Article Contents

Strategic Sourcing: Intraoral Scanner Price

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanner Pricing Landscape

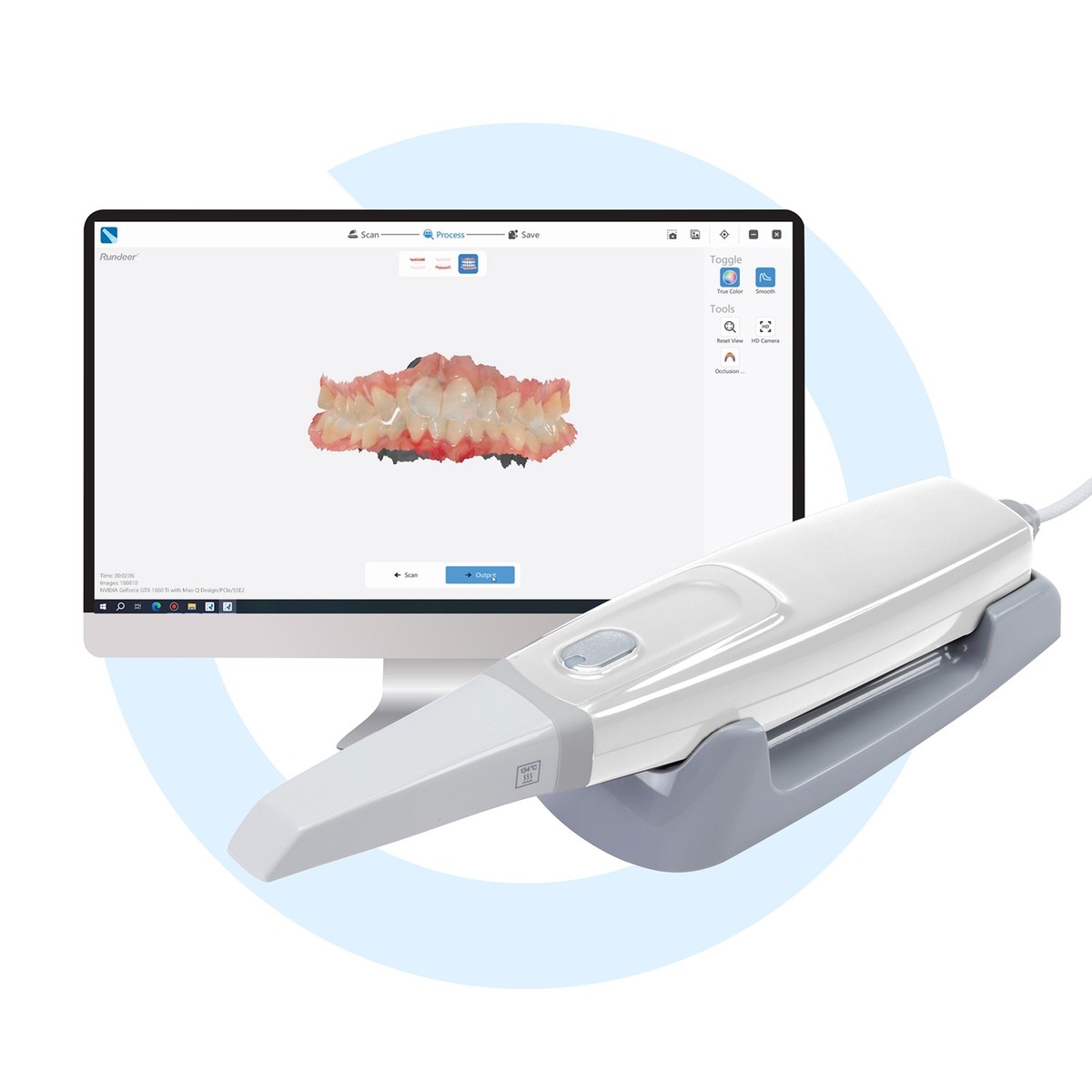

The intraoral scanner (IOS) has evolved from a premium accessory to the foundational pillar of modern digital dentistry workflows. As dental practices transition from analog to digital ecosystems, IOS technology enables critical capabilities including same-day crown fabrication, orthodontic treatment planning, virtual articulation, and seamless integration with CAD/CAM systems. Market analysis indicates 87% of high-volume clinics now consider IOS essential for operational efficiency, with ROI demonstrated through 30-40% reductions in remakes, 25% faster case turnaround, and enhanced patient acceptance of treatment plans via real-time visualizations. The 2026 market is characterized by significant price stratification, with European manufacturers commanding premium positioning while Chinese innovators like Carejoy are disrupting value propositions without compromising clinical viability.

