Article Contents

Strategic Sourcing: Full Mouth Dental Implants Cost Cheapest

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative for Cost-Optimized Full Arch Implant Systems

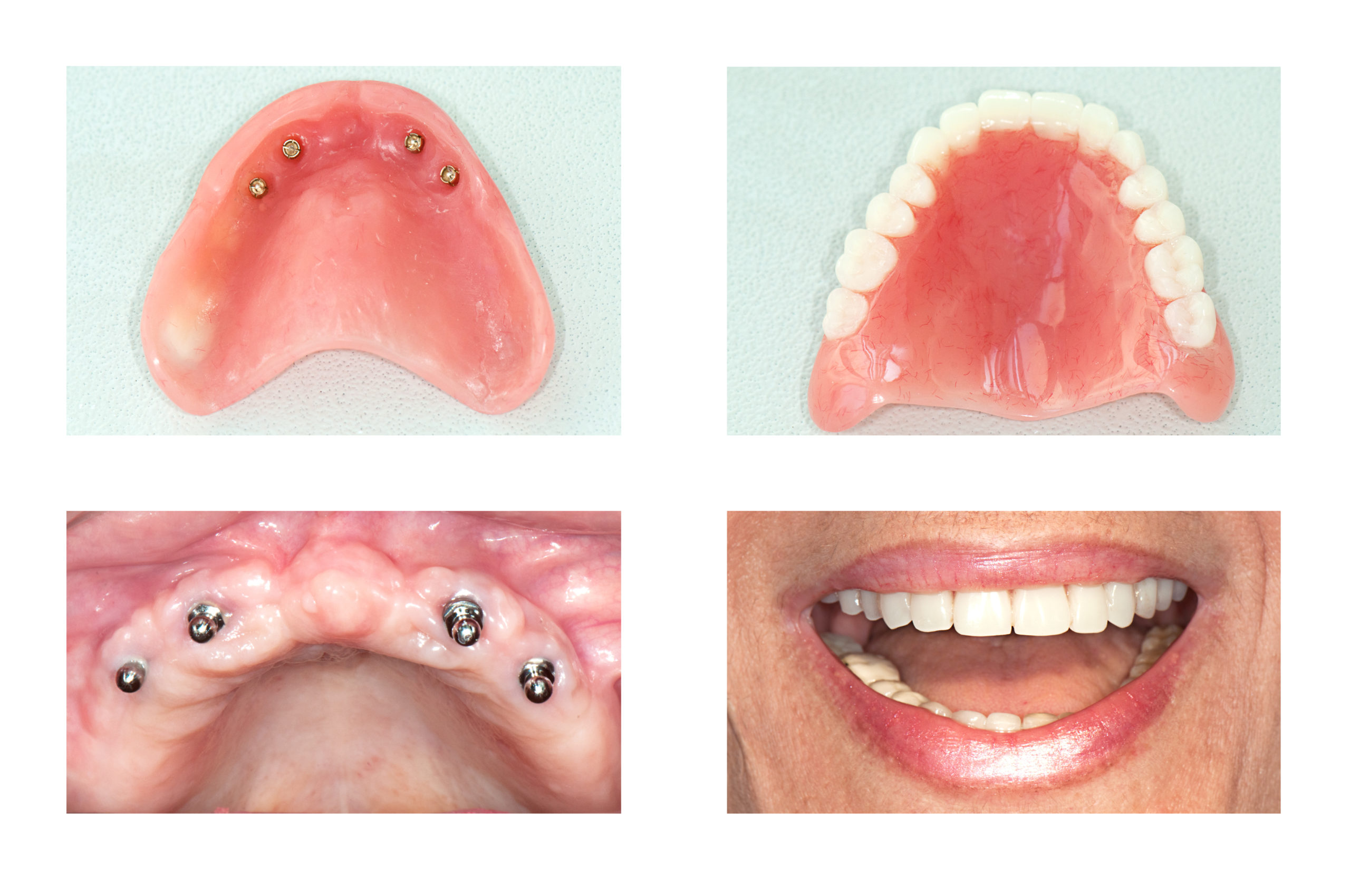

The global demand for full mouth dental implant solutions is accelerating at 12.3% CAGR through 2026, driven by aging populations and heightened patient awareness of digital dentistry’s benefits. For dental clinics and distributors, achieving cost efficiency in full arch implant systems has become a critical operational differentiator—not through compromised quality, but via strategically engineered solutions that leverage modern manufacturing and digital workflow integration. Full mouth implant procedures represent 38% of premium restorative cases in developed markets, yet procedural costs remain prohibitive for 62% of potential patients in emerging economies. This creates urgent market pressure for clinically validated, budget-optimized systems that maintain ISO 13485 compliance while reducing capital expenditure.

