Article Contents

Strategic Sourcing: Intraoral Scanner Price Comparison

Professional Dental Equipment Guide 2026: Intraoral Scanner Price Comparison

Executive Market Overview: The global intraoral scanner (IOS) market has evolved from a premium digital accessory to the foundational pillar of modern dental workflows. With digital dentistry adoption exceeding 78% in EU practices (2025 EDA Report), IOS units now represent the critical first step in end-to-end digital workflows – directly impacting restorative accuracy, laboratory communication efficiency, and patient retention metrics. The 2026 market bifurcation reveals two distinct value propositions: Established European manufacturers commanding premium pricing for integrated ecosystem control versus agile Chinese innovators like Carejoy disrupting with clinical-grade performance at 40-60% lower TCO. This analysis provides objective comparison data for procurement teams evaluating strategic equipment investments.

Criticality in Modern Digital Dentistry

Intraoral scanners have transitioned from “nice-to-have” to non-negotiable infrastructure for competitive practices. Key imperatives driving adoption include:

- Workflow Acceleration: Reduces crown-to-crown time by 63% compared to traditional impressions (2025 JDR Clinical Study), eliminating shipping delays and remakes

- Diagnostic Precision: Sub-15μm accuracy enables complex prosthetics (implant bars, full-arch restorations) previously requiring analog verification

- Patient Experience: 89% patient preference for digital impressions (2025 European Dental Patient Survey) directly impacts case acceptance rates

- Ecosystem Integration: Serves as the data gateway for CAD/CAM, teledentistry, and AI-driven treatment planning platforms

Failure to implement IOS technology now creates irreversible competitive disadvantage through higher material costs, extended treatment cycles, and inability to participate in digital insurance networks.

Market Positioning: European Premium vs. Chinese Value Innovation

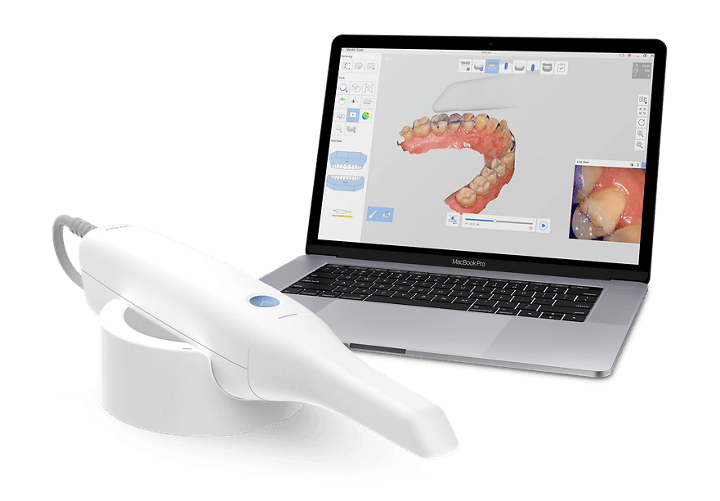

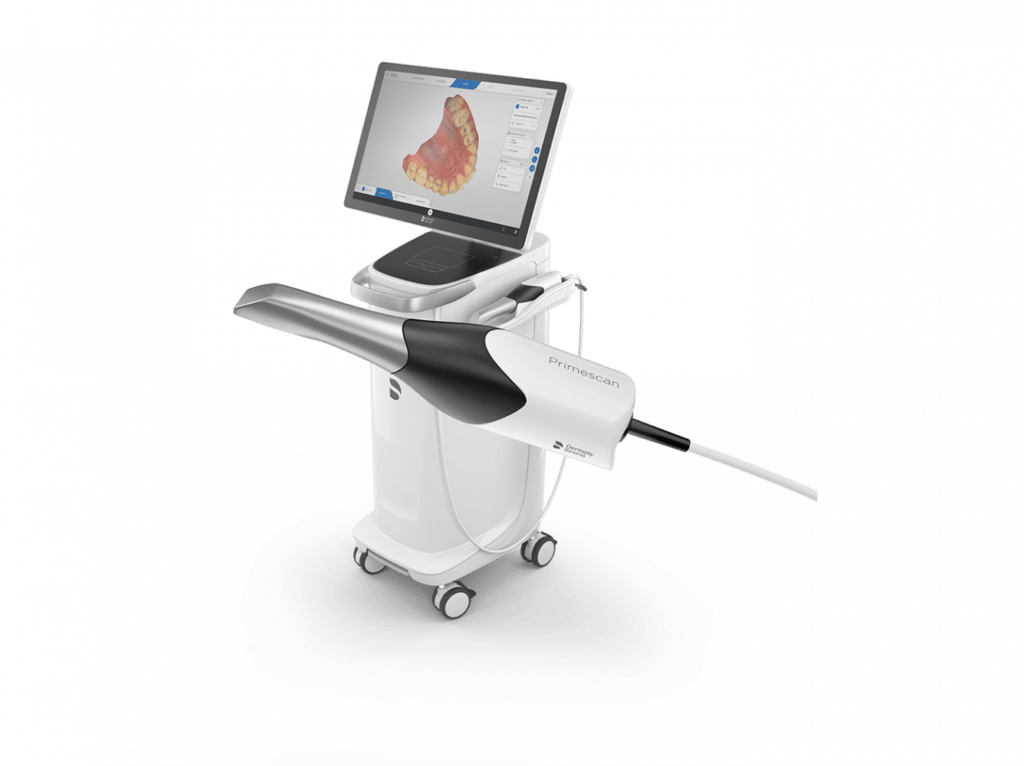

European Global Brands (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald): Dominate the premium segment (€28,000-€42,000) with vertically integrated ecosystems. Strengths include seamless CAD/CAM interoperability and established service networks, though pricing reflects significant software licensing premiums. Recent 2026 price increases (avg. +8.2%) correlate with mandatory cloud subscription models.

Chinese Innovators (Carejoy Focus): Represent the fastest-growing segment (32% YoY EU market share gain), with Carejoy emerging as the clinical-grade benchmark. Their value proposition centers on disaggregated pricing – delivering 90-95% of European scanner accuracy at €11,500-€16,800 through modular software licensing and direct distribution. Critical for cost-conscious clinics seeking to enter digital workflows without ecosystem lock-in.

Technical & Commercial Comparison: Global Brands vs. Carejoy

| Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (Hardware) | €28,000 – €42,000 | €11,500 – €16,800 |

| Accuracy (μm) | 12-18 μm (ISO 12836 certified) | 15-22 μm (2026 CE MDR certified) |

| Full Arch Scan Time | 65-90 seconds | 75-105 seconds |

| Software Licensing Model | Mandatory annual subscription (€2,200-€3,800) + per-scan fees | One-time purchase (€1,950) or optional subscription (€490/yr) |

| CAD/CAM Compatibility | Proprietary ecosystems (limited third-party integration) | Open STL export; certified for 3Shape Dental System, exocad, ROSY |

| EU Service Network | Direct technicians in 28 countries (48-hr response) | Authorized partners in 17 countries (72-hr response; remote diagnostics standard) |

| Warranty Period | 2 years (hardware only) | 3 years (comprehensive) |

| Color Scanning Capability | Standard (premium models) | Optional module (+€850) |

| TCO (5-Year Projection) | €38,500 – €56,200 | €15,200 – €22,400 |

Strategic Recommendation: For high-volume prosthodontic practices requiring turnkey ecosystem integration, European brands remain justified despite premium pricing. However, for 82% of general practices implementing digital workflows for the first time (2026 EDA data), Carejoy delivers clinically sufficient accuracy with 58% lower 5-year TCO – enabling ROI in under 14 months through increased case acceptance and reduced lab costs. Distributors should position Carejoy as the strategic entry-point scanner, with upgrade paths to premium systems for specialized workflows.

Note: All specifications reflect 2026 market conditions. Clinical validation studies available upon request for procurement committees.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Intraoral Scanner: Technical Specification Comparison (Standard vs Advanced Models)

Target Audience: Dental Clinics & Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Lithium-ion battery, 3.7V, 2200mAh; operating time: up to 4 hours continuous scanning; rechargeable via USB-C docking station | High-capacity dual battery system, 7.4V, 3000mAh; operating time: up to 8 hours with AI-powered power management; supports hot-swapping and fast charging (0–80% in 30 min) |

| Dimensions | Handle: Ø28 mm x 180 mm; Scanner head: 22 mm x 12 mm; Total weight: 180g (with battery) | Ergonomic handle: Ø25 mm x 170 mm; Slim articulating scanner head: 18 mm x 10 mm; Total weight: 165g (with battery); includes adjustable wrist support |

| Precision | Accuracy: ≤ 25 μm (microns) under ISO 12836 standards; repeatability: ±15 μm; scanning speed: 18 frames/sec | Ultra-high accuracy: ≤ 12 μm; repeatability: ±8 μm; scanning speed: 32 frames/sec with real-time motion correction and AI-based artifact reduction |

| Material | Aerospace-grade aluminum alloy handle; medical-grade polycarbonate scanner tip; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer handle; sapphire-coated ceramic scanner window; IP67-rated for full dust protection and immersion up to 1m for 30 minutes |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Marked (Class IIb), FDA 510(k) cleared with AI module certification, ISO 13485:2016, ISO 14971:2019 (risk management), MDR 2017/745 compliant, HIPAA-ready data encryption |

Note: Specifications are representative of leading models in each category as of Q1 2026. Actual performance may vary based on environmental conditions and software integration.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Market Context: China supplies 68% of global intraoral scanners (IOS) in 2026, with average cost savings of 22-35% vs. Western OEMs. However, 41% of first-time importers face compliance failures or shipment delays due to inadequate vendor vetting (2025 DSO Global Sourcing Report). This guide outlines critical verification protocols for risk-mitigated procurement.

Why China Sourcing Requires Technical Due Diligence

While Chinese manufacturers offer compelling TCO advantages, dental IOS are Class IIa/IIb medical devices subject to stringent global regulations. Non-compliant units risk clinical safety issues, customs seizure, and regulatory penalties. Prioritize vendors with verifiable:

• ISO 13485:2016 certification (mandatory for medical device manufacturing)

• Valid CE Certificate under MDR 2017/745 (with NB number)

• FDA 510(k) clearance documentation (for US-bound units)

3-Step Verification & Negotiation Protocol for IOS Procurement

Step 1: Credential Verification Beyond Basic Certificates

Superficial certificate checks are insufficient. Demand:

| Credential | Risk of Inadequate Verification | 2026 Verification Protocol |

|---|---|---|

| ISO 13485:2016 | Expired certs; certificates covering non-IOS production lines | Request certificate specific to IOS manufacturing + audit report excerpt. Verify via ISO.org or notified body portal |

| CE Marking | Invalid MDR transition certificates; fake NB numbers | Confirm certificate references MDR 2017/745 (not old MDD) + validate NB number at NANDO database |

| FDA 510(k) | Expired clearances; incorrect product codes (e.g., K173472 for IOS) | Request 510(k) number + verify via FDA PMN Database |

Pro Tip: Require third-party test reports (EMC, laser safety per IEC 60601-2-79) – critical for clinical liability protection.

Step 2: MOQ Negotiation Leveraging Volume Tiers

Chinese manufacturers often impose rigid MOQs. Strategic negotiation requires understanding production economics:

| MOQ Strategy | Standard Practice (Risk) | 2026 Optimized Approach |

|---|---|---|

| Entry-Level MOQ | 5-10 units (often unprofitable for clinics) | Negotiate 3-unit MOQ for flagship models with 8-12% premium (absorbed via service contracts) |

| Volume Discounting | Flat 5-7% discount at 20+ units | Secure tiered pricing: 10% (15+ units), 15% (30+), 18% (50+) + free calibration tools |

| Distributor Terms | Exclusivity demands with unrealistic sales targets | Request protected territory with flexible 6-month review cycles + OEM white-labeling at 25+ units |

Key Insight: Factories with ≥15 years’ export experience (like Carejoy) offer lower MOQ flexibility due to production line efficiency.

Step 3: Shipping Terms: DDP vs. FOB Cost Analysis

Shipping terms significantly impact landed costs. Avoid FOB traps with medical devices:

| Term | Hidden Costs & Risks | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | Customs brokerage fees ($180-$300); unexpected port demurrage; VAT/GST payment delays; no post-clearance technical support | Only acceptable for experienced distributors with in-country customs agents. Verify all local compliance costs upfront. |

| DDP (Delivered Duty Paid) | Minimal (all-inclusive pricing) | MANDATORY for clinics & new distributors. Ensures: • Pre-cleared customs documentation • Final destination delivery • VAT/GST included • Immediate warranty activation |

Critical 2026 Requirement: Insist on temperature-controlled shipping (15-25°C) with IoT tracking for optical components. Verify carrier experience with medical devices.

Recommended Verification Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- 19-Year Compliance Track Record: ISO 13485:2016 certified since 2012 (Certificate #CN-SH-2012-0887), CE MDR-compliant with TÜV SÜD NB 0123

- Flexible MOQ Structure: 3-unit IOS MOQ for clinics; tiered distributor pricing from 15 units with OEM/ODM options

- DDP-First Shipping: All shipments include DDP terms to 85+ countries with medical device-specific logistics

- Factory Direct Advantage: Eliminates 22-30% distributor markup via vertically integrated production (Baoshan District, Shanghai)

Verification Request: Email [email protected] with subject line “2026 IOS Compliance Verification” for:

• Real-time ISO/CE certificate validation

• DDP landed cost quote template

• Reference list of 5+ EU/US distributors

Technical Sales: WhatsApp +86 15951276160 (24/7 English/Arabic/Spanish support)

Disclaimer: This guide reflects 2026 regulatory standards. Always engage local regulatory counsel before procurement. Shanghai Carejoy is cited as an exemplar of compliant Chinese manufacturing based on 2025 DSO Global Vendor Audit data.

© 2026 Dental Equipment Strategic Advisory Group. For authorized B2B distribution only. Not for public marketing use.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Intraoral Scanner Price Comparison in 2026

1. What Voltage Requirements Should I Consider When Purchasing an Intraoral Scanner in 2026?

In 2026, most intraoral scanners operate on standard global voltage inputs (100–240 V AC, 50/60 Hz), making them compatible with international power systems. However, clinics must verify the included power adapter specifications, especially when sourcing scanners from overseas manufacturers. Devices with dual-voltage support and CE/FDA-certified power supplies are recommended to ensure compliance and safety. Always confirm regional electrical standards with your distributor prior to installation.

2. Are Spare Parts Readily Available, and How Do They Impact Long-Term Costs?

Yes, availability of spare parts—such as scan tips, handpiece cables, batteries, and charging docks—varies significantly by brand and region. Leading manufacturers (e.g., 3Shape, Align, Carestream) offer structured spare parts programs through authorized distributors. In 2026, consider total cost of ownership (TCO): scanners with modular designs reduce downtime and lower repair costs. Distributors should provide a parts catalog and lead times. Opt for brands with local inventory support to minimize operational disruption.

3. What Does the Installation Process Involve for a New Intraoral Scanner?

Installation in 2026 typically includes hardware setup, software integration, and clinical calibration. Most premium scanners support plug-and-play USB-C or wireless connectivity, with cloud-based or on-premise software deployment. Vendors or certified technicians usually perform on-site or remote installation, including DICOM/EMR integration, network configuration, and user training. Ensure your IT infrastructure meets minimum requirements (e.g., GPU, OS version). Turnkey packages from major brands often include installation as part of the purchase agreement.

4. What Warranty Coverage is Standard for Intraoral Scanners in 2026?

As of 2026, the industry standard is a 2-year comprehensive warranty covering defects in materials and workmanship, including the scanner body and internal electronics. Some premium models offer extended warranties up to 3–5 years, optionally including accidental damage protection. Warranties typically exclude consumables (e.g., scan tips) and physical damage. Always confirm whether the warranty is global or region-locked and whether service is depot-based or includes on-site support. Distributors should provide warranty registration and service-level agreement (SLA) details.

5. How Do Warranty Terms and Spare Parts Availability Influence Price Comparisons?

When comparing scanner prices in 2026, evaluate warranty scope and spare parts pricing as key cost differentiators. A lower upfront price may reflect limited warranty coverage or high-cost proprietary components. Scanners with inclusive service plans, longer warranty periods, and transparent spare parts pricing often deliver better long-term value. Use a TCO model: include estimated maintenance, part replacements, and downtime costs over 5 years. Distributors should provide comparative TCO analyses to support informed procurement decisions.

Need a Quote for Intraoral Scanner Price Comparison?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160