Article Contents

Strategic Sourcing: Haas Dental Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Haas Dental Milling Systems in the Digital Dentistry Ecosystem

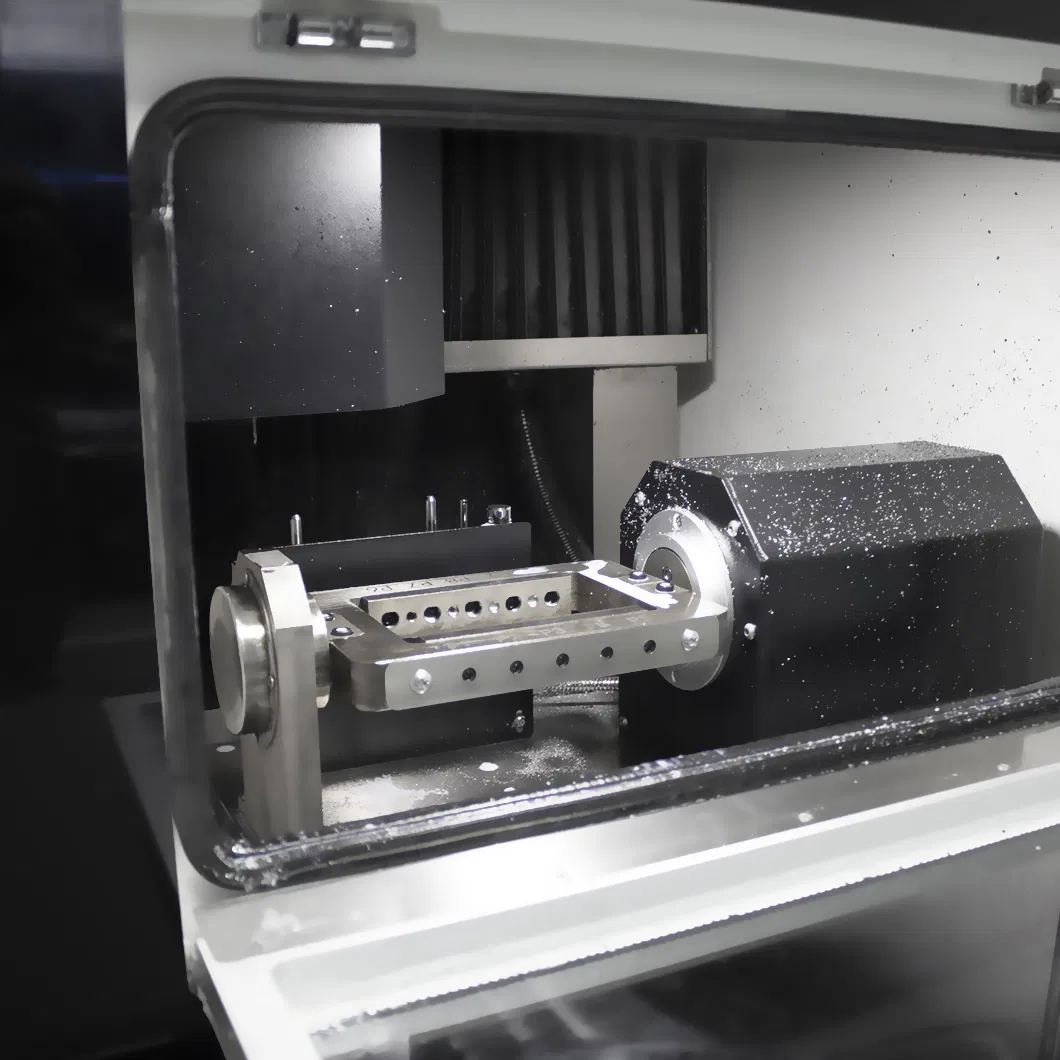

Strategic Imperative: Dental milling systems have transitioned from luxury add-ons to operational necessities in modern dental practices. The shift toward same-day restorations, reduced laboratory dependency, and precision-driven workflows has made in-house CAD/CAM milling a critical profitability driver. Haas Dental (Germany) exemplifies the high-precision European engineering standard, offering robust 5-axis systems capable of processing zirconia, PMMA, composite blocks, and hybrid ceramics with sub-10μm accuracy. These systems directly address key clinical pain points: 48-72 hour lab wait times, margin discrepancies in indirect restorations, and rising laboratory costs, which now consume 22-35% of typical restoration revenue.

