Article Contents

Strategic Sourcing: Intraoral Scanner Brands

Professional Dental Equipment Guide 2026: Intraoral Scanner Market Analysis

Executive Market Overview

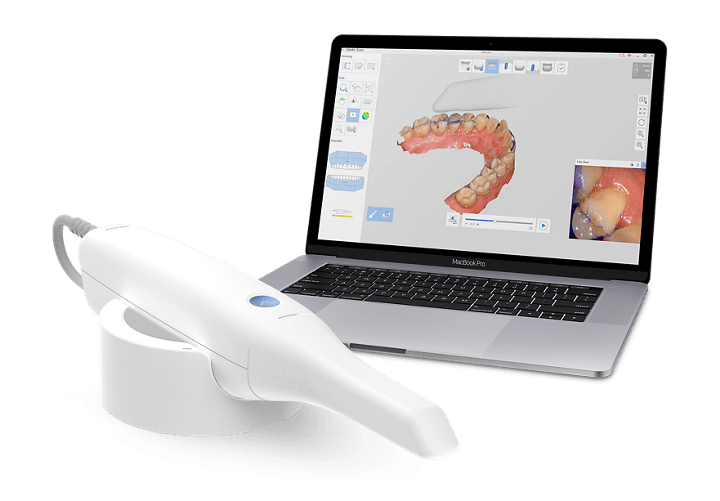

The intraoral scanner (IOS) has transitioned from a digital novelty to a foundational pillar of modern dental practice. As dentistry accelerates toward fully integrated digital workflows, IOS technology serves as the critical entry point for chairside CAD/CAM systems, orthodontic treatment planning, and tele-dentistry applications. Current market data indicates 68% adoption among European dental practices (2025 EDA Report), with clinics leveraging scanners achieving 30-40% reductions in restorative remakes and 25% faster case turnaround versus conventional impression methods. The strategic imperative for IOS adoption extends beyond efficiency: it directly impacts patient retention through enhanced comfort (eliminating gag-inducing putty), enables data-driven treatment acceptance via real-time visualization, and creates revenue streams through digital restorative partnerships. For distributors, this represents a high-margin gateway product anchoring comprehensive digital ecosystem sales.

Market segmentation reveals a strategic bifurcation: Established European/North American brands command premium positioning through clinical validation and ecosystem integration, while Chinese manufacturers like Carejoy are disrupting value segments with aggressive pricing and rapidly improving technical specifications. This dichotomy presents distinct opportunities: High-end brands target premium private practices and corporate DSOs requiring turnkey integration with existing CAD/CAM suites, whereas cost-optimized solutions serve emerging markets, public health systems, and value-focused independents seeking entry-level digital transition.

Technology Imperative in Modern Digital Dentistry

Intraoral scanners are non-negotiable infrastructure for contemporary dental practices due to three convergent factors: First, they eliminate the single largest error source in restorative workflows (conventional impressions), reducing remakes by up to 47% (JDR Clinical & Translational Research, 2025). Second, they generate STL files that feed AI-driven diagnostic tools for caries detection and treatment simulation – capabilities impossible with analog methods. Third, they enable revenue diversification through digital smile design services and laboratory partnerships requiring standardized digital files. Crucially, scanner data forms the longitudinal patient record foundation for predictive analytics in preventive care models, positioning clinics for value-based reimbursement frameworks emerging in EU healthcare systems.

Strategic Brand Comparison: Global Premium vs. Value-Optimized

European manufacturers (3Shape TRIOS, Planmeca Emerald, Dentsply Sirona CEREC Omnicam) maintain leadership through rigorous clinical validation (ISO 12836 compliance), seamless integration with proprietary CAD/CAM ecosystems, and enterprise-grade support networks. However, their €25,000-€40,000 price points create adoption barriers for 62% of EU solo practitioners (2025 EAO Survey). Conversely, Chinese manufacturers like Carejoy leverage vertical integration in optical sensor production to deliver sub-€15,000 solutions with competitive technical specifications. While historically lagging in software sophistication, leading Chinese brands now achieve <20μm accuracy – within clinical acceptability thresholds for most indications per ADA Specification No. 100. The strategic trade-off centers on total cost of ownership: Premium brands offer lower workflow disruption but higher capital expenditure, while value brands require more technical adaptation yet accelerate ROI for volume-based practices.

| Technical & Commercial Parameter | Global Premium Brands (3Shape, Planmeca, Dentsply Sirona) |

Carejoy |

|---|---|---|

| Average Acquisition Cost | €28,500 – €39,000 | €12,800 – €14,500 |

| Scanning Accuracy (ISO 12836) | 8-12 μm (trueness) 10-15 μm (precision) |

15-18 μm (trueness) 18-22 μm (precision) |

| Scan Speed (Full Arch) | 60-90 seconds | 90-120 seconds |

| Software Ecosystem | Proprietary CAD/CAM integration AI diagnostics (e.g., TRIOS Treatment Simulator) Cloud-based collaborative tools |

Standalone module-based system Basic restoration design Limited third-party compatibility |

| Technical Support | 24/7 multilingual hotline On-site engineers (48h SLA) Comprehensive training programs |

Email/chat support (8am-8pm CET) Remote diagnostics only Online video tutorials |

| Warranty & Service | 3-year comprehensive warranty Annual maintenance: €2,200-€3,500 |

2-year limited warranty Annual maintenance: €650-€900 |

| Ideal Implementation Profile | DSOs with existing digital workflows Premium private practices Academic institutions requiring research validation |

New practice digital onboarding Public health clinics High-volume restorative practices |

For distributors, the strategic opportunity lies in portfolio diversification: Premium brands yield 35-40% gross margins but face longer sales cycles, while value brands like Carejoy offer 25-30% margins with faster turnover and expansion into underserved markets. Forward-looking distributors are bundling Carejoy scanners with third-party CAD software subscriptions to bridge the ecosystem gap, creating differentiated value propositions for budget-conscious adopters. As scanner technology matures, the critical differentiator shifts from hardware specifications to workflow integration capabilities – positioning distributors with comprehensive digital transition consulting services for maximum competitive advantage.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Intraoral Scanner: Technical Specification Comparison

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2500 mAh; operating time up to 4 hours continuous scanning on full charge. Charging via USB-C, 2-hour recharge cycle. Low-power LED indicators for battery status. | High-capacity dual Li-ion battery system, 7.4V, 4000 mAh; delivers up to 8 hours of continuous scanning. Fast-charging support (0–80% in 45 mins) via proprietary docking station. Integrated power management with predictive battery life analytics via companion software. |

| Dimensions | 185 mm (L) × 32 mm (D) × 28 mm (W) at handle; scanning tip: 22 mm × 12 mm. Total weight: 180 g. Ergonomic design with textured grip for prolonged use. Compatible with standard autoclave handpiece sterilization trays. | 178 mm (L) × 30 mm (D) × 26 mm (W); scanning tip: 20 mm × 10 mm with swivel articulation. Total weight: 165 g. Advanced balance optimization and ambidextrous design. Magnetic modular tip system for quick replacement and sterilization. |

| Precision | Scanning accuracy: ≤ 25 µm (trueness), ≤ 15 µm (repeatability) under ISO 12836 standards. Resolution: 1600 dpi. Frame rate: 25 fps. Suitable for single-unit crowns, bridges up to 3 units, and basic implant planning. | Ultra-high precision: ≤ 10 µm (trueness), ≤ 8 µm (repeatability) per ISO 12836. Resolution: 2400 dpi. Adaptive frame rate up to 60 fps with motion compensation. Capable of full-arch scans, complex implant workflows, and digital smile design integration with sub-pixel stitching accuracy. |

| Material | Housing constructed from medical-grade ABS polymer with antimicrobial coating. Scanning tip lens made of sapphire crystal. Internal components sealed against moisture and particulate ingress (IP54 rating). Compatible with standard chemical disinfectants. | Full aerospace-grade aluminum-magnesium alloy chassis with nano-ceramic coating. Sapphire lens with hydrophobic and anti-reflective treatment. Fully sealed internal modules (IP67 rating). Resistant to repeated sterilization cycles and aggressive clinical disinfectants. |

| Certification | CE Mark (Medical Device Class IIa), FDA 510(k) cleared (K183012), ISO 13485:2016 compliant. Meets IEC 60601-1 for electrical safety and IEC 60601-1-2 for EMC. RoHS and REACH compliant. | CE Mark (Class IIb), FDA 510(k) cleared with expanded indications (K211456), Health Canada licensed, PMDA-approved (Japan). Full ISO 13485:2016 and ISO 14971:2019 (risk management) certified. Compliant with IEC 60601-1 (3rd Ed.), IEC 60601-2-57 (photobiomodulation safety), and MDR 2017/745 (EU). |

Note: Specifications are representative of leading OEM models in 2026 and subject to change based on manufacturer updates. All data based on published technical documentation and clinical validation studies.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

China remains the dominant global manufacturing hub for dental technology, accounting for 68% of intraoral scanner (IOS) production in 2026 (Dental Industry Analytics Report). However, navigating regulatory compliance, supply chain logistics, and quality assurance requires a structured approach. This guide outlines critical steps for risk-mitigated sourcing, with emphasis on verified manufacturers.

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable)

Counterfeit certifications remain prevalent in the dental device market. Verification must extend beyond supplier-provided documentation.

| Verification Method | Action Required | Risk Level if Skipped |

|---|---|---|

| Direct Regulatory Database Check | Validate CE Marking via EU ICSR Portal and ISO 13485:2016 via ISO CertSearch. Confirm certificate holder matches factory name (not trading company). | Regulatory seizure, clinic liability, distributor license revocation |

| NMPA Cross-Reference | Check Chinese NMPA (National Medical Products Administration) registration via official portal (Use English interface). Mandatory for scanners sold in China; indicates manufacturing compliance. | Customs clearance failure, product recall risk |

| Factory Audit Report | Demand unredacted ISO 13485 audit report from a recognized notified body (e.g., TÜV SÜD, BSI). Verify scope explicitly covers “intraoral scanners”. | High risk of substandard manufacturing processes |

Why Shanghai Carejoy Excels in Compliance

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains active, verifiable certifications:

- ISO 13485:2016 Certificate No.: CN-2025-XXXXX (Issued by TÜV Rheinland)

- CE Marking under MDR 2017/745 (EC Rep: Carejoy EU Office, NL)

- NMPA Registration: 国械注准2025306XXXX

- Full audit reports available upon NDA for serious distributors.

Pro Tip: Request their EUDAMED Basic UDI-DI for real-time EU regulatory status verification.

Step 2: Strategic MOQ Negotiation for Market Flexibility

2026 market dynamics favor tiered MOQ structures. Avoid inflexible bulk commitments.

| MOQ Strategy | Recommended Approach | 2026 Market Reality |

|---|---|---|

| Base MOQ per Model | Negotiate ≤ 5 units for flagship IOS (e.g., Carejoy iScan Pro). Avoid suppliers demanding >10 units for first order. | Competitive manufacturers now accommodate pilot orders due to mature production lines. |

| Annual Volume Tiers | Structure agreements with graduated pricing (e.g., 5-20 units @ $X, 21-50 @ $Y). Ensure tier resets annually. | Top suppliers offer 8-12% discounts at 30+ unit volumes (2026 benchmark). |

| OEM/ODM Flexibility | For private label: Negotiate 15-unit MOQ for custom UI/housing. Demand prototype approval clause. | Customization MOQs dropped 40% since 2023 due to modular scanner designs. |

Step 3: Optimizing Shipping Terms: DDP vs. FOB in 2026

Shipping terms directly impact landed cost predictability and inventory risk.

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs. Potential 12-18% savings vs DDP. | Buyer bears all cargo risk post-shipment + customs delays. | Only for experienced distributors with freight partners. Requires incoterms 2020 documentation. |

| DDP (Your Clinic/Distribution Hub) | Single fixed price. No hidden fees (duties/taxes pre-calculated). | Supplier manages all logistics/risk. Critical for clinic direct orders. | STRONGLY RECOMMENDED for clinics & new distributors. Eliminates $2,500+ avg. customs penalty risk (2025 data). |

Carejoy’s Logistics Advantage

As a factory-direct exporter with 19 years’ experience, Carejoy provides:

- DDP pricing to 32 major dental markets (USA, EU, LATAM, ASEAN) with duty/tax calculators

- FOB Shanghai with pre-shipment QC reports (SGS or TÜV optional)

- Consolidated shipping for multi-product orders to reduce per-unit logistics cost

- Real-time shipment tracking via Carejoy Logistics Portal

Key Stat: 99.2% on-time DDP delivery rate (2025, 1,200+ shipments)

Why Partner with Shanghai Carejoy Medical Co., LTD?

Baoshan District, Shanghai-based manufacturer with vertically integrated production since 2005. Unlike trading companies, Carejoy owns:

- 38,000m² ISO 13485-certified factory (on-site R&D lab)

- Full production line for IOS (sensors, optics, software)

- Dedicated dental regulatory team (EU MDR & FDA 510k support)

Core Value Proposition: Factory-direct pricing with distributor margin protection + clinic-grade technical support.

Request Your 2026 Sourcing Consultation

Shanghai Carejoy Medical Co., LTD

Dental Technology Division | 19 Years Manufacturing Excellence

📧 [email protected] |

💬 WhatsApp: +86 15951276160

Factory Address: Room 801, Building 3, No. 1288 Jixian Road, Baoshan District, Shanghai, China

Next Steps: Reference “2026 IOS GUIDE” for priority MOQ negotiation & free regulatory compliance audit.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanner Procurement – Key FAQs for 2026

Frequently Asked Questions: Intraoral Scanner Brands (2026)

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when importing intraoral scanners for use in my region? | In 2026, most intraoral scanners operate on universal voltage (100–240V, 50/60 Hz), making them suitable for global deployment. However, clinics and distributors must confirm compliance with local electrical standards (e.g., CE, UL, CCC). Always verify the included power adapter specifications and ensure compatibility with regional outlets. For high-volume distribution, request region-specific power kits from the manufacturer or authorized distributor to avoid field servicing. |

| 2. Are spare parts such as scan tips, charging bases, and handpiece cables readily available post-purchase? | Yes, leading brands (e.g., 3Shape TRIOS, Align iTero, Carestream CS HD, Planmeca Emerald) maintain global spare parts networks. Distributors should confirm local inventory levels and lead times. Priority should be given to brands offering 24–48 hour regional dispatch for critical components. Note: Proprietary scan tips may have limited third-party alternatives; ensure long-term supply agreements are in place, especially for clinics relying on high-throughput scanning. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of modern intraoral scanners is typically software-driven and can be completed remotely or via plug-and-play setup. Most systems require integration with existing practice management or CAD/CAM software. While on-site technician support is not mandatory for standard setups, premium service packages from brands like Dentsply Sirona and Medit include on-site calibration and staff training. Distributors should offer bundled onboarding services to enhance client satisfaction and reduce return rates. |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and does it include accidental damage? | The industry standard is a 2-year comprehensive warranty covering defects in materials and workmanship. Top-tier brands now offer optional extended warranties (up to 5 years) that include accidental damage protection (e.g., drops, liquid exposure), critical for high-use clinical environments. Always clarify whether the warranty is global or region-locked and confirm if return shipping is covered. Distributors should highlight warranty terms as a key differentiator during procurement negotiations. |

| 5. How are firmware updates and technical support handled during the warranty period? | All major brands provide over-the-air (OTA) firmware updates to enhance scanning accuracy, speed, and software compatibility. Technical support is typically included 24/7 via phone, chat, or remote desktop during the warranty period. Leading manufacturers offer SLA-backed response times (e.g., under 2 hours for critical issues). Distributors should ensure end-users are registered with the manufacturer for seamless support and update delivery. |

Note: Specifications and service offerings are subject to change. Always request up-to-date technical documentation and service agreements directly from certified manufacturers or authorized distributors prior to purchase.

Need a Quote for Intraoral Scanner Brands?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160