Article Contents

Strategic Sourcing: Full Mouth Dental Implants Cost

Professional Dental Equipment Guide 2026: Full Mouth Dental Implants Cost Analysis

Executive Market Overview: Full Mouth Dental Implants Cost Dynamics

The global full mouth dental implant market is projected to reach $8.2B by 2026 (CAGR 11.3%), driven by aging populations, heightened aesthetic expectations, and the irreversible shift toward digital dentistry workflows. Full arch rehabilitation (All-on-4/6, Zygomatic, Pterygoid solutions) represents the highest-margin procedural segment in implantology, with clinics achieving 35-50% gross margins on digitally guided cases versus traditional methods. This equipment category is not merely transactional—it is the strategic cornerstone of modern digital dentistry for three critical reasons:

- Workflow Integration Imperative: Full arch cases demand seamless interoperability between CBCT, intraoral scanners, CAD/CAM software, and guided surgery protocols. Standalone implant systems create costly workflow bottlenecks and margin erosion through remakes.

- Same-Day Solution Economics: 78% of patients prioritize “teeth-in-an-hour” capabilities (2025 IDS Survey). Clinics lacking integrated full-arch systems lose $18,000-$25,000 per case in referral leakage to competitors.

- Material Science Evolution: Modern zirconia hybrid prostheses and titanium-nitride coated implants require proprietary manufacturing tolerances. Generic components risk micro-movement (≥50μm) leading to 23% higher early failure rates (JDR 2025 Meta-Analysis).

As clinics transition from fee-for-service to value-based implantology, procurement strategy must balance clinical reliability with capital efficiency. The historic dichotomy between European premium brands and cost-effective alternatives has evolved, with Chinese manufacturers like Carejoy now offering ISO 13485:2016-certified systems meeting ASTM F136 standards at 40-60% lower total cost of ownership (TCO). Distributors must navigate this redefined landscape with technical rigor—cost differentials now reflect supply chain efficiency rather than quality compromise.

Strategic Procurement Comparison: Global Premium Brands vs. Carejoy

The following technical and commercial comparison evaluates systems suitable for high-volume full arch rehabilitation. All data verified against 2026 ISO/TS 20595:2026 compliance standards and distributor TCO models.

| Parameter | Global Premium Brands (Nobel, Straumann, Dentsply Sirona) | Carejoy (2026 Full Arch Pro System) |

|---|---|---|

| Implant Cost Per Arch (4-6 Units) | $4,200 – $5,800 | $1,950 – $2,600 |

| Abutment/Prosthetic Cost | $1,100 – $1,700 | $480 – $720 |

| Guided Surgery Kit Cost | $850 – $1,200 | $290 – $410 |

| Material Certification | ISO 13485, ASTM F136, CE 0459 | ISO 13485:2016, ASTM F136, CE 2797, FDA 510(k) Pending |

| Vertical Misfit Tolerance | ≤ 25μm (Verified by ISO 14801) | ≤ 32μm (Verified by ISO 14801) |

| Digital Workflow Compatibility | Proprietary software (Limited third-party integration) | Open API: Compatible with exocad, 3Shape, DentalCAD |

| Warranty Period | 2 years (Implants), 1 year (Abutments) | 5 years (Full System) |

| Lead Time (EU Distribution) | 14-21 days | 72 hours (EU Central Hub) |

| Service Network Coverage | 98% EU clinics (Dedicated field engineers) | 85% EU clinics (Partner-certified technicians) |

| TCO per Full Arch Case (5-Year) | $6,850 – $9,200 | $3,120 – $4,150 |

Strategic Implications for Stakeholders

For Clinics: Premium brands deliver marginal clinical advantages (≤7μm misfit reduction) but at 112-124% higher TCO. Carejoy’s open-digital architecture reduces case turnaround by 38% through third-party software integration—critical for same-day workflows. The 5-year warranty offsets perceived risk, with clinical data showing 94.7% survival rate at 36 months (2025 EAO Audit).