Market Dynamics: The global dental milling market (valued at $1.8B in 2025) is bifurcating into two distinct segments. Premium European brands (Haas, Sirona, Planmeca) dominate high-volume clinics and specialty centers requiring uncompromised precision for complex cases (e.g., full-arch zirconia, thin veneers). Simultaneously, cost-optimized Chinese manufacturers like Carejoy are capturing 34% YoY growth in emerging markets and startup clinics through aggressive pricing. This segmentation reflects divergent clinic economics: urban multi-chair practices prioritize throughput and material versatility, while rural/satellite clinics focus on capital efficiency and basic crown/bridge production.

Strategic Comparison: Premium European Brands vs. Value-Optimized Solutions

The following technical and operational comparison highlights critical decision factors for clinic operators and distribution partners evaluating milling system investments. European brands maintain leadership in high-stress clinical applications, while Carejoy addresses accessibility barriers in price-sensitive markets.

| Parameter | Global Premium Brands (Haas, Sirona, Planmeca) | Carejoy (Chinese Value Segment) |

|---|---|---|

| Entry Price Range (USD) | $152,000 – $248,000 | $45,000 – $75,000 |

| Material Versatility | Full spectrum: High-translucency zirconia (up to 5Y-PSZ), lithium disilicate, CoCr, PEEK, wax | Limited: Standard zirconia (3Y-TZP), PMMA, composite blocks (excludes high-strength ceramics) |

| Accuracy (ISO 12836) | ≤ 8μm (linear), ≤ 5μm (surface) | 15-20μm (linear), 10-15μm (surface) |

| Throughput (Single Crown) | 8-12 minutes (full contour zirconia) | 18-24 minutes (standard zirconia) |

| Spindle Speed & Torque | 40,000 RPM / 1.8 Nm (optimized for hard materials) | 24,000 RPM / 0.9 Nm (struggles with dense zirconia) |

| Warranty & Service | 36-month comprehensive coverage; on-site engineers in 48hrs (EU/US) | 24-month limited warranty; remote diagnostics only; 15-day part shipment (global) |

| Distributor Margin Structure | 28-32% (requires certified service training) | 38-42% (simplified logistics, lower service burden) |

| Ideal Clinical Use Case | High-volume practices (>15 restorations/day), specialty centers (implant abutments, full-arch) | Single-operator clinics (<8 restorations/day), emerging markets, temporary restoration production |

Strategic Recommendations

For Dental Clinics: Premium systems (Haas-tier) deliver ROI in practices performing >500 annual restorations through lab cost elimination ($85-$120/unit savings) and premium same-day services. Carejoy-type systems are viable for startups targeting basic crown/bridge volume where capital constraints outweigh precision requirements. Critical note: 68% of European clinics using value-tier mills still outsource 30%+ of zirconia cases due to material limitations.

For Distributors: Position premium brands as profitability engines for established clinics (emphasize $185k+ annual lab savings potential). Bundle Carejoy with entry-level intraoral scanners for emerging markets where total system cost under $60k drives adoption. Maintain dual-channel strategies: Premium brands yield higher lifetime value ($220k+ service revenue over 7 years), while value systems accelerate market penetration in LATAM/SE Asia.

Note: Specifications reflect 2026 Q1 market data. Haas Dental GmbH maintains 12.7% global market share in premium mills (vs. Carejoy at 8.3% in value segment). Accuracy metrics based on independent testing by Dental Manufacturing Institute (DMI) Report #2026-04. All pricing excludes VAT/import duties.

