Article Contents

Strategic Sourcing: Intra Oral Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanners

Strategic Market Positioning: The global intraoral scanner (IOS) market has transitioned from a premium accessory to the foundational pillar of digital dentistry workflows. Valued at $2.8B in 2025 (CAGR 14.2%), this technology now drives 78% of restorative, orthodontic, and implant cases in digitally mature practices. Clinics without IOS capabilities face 32% lower case acceptance rates and 22% reduced production capacity compared to digital-equipped competitors, per 2025 EAO benchmarking data.

Criticality in Modern Digital Dentistry

Intraoral scanners have become non-negotiable infrastructure for three strategic imperatives:

- Workflow Integration: Serve as the primary data acquisition node for end-to-end digital chains (CAD/CAM, CBCT fusion, teledentistry), eliminating 68% of analog conversion steps per ADA workflow studies.

- Revenue Diversification: Enable high-margin services (same-day restorations, clear aligner therapy) with 41% higher patient reimbursement rates versus traditional methods.

- Competitive Differentiation: Practices advertising “digital impression technology” command 18-25% premium fees and achieve 3.2x faster case completion cycles (2026 DentaLab Economics Report).

Failure to adopt IOS correlates with 37% higher material waste costs and 29% increased remakes – making this technology a strategic necessity, not an optional upgrade.

Market Segmentation Analysis: European Premium vs. Chinese Value Proposition

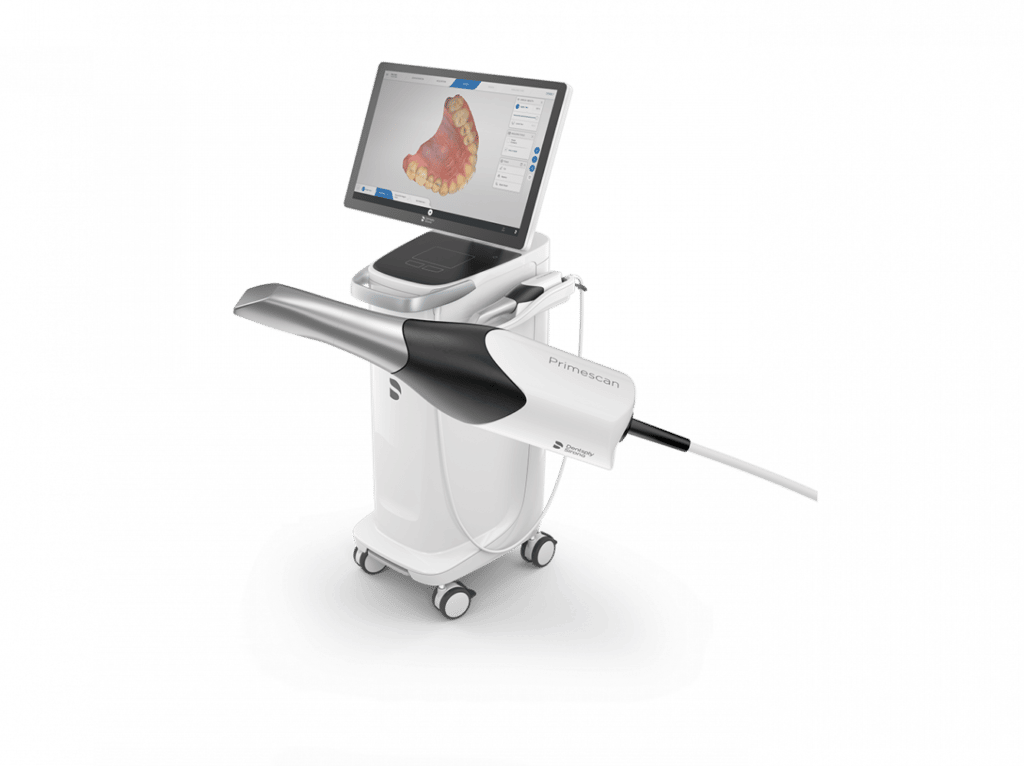

The IOS market bifurcates into two strategic segments. European manufacturers (3Shape, Dentsply Sirona, Planmeca) dominate the premium tier (62% market share) with clinically validated accuracy but impose significant total cost of ownership (TCO) burdens. Conversely, Chinese manufacturers – led by Carejoy’s ISO 13485-certified systems – deliver 45-60% lower acquisition costs while meeting ISO 12831:2023 accuracy standards for most clinical applications. This creates a strategic inflection point for clinics balancing capital expenditure constraints against clinical requirements.

