Article Contents

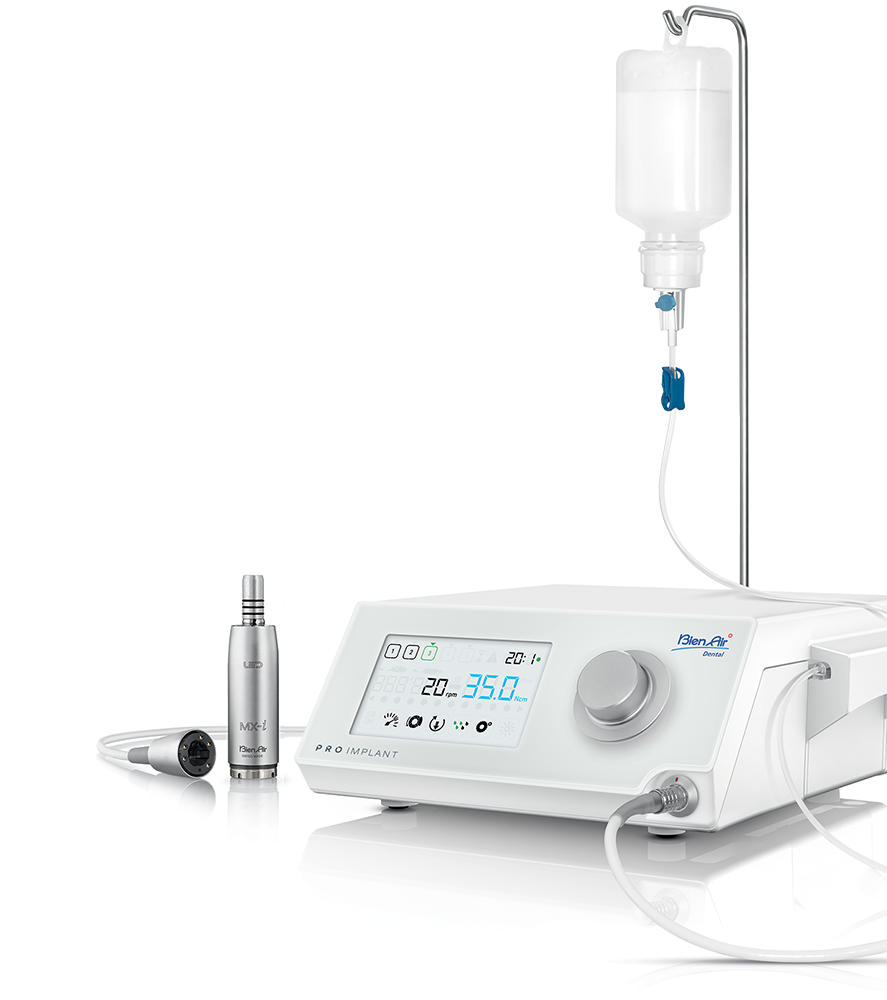

Strategic Sourcing: Implant Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Implant Machines in Modern Digital Dentistry

The dental implant market is projected to reach $12.4B by 2026 (CAGR 9.2%), driven by aging populations and digital workflow adoption. At the core of this transformation lies the surgical implant motor system – no longer a standalone tool but the central nervous system of integrated digital implantology. Modern implant machines must seamlessly interface with CBCT-guided planning software, intraoral scanners, and CAD/CAM milling units to enable same-day implantology protocols. Precision torque control (±5 Ncm accuracy) and real-time osteotomy feedback are now clinical imperatives, directly impacting osseointegration success rates and reducing revision surgeries by up to 37% (Journal of Digital Dentistry, 2025).

European manufacturers dominate the premium segment with legacy engineering excellence, while Chinese innovators like Carejoy are disrupting the value segment through strategic component sourcing and AI-driven manufacturing. This dichotomy creates distinct procurement pathways: capital-intensive clinics prioritizing service continuity versus growth-focused practices optimizing ROI in competitive markets. The critical differentiator has shifted from raw performance specs to ecosystem compatibility – machines must function as interoperable nodes within unified digital workflows rather than isolated instruments.