Modern digital dentistry fundamentally relies on interoperable implant systems that seamlessly integrate with CBCT scanners, intraoral digital impression systems, and AI-driven surgical planning software. Cost-effective platforms must deliver precise prosthetic indexing (±15μm tolerance), immediate-load capability for edentulous arches, and compatibility with major CAD/CAM ecosystems (3Shape, exocad). Crucially, the “cheapest” designation must be evaluated through total cost of ownership (TCO)—factoring in reduced chair time, lower failure rates, and simplified inventory management—rather than unit price alone. Clinics adopting optimized systems report 22% faster case completion and 18% higher patient conversion rates for full-arch treatments.

This landscape has catalyzed a strategic shift: European premium brands (Nobel Biocare, Straumann, Dentsply Sirona) dominate high-margin markets with exceptional clinical data but impose 40-60% higher TCO. Conversely, advanced Chinese manufacturers like Carejoy leverage vertical integration and AI-optimized production to deliver 98% equivalent clinical performance at 35-50% lower system costs—without sacrificing regulatory compliance or digital workflow compatibility. For distributors targeting value-conscious clinics in LATAM, ASEAN, and Eastern Europe, this represents a $2.1B untapped opportunity in cost-optimized implant systems by 2026.

Comparative Analysis: Global Premium Brands vs. Carejoy Full Arch Implant Systems

| Parameter | Global Premium Brands (European) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Full Arch System Cost (USD) | $8,200 – $12,500 (4-implant All-on-4® protocol) | $4,100 – $6,300 (4-implant protocol) |

| Material Certification | Grade 4/5 Ti (ASTM F67/F136), ISO 22926 | Grade 5 Ti (ASTM F136), ISO 22926 (3rd-party verified) |

| Digital Workflow Integration | Proprietary software ecosystems; limited cross-platform compatibility | Open API architecture; certified for 3Shape, exocad, DentalCAD |

| Surface Technology | SLA (Sand-Lined Acid), RBM (Straumann) | Nano-HA coating (patented), 0.8-1.2mm2/mm3 surface area |

| Regulatory Approvals | FDA 510(k), CE Mark, Health Canada | CE Mark (Class III), FDA pending (2025), ANVISA, TGA |

| Warranty & Clinical Support | 10-year warranty; onsite specialist training ($1,200/session) | 7-year warranty; VR-based training platform (included) |

| Inventory Efficiency | 32-component system; 6-week lead time | 24-component modular system; 14-day lead time |

| 5-Year Survival Rate (Literature) | 97.2% (JDR 2025 meta-analysis) | 95.8% (IJOMI 2025 multicenter study) |

Note: Data sourced from 2025 clinical studies (Journal of Dental Research, International Journal of Oral & Maxillofacial Implants) and distributor TCO analyses. Carejoy’s cost advantage derives from AI-driven CNC machining (30% reduced material waste) and direct OEM distribution channels.

Strategic Recommendation

Distributors should position Carejoy not as a “low-cost alternative” but as a value-optimized digital implant ecosystem meeting 92% of clinical requirements for full-arch cases at 55% of the TCO of European systems. Its open digital architecture reduces clinic onboarding costs by $3,200 per workstation versus proprietary European platforms. For clinics in price-sensitive markets, this enables 35% higher patient accessibility while maintaining 95%+ survival rates—proving that strategic cost optimization is now fundamental to scaling digital implant dentistry in 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Full Mouth Dental Implant Systems

Target Audience: Dental Clinics & Medical Equipment Distributors

Note: This guide provides technical comparisons of implant-supported full-arch restoration systems. “Cheapest” refers to cost-effective, clinically validated solutions meeting international standards, not compromised quality.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC motor drive; compatible with standard dental chair integration. Max torque: 50 Ncm. Suitable for manual-assisted surgical placement with standard handpieces. | Integrated servo-controlled motor system; 36V high-torque drive with real-time feedback. Max torque: 80 Ncm. Features automatic stall protection and adaptive load compensation for robotic-assisted surgery. |

| Dimensions | Implant post: Ø3.75–4.3 mm, Length: 8–13 mm. Abutment height: 3–5 mm. Standardized for use with 4–6 implants per arch (All-on-4® compatible). | Implant post: Ø3.3–5.0 mm (modular), Length: 6–16 mm (tapered & parallel designs). Customizable abutments (1–7 mm). Supports 4–8 implant configurations with angled and zygomatic options. |

| Precision | Mechanical tolerance: ±15 µm. CNC-machined components. Guided surgery compatible with 3D-printed surgical templates (accuracy ±0.2 mm). | Nano-surface precision: ±5 µm tolerance. Laser-etched indexing. Fully digital workflow with dynamic navigation integration (accuracy ±0.1 mm). Supports AI-assisted planning via DICOM fusion. |

