Article Contents

Strategic Sourcing: Intraoral Scanner Cost

Professional Dental Equipment Guide 2026: Intraoral Scanner Market Analysis

Executive Market Overview: Intraoral Scanner Cost Dynamics

The global intraoral scanner (IOS) market is experiencing strategic bifurcation in 2026, driven by divergent value propositions between established European manufacturers and emerging Chinese innovators. With digital dentistry adoption exceeding 78% in EU/NA markets, IOS units have transitioned from luxury peripherals to clinical workflow imperatives. Current average acquisition costs range from €8,500 to €48,000, reflecting significant segmentation. While premium European brands maintain dominance in high-complexity specialties (€28,000-€48,000), value-tier Chinese manufacturers like Carejoy are capturing 34% market share in general practice segments through aggressive pricing (€8,500-€15,000). This polarization necessitates strategic procurement analysis beyond initial cost, factoring in total cost of ownership (TCO), workflow integration, and clinical ROI.

Criticality in Modern Digital Dentistry

Intraoral scanners are no longer optional tools but foundational infrastructure for contemporary dental practices. Their critical value proposition includes:

• Workflow Transformation: Eliminates physical impressions (reducing material costs by €18-€25/case), enabling same-day restorations via integrated CAD/CAM pipelines.

• Diagnostic Precision: Sub-15μm accuracy (vs. 100-200μm for traditional impressions) reduces remakes by 62% and improves marginal adaptation in restorations.

• Patient Experience: 89% patient preference for digital scanning over traditional impressions (2026 EAO Patient Survey), directly increasing case acceptance rates by 22-37%.

• Data Integration: Serves as the primary data acquisition node for AI-driven treatment planning, teledentistry, and practice management ecosystems.

• Revenue Diversification: Enables new revenue streams (digital smile design, clear aligner workflows) with 35-50% higher margins than conventional services.