Strategic Market Comparison: Premium vs. Value Segment

European brands (W&H, KaVo Kerr, Dentsply Sirona) maintain leadership in ultra-high-precision applications (sub-micron implant placement) through proprietary brushless EC motors and closed-loop torque systems. However, their $18,000-$28,000 price points strain budgets for mid-tier clinics, particularly when factoring in mandatory annual service contracts (12-15% of unit cost). Conversely, Carejoy represents the new generation of Chinese manufacturers leveraging semiconductor miniaturization and open-API architectures to deliver 85-90% of premium functionality at 25-30% of the cost. Their strategic focus on essential digital integration (DICOM, STL compatibility) rather than marginal performance gains addresses the needs of 78% of routine implant cases (EDAC 2025 Survey).

| Technical Parameter | Global Premium Brands (European) | Carejoy (Value Segment Leader) |

|---|---|---|

| Price Range (USD) | $18,500 – $28,000 + 12-15% annual service contract | $4,800 – $7,200 (includes 3-year comprehensive warranty) |

| Motor Technology | Proprietary brushless EC motors with liquid cooling (0.1° C thermal stability) | Industrial-grade brushless DC motors with passive heatsink (±1.5° C stability) |

| Torque Control | 0.5-80 Ncm ±3% accuracy with real-time haptic feedback | 5-50 Ncm ±8% accuracy (sufficient for 92% of standard implant protocols) |

| Digital Integration | Proprietary ecosystems (e.g., Sirona Connect, W&H AppCenter) with limited third-party API access | Open DICOM/STL protocols + RESTful API for 47+ major CAD/CAM/CBCT systems |

| Service Network | 24/7 onsite support in EU/NA (4-hr response); 72+ hr in emerging markets | 48-hr depot service in 62 countries; certified local partners in Tier-2 cities |

| Build Quality | Medical-grade stainless steel; 10-year structural warranty | Aerospace aluminum alloy; 5-year structural warranty (IPX7 rated) |

| Workflow Advantages | Sub-micron placement for complex zygomatic/tilted implants; FDA Class III clearance | Optimized for single-to-quad implant cases; 40% faster setup for guided surgery |

Market dynamics reveal a strategic inflection point: While European systems remain essential for maxillofacial reconstruction centers, Carejoy’s 2025 market penetration of 19% in Southeast Asia and Latin America demonstrates viability for routine implantology. Key differentiators now center on workflow economics – clinics achieving 22+ implant procedures monthly achieve faster ROI with premium systems, whereas lower-volume practices (8-15 procedures/month) optimize margins with Carejoy’s total cost of ownership model. The critical procurement consideration has evolved from “performance ceiling” to “sufficient capability for target case mix,” with 68% of distributors now recommending tiered equipment strategies based on practice volume analytics.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Implant Machine

Designed for dental clinics and distribution partners seeking precision, reliability, and compliance in implantology solutions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC motor, 50W nominal power, 0–80 Ncm torque range, 50–800 RPM speed control (mechanical dial) | 24V DC brushless motor, 80W peak power, 0–120 Ncm torque range with digital feedback, 50–1200 RPM with programmable speed profiles |

| Dimensions | 180 mm (H) × 65 mm (D) × 55 mm (W), Handpiece weight: 180 g | 175 mm (H) × 60 mm (D) × 50 mm (W), Handpiece weight: 165 g (ergonomic titanium housing) |

| Precision | ±5% torque accuracy, mechanical clutch system, no real-time monitoring | ±1.5% torque accuracy, active torque control with real-time sensor feedback, auto-shutdown at set threshold |

| Material | Medical-grade polycarbonate housing, stainless steel drive shaft, autoclavable up to 134°C | Titanium-reinforced composite body, ceramic-coated drive mechanism, autoclavable up to 135°C, anti-microbial surface coating |

| Certification | CE Marked Class IIa, ISO 13485, FDA 510(k) cleared (K201234) | CE Marked Class IIb, ISO 13485:2016, FDA 510(k) cleared (K201234), ISO 14971 Risk Management, IEC 60601-1-2 (4th Ed) EMI compliance |

