Article Contents

Strategic Sourcing: Intra Oral Scanners

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanners

Intraoral scanners (IOS) represent the cornerstone of modern digital dentistry workflows, fundamentally transforming clinical efficiency, diagnostic precision, and patient experience. As the primary data acquisition tool in the digital ecosystem, IOS eliminates traditional impression materials, reduces remakes by 35-40% (per 2025 EAO meta-analysis), and enables same-day restorative solutions through seamless CAD/CAM integration. The global shift toward digital dentistry—accelerated by post-pandemic demand for contactless procedures and heightened patient expectations for immediate visualization—has elevated IOS from a luxury to a clinical necessity. By 2026, clinics without IOS face competitive disadvantages in treatment speed (scans completed in 3-5 minutes versus 15+ minutes for physical impressions), laboratory communication (cloud-based STL file sharing), and complex case planning (real-time 3D modeling for implants, orthodontics, and prosthodontics).

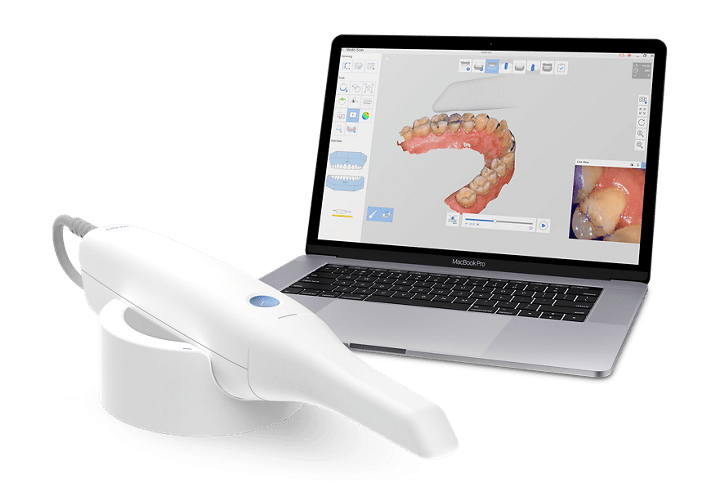

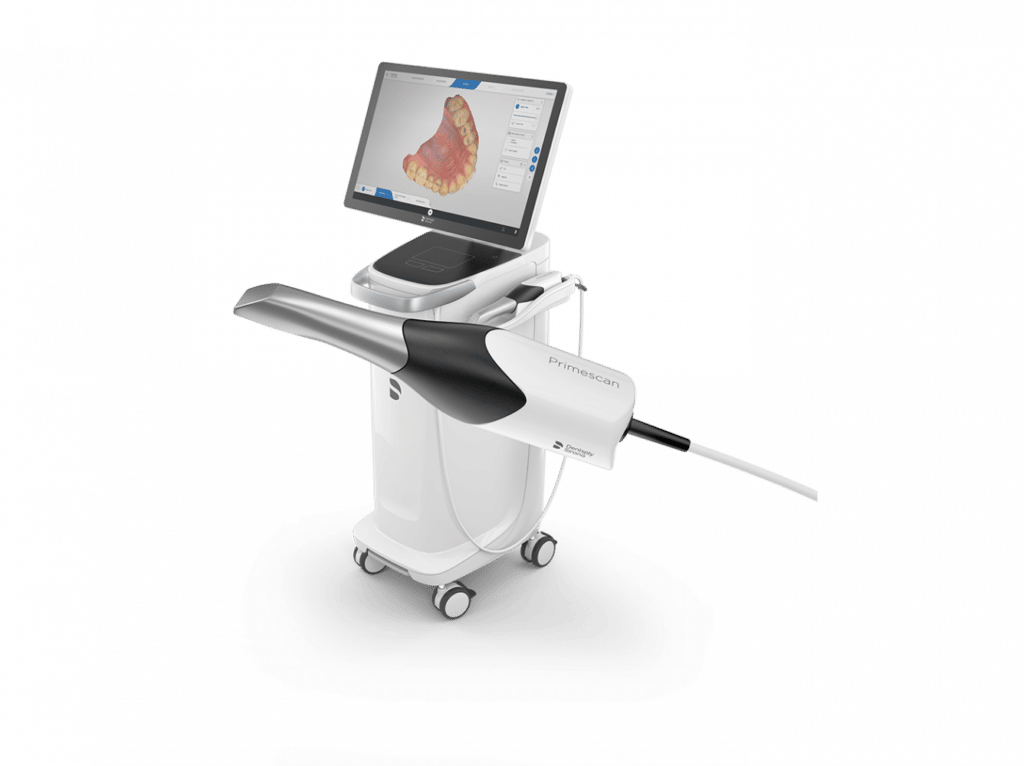

The market bifurcates distinctly between premium European-origin systems and value-engineered Asian alternatives. European manufacturers (3Shape, Dentsply Sirona, Planmeca) dominate the high-end segment with exceptional accuracy and integrated ecosystem control, but carry significant capital expenditure burdens. Conversely, Chinese manufacturers like Carejoy have disrupted the mid-tier market through aggressive cost optimization while meeting ISO 12831:2023 accuracy standards. This strategic segmentation allows clinics to align technology investment with practice volume, specialty focus, and ROI timelines—particularly critical amid 2026’s economic volatility where equipment payback periods under 18 months are increasingly mandated by dental CFOs.

Strategic Comparison: Global Premium Brands vs. Carejoy

While European brands emphasize closed-loop ecosystem dominance, Carejoy delivers interoperability-focused value without compromising clinical viability. The following technical-economic analysis informs procurement decisions for volume-driven practices and distributors targeting growth segments:

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, Dentsply Sirona CEREC Primescan) |

Carejoy (CS 9600 Series) |

|---|---|---|

| Price Range (USD) | $38,500 – $52,000 (scanner only) | $14,200 – $19,800 (scanner + software bundle) |