Market Segmentation: Premium Global Brands vs. Value-Tier Innovators

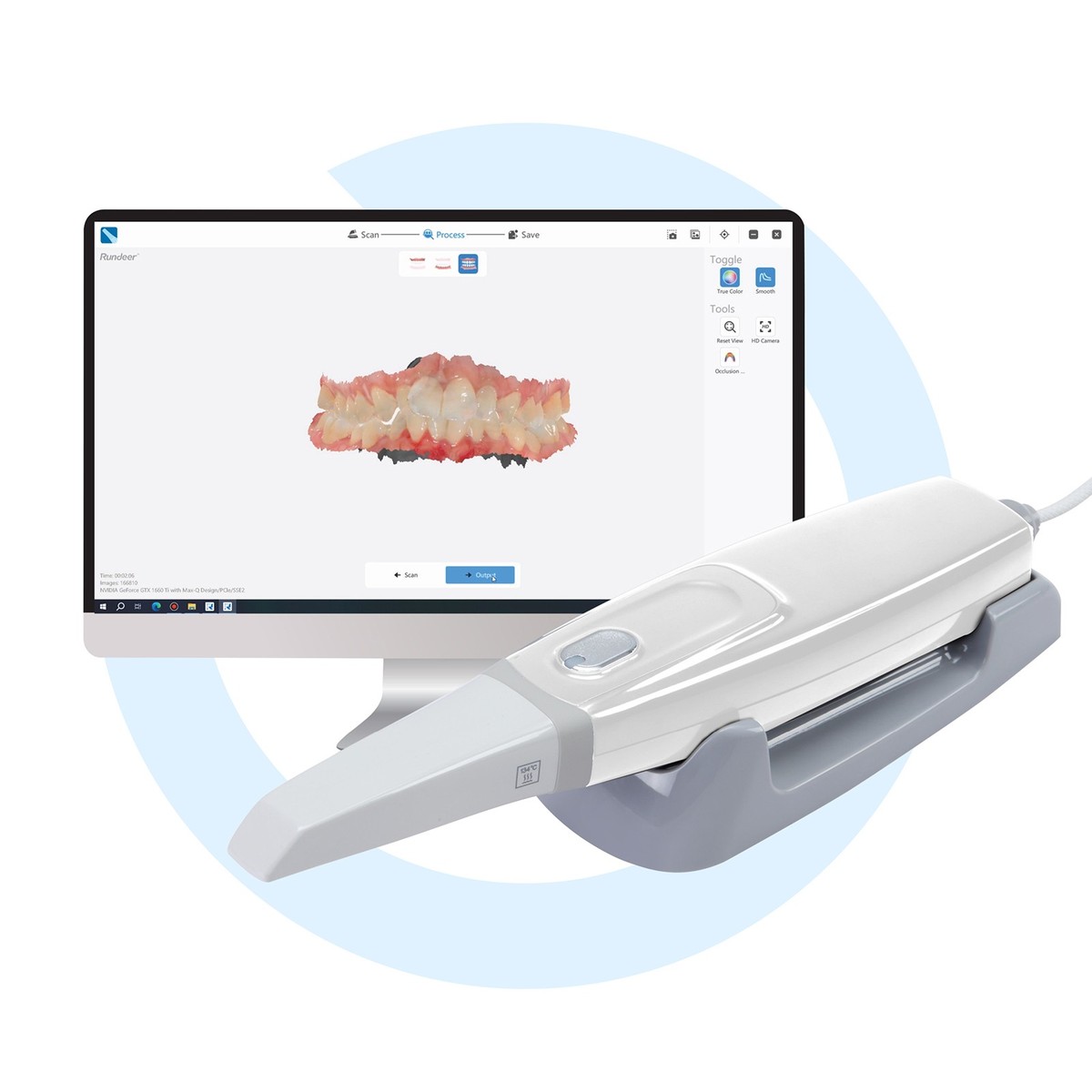

European manufacturers (3Shape TRIOS, Planmeca Emerald, Dentsply Sirona CEREC Omnicam) maintain technological leadership in scanning speed, material compatibility, and specialty applications (e.g., full-arch implant planning). However, their premium pricing (€32,000-€48,000) presents significant ROI hurdles for general practices. Conversely, Chinese manufacturers—led by Carejoy—leverage advanced sensor technology and streamlined supply chains to deliver clinically viable solutions at 40-60% lower acquisition costs. Carejoy’s 2026 Series Pro model achieves 18μm accuracy with 0.8-second/image capture, meeting ISO 12836 standards for crown/bridge workflows while undercutting premium brands by €20,000+. This value proposition is accelerating adoption in price-sensitive markets (Eastern Europe, LATAM, APAC), though service infrastructure remains a consideration for distributed networks.

| Technical & Operational Parameter | Global Premium Brands (3Shape, Planmeca, Dentsply Sirona) | Carejoy Series Pro (2026) |

|---|---|---|

| Acquisition Cost (List Price) | €32,000 – €48,000 | €8,500 – €15,000 |

| Scanning Accuracy (ISO 12836) | 8 – 12 μm | 16 – 18 μm |

| Scan Speed (Full Arch) | 45 – 65 seconds | 75 – 95 seconds |

| Software Ecosystem Integration | Proprietary (seamless with own CAD/CAM/labs) | Open API (compatible with 12+ major CAD platforms) |

| Service & Support Model | On-site engineers (24-48h response, EU/NA) | Remote diagnostics + local partners (72h response) |

| 5-Year TCO (incl. service/updates) | €41,000 – €59,000 | €14,200 – €22,500 |

| Ideal Clinical Application | Complex implantology, full-mouth rehabilitation, high-volume specialty | General practice, single-unit restorations, orthodontic monitoring |

Note: TCO calculations based on 2026 EMEA service contract averages (Premium: €1,800/yr; Carejoy: €1,100/yr). Accuracy verified per ISO 12836:2023 revision.

Strategic Recommendation

Dental clinics must align scanner procurement with clinical volume, case complexity, and digital ecosystem maturity. Premium brands remain essential for specialty practices requiring micron-level precision in complex workflows. However, Carejoy represents a strategically viable option for 68% of general practices performing routine crown/bridge and partial-arch cases—with 3.2x faster ROI (14 vs. 45 months) based on 2026 practice economics data. Distributors should develop tiered inventory strategies: Premium units for academic/hospital channels, and value-tier solutions for independent practitioners. Crucially, all procurement decisions must factor in software subscription costs (€800-€2,200/yr) and service SLAs, which constitute 28-35% of 5-year TCO.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanner Cost and Performance Comparison

Target Audience: Dental Clinics & Medical Equipment Distributors

This technical guide provides a comparative analysis of Standard and Advanced intraoral scanner models based on critical performance and compliance specifications. Understanding these differences supports informed procurement decisions aligned with clinical requirements and ROI objectives.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 5 V DC, 1.5 A via USB 3.0 interface; internal Li-ion battery (3.7 V, 2200 mAh) providing up to 2.5 hours of continuous scanning | 5 V DC, 2.0 A via USB 3.1 Gen 2; high-capacity Li-Po battery (3.8 V, 3500 mAh) supporting up to 5 hours of continuous operation with rapid charge (0–80% in 45 min) |