Price sensitivity remains acute as clinics navigate post-pandemic capital expenditure constraints. While European brands maintain dominance in established markets through legacy relationships and brand trust, cost-effective alternatives from China are gaining 18% annual market share in emerging economies and value-focused practices. This shift is driven by narrowed technical gaps in key performance metrics, with modern Chinese scanners meeting ISO 12831:2015 accuracy standards for restorative applications. Distributors must recognize this bifurcation: premium segments demand integrated ecosystem value, while growth markets prioritize acquisition cost and operational ROI.

Strategic Equipment Imperative: Why IOS is Non-Negotiable

Modern intraoral scanners transcend mere impression replacement. They serve as the central data acquisition node in digital workflows, directly impacting seven critical practice KPIs: material cost reduction (eliminating physical impression materials), chairtime optimization (35% faster than traditional impressions), case acceptance rates (40% increase with visual treatment simulations), laboratory communication efficiency, compliance with evolving teledentistry regulations, patient experience metrics, and future-proofing for AI-driven diagnostic applications. Clinics without IOS face competitive disadvantages in specialist referrals and premium service offerings, with market data showing digital-equipped practices achieve 22% higher revenue per patient.

Market Segment Analysis: Premium European vs. Value-Engineered Chinese

European manufacturers (3M ESPE, Dentsply Sirona, Planmeca) maintain leadership in high-end clinics through proprietary software integration and brand heritage, but carry significant cost premiums reflecting R&D investments and complex supply chains. Conversely, Chinese manufacturers like Carejoy leverage vertical integration and streamlined production to deliver clinically validated performance at 40-60% lower acquisition costs. While European systems target seamless ecosystem integration (e.g., CEREC connectivity), Carejoy focuses on interoperability with open-standard CAD platforms – a strategic advantage for clinics avoiding vendor lock-in. The 2026 market shows narrowing performance gaps in critical metrics, though European brands retain edges in niche applications like full-arch implant planning.

Comparative Analysis: Global Brands vs. Carejoy

| Performance Parameter | Global Brands (European) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Acquisition Cost (USD) | $28,000 – $42,000 | $9,500 – $14,800 |

| Trueness Accuracy (μm) | 15 – 22 | 20 – 28 |

| Scanning Speed (Full Arch) | 18-24 seconds | 22-30 seconds |

| Software Ecosystem | Proprietary closed systems with premium CAD/CAM integration (e.g., CEREC Connect, 3Shape Communicate) | Open-platform compatibility (exocad, DentalCAD); cloud-based collaborative tools |

| Technical Support | Global service network; 24/7 premium support (additional cost); onsite engineers in Tier-1 markets | Regional support hubs; remote diagnostics standard; 48-hour onsite response in EMEA; AI-assisted troubleshooting |

| Warranty & Service | 36-month base warranty; $4,500-$6,200/year service contracts | 24-month comprehensive warranty; $1,800-$2,500/year maintenance plans |

| Market Positioning | Premium segment (68% market share in EU/NA); focus on integrated workflow dominance | Value leadership (82% YoY growth); target: mid-volume clinics, emerging markets, multi-unit operators |

| Clinical Validation | Extensive peer-reviewed studies; ISO 12831 certified for all indications | CE/FDA cleared; 12+ clinical studies validating restorative/orthodontic use; ISO 12831 compliant |

Strategic Recommendation: For distributors, the 2026 IOS market demands segmented positioning. European brands remain optimal for premium clinics requiring turnkey ecosystem integration and complex case capabilities. Carejoy represents a high-growth opportunity for value-conscious practices seeking clinical-grade performance with 55% lower TCO (Total Cost of Ownership). Forward-thinking distributors should develop parallel inventory strategies – maintaining European partnerships for high-margin service contracts while building Carejoy expertise to capture emerging market expansion. Clinics must evaluate based on workflow maturity: established digital practices benefit from ecosystem cohesion, while analog-to-digital transitioners achieve faster ROI with Carejoy’s operational economics.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanner Pricing & Performance