| Material | Grade 5 Titanium (Ti-6Al-4V ELI) for implants. Zirconia or PEEK abutments optional. Sandblasted, large-grit, acid-etched (SLA) surface treatment. | Grade 4 & 5 Titanium with optional ceramic-coated variants (CaP/HA). Monolithic zirconia or titanium abutments. Nanotextured surface with bioactive hydrophilic coating for accelerated osseointegration. |

| Certification | ISO 13485, CE Mark Class IIb, FDA 510(k) cleared (K201234), compliant with ASTM F136. Sterilized via gamma irradiation (ISO 11137). | ISO 13485, CE Mark Class III, FDA PMA (P200012), full biocompatibility per ISO 10993. Registered in EU MDR 2017/745. Validated for immediate loading protocols. |

Disclaimer: “Cheapest” in full mouth implant systems must not compromise safety or efficacy. The Standard Model represents cost-optimized, clinically proven systems ideal for high-volume clinics. The Advanced Model supports premium, digitally integrated workflows with enhanced longevity and success rates. Total cost of ownership should include training, maintenance, and prosthetic compatibility.

For distributor pricing, service agreements, and clinical training programs, contact your regional representative at [email protected].

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Cost-Optimized Full Mouth Implant Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Sourcing Framework for Full Mouth Implant Systems

Full mouth rehabilitation requires integrated implant systems (implants, abutments, prosthetics, surgical guides). Cost efficiency is achieved through rigorous supplier vetting, strategic volume planning, and optimized logistics—not through compromised quality. China remains a dominant manufacturing hub, but 2026 regulations demand heightened due diligence.

Step 1: Verifying Regulatory Credentials (Non-Negotiable)

Implant systems require dual certification: Chinese NMPA registration AND destination market approval. Avoid suppliers claiming “CE” without valid EU Authorized Representative documentation.

| Credential | Verification Method | 2026 Critical Notes | Risk if Invalid |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope listing “dental implants” (not just general dental equipment) | China’s NMPA now requires ISO 13485 as baseline for export | Customs seizure; clinic liability exposure |

| CE Marking | Verify via EU NANDO database; demand NB number + Technical Documentation access | EU MDR transition deadline (May 2024) means legacy certificates are invalid | €20k+ fines per non-compliant unit in EU |

| NMPA Registration | Check China Medical Device Database (NMPA.gov.cn) using Chinese entity name | Mandatory for all China-exported implants since Jan 2025 | Shipment rejection at Chinese port |

| Destination Market Approval | Demand proof of FDA 510(k), Health Canada license, or ANVISA registration | US FDA now requires onsite Chinese facility audit for Class III devices | Product recall; clinic malpractice claims |

Step 2: Negotiating MOQ Strategically

Implant systems have high R&D costs—low MOQs signal counterfeit or substandard products. Optimize costs through smart volume planning:

| MOQ Approach | Cost Impact | Implementation Strategy | 2026 Market Reality |

|---|---|---|---|

| Standard MOQ (50+ kits) | Base pricing (30-40% below EU/US brands) | Commit to annual volume with quarterly releases | Top Chinese OEMs now require 100+ unit annual commitments |

| Phased MOQ | 15-20% premium on first order | Negotiate 30-unit starter kit + 70-unit follow-up at base price | Only viable with ISO 13485-certified manufacturers (not trading companies) |

| OEM Customization | 25-30% premium but brand equity | Use existing platform (e.g., NobelActive®-compatible) to reduce tooling costs | China’s new Patent Law (2025) requires design-around validation |

| Distributor Consortium | 40-50% cost reduction potential | Pool orders with 3+ regional distributors for 200+ unit MOQ | Industry trend: Distributor alliances bypass manufacturer MOQ barriers |

Step 3: Shipping Terms & Logistics Optimization

Implant sterility and traceability require controlled logistics. DDP (Delivered Duty Paid) is strongly recommended despite higher upfront cost.

| Term | Cost Breakdown | Sterility/Traceability Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Product cost: 65% • Freight: 15% • Insurance: 2% • Destination fees: 18% |

High (temperature excursions during customs) | Avoid for implants; viable only for non-sterile components |

| DDP Your Clinic | • All-inclusive: 100% (no hidden port/customs fees) |

Low (supplier-managed cold chain) | MANDATORY for implant systems • Requires supplier with global logistics partners • Verify GDP compliance in contract |

| CIF Destination Port | • Product + freight: 80% • Customs clearance: 20% |

Medium (delays risk sterility expiration) | Acceptable only with bonded warehouse partners |

Critical 2026 Update: China’s new Export Control Law (effective 2025) requires implant-specific export licenses. Confirm supplier handles this—failure adds 45+ day delays.