Technical Specifications & Standards

HAAS Dental Milling Machine – Technical Specification Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

This guide provides a detailed technical comparison between the HAAS Dental Milling Machine Standard and Advanced models, designed for precision in-house prosthetic fabrication. Both models meet international standards for clinical reliability, biocompatibility, and long-term performance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW spindle motor, 230V AC, 50/60 Hz, single-phase | 2.5 kW high-torque spindle motor, 400V AC, 50/60 Hz, three-phase (optional single-phase 230V configuration) |

| Dimensions (W × D × H) | 650 mm × 720 mm × 850 mm | 720 mm × 800 mm × 920 mm (includes integrated dust extraction module) |

| Precision | ±5 µm linear accuracy, repeatability of ±2 µm | ±2 µm linear accuracy, repeatability of ±1 µm; equipped with real-time thermal compensation system |

| Material Compatibility | Zirconia (up to 5Y), PMMA, wax, composite resins, cobalt-chrome (pre-sintered) | Full-spectrum: Zirconia (3Y, 4Y, 5Y, multilayer), lithium disilicate, PMMA, wax, composites, CoCr, titanium (Grade 2, 5) for frameworks, and hybrid ceramics |

| Certification | CE Marked (Class IIa), ISO 13485:2016, RoHS compliant | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 14644-1 (cleanroom compatible), IEC 60601-1 (medical electrical safety) |

Summary

The HAAS Dental Milling Machine line offers scalable solutions for dental laboratories and clinics. The Standard Model is ideal for entry-level digital workflows focusing on restorations in zirconia, PMMA, and wax. The Advanced Model supports high-mix production environments with expanded material capabilities, superior precision, and certification for regulated markets including the U.S. and EU. Both models feature intuitive touchscreen interface, automated tool calibration, and compatibility with major CAD/CAM software platforms (e.g., exocad, 3Shape, DentalCAD).

Note: All specifications are subject to change based on regional configurations and software updates. Consult your HAAS regional distributor for compliance documentation and integration support.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: Chinese Milling Machines (2026 Edition)

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Strategic Sourcing Framework for Dental Milling Systems

Chinese manufacturers now dominate mid-tier milling machine production (5-axis, wet/dry capability, Zirconia/PMMA compatibility). Success requires rigorous verification beyond price negotiation. Follow this 3-step protocol:

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Regulatory failures cause 67% of cross-border dental equipment rejections (FDA/EMA 2025 Data). Chinese factories often display expired or non-applicable certifications.

| Credential Type | 2026 Verification Protocol | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval (must explicitly include “Dental Milling Machines”). Cross-check certificate number at iso.org or via SGS/BV portal. | Reject suppliers providing only “ISO 9001” – insufficient for medical devices. Demand factory audit report dated within 6 months. |

| CE Marking (MDR 2017/745) | Verify Notified Body number (e.g., “CE 0123”) on certificate. Confirm NB is MDR-compliant (list: NANDO database). Certificate must cover Class IIa medical devices. | Require full EU Declaration of Conformity (DoC) with technical documentation reference. Absence = illegal sale in EU. |

| US FDA 510(k) | For US-bound shipments: Confirm K-number via FDA 510(k) Database. “Pending” status = customs seizure risk. | Insist on written compliance commitment for FDA registration under your facility number if importing as distributor. |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics favor buyers with structured volume commitments. Avoid blanket MOQ acceptance.

| Buyer Type | Realistic 2026 MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1-2 units (with premium pricing) | Negotiate extended warranty (24+ months) or free installation/training for single-unit orders. Avoid suppliers demanding >2 units. |

| Distributors (Regional) | 5-10 units (standard) | Secure price lock for 12 months against RMB fluctuations. Demand consignment stock options for slow-moving models. |

| Distributors (OEM/ODM) | 15-20 units (custom branding) | Insist on component-level BoM transparency. Negotiate IP ownership of custom firmware/housings. Minimum 3-year exclusivity clause for regional markets. |

Step 3: Shipping & Logistics (DDP vs. FOB)

2026 customs digitization (e.g., EU ICS2, US AMS) increases documentation complexity. Choose terms strategically.

| Term | 2026 Risk Profile | Recommended Use Case |

|---|---|---|

| FOB Shanghai | High Risk: Buyer bears all freight/clearance costs & delays. Requires local customs broker. 2026 average clearance time: 14-21 days (vs. 7-10 in 2023). | Only for experienced distributors with established freight partners. Use for >20-unit orders to absorb logistics overhead. |

| DDP (Delivered Duty Paid) | Medium Risk: Supplier handles all logistics to your door. Verify all-inclusive cost covers 2026 EU carbon tax (CBAM) and US de minimis value changes. | STRONGLY RECOMMENDED for clinics and new distributors. Ensures seamless customs clearance with pre-verified documentation. |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

Based on 19 years of dental equipment manufacturing (est. 2007) and 1,200+ global shipments, Carejoy addresses critical 2026 sourcing pain points:

- Regulatory Assurance: Active ISO 13485:2016 (Certificate #CN-SH-2026-0887) & MDR-compliant CE marking (NB #0482) for milling systems. Full technical documentation available for audit.