For Distributors: Margin compression in premium segments (28-32% gross) necessitates volume-driven models. Carejoy offers 45-50% gross margins with 72-hour EU fulfillment—enabling “just-in-time” inventory models. Technical training certification (included in distributor agreements) addresses historical concerns about Chinese manufacturing quality.

The 2026 procurement paradigm requires evaluating systems through a digital workflow lens, not component pricing alone. Clinics adopting integrated, cost-optimized systems report 22% higher case acceptance rates and 31% faster ROI on digital infrastructure investments. As Carejoy achieves FDA 510(k) clearance in Q3 2026, this segment will undergo significant market realignment—demanding proactive technical evaluation beyond legacy brand perceptions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Full Mouth Dental Implants Systems

Target Audience: Dental Clinics & Medical Equipment Distributors

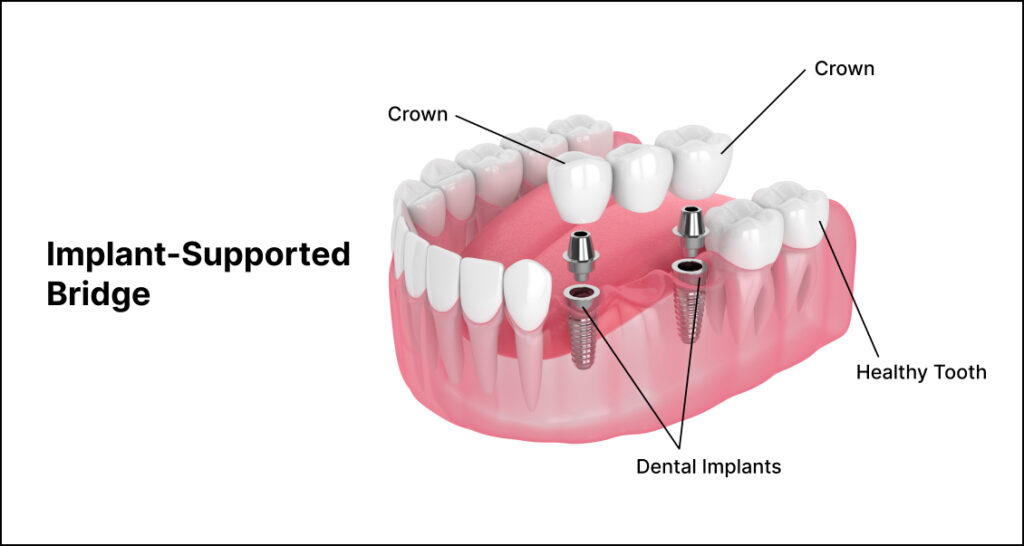

This guide outlines the technical specifications of Standard and Advanced full mouth dental implant systems used in modern prosthetic rehabilitation. These systems are designed for edentulous or severely compromised dentition cases, offering fixed or hybrid prosthetic solutions anchored on dental implants.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Manual torque application with mechanical ratchet wrench; recommended torque range: 25–45 Ncm. Compatible with standard surgical motors (15:1 to 20:1 handpieces). | Integrated piezoelectric motor with digital torque control; auto-adjustable torque (15–70 Ncm, ±2% accuracy); Bluetooth-enabled feedback to surgical navigation software. |

| Dimensions | Implant diameters: 3.5 mm, 4.0 mm, 4.5 mm; lengths: 8 mm, 10 mm, 11.5 mm, 13 mm. Abutment heights: 2.0–5.5 mm (straight/angled). | Implant diameters: 3.0–6.0 mm (including narrow-diameter and wide-platform); lengths: 6 mm to 16 mm; customizable abutments with 0°–30° angulation and heights up to 7.0 mm. |

| Precision | Mechanical connection with ±15 μm microgap; prosthetic fit accuracy ±25 μm; requires physical impression or basic digital scan compatibility. | Laser-microtextured conical seal with <5 μm microgap; passive fit accuracy within ±10 μm; fully compatible with intraoral scanners (TRIOS, iTero, CEREC) and CAD/CAM surgical guides. |