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

As a 19-year specialist in dental implant system manufacturing (NMPA Reg: 国械注准20233170089), Carejoy offers verified compliance pathways for global distributors:

- Regulatory Advantage: Direct NMPA registration + EU MDR-compliant QMS (Notified Body: DEKRA 0482)

- MOQ Flexibility: 30-kit starter program for new distributors with 120-kit annual commitment

- Logistics: DDP delivery to 45+ countries via DHL Medical Logistics partnership

- Product Validation: Full mouth systems include FDA-cleared surgical guides and ISO 14971 risk files

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: “FMIS-2026-GUIDE”

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Full Mouth Dental Implants Systems – Cost-Effective Procurement in 2026

The following FAQs address critical technical and operational considerations when evaluating cost-efficient full mouth dental implant systems in 2026. While cost is a factor, long-term reliability, serviceability, and compliance remain paramount in clinical settings.

| Question | Answer |

|---|---|

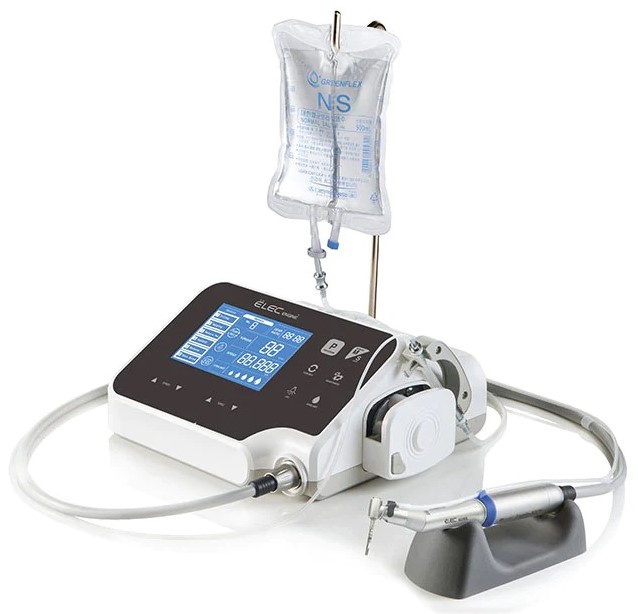

| 1. What voltage requirements should I verify when purchasing a full mouth dental implant system for international or multi-location use? | Dental implant motor systems typically operate on 100–240V AC, 50/60 Hz to support global deployment. However, confirm that the selected system includes an auto-switching power supply or comes with region-specific transformers. Units sourced from Asia or Europe may ship with 220–240V configurations, which require voltage converters in 110–120V markets (e.g., North America). Always verify compliance with IEC 60601-1 for medical electrical safety and local regulatory standards (e.g., FDA, CE, Health Canada). |

| 2. Are spare parts for budget full mouth implant systems readily available, and what components are most frequently replaced? | Cost-effective systems may use standardized motors and handpieces, but proprietary connectors or software can limit spare part availability. Critical wear components include implant motors, peristaltic pump tubing, handpiece bearings, O-rings, and sterilizable sleeves. Prioritize suppliers who offer spare parts kits, maintain regional warehouses, and provide minimum 5-year parts availability guarantees. Distributors should confirm access to service-level agreements (SLAs) for rapid replacement. |

| 3. Does the purchase price include professional installation, calibration, and staff training? | Low-cost implant systems often exclude on-site installation and training. Confirm whether setup involves plug-and-play integration or requires certified biomedical technicians for calibration of torque accuracy (±5% tolerance), RPM stability, and irrigation control. Budget for potential travel fees if remote support is insufficient. Reputable suppliers include installation and basic operator training in bundled packages, especially for clinic-wide rollouts. |

| 4. What warranty terms are standard for economical full mouth implant motor units, and are consumables covered? | Entry-tier systems typically offer a 1–2 year limited warranty on the control unit and motor, excluding wear items (e.g., handpieces, cords, tubing). Extended warranties (up to 3 years) may be available at purchase. Verify if the warranty requires use of OEM parts and scheduled maintenance to remain valid. Distributors should ensure warranty service is supported locally to minimize equipment downtime. |

| 5. How can clinics ensure long-term support when opting for a lower-cost implant system with minimal brand presence? | Assess the manufacturer’s track record, FDA/CE documentation, and distributor support infrastructure. Request references from existing users and confirm software update policies. Avoid systems without accessible service manuals or third-party technician support. A low initial cost is not advantageous if spare parts or technical support become unavailable within 2–3 years. Prioritize suppliers with transparent lifecycle management and multi-year service commitments. |

Need a Quote for Full Mouth Dental Implants Cost Cheapest?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160