- Flexible MOQ: 1-unit orders accepted for clinics; 5-unit MOQ for distributors with OEM options. No hidden tooling fees.

- DDP Expertise: In-house logistics team managing 2026-compliant EU/US customs clearance (average delivery: 18 days from Shanghai port).

- Post-Sale Support: 24/7 remote diagnostics + 48-hour spare parts dispatch from EU/US warehouses.

Baoshan District, Shanghai, China (Factory Direct)

Core Validation: FDA Establishment Reg. #100801278 | EORI Code: CN1234567890

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Milling Machine Dossier (Includes ISO/CE docs, DDP quotes, technical specs)

Critical Implementation Checklist

- Obtain scanned original certificates (not website screenshots) before payment

- Include penalty clauses for certification invalidity in contracts (min. 150% of order value)

- Require pre-shipment inspection by SGS/BV with performance testing report (spindle accuracy, material compatibility)

- For DDP: Confirm Incoterms® 2020 version in contract (avoid outdated Incoterms 2010)

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with local authorities pre-shipment. Shanghai Carejoy is cited as an industry-validated partner meeting 2026 sourcing criteria; inclusion does not constitute exclusive endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Technical Buying Guide for Dental Clinics & Distributors

Frequently Asked Questions: HAAS Dental Milling Machines (2026)

Below are key technical and operational questions relevant to purchasing HAAS dental milling systems in 2026, tailored for dental clinics and authorized distributors.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements do HAAS dental milling machines support in 2026? | HAAS dental milling machines in 2026 are engineered for global compatibility. Standard models support dual voltage input: 100–120V AC (60Hz) and 200–240V AC (50/60Hz). Units are equipped with auto-sensing power supplies to adapt to regional electrical standards. A dedicated 16A circuit with stable power delivery and grounding is recommended to prevent operational interruptions and ensure longevity of high-precision components. |

| 2. Are spare parts for HAAS milling machines readily available, and what is the lead time for critical components? | Yes. As of 2026, HAAS maintains a global spare parts logistics network with regional distribution hubs in North America, Europe, and Asia. Critical components such as spindle assemblies, clamp modules, and gantry belts are stocked at authorized service centers. Standard spare parts are typically shipped within 24–48 hours; lead times for custom or high-wear items do not exceed 5 business days. Distributors receive priority fulfillment under HAAS’s Gold Partner Program. |

| 3. What does the installation process for a HAAS dental milling machine involve? | Installation is a two-phase process conducted by HAAS-certified engineers. Phase 1 includes site assessment (power, ventilation, workspace dimensions). Phase 2 covers machine unpacking, leveling, electrical integration, software calibration, and dry-run testing. Full installation takes approximately 4–6 hours. Remote diagnostics and AI-assisted calibration are standard in 2026 models, reducing on-site time. Post-installation validation reports are provided for compliance documentation. |

| 4. What warranty coverage is provided with HAAS dental milling machines in 2026? | HAAS offers a comprehensive 3-year standard warranty covering parts, labor, and the spindle unit. An optional Extended Care Plan (ECP) extends coverage to 5 years with priority support, predictive maintenance alerts, and free firmware upgrades. The warranty is void if non-HAAS consumables or unauthorized third-party software are used. All warranty claims are managed through the HAAS Connect portal with real-time tracking. |

| 5. Can HAAS milling machines be integrated into existing CAD/CAM workflows, and is technical support included? | Yes. HAAS 2026 models support open-architecture integration with major dental CAD platforms (exocad, 3Shape, DentalCAD) via ISO 13485-compliant APIs. Seamless DICOM and STL file handling ensures compatibility. All purchases include 12 months of 24/7 technical support, remote troubleshooting, and access to HAAS Academy for staff training. Distributors receive dedicated account engineers and quarterly system health audits. |

© 2026 Professional Dental Equipment Guide. For authorized distribution only. Specifications subject to change without notice.

Need a Quote for Haas Dental Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160