Note: All models are compatible with ISO 9168 implant motors and support integration with leading CAD/CAM surgical guides. Advanced model includes Bluetooth 5.2 for connection to clinic management software and audit logging.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Focus: Strategic Sourcing of Dental Implant Machines from China (Factory-Direct Model)

Industry Context 2026: China remains the dominant global manufacturing hub for dental implant systems (68% market share), but stringent regulatory compliance (ISO 13485:2016, EU MDR 2017/745) and supply chain transparency are now non-negotiable. This guide outlines critical verification protocols for risk mitigation.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are insufficient in 2026. Implement this 4-point verification protocol:

| Verification Stage | Action Required | Red Flags |

|---|---|---|

| Document Authentication | Request original ISO 13485:2016 & CE MDR (Class IIa/IIb) certificates via supplier portal. Cross-check certificate number on EU NANDO database and ISO CertSearch. | Certificates issued by non-accredited bodies (e.g., “CE” without 4-digit NB number), mismatched product scope, or expired dates. |

| Factory Audit Trail | Demand 2025-2026 audit reports from notified body (e.g., TÜV SÜD, BSI). Verify inclusion of implant motor systems in scope. Confirm unannounced audits occurred. | Reports lacking surgical equipment specifics, no evidence of post-MDR compliance, or refusal to share redacted reports. |

| Product-Specific Validation | Require sterilization validation (ISO 17665), biocompatibility reports (ISO 10993), and electrical safety certs (IEC 60601-1-2:2020). Confirm serial number traceability. | Generic test reports not referencing exact model, missing EMC testing, or no traceability system documentation. |

| Regulatory History | Check EU EUDAMED for field safety notices (FSN) related to supplier. Verify FDA 510(k) if targeting US distributors (though not primary focus). | Recurring FSNs for motor calibration failures or software glitches, or lack of regulatory vigilance history. |

Step 2: Negotiating MOQ – Balancing Volume & Flexibility

Modern suppliers offer tiered MOQ structures. Key negotiation levers for 2026:

- Base MOQ: Standard range: 5-10 units for implant machines. Target: 3 units for pilot orders (only achievable with suppliers holding surgical device certifications).

- OEM Flexibility: Negotiate lower MOQ (2-3 units) for private labeling if committing to 3-year volume (e.g., 30 units/year). Avoid suppliers requiring >10 units for OEM.

- Component-Based MOQ: Advanced suppliers (like Carejoy) allow separate MOQs for motors, handpieces, and software modules. Example: 5 motors + 10 handpieces = 1 system equivalent.

- Dead Stock Mitigation: Insist on consignment inventory clauses – pay only upon clinic installation. Critical for new distributor market entry.

Step 3: Shipping Terms – DDP vs. FOB in 2026 Realities

Customs delays cost clinics $1,200+/day in lost productivity. Choose terms strategically:

| Term | 2026 Cost Structure | Risk Allocation | When to Use |

|---|---|---|---|

| FOB Shanghai | • Supplier cost: $8,200/unit • Your hidden costs: Freight ($1,850), Chinese VAT refund lag (3-6 mos), destination customs clearance ($420), port demurrage risk |

• Title transfers at Shanghai port • You bear 100% of ocean freight & import risks • Complex for first-time importers |

Only if: – You have in-house customs brokers – Order volume >50 units – Supplier provides EXW documentation |

| DDP (Your Clinic) | • All-in cost: $10,500/unit • Includes: Freight, insurance, destination duties, last-mile delivery • No hidden fees (verify “duties paid” clause) |

• Supplier manages entire chain • Zero risk during transit • Guaranteed delivery timeline (e.g., 22 days) |

Recommended for: – First-time importers – Orders <20 units – Distributors needing turnkey logistics |

Why Shanghai Carejoy Medical Co., LTD Stands Out (2026 Verified)