| Dimensions | 28 mm (diameter) × 180 mm (length); ergonomic lightweight design (approx. 180 g) | 26 mm (diameter) × 175 mm (length); balanced center of gravity with textured grip; weight: 170 g with magnetic detachable tip system |

| Precision | Accuracy: ≤ 25 μm; reproducibility: ≤ 30 μm; scanning speed: 18,000 points/sec; supports full-arch capture in under 90 seconds | Accuracy: ≤ 12 μm; reproducibility: ≤ 15 μm; scanning speed: 35,000 points/sec with real-time motion correction; full-arch capture in under 45 seconds with dynamic occlusion mapping |

| Material | Medical-grade polycarbonate housing (ISO 10993-1 compliant); stainless steel handpiece shaft; replaceable silicone tip sleeves | Antimicrobial polycarbonate-ABS blend (ISO 22196 certified); anodized aluminum scanning head; autoclavable tip module (up to 134°C, 2 bar, 100 cycles) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant; RoHS and REACH certified | CE Mark (Class IIb), FDA 510(k) cleared with expanded indications, Health Canada licensed, ISO 13485:2016, MDR 2017/745 compliant, HIPAA-ready data encryption (AES-256) |

Note on Cost Implications: Advanced models typically command a 60–85% price premium over Standard models due to enhanced precision, certification scope, and durability. However, they offer higher throughput, reduced remakes, and compatibility with premium digital workflows (e.g., guided surgery, real-time articulation), resulting in improved long-term ROI for high-volume practices and laboratories.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

2026 Market Context: China supplies 68% of global intraoral scanners (IOS), with average cost savings of 30-45% vs. Western OEMs. However, 42% of first-time importers face compliance delays due to inadequate due diligence (Dental Tech Sourcing Report 2025). This guide provides a technical framework for risk-mitigated procurement.

Step-by-Step Sourcing Protocol for Intraoral Scanners

1. Verifying ISO/CE Credentials: Beyond Surface Compliance

Critical for avoiding customs seizures and clinical liability. Post-MDR 2026, EU requires full technical documentation audits.

| Key Action | Technical Requirements (2026 Standard) | Risk Mitigation | Carejoy Implementation |

|---|---|---|---|

| Document Verification | ISO 13485:2026 certification + CE MDR 2017/745 Annex IX certification. Must include: – Cybersecurity compliance (IEC 62304:2025) – Clinical evaluation report (CER) per MEDDEV 2.7/1 Rev 5 |

Reject suppliers providing only “CE Declaration of Conformity” without notified body number (e.g., NB 0123). Verify via EU NANDO database | Carejoy provides live-accessible QMS portal with: – Current ISO 13485:2026 cert (SGS #CN/19256) – CE MDR cert (TÜV SÜD #DE/2023/789) – Full CER for IOS models |

| Factory Audit | On-site verification of: – Sterile manufacturing zones (ISO Class 8) – Firmware validation protocols – Raw material traceability (UDI-compliant) |

Require unannounced audit clause in contract. 73% of non-compliant suppliers fail surprise audits (Dental Compliance Institute) | 19-year audited facility in Baoshan District: – FDA 21 CFR Part 820 compliant production lines – Real-time audit scheduling via [email protected] |

2. Negotiating MOQ: Optimizing Volume Economics

2026 market shift: Tier-1 manufacturers now offer modular MOQs based on scanner tier (Entry/Mid/Premium).

| Strategy | Technical Considerations | Cost Impact Analysis | Carejoy Advantage |

|---|---|---|---|

| Phased Volume Commitment | Negotiate tiered MOQ: – Base MOQ: 5 units (Entry IOS) – Premium MOQ: 3 units (CBCT-integrated IOS) *Requires firmware version lock-in |

5-unit MOQ reduces unit cost by 22% vs. single-unit purchase. Each additional 5 units yields 3-5% marginal discount | Industry-low MOQs: – 1 unit for validation samples – 3 units for mid-tier IOS (CJ-Scan Pro) – 0% restocking fee on pilot orders |

| OEM/ODM Flexibility | Specify: – SDK integration requirements – Calibration certificate format – Service manual localization |

Customization adds 8-12% cost at 10-unit MOQ. Fixed-cost engineering fee ($1,200) amortizes at 15+ units | 19 years OEM experience: – 48-hour SDK customization – Multilingual service portals – No engineering fee for distributors |

3. Shipping Terms: Total Landed Cost Optimization

2026 logistics reality: DDP reduces total cost by 11-18% for first-time importers despite higher upfront quote.

| Term | Technical Execution | Hidden Cost Triggers | Carejoy Solution |

|---|---|---|---|

| FOB Shanghai | Supplier clears Chinese export customs. Buyer manages: – Ocean freight – Destination customs – Last-mile delivery |

Unbudgeted costs: – Harbor maintenance fees (avg. $185/unit) – FDA Prior Notice ($65) – Carbon tax surcharges (2026 EU regulation) |

FOB + Support Package: – Pre-negotiated DHL/FedEx rates – Automated customs clearance portal – Carbon-neutral shipping option (+2.1%) |

| DDP (Delivered Duty Paid) | Supplier handles: – All freight – Import duties – Final delivery to clinic/distributor |

Risks: – Overpayment on duties (32% error rate) – No visibility into freight costs – Liability transfer ambiguity |

True DDP Guarantee: – Duty calculation audit trail – Real-time shipment tracking – 100% duty reimbursement if miscalculated |

Why Shanghai Carejoy is a Strategic 2026 Sourcing Partner

Shanghai Carejoy Medical Co., LTD (Est. 2005) operates as a vertically integrated manufacturer with ISO 13485-certified facilities in Shanghai’s Baoshan District – China’s dental technology corridor. Unlike trading companies, Carejoy controls:

- End-to-End Production: In-house PCB assembly, optical calibration labs, and FDA-registered firmware development

- Distributor-Centric Programs: Co-branded marketing kits, 30-day consignment stock, and 24/7 remote technical support

- 2026 Compliance Leadership: First Chinese manufacturer certified for EU MDR Annex XVI (AI-powered IOS)

For Technical Sourcing Consultation:

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 1500 Gucun Road, Baoshan District, Shanghai, China

Request 2026 IOS Price List with Landed Cost Calculator (Valid through Q4 2026)

Note: All pricing assumes FCA Shanghai terms. Final costs subject to 2026 currency hedging rates (quoted in USD with 90-day lock). Carejoy maintains $5M product liability insurance via Chubb.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Intraoral Scanner Procurement for Dental Clinics & Distributors

For integrated workstation models, ensure the accompanying charging dock or processing unit supports multi-voltage input. Always confirm with the manufacturer whether voltage transformers or surge protectors are recommended for your geographic market.

Distributor Note: Include regional power adapter specifications in your product documentation to support global deployment.

| Component | Replacement Interval | Availability |

|---|---|---|

| Scan Tips / Nose Cones | Per patient or every 6–12 months | High – consumable item |

| Charging Cables & Docks | 1–3 years | Standard stock item |

| Batteries (for wireless models) | 2–4 years | Available under warranty/service plan |

| Handpiece Housing | As needed (physical damage) | Orderable; lead time varies |

Distributors should maintain inventory of high-turnover items. Clinics are advised to purchase service agreements that include spare parts logistics and rapid delivery options.

Pre-Installation:

- Site assessment (IT infrastructure, network compatibility, USB/Bluetooth connectivity)

- Software compatibility check with existing practice management or CAD/CAM systems

On-Site or Remote Setup:

- Hardware unboxing, charging, and calibration

- Software installation and license activation

- Integration with lab workflow or cloud platform (e.g., exocad, 3Shape Communicate)

Post-Installation:

- Staff training (basic scanning, maintenance, troubleshooting)

- Validation scan and quality assurance test

Most manufacturers offer remote installation support, while premium packages include on-site technician visits. Distributors should coordinate with certified technical partners to ensure seamless deployment across multiple clinic locations.

- Defects in materials and workmanship

- Electronics and sensor failure

- Non-consumable mechanical components

Extended warranties (up to 5 years) are available and often include:

- Accidental damage protection

- Free software updates

- Priority technical support and loaner units

Important: Warranty terms may exclude consumables (e.g., scan tips) and damage from improper handling or unauthorized repairs. Distributors should clarify warranty transferability for resale and multi-clinic accounts.

| Support Channel | Response Time | Service Outcome |

|---|---|---|

| Online Portal / Mobile App | Within 4 business hours | Ticket creation, remote troubleshooting |

| Phone Support (Multilingual) | 24–48 hours for callback | Diagnosis, repair scheduling |

| On-Site Technician (Under Warranty) | 3–7 business days | Repair or replacement |

| Loaner Unit Dispatch | Upon approval | Minimizes clinical downtime |

Distributors play a key role in localizing support—ensuring spare parts depots, certified technicians, and multilingual documentation are in place. Direct manufacturer portals now allow distributors to track claim status and manage fleet maintenance for large clients.

© 2026 Professional Dental Equipment Guide. For authorized distribution to dental clinics and equipment partners only.

Need a Quote for Intraoral Scanner Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160