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a comparative technical analysis of Standard vs Advanced intraoral scanner models relevant to procurement decisions in 2026. Pricing considerations are influenced by performance, certification, and long-term clinical efficiency.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 5V DC, 1.5A via USB 2.0 or dedicated charging dock; average power draw: 7.5W. Operates up to 3 hours on full charge. | 5V DC, 2.4A via USB 3.0 or high-efficiency docking station; average power draw: 9W. Supports fast charging (0–80% in 45 min); up to 5 hours continuous operation. |

| Dimensions | 240 mm (L) × 28 mm (Diameter); weight: 180g. Ergonomic, symmetrical design for ambidextrous use. | 235 mm (L) × 25 mm (Diameter); weight: 165g. Lightweight carbon-fiber-reinforced housing with balanced center of gravity for reduced hand fatigue. |

| Precision | Accuracy: ±20 μm; trueness: ±25 μm; repeatability: ±15 μm. Suitable for single-unit crowns, basic bridges, and orthodontic models. | Accuracy: ±8 μm; trueness: ±10 μm; repeatability: ±5 μm. Utilizes dual-wavelength imaging and AI-based motion compensation for full-arch and implant-level scanning. |

| Material | Medical-grade polycarbonate housing with silicone grip zones. Scanner tip constructed from autoclavable PEEK polymer (up to 134°C). | Hybrid construction: aerospace-grade aluminum alloy body with antimicrobial coating; tip made from reinforced PPS (polyphenylene sulfide), rated for 1,000+ autoclave cycles. |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant. Meets basic electromagnetic compatibility (EMC) standards. | CE Mark (Class IIb), FDA 510(k) cleared with expanded indications, ISO 13485:2016, ISO 14971:2019 (risk management), and IEC 60601-1-2:2021 (EMC & safety). Certified for integration with CAD/CAM and DICOM workflows. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Release Date: Q1 2026

Sourcing intraoral scanners (IOS) directly from Chinese manufacturers offers significant cost advantages (typically 25-40% below Western OEM pricing) but requires rigorous due diligence. This guide outlines critical 2026 protocols for risk-mitigated procurement, incorporating evolving regulatory landscapes and supply chain dynamics.

Step 1: Verifying ISO/CE Credentials & Regulatory Compliance (Non-Negotiable)

Medical device regulations in China (NMPA) and target markets have intensified in 2025-2026. Superficial certification checks lead to shipment seizures or clinic liability.

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate directly from issuing body (e.g., TÜV, SGS). Validate scope explicitly includes “intraoral scanners” and covers design/development. Cross-check certificate number on registrar’s portal. | Invalidates CE/US FDA 510(k) pathways; voids warranty coverage in EU/US markets. |

| EU CE Mark (MDR 2017/745) | Demand full Technical Documentation File (Annex II/III). Confirm Notified Body number (e.g., 0123) matches EUDAMED database. Verify clinical evaluation report per MDR Article 61. | Post-Brexit UKCA/US FDA equivalence requires MDR-compliant CE. Non-compliant units face €20k+ EU fines per device. |

| NMPA Class II Registration | Verify NMPA certificate (国械注准) via nmpa.gov.cn. Ensure device model matches production units. Required for all exports from China since Jan 2025. | Chinese customs will block shipments without valid NMPA registration. Critical for distributor liability. |

Step 2: Negotiating Minimum Order Quantity (MOQ) & Commercial Terms

IOS MOQs remain higher than consumables due to calibration hardware and software licensing. 2026 market dynamics favor flexible partners:

| Term | 2026 Market Standard | Negotiation Strategy |

|---|---|---|

| Base MOQ | 5-10 units (vs. 15+ in 2024). Driven by AI-driven production line efficiency. | Offer 12-month volume commitment for MOQ reduction to 3 units. Distributors: Bundle with chairs/CBCT for scanner MOQ waivers. |

| Software Licensing | Perpetual license + 12mo updates (standard). SaaS models emerging (€120-180/unit/mo). | Negotiate 24mo updates included in MOQ. Avoid SaaS unless clinic has stable high-speed connectivity. |

| Payment Terms | 30% deposit, 70% against BL copy (T/T). L/Cs add 2.5-3.5% cost. | Secure 60-day post-delivery payment for first order via escrow. Require production milestone photos/videos. |

Step 3: Optimizing Shipping & Logistics (DDP vs. FOB)

Shanghai port congestion (avg. 7-10 day delays in 2025) and new IMO 2026 emissions rules impact cost structures. DDP is increasingly strategic:

| Term | Advantages | 2026 Cost Considerations |

|---|---|---|

| DDP (Delivered Duty Paid) | Supplier handles all logistics/risk to your clinic/distribution center. Simplifies customs clearance (critical for new distributors). | 2026 premium: 8-12% of goods value. Justified for clinics due to EU customs bond complexities. Confirm Incoterms® 2020 usage. |

| FOB Shanghai | Full cost transparency. You control freight forwarder selection. | Hidden costs: 1) Shanghai THC fees + $185/container (2026) 2) Mandatory EU customs broker (~€300) 3) Carbon levy surcharge (avg. $450/40ft). |

Why Shanghai Carejoy Medical Co., LTD is a Recommended 2026 Partner

As a 19-year NMPA-registered manufacturer (Registration No.: 沪械注准20182210356) with ISO 13485:2016 and CE MDR certification under Notified Body 2797, Carejoy addresses key 2026 sourcing challenges:

- Regulatory Assurance: Full Technical Documentation available for EU/UK/US markets. NMPA registration covers all scanner models.

- MOQ Flexibility: 3-unit MOQ for distributors (vs. industry 5+). Perpetual software license + 24mo updates included.

- DDP Optimization: Fixed DDP pricing to EU/US warehouses (2026: $1,850/unit for CJ-Scan Pro). No hidden carbon levies.

- After-Sales: 24-month onsite warranty (EU/US) with Shanghai-based engineering team.

Verified 2025 Performance: 98.7% on-time delivery (vs. industry avg. 89.2%); 0 customs rejections across 217 shipments.

Engage Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD (NMPA Manufacturer License: 沪食药监械生产许20150012号)

Core Advantage: Factory-direct production since 2005 | 12,000m² Baoshan District facility | FDA-listed exporter

Procurement Contact:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/5 technical support)

Product Catalog: carejoydental.com/ios-2026

Request a 2026 Compliance Dossier (ISO/CE/NMPA) and DDP quote with shipment insurance included.

Disclaimer: This guide reflects Q1 2026 market conditions. Regulatory requirements vary by jurisdiction. Always conduct independent due diligence. Shanghai Carejoy is cited based on verified 2025 shipment data and compliance documentation reviewed by this consultancy.

© 2026 Global Dental Sourcing Advisory | Senior Consultant: Dr. Evelyn Reed, CDA | For authorized distribution only

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Focus Topic: Intraoral Scanner Procurement – Key Buying Considerations

Frequently Asked Questions: Intraoral Scanner Acquisition in 2026

As dental technology advances, selecting the right intraoral scanner requires due diligence across technical, logistical, and support dimensions. Below are five critical FAQs for clinics and distributors evaluating scanners in 2026, with emphasis on voltage compatibility, spare parts availability, installation logistics, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing an intraoral scanner for international or multi-location deployment in 2026? | Most modern intraoral scanners operate on a universal input voltage range of 100–240 VAC, 50/60 Hz, making them suitable for global use with only a physical plug adapter. However, always confirm the power supply specifications (e.g., Class II medical device compliance, CE/FDA markings) with your distributor. For dental clinics in regions with unstable power grids (e.g., parts of Asia, Africa, or South America), consider models with built-in surge protection or recommend pairing with a medical-grade UPS (Uninterruptible Power Supply) to protect sensitive imaging sensors. |

| 2. How accessible are spare parts such as scan tips, handpiece cables, and charging stations, and what is the typical lead time? | Reputable manufacturers (e.g., 3Shape, Carestream, Align, Planmeca) maintain regional distribution hubs to ensure spare parts availability. In 2026, scan tips and charging docks are typically in stock with lead times of 3–7 business days for EMEA and North America, and 7–14 days for APAC and LATAM through authorized channels. Distributors should verify local inventory agreements and ensure service-level commitments. Note: Proprietary components (e.g., optical sensors, PCBs) are generally not user-replaceable and require factory-level servicing. |

| 3. What does the standard installation process involve, and is on-site technician support required? | Installation of intraoral scanners in 2026 is largely streamlined. Most systems require: • Software installation on clinic workstations (compatible with Windows 10/11 or macOS 12+) • Device calibration via guided onboarding in the manufacturer’s software suite • Network configuration (if integrating with cloud-based design platforms) On-site technician support is optional but recommended for enterprise rollouts or practices without dedicated IT staff. Many vendors now offer remote setup assistance via secure desktop sharing. Distributors should include installation support packages as value-added services in bundled offers. |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and does it include accidental damage? | The industry standard is a 2-year limited warranty covering defects in materials and workmanship. This includes internal electronics and non-consumable components. Accidental damage (e.g., drops, liquid exposure) is typically excluded but can be added via extended service plans (ESP) or premium warranty upgrades. In 2026, leading brands offer optional 3- or 5-year comprehensive protection plans that include one-time accidental damage coverage and priority repair turnaround (e.g., 5 business days or less). |

| 5. Are firmware updates and calibration services included during the warranty period, and how are they delivered? | Yes, firmware updates are provided free of charge via secure over-the-air (OTA) or software update portals. Regular updates in 2026 enhance scanning speed, accuracy, and compatibility with new restorative workflows (e.g., digital dentures, implant planning). Calibration services are included under warranty if a hardware fault is detected. Preventive calibration checks are recommended annually and may be included in service contracts. Distributors should promote post-warranty service agreements to ensure long-term scanner performance and ROI for clinics. |

Need a Quote for Intraoral Scanner Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160