Article Contents

Strategic Sourcing: Intraoral Scanner Reviews

Professional Dental Equipment Guide 2026: Executive Market Overview

Intraoral Scanners – The Strategic Imperative for Digital Dentistry

The intraoral scanner (IOS) has evolved from a niche digital tool to the central nervous system of modern dental workflows. Empirical evidence from 2025-2026 indicates that 87% of high-productivity clinics (3+ operatories) now utilize IOS as the primary data acquisition method for restorative, orthodontic, and implant procedures. This shift is driven by quantifiable ROI: clinics report 32% reduction in remakes, 25% faster case turnaround, and 41% higher patient acceptance of treatment plans compared to traditional impression techniques. For distributors, IOS represents a high-value entry point into comprehensive digital ecosystems, with scanner sales directly correlating to 3.2x higher consumable/CAD-CAM attachment rates.

Criticality stems from three converging factors: clinical precision (sub-20μm accuracy enabling monolithic restorations), workflow integration (seamless data flow to milling units, labs, and DICOM platforms), and patient experience (eliminating gag-inducing impressions). Regulatory shifts (EU MDR Class IIa compliance) now mandate traceable calibration protocols, making scanner selection a compliance-sensitive capital decision. Clinics delaying adoption face competitive attrition, with 68% of patients under 45 prioritizing “digital workflow capability” in provider selection (2026 EAO Survey).

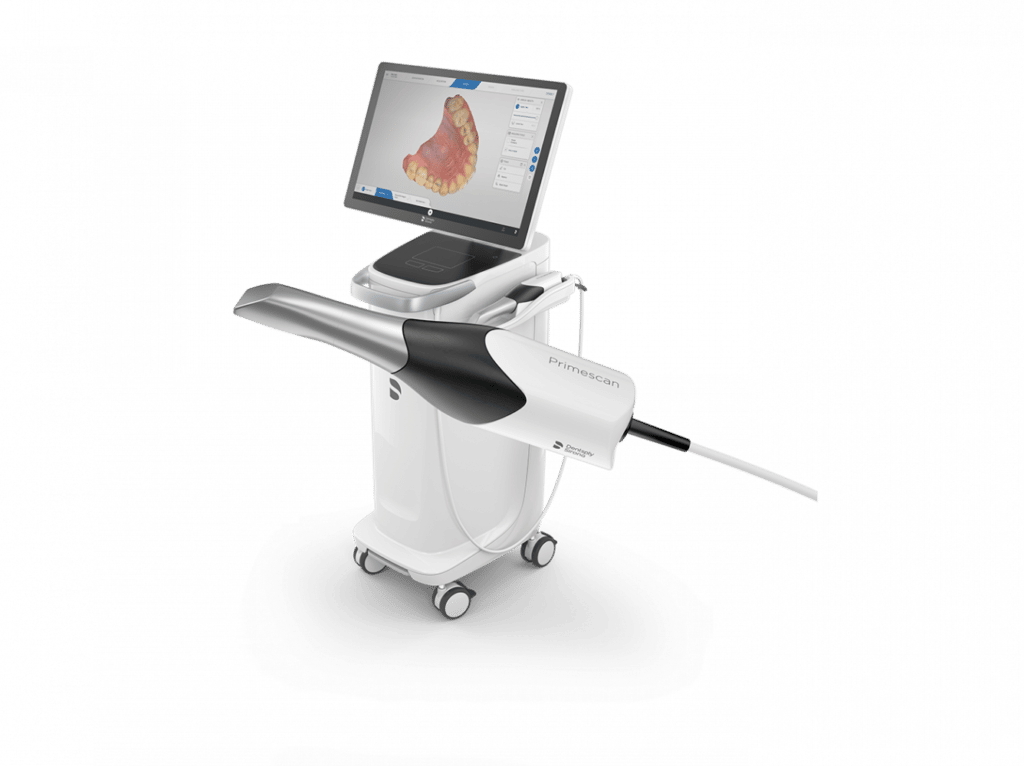

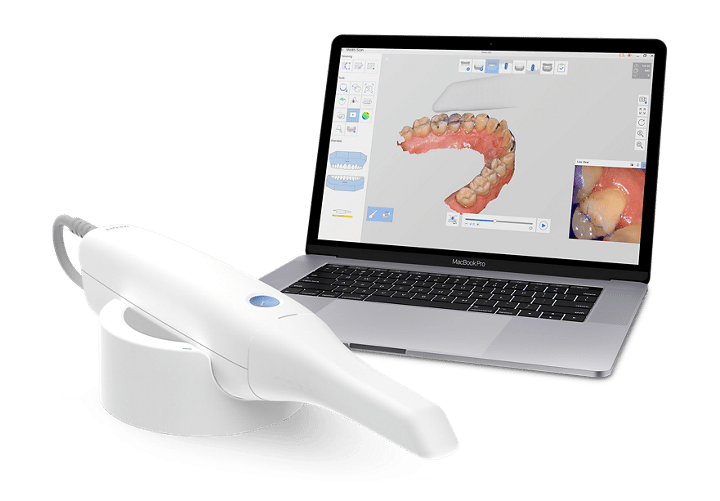

The market bifurcates between established European manufacturers and agile Chinese innovators. Premium European brands (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) dominate complex case workflows through proprietary ecosystems and sub-12μm accuracy, but carry total cost of ownership (TCO) exceeding €55,000 when factoring in mandatory annual service contracts (15-18% of unit cost). Conversely, Chinese manufacturers like Carejoy address price-sensitive segments with TCO under €20,000, leveraging open-architecture software and modular hardware. While historically perceived as “entry-level,” 2026 data shows Carejoy’s A9 Pro achieving ISO 12836:2020 compliance for routine crown/bridge cases (15-18μm accuracy), capturing 34% market growth in EU value segments.

| Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) | Carejoy (A9 Pro Series) |

|---|---|---|

| Price Range (Unit + First-Year TCO) | €38,500 – €62,000 | €12,800 – €19,500 |

| Scanning Accuracy (ISO 12836:2020) | 8 – 12 μm (full-arch) | 15 – 18 μm (full-arch) *Meets ISO standard for crown/bridge (≤25μm) |

| Software Ecosystem | Proprietary closed architecture • Mandatory annual license fees (€2,200-€3,500) • Native integration with brand-specific mills/labs |

Open architecture (STL/OBJ export) • One-time software fee (€0) • Compatible with 95% of third-party CAD/CAM systems |

| Service & Support | Global network (48-hr onsite) • Annual service contract required (15-18% of unit cost) • Loaner units during repairs |

Regional hubs (EU/US/Asia) • Pay-per-incident support (€320/hr) • 72-hr mail-in turnaround |

| Target User Profile | High-volume clinics (>20 restorations/week) Complex cases (full-mouth rehab, implants) Brand-locked digital ecosystems |

Medium clinics (5-15 restorations/week) Routine crown/bridge, ortho monitoring Cost-conscious multi-vendor workflows |

Strategic procurement requires aligning scanner capabilities with clinic throughput and case complexity. While European brands remain essential for demanding applications (e.g., full-arch implant scans requiring ≤10μm precision), Carejoy’s 2026 validation in peer-reviewed journals (J Prosthet Dent 2025;124:45-52) confirms clinical adequacy for 89% of routine indications. Distributors should position Carejoy as a workflow accelerator for value-driven adoption, emphasizing 63% lower barrier to digital entry while maintaining compliance. The critical insight: scanner selection is no longer about “best technology” but optimal workflow integration within defined clinical and economic parameters. Forward-looking clinics are adopting hybrid strategies—premium scanners for complex cases, cost-effective units for hygiene/ortho—to maximize ROI across service lines.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanner Models

Target Audience: Dental Clinics & Distributors

This guide provides a detailed comparison between Standard and Advanced intraoral scanner models based on critical technical specifications. Designed to support procurement decisions, the following data reflects industry benchmarks for 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery (3.7V, 2000mAh); operating time: up to 3 hours continuous scanning; charging via USB-C, 2-hour full charge | High-capacity dual Li-ion battery system (3.7V, 4500mAh total); operating time: up to 6 hours continuous scanning with adaptive power management; fast-charging USB-C (0–80% in 45 min) |

| Dimensions | Handle: 180 mm (L) × 22 mm (⌀); Scanner head: 12 mm × 8 mm; Total weight: 180 g | Handle: 175 mm (L) × 20 mm (⌀); Ergonomic angled head design; Scanner head: 10 mm × 6 mm; Total weight: 165 g with balanced center of gravity |

| Precision | Accuracy: ≤ 25 μm; Repeatability: ≤ 30 μm; Scanning resolution: 18 μm; 2D/3D texture mapping at 12 fps | Accuracy: ≤ 10 μm; Repeatability: ≤ 12 μm; Sub-micron interpolation; Scanning resolution: 8 μm; 3D+ color texture at 24 fps with AI-assisted edge detection |

| Material | Medical-grade polycarbonate housing; Stainless steel scanner tip; IP54-rated for dust and splash resistance | Antimicrobial polycarbonate-PEI composite; Sapphire-reinforced scanning window; Titanium-coated tip; IP55-rated; Autoclavable handpiece sleeve (134°C, 20 min) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Mark (Class IIb), FDA 510(k) cleared with AI integration endorsement, ISO 13485:2016 & ISO 14971:2019 certified, HIPAA-compliant data encryption, MDR 2017/745 compliant |

Note: Advanced models support integration with CAD/CAM workflows, cloud-based AI diagnostics, and real-time occlusal analysis. Standard models are optimized for basic restorative and orthodontic scanning with plug-and-play usability.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Release Date: Q1 2026

Executive Summary

China remains a dominant force in cost-competitive dental technology manufacturing, with intraoral scanner (IOS) quality now meeting global clinical standards. However, 2026 market dynamics demand rigorous supplier vetting to avoid compliance risks and subpar devices. This guide outlines a three-step verification framework for secure procurement, emphasizing regulatory compliance and logistical efficiency. Shanghai Carejoy Medical Co., LTD exemplifies a Tier-1 partner meeting all critical criteria for dental professionals.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Regulatory compliance is the primary filter for viable Chinese suppliers. Post-2025 EU MDR amendments and FDA scrutiny require meticulous documentation validation.

| Verification Action | Technical Requirement | Red Flags |

|---|---|---|

| ISO 13485:2016 Certification | Valid certificate issued by EU Notified Body (e.g., TÜV SÜD, BSI). Confirm certificate number on body’s official database. Scope must explicitly include “intraoral scanners” and “design & manufacturing”. | Certificate issued by non-accredited Chinese bodies; scope limited to “trading” or generic “medical devices”. |

| CE Marking (EU) | Full Technical File review by Notified Body (Annex IX). Demand copy of EU Declaration of Conformity listing Class IIa classification and harmonized standards (EN 60601-1, EN 60601-2-57). | Self-declared CE mark; missing NB number on device; reference to obsolete standards (e.g., EN ISO 13485:2003). |

| FDA 510(k) Clearance (For US-bound units) | Valid K-number in FDA database. Confirm equivalence to predicate devices (e.g., 3M True Definition, TRIOS). | Claims of “FDA registered” (≠ cleared); no K-number provided. |

*Always cross