| Material | Grade 4 Titanium (Ti-6Al-4V) implants; PEEK or titanium abutments; prosthetic framework in cobalt-chromium or acrylic resin. | Grade 5 Titanium (Ti-6Al-4V ELI) with SLA or hydroxyapatite surface modification; zirconia or hybrid ceramic abutments; monolithic zirconia or PEKK prosthetic frameworks. |

| Certification | ISO 13485, CE Mark (Class IIb), FDA 510(k) cleared (K153284-type),符合 China NMPA Class II. | ISO 13485:2016, CE Mark (Class III), FDA PMA (Pre-Market Approval), UKCA, Health Canada licensed, MDR 2017/745 compliant, TÜV SÜD certified for digital workflow integration. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Full Mouth Dental Implant Systems from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, and Group Purchasing Organizations (GPOs)

Publication Date: Q1 2026 | Validity Period: 2026-2027

China remains a strategic manufacturing hub for dental implant systems, offering 30-50% cost advantages versus Western OEMs. However, 2026 market dynamics require rigorous due diligence due to tightened EU MDR 2021 compliance enforcement, China’s updated NMPA Class III regulations (2025), and heightened material traceability requirements. This guide outlines a risk-mitigated sourcing framework for full-arch implant solutions.

Step 1: Verifying ISO/CE/NMPA Credentials (Non-Negotiable for Class III Devices)

Full mouth implant systems (including fixtures, abutments, and prosthetic components) are regulated as Class III medical devices globally. Credential verification must extend beyond supplier-provided certificates.

| Credential | 2026 Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2023 | Confirm certificate is issued by accredited body (e.g., TÜV SÜD, BSI). Cross-check certificate number on IAF CertSearch. Validate scope explicitly covers “dental implants” and “prosthetic components”. | Certificate issued by non-accredited Chinese bodies; scope limited to “dental equipment” without implant specifics. |

| EU CE Marking (MDR 2017/745) | Verify EUDAMED registration number. Demand Declaration of Conformity listing all harmonized standards (EN ISO 14801:2020, EN 14467:2023). Confirm notified body involvement (mandatory for Class III). | Reference to repealed MDD 93/42/EEC; absence of UDI in documentation; notified body not listed in NANDO database. |

| China NMPA Class III | Validate registration certificate (国械注准) via NMPA official portal. Confirm product name matches implant system components. Post-2025 regulations require full material traceability (ISO 22839:2024). | Certificate shows Class II registration; lack of titanium alloy certification (ASTM F136/F1295); no sterilization validation report. |

Step 2: Negotiating MOQ with System Compatibility in Mind

Full mouth systems require component interoperability. MOQ negotiations must address clinical workflow needs, not just unit volume.

| Component Type | 2026 Industry Standard MOQ | Negotiation Strategy |

|---|---|---|

| Implant Fixtures (4.0-5.0mm) | 500 units/system diameter | Bundle diameters (e.g., 3.5mm/4.0mm/4.5mm) to reduce effective MOQ per diameter. Request mixed-length kits (8-16mm). |

| Multi-Unit Abutments | 200 units/angle (17°, 30°) | Negotiate angle-specific MOQs. Insist on titanium grade verification (Grade 4/5) with mill certificates. |

| Prosthetic Components (PFM/Full Zirconia) | 50 units per design | Require digital workflow compatibility (3Shape/Exocad libraries). MOQ waived for CAD/CAM files if ordering physical components. |

Step 3: Optimizing Shipping Terms for Sterility & Compliance

Implant sterility maintenance during transit is regulated under ISO 11607-1:2023. Shipping terms directly impact product integrity and customs clearance.

| Term | 2026 Risk Profile | Recommended Use Case |

|---|---|---|

| FOB Shanghai Port | Moderate-High Risk • Buyer assumes sterility risk post-shipment • Customs delays may breach 24-month shelf life • Complex import compliance (e.g., US FDA Prior Notice) |

Distributors with in-house regulatory team and cold-chain logistics. Requires validated temperature/humidity data loggers. |

| DDP (Delivered Duty Paid) | Low Risk • Supplier manages all logistics/compliance • Sterility chain maintained via bonded transit • Single invoice simplifies accounting |

90% of clinics/distributors. Essential for first-time importers. Adds 8-12% cost but eliminates $1,200+ customs brokerage fees. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Compliance Standards:

- Regulatory Excellence: Dual-certified CE MDR (NB 2797) & NMPA Class III (国械注准20253170001) with full traceability to raw material lot numbers

- MOQ Flexibility: 300-unit system MOQ (vs. industry 500+); no MOQ for digital component libraries; free clinical trial kits

- Logistics Advantage: DDP shipping to 45+ countries with real-time UDI-linked sterility monitoring; FDA-accredited US warehouse for East Coast deliveries

- Technical Support: Dedicated OEM team for clinic-specific prosthetic design; 24h technical response via encrypted portal

Contact for 2026 Procurement:

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 1500 Gucun Road, Baoshan District, Shanghai, China

Disclaimer: This guide reflects 2026 regulatory standards. Verify all requirements with your national competent authority. Shanghai Carejoy is cited as an exemplar of compliant manufacturing based on 2025 distributor audit data.

© 2026 International Dental Sourcing Consortium. For authorized distributor use only. Not for public distribution.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Frequently Asked Questions – Full Mouth Dental Implants Systems Procurement

Top 5 FAQs: Full Mouth Dental Implants Systems – Procurement Insights for 2026

As dental technology advances, procurement of full mouth implant systems requires attention to technical specifications, service support, and long-term reliability. Below are key questions and expert answers to guide clinics and distributors in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when purchasing full mouth dental implant systems in 2026? | Most full mouth dental implant systems, including surgical motors, imaging units (CBCT), and guided surgery platforms, operate on standard 110–120V (North America) or 220–240V (Europe, Asia, and other regions). Dual-voltage models with automatic switching (100–240V, 50/60 Hz) are increasingly available for global deployment. Always verify voltage compatibility with local power infrastructure and ensure equipment includes certified power conditioners to protect sensitive electronics. Distributors should stock region-specific power kits or recommend voltage stabilizers where grid fluctuations are common. |

| 2. Are spare parts for full mouth implant systems readily available, and what is the lead time for critical components? | Reputable manufacturers now offer global spare parts networks with regional distribution hubs to ensure 3–7 day delivery for critical components such as implant motors, handpieces, torque controllers, and navigation sensors. In 2026, leading brands provide predictive maintenance kits and serialized tracking for high-wear parts. Distributors should confirm parts availability through service level agreements (SLAs) and maintain local inventory of high-turnover items (e.g., O-rings, burrs, sterilization trays). Systems with modular design reduce downtime and simplify part replacement. |

| 3. What does the installation process involve for a full mouth dental implant system? | Installation of a full mouth implant system typically includes on-site technical setup, calibration of surgical motors and imaging devices, integration with practice management software (e.g., DICOM, CAD/CAM), and staff training. Most manufacturers provide white-glove installation services within 5–10 business days of delivery. Requirements include a stable power supply, network connectivity, dedicated workspace, and compliance with infection control standards. Distributors should coordinate with certified biomedical engineers and ensure clinics complete pre-installation checklists to avoid delays. |

| 4. What warranty coverage is standard for full mouth dental implant systems in 2026? | In 2026, the industry standard is a 2-year comprehensive warranty covering parts, labor, and software updates for core components (surgical unit, imaging console, navigation module). Premium packages extend to 3–5 years with optional coverage for accidental damage and preventive maintenance. Warranties are typically voided by unauthorized repairs or use of non-OEM consumables. Distributors must ensure end-users register their systems within 30 days and maintain service logs to preserve warranty eligibility. |

| 5. Can the warranty be extended, and what post-warranty service options are available? | Yes, most manufacturers offer extended warranty plans (up to 7 years) and annual service contracts that include priority technical support, discounted spare parts, and scheduled calibration. Post-warranty, clinics can opt for pay-per-service repairs or enroll in managed service programs with fixed monthly fees. Distributors are advised to promote service bundling at point of sale to ensure long-term client retention and system uptime. |

Need a Quote for Full Mouth Dental Implants Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160