testing for polycarbonate sheets. Carejoy provides quarterly 3rd-party audit footage via secure portal.

- Documentation Depth: Valid certificates must include:

– EU Authorized Representative details (mandatory post-2021)

– Full technical documentation index per MDR Annex II

– Sterilization validation reports (EO or Gamma)

2026 Critical Note: Chinese suppliers without active CE MDR certificates face 100% EU customs rejection. Carejoy maintains EU rep in Dublin for seamless compliance.

Step 2: Negotiating MOQ with Commercial Intelligence

Traditional 50+ unit MOQs are obsolete. Leverage 2026 market dynamics:

| MOQ Strategy | Traditional Supplier (2025) | Advanced Supplier (2026 Standard) | Carejoy Implementation |

|---|---|---|---|

| Base MOQ | 30-50 units | 10-15 units (with sheet consumable commitment) | 10 units (CJ-ER2026 model) + 200 sheet minimum |

| OEM Flexibility | $8,500 setup fee | $3,000 fee (waived at 50+ units) | $2,500 fee (waived at 30+ units; includes UI localization) |

| Payment Terms | 100% TT pre-shipment | 30% deposit, 70% against BL copy | 30% deposit, 60% pre-shipment, 10% post-installation verification |

| Lead Time | 60-90 days | 35-45 days (modular production) | 30 days (standard), 20 days (rush +15%) |

Negotiation Tip: Distributors should bundle with consumables (Essix sheets) for 12-18% total cost reduction. Carejoy offers tiered pricing: 15% discount at 100+ machines annually.

Step 3: Optimizing Shipping Terms (DDP vs FOB)

2026 freight volatility demands precise Incoterms 2020 alignment:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs (avg. $1,850-$2,200/40ft HC to EU/US) | Buyer assumes all risk post-container loading. Requires freight forwarder expertise. | Only for distributors with established logistics partners. Carejoy provides EXW pricing + FOB documentation support. |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive landed cost (typically +18-22% over FOB) | Supplier bears all risk until clinic/distributor warehouse. Includes customs clearance. | STRONGLY RECOMMENDED for clinics. Carejoy’s 2026 DDP accuracy: 99.2% (per DentTrade 2025 audit). Eliminates brokerage fees and tariff misclassification risks. |

2026 Critical Update: US Section 301 tariffs (List 3/4A) still apply to Chinese dental equipment. DDP pricing must explicitly state “Tariff Engineering Applied” – Carejoy uses HS code 8479.89.94 (non-listed) via technical reclassification.

Critical Considerations for 2026 Sourcing

- After-Sales Validation: Demand proof of service network (Carejoy has 17 certified technicians across EU/US with 48-hr response SLA).

- IP Protection: Use Chinese notarized OEM agreements. Carejoy files design patents in client’s name pre-production.

- Payment Security: Avoid Alibaba Trade Assurance. Use LC at sight or Escrow.com with post-shipment quality verification clause.

- Future-Proofing: Specify 2026-ready firmware (Bluetooth 5.3, DICOM 3.0 compatibility). Carejoy machines include free annual updates until 2030.

Conclusion: Strategic Partnership Over Transactional Sourcing

Successful 2026 sourcing requires moving beyond price-centric procurement. Partner with manufacturers demonstrating regulatory agility, flexible commercial terms, and transparent logistics. Shanghai Carejoy’s 19-year specialization in dental thermoplastic systems—validated by 1,200+ global clinic installations—exemplifies the partner profile that mitigates China-sourcing risks while maximizing ROI.

Action Step: Request Carejoy’s 2026 Compliance Dossier (ISO/CE/FDA evidence pack) and DDP Price Matrix: [email protected] | +86 15951276160

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Essix Retainer Machine Procurement (2026)

Need a Quote for Essix Retainer Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160