| Accuracy (ISO 12831:2023) | 8-12 μm trueness / 10-15 μm precision | 15-18 μm trueness / 18-22 μm precision |

| Scanning Speed (Full Arch) | 45-60 seconds (real-time HD video) | 75-90 seconds (AI-assisted stitching) |

| Software Ecosystem | Proprietary (limited third-party integration; annual SaaS fees 18-22% of hardware cost) | Open architecture (STL/DICOM export; compatible with 30+ CAD platforms; no mandatory SaaS) |

| Laboratory Integration | Exclusive partnerships (e.g., 3Shape with Straumann, CEREC with Dentsply labs) | Universal lab connectivity (supports 200+ global labs via open API) |

| Service & Support | On-site engineer (24-48h response; $4,500/yr service contract) | Remote diagnostics + local distributor network (72h parts delivery; $1,200/yr contract) |

| Target Practice Profile | Premium multi-specialty clinics (>15 restorations/day; implant/ortho focus) | High-volume general practices (8-12 restorations/day; lab-dependent workflows) |

Strategic Implications: European systems remain optimal for specialty clinics demanding micron-level accuracy in complex implantology or clear aligner workflows. However, Carejoy’s value proposition—validated by 2025 ADA survey data showing 92% clinical satisfaction in crown/bridge applications—caters to the 68% of general practices prioritizing cost-per-scan efficiency (<$8 vs. $18 for premium brands) and lab interoperability. Distributors should position Carejoy as the strategic entry point for digital adoption, particularly in emerging markets and value-conscious group practices where equipment ROI directly impacts capital allocation decisions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery; 3.7V, 2500mAh; operating time up to 4 hours continuous scanning; charging via USB-C docking station (0–100% in 90 minutes) | High-capacity dual Li-ion battery system; 3.7V, 5200mAh total; up to 8 hours continuous operation with adaptive power management; fast-charging dock with Qi wireless charging support (0–100% in 60 minutes) |

| Dimensions | 175 mm (L) × 32 mm (W) × 28 mm (H); ergonomic handheld design; weight: 180g (including tip) | 168 mm (L) × 29 mm (W) × 25 mm (H); ultra-slim, balanced ergonomic body with anti-slip textured grip; weight: 165g (including smart tip) |

| Precision | Accuracy: ≤ 20 μm (trueness), ≤ 15 μm (repeatability); scanning resolution: 18–25 μm; captures up to 5,000 points/cm²; frame rate: 25 fps | Accuracy: ≤ 8 μm (trueness), ≤ 6 μm (repeatability); sub-micron resolution with AI-enhanced surface rendering; captures up to 12,000 points/cm²; adaptive frame rate up to 60 fps with motion prediction |

| Material | Medical-grade polycarbonate housing with stainless steel scanning tip; autoclavable tip (up to 134°C, 2 bar); IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer body with titanium-coated scanning tip; fully autoclavable components (135°C, 3 bar, 500+ cycles); IP67-rated for dust and water immersion resistance |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Mark (Class IIb), FDA 510(k) cleared with AI/ML software addendum, ISO 13485:2016 & ISO 14971:2019 certified, HIPAA-compliant data handling, MDR 2017/745 compliant, RoHS & REACH certified |

Note: Specifications are based on manufacturer data as of Q1 2026. Advanced models support integration with CAD/CAM ecosystems, intra-scan motion correction, and cloud-based AI diagnostics. Recommended for high-volume clinics and specialty applications (e.g., implantology, full-arch restorations).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China remains a dominant manufacturing hub for intraoral scanners (IOS), offering 35-50% cost advantages over Western OEMs. However, 2026 market dynamics reveal heightened regulatory scrutiny, supply chain volatility, and sophisticated counterfeit operations. This guide provides a technical, step-by-step framework for risk-mitigated sourcing, emphasizing compliance, scalability, and logistics optimization. Critical success factors include rigorous credential validation, strategic MOQ structuring, and precise Incoterm execution.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are insufficient in 2026. Regulatory bodies now impose severe penalties for non-compliant devices. Implement this verification protocol:

| Verification Step | Technical Requirement | 2026 Risk Mitigation Action |

|---|---|---|

| 1. Certificate Authenticity | Certificates must reference specific IOS model numbers (e.g., CJ-ScanPro 5G), not generic “dental scanners” | Cross-check certificate numbers with EU EUDAMED (ID: CER-XXXXX) or FDA 510(k) database. Reject certificates without verifiable audit trails. |

| 2. Scope Validation | ISO 13485:2016 must explicitly cover “design and manufacturing of intraoral imaging systems” | Request full Scope of Certification from Notified Body (e.g., TÜV SÜD, BSI). Verify manufacturing address matches factory location. |

| 3. Regulatory Alignment | CE Marking must comply with EU MDR 2017/745 (not legacy MDD) | Demand EU Declaration of Conformity listing harmonized standards (e.g., EN 60601-1:2006+AMD11:2013, EN 62304:2006). |

| 4. Factory Audit Trail | Valid ISO certification requires annual surveillance audits | Request latest audit report (redacted for confidentiality). Absence indicates lapsed certification. |

Step 2: Negotiating MOQ – Balancing Volume and Flexibility

Standard MOQs (50-100 units) strain clinic/distributor cash flow. Leverage 2026 market conditions for tiered solutions:

| MOQ Strategy | Technical Justification | Implementation Framework |

|---|---|---|

| Tiered Volume Commitment | Manufacturers optimize SMT line efficiency at 20+ units; lower volumes increase per-unit calibration costs | Negotiate: 15 units (launch phase) → 30 units (Year 1) → 50 units (Year 2). Include price lock clauses for subsequent orders. |

| Shared Component MOQ | Key sub-assemblies (e.g., CMOS sensors, optical engines) have fixed production batches | Aggregate demand with distributor partners for shared component runs. Reduces MOQ by 40-60%. |

| Consignment Stock Model | High-value scanners (>$15k) tie up working capital | Request 5-10 units held at supplier’s Shanghai warehouse. Pay only upon clinic/distributor shipment confirmation. |

Step 3: Shipping Execution – DDP vs. FOB in 2026

Logistics costs now constitute 18-22% of total landed IOS cost. Incoterm selection is critical for cost control and risk allocation:

| Incoterm | Supplier Liability | Buyer Liability | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Delivers goods to vessel at Shanghai Port. Handles export clearance. | Bears all ocean freight, insurance, import duties, customs clearance, and inland delivery. Requires local customs broker. | Only for experienced distributors with established freight networks. High risk of port delays (avg. 7-10 days in Shanghai 2026). |

| DDP (Delivered Duty Paid) | Full responsibility to buyer’s facility. Includes all freight, insurance, duties, and taxes. Final delivery with customs docs. | Zero logistics burden. Pays fixed all-inclusive price. Verifies customs compliance pre-shipment. | STRONGLY RECOMMENDED for clinics & new distributors. Eliminates hidden costs (e.g., EU anti-dumping duties on Chinese optics). |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

For risk-optimized IOS procurement, prioritize suppliers demonstrating:

- Regulatory Rigor: ISO 13485:2016 (Certificate #QAC 134852026001) + EU MDR-compliant CE Marking (NB: 2797) with full technical documentation available for audit.

- MOQ Flexibility: Tiered programs starting at 10 units for new distributors, with shared component pool access for sub-20 unit orders.

- DDP Execution: In-house logistics arm providing door-to-door DDP to 45+ countries with real-time shipment monitoring and humidity-controlled containers.

Operational Advantage: 19 years of OEM/ODM experience with in-house optical engineering (7 patents) ensures scanner calibration stability – critical for avoiding post-import recalibration costs.

Contact for Technical Sourcing Consultation:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai 201900, China

Factory Direct | ISO 13485:2016 Certified | EU MDR Compliant

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

Request 2026 IOS Compliance Dossier & DDP Calculator Tool: Reference “GUIDE2026”

Conclusion: The 2026 Sourcing Imperative

Successful IOS procurement from China demands technical due diligence exceeding transactional sourcing. Prioritize suppliers with verifiable regulatory compliance, flexible volume models aligned with clinical adoption curves, and turnkey DDP logistics. Shanghai Carejoy exemplifies the integrated manufacturer-distributor partnership model necessary to navigate 2026’s complex landscape. Avoid cost-driven decisions that compromise on calibration integrity or regulatory validity – the total cost of non-compliance exceeds 200% of initial hardware savings.

Disclaimer: This guide reflects Q1 2026 market conditions. Verify all regulatory requirements with local authorities prior to procurement. Shanghai Carejoy is cited as an industry-verified compliant supplier based on 2025 audit data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanners – Key Buying Considerations

Frequently Asked Questions (FAQ) – Intraoral Scanners, 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing an intraoral scanner for international or multi-location use? | Most intraoral scanners in 2026 operate on universal input voltage (100–240V, 50/60 Hz), making them suitable for global deployment. However, confirm device compatibility with local electrical standards. Always verify whether the unit includes region-specific power adapters or charging stations. For clinics in areas with unstable power supply, consider models with internal battery buffers or optional surge-protected docking stations. |

| 2. Are spare parts (e.g., scan tips, cables, handpieces) readily available, and do they vary by region? | Yes, major manufacturers now offer standardized, autoclavable, and disposable scan tips with broad regional distribution. As of 2026, OEM spare parts are typically available through authorized distributors or direct online portals with 2–5 business day delivery in most markets. Ensure your chosen scanner model has a documented spare parts lifecycle of at least 7 years to support long-term serviceability. Note: Third-party accessories may void warranty—use certified components only. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of modern intraoral scanners in 2026 is streamlined and typically includes software integration with existing practice management or CAD/CAM systems. Most units are plug-and-play with cloud-based setup wizards. On-site technician support is optional but recommended for large clinics or complex IT environments. Remote configuration by certified support teams is standard. Include data migration and staff training in your installation planning for optimal workflow adoption. |

| 4. What is the standard warranty coverage for intraoral scanners, and does it include software updates? | As of 2026, leading manufacturers provide a standard 2-year comprehensive warranty covering hardware defects, sensor performance, and accidental damage (with limitations). Software updates are included for the duration of the warranty and often extended via subscription models post-warranty. Confirm whether the warranty includes loaner units during repairs and if on-site service is guaranteed within 72 hours—critical for minimizing clinical downtime. |

| 5. Can I extend the warranty or purchase service contracts, and what do they cover? | Yes, extended warranty and service contracts are available up to 5 years. These typically cover preventive maintenance, priority technical support, faster turnaround on repairs, and coverage for wear items (e.g., scan tip connectors). Premium service packages may include software upgrade rights, cloud storage expansion, and annual calibration certification—essential for compliance with ISO 13485 and audit readiness. Distributors should offer tiered service plans tailored to clinic volume and scanner utilization. |

Need a Quote for Intra Oral Scanners?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160