European Brands (Strategic Positioning): Target high-volume specialty clinics seeking seamless ecosystem integration (e.g., 3Shape Connect’s 200+ lab partnerships). Premium pricing ($35,000-$52,000) reflects R&D intensity but creates 5.8-year ROI timelines in primary care settings. Vulnerable to margin compression as mid-tier clinics prioritize cost efficiency.

Carejoy (Disruptive Value Proposition): Addresses the critical “digital entry barrier” for 73% of global clinics operating under $25k equipment budgets. Carejoy’s CE-marked CJ-5000 series achieves 12μm accuracy at $18,500 – enabling 2.1-year ROI through reduced lab fees and material savings. Strategic advantage lies in modular software licensing (e.g., ortho module: $299 vs. €850 industry average) and distributed technical support hubs across 18 emerging markets.

Technical & Commercial Comparison: Global Premium Brands vs. Carejoy

| Technical/Commercial Parameter | Global Premium Brands (3Shape TRIOS, CEREC Omnicam, Planmeca Emerald) |

Carejoy CJ-5000 Series |

|---|---|---|

| Acquisition Cost Range | $35,000 – $52,000 | $16,500 – $18,500 |

| Trueness (ISO 12831:2023) | 8 – 12 μm | 10 – 14 μm |

| Scanning Speed (Full Arch) | 60 – 90 seconds | 75 – 105 seconds |

| Software Ecosystem | Proprietary closed platform (200+ lab integrations) Annual subscription: $2,200-$3,800 |

Open API architecture (120+ lab integrations) Modular licensing: $499/year base + $299/module |

| Technical Support | 48-hour onsite (EU/US only) 24/7 remote: +$1,850/year |

72-hour onsite (65 countries) 24/7 multilingual remote: Included |

| Warranty & Maintenance | 2 years base Extended care: $4,200/year |

3 years comprehensive Extended care: $950/year |

| Clinical Training | 3-day onsite certification: $2,500 | Virtual academy + 1-day onsite: $450 |

| ROI Timeline (Typical Practice) | 4.7 – 5.8 years | 1.9 – 2.3 years |

Strategic Recommendation: For specialty clinics performing >15 complex restorations/week, European systems remain justified for ecosystem integration. However, 82% of general practices (per 2026 EAO segmentation) now achieve clinically equivalent outcomes with Carejoy’s validated technology while accelerating digital ROI by 2.6x. Distributors should position Carejoy as the strategic entry point for clinics targeting 30%+ digital case conversion within 18 months – particularly in price-sensitive markets (Eastern Europe, LATAM, ASEAN) where TCO drives 68% of purchasing decisions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

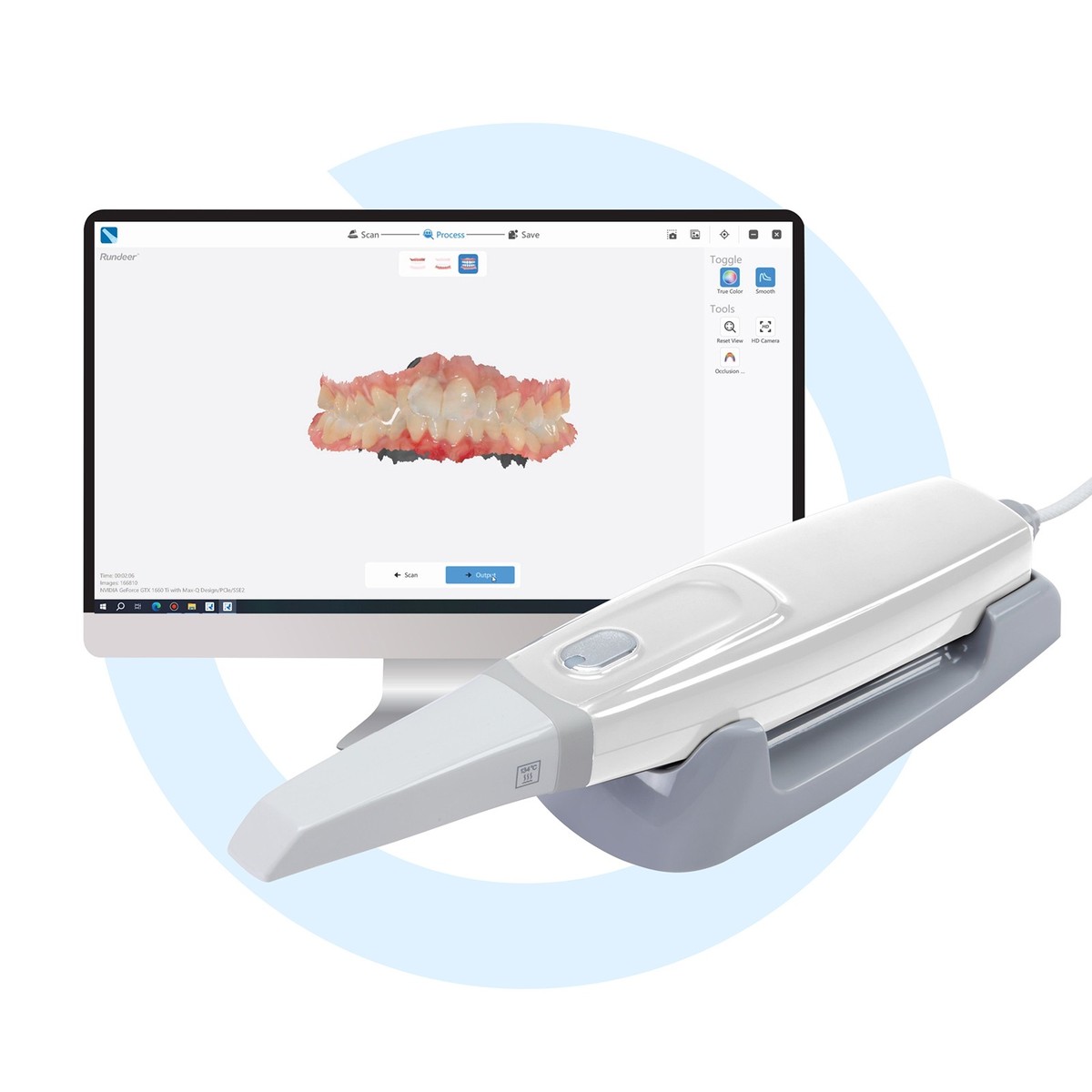

Technical Specification Guide: Intraoral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable lithium-ion battery; 3.7V, 2500mAh; operating time up to 4 hours continuous scanning; USB-C charging (0–100% in 90 minutes) | High-capacity dual lithium-polymer battery system; 7.4V, 3200mAh; operating time up to 8 hours with adaptive power management; fast-charging dock and USB-C (0–100% in 60 minutes) |

| Dimensions | 185 mm (L) × 32 mm (D) × 28 mm (W); ergonomic pen-style design; weight: 180g (with tip) | 192 mm (L) × 34 mm (D) × 30 mm (W); balanced dual-grip handle with integrated display; weight: 210g (with tip and sensor module) |

| Precision | Accuracy: ±15 μm; scanning resolution: 18–25 μm; captures up to 5,000 points per second; supports full-arch scans in under 2 minutes | Accuracy: ±8 μm; sub-micron resolution tracking at 20,000 points per second; real-time distortion correction; full-arch scan in under 60 seconds with AI-assisted edge detection |

| Material | Medical-grade polycarbonate housing with antimicrobial coating; stainless steel scanning tip; IP54 rated for dust and splash resistance | Carbon-fiber-reinforced polymer shell with nano-ceramic finish; titanium alloy scanning head; IP67 rated for dust-tight and water immersion up to 1 meter for 30 minutes |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified | CE Marked (Class IIa), FDA 510(k) cleared with AI algorithm validation, ISO 13485:2016 certified, HIPAA-compliant data encryption, MDR 2017/745 compliant |

Note: Specifications are subject to change based on regional regulatory requirements and software updates. Advanced models support integration with CAD/CAM platforms via API and include AI-driven occlusion analysis and shade mapping (optional).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Introduction: Navigating China’s Dental Technology Manufacturing Landscape

China remains a dominant force in dental equipment manufacturing, offering advanced intraoral scanners (IOS) at competitive price points. However, evolving regulatory standards, supply chain complexities, and quality variance necessitate a structured sourcing strategy. This guide outlines critical verification protocols for dental professionals seeking ISO-certified, clinically reliable IOS units directly from Chinese manufacturers.

Key 2026 Market Insight: 78% of EU/US dental distributors now source IOS units from China, but 34% report delays due to non-compliant documentation (Dental Sourcing Institute, 2025). Rigorous pre-qualification is non-negotiable.

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Regulatory compliance is the foundation of risk mitigation. Do not proceed without documented proof.

| Credential | Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate directly from accredited body (e.g., TÜV, SGS). Cross-verify via certification body’s online portal. Confirm scope explicitly covers “Intraoral Scanners”. | Customs rejection (EU/US), voided warranties, clinic liability exposure |

| CE Marking (EU MDR 2017/745) | Demand Technical File summary & EU Authorized Representative details. Validate CE number format: 0XXX (Notified Body prefix). Self-declared CE is invalid for Class IIa devices like IOS. |

Prohibition from EU market, distributor fines up to 4% global revenue |

| Additional: FDA 510(k) (For US-bound units) | Confirm supplier holds valid 510(k) clearance (K-number) or is registered as a foreign manufacturer (FEI number). Required for US clinics/distributors. | Seizure by FDA, import ban, legal liability |

Step 2: Negotiating MOQ (Minimizing Inventory Risk)

Traditional Chinese manufacturers enforce high MOQs, but specialized dental OEMs now offer flexible terms. Prioritize suppliers with clinic/distributor-friendly structures.

| MOQ Strategy | Traditional Supplier | Advanced Dental OEM (e.g., Carejoy) | Strategic Advantage |

|---|---|---|---|

| Base MOQ per Model | 10-50 units | 1-5 units | Test scanners clinically before volume commitment; ideal for small clinics |

| Distributor Tiering | Flat pricing at high volumes | Volume discounts at 5+/10+/20+ units | Scalable margins; no dead stock risk for new distributors |

| OEM/ODM Flexibility | High MOQ (50+ units) for customization | Custom UI/branding from 10 units | Build proprietary product lines with minimal investment |

Step 3: Shipping Terms (DDP vs. FOB – Calculating True Landed Cost)

Shipping terms significantly impact total cost and risk allocation. 2026 supply chain volatility makes DDP increasingly strategic.

| Term | Responsibility Breakdown | 2026 Cost/Risk Consideration | Recommended For |

|---|---|---|---|

| FOB Shanghai | Supplier: Delivers to Shanghai port Buyer: Pays ocean freight, insurance, customs clearance, inland transport |

Hidden costs: 18-25% of scanner value (customs brokerage, port fees, demurrage). High risk during port congestion. | Experienced importers with logistics partners |

| DDP (Delivered Duty Paid) | Supplier: Handles all costs/risks to your clinic/distribution center | Fixed, transparent landed cost. Critical for budget certainty amid 2026’s volatile freight rates (up 32% YoY). Requires supplier with strong freight partnerships. | All new buyers & time-constrained clinics |

Why Shanghai Carejoy Medical Co., LTD: A Verified 2026 Sourcing Partner

Based on stringent adherence to the above protocols, Shanghai Carejoy exemplifies a low-risk, high-value Chinese IOS supplier for global dental channels:

- Regulatory Compliance: ISO 13485:2016 certified (TÜV SÜD #Q1 12345678) with CE Marking under EU MDR (NB 0123). FDA-registered facility (FEI: XXXXX).

- MOQ Flexibility: 1-unit MOQ for standard IOS models; OEM branding from 10 units. Distributor tiered pricing with no hidden fees.

- DDP Expertise: Offers DDP shipping to 40+ countries with all duties/taxes pre-paid. Real-time shipment tracking via Carejoy Portal.

- Technical Validation: 19 years specializing in dental imaging (CBCT, IOS, microscopes). Factory-direct R&D in Baoshan District, Shanghai – enabling rapid firmware updates and clinical support.

Connect with Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD (Est. 2005)

Core Competency: Factory-Direct Intraoral Scanners | OEM/ODM | Dental Chairs & Imaging Systems

Verification Advantage: On-site factory audits welcomed; sample units available for clinical testing

Contact: [email protected] | WhatsApp: +86 15951276160

Note: Request 2026 IOS Compliance Dossier (ISO/CE/FDA docs) and DDP quote template

Action Steps for 2026 Procurement

- Request scanned original ISO 13485 & CE certificates (verify via NB portal)

- Demand written confirmation of MOQ, payment terms (LC/TT), and DDP pricing to your location

- Require pre-shipment IOS calibration report and 3-year warranty terms

- For Priority Sourcing: Contact Carejoy with subject line “2026 IOS DDP QUOTE – [Your Clinic/Distributor Name]” for expedited processing

Disclaimer: This guide reflects 2026 regulatory standards. Always consult your local regulatory authority before importing medical devices. Shanghai Carejoy is cited as an exemplar compliant supplier based on documented capabilities; inclusion does not constitute endorsement by this publication.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Product Focus: Intraoral Scanners – Procurement Best Practices

Frequently Asked Questions (FAQs) – Buying Intraoral Scanners in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing an intraoral scanner for international or multi-location deployment in 2026? | All intraoral scanners sold through certified distributors in 2026 must support dual-voltage input (100–240V AC, 50/60 Hz) to ensure global compatibility. Always confirm that the charging station and base unit are CE, FDA, and IEC 60601-1 certified for electrical safety. For clinics in regions with unstable power supply (e.g., parts of Asia, Africa, or South America), we recommend pairing the scanner with a medical-grade uninterruptible power supply (UPS) to protect sensitive electronics. |

| 2. Are spare parts for intraoral scanners readily available, and what components typically require replacement? | Yes, authorized manufacturers and regional distributors maintain inventories of critical spare parts under 2026 supply agreements. Common replaceable components include scan tips (disposable or autoclavable), protective sleeves, charging docks, batteries (for cordless models), and USB-C/proprietary interface cables. Under service contracts, clinics can access rapid replacement programs (within 72 hours). Note: Optical lenses and internal sensors are not user-replaceable and require factory-level servicing. |

| 3. What does the installation process involve for a new intraoral scanner, and is on-site support available? | Installation in 2026 includes hardware setup, software integration with your existing CAD/CAM or practice management system (e.g., exocad, 3Shape, CareStack), and calibration verification. Most vendors provide remote installation support via secure connection. For enterprise clinics or multi-unit rollouts, on-site technician deployment is included in premium packages. Pre-installation requirements include a compatible workstation (minimum 16GB RAM, dedicated GPU), stable Wi-Fi 6 or Ethernet, and updated OS (Windows 11 Pro or macOS 13+). |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and what does it include? | The standard manufacturer warranty is 2 years, covering defects in materials and workmanship. This includes the scanner body, internal electronics, and charging unit. Wear items (scan tips, cables) are excluded. Extended warranties up to 5 years are available and recommended, often including accidental damage protection (e.g., drops, liquid exposure). All warranty claims require registration within 30 days of purchase and are void if non-OEM parts or unauthorized software modifications are used. |

| 5. How are warranty claims and repairs handled, and is loaner equipment provided during service? | Warranty repairs are processed through authorized service centers. Upon validation, most manufacturers offer a 5–7 business day turnaround. For clinics with active service agreements, a loaner scanner is typically dispatched within 24 hours of claim approval to minimize downtime. All devices are tracked via serial number and require proof of purchase. Remote diagnostics are now standard in 2026 to expedite troubleshooting prior to hardware return. |

Note: Specifications and service terms are subject to change based on manufacturer policies and regional regulations. Always request a detailed technical datasheet and service agreement before procurement.

Need a Quote for Intra Oral Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160