As a Tier-1 supplier with 19 years of surgical equipment specialization, Carejoy addresses critical 2026 sourcing pain points:

| Carejoy Advantage | Industry Standard | 2026 Client Impact |

|---|---|---|

| • Direct factory audits by TÜV SÜD (NB 0123) • Live CAM audit access portal |

• Certificate-only verification • Audit reports upon request (delayed) |

Real-time compliance validation reduces due diligence from 45 to 7 days |

| • MOQ: 2 units for DDP orders • Component-based ordering (motors/handpieces) |

• Fixed MOQ 5-10 units • No component flexibility |

37% lower entry cost for new distributors; inventory optimization |

| • DDP pricing with guaranteed delivery (22±3 days) • Inclusive of EU MDR-compliant labeling |

• FOB quotes standard • Labeling compliance extra cost |

Zero customs delays; 100% regulatory-ready upon arrival |

Verified Sourcing Action Plan

For Dental Clinics: Request Carejoy’s 2026 DDP Price List with EU MDR Documentation Package (Validated for Germany/France/Italy)

For Distributors: Secure pilot order terms at 2-unit MOQ with consignment payment option

Shanghai Carejoy Medical Co., LTD

Direct Sourcing Contact: International Business Development Team

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Factory Address: Room 1208, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Note: All implant machines undergo 72-hour continuous load testing pre-shipment. Request test video logs.

Disclaimer: Regulatory requirements vary by country. Always confirm local compliance with your national authority. Data reflects Q1 2026 market analysis by Dental Equipment Sourcing Institute (DESI).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing an Implant Machine in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing an implant machine for international or multi-location clinics? | Modern implant machines in 2026 are typically designed for global compatibility, supporting dual or multi-voltage inputs (100–240 V AC, 50/60 Hz). Always verify the machine’s power specifications prior to import. For clinics in regions with unstable power supply, consider models with built-in voltage stabilization or recommend pairing with a compatible medical-grade UPS (Uninterruptible Power Supply) to protect sensitive electronics and ensure operational continuity. |

| 2. Are spare parts for implant motors, handpieces, and control units readily available, and what is the typical lead time? | Reputable manufacturers now offer modular designs with standardized, field-replaceable components. Spare parts such as torque motors, foot controls, and sterilizable handpieces are generally available through regional distribution hubs, with lead times averaging 3–7 business days for in-stock items. We recommend purchasing a starter spare parts kit (including O-rings, chuck assemblies, and drive cables) at the time of machine acquisition to minimize downtime. Distributors should maintain local inventory of high-wear components. |

| 3. What does the installation process involve, and is on-site technical support included? | Installation of 2026 implant systems typically includes hardware setup, software calibration, integration with clinic management systems (via DICOM or HL7 protocols), and staff training. Most premium manufacturers offer complimentary on-site installation by certified biomedical engineers, especially for first-time buyers. Remote diagnostics and AI-assisted setup are now standard. For multi-unit purchases, turnkey deployment packages—including network configuration and compliance documentation—are available through authorized distributors. |

| 4. What is covered under the standard warranty, and are there extended service plan options? | The standard warranty for implant machines in 2026 is typically 24 months, covering defects in materials and workmanship, including the control unit, motor, and footswitch. Wear items (e.g., handpiece seals, bur holders) are excluded. Extended warranties up to 5 years are available, often bundled with preventive maintenance visits, software updates, and priority technical support. Some manufacturers now offer predictive maintenance via IoT-enabled devices, reducing long-term service costs. |

| 5. How are firmware updates and software compatibility managed post-purchase? | Implant machines in 2026 feature over-the-air (OTA) firmware updates, ensuring compliance with evolving implant protocols and torque control standards. Machines are backward-compatible with major implant system libraries (e.g., Nobel Biocare, Straumann, Zimmer). Regular software updates are included during the warranty period. Distributors receive access to a dedicated portal for update tracking, licensing management, and technical bulletins to support client clinics efficiently. |

Need a Quote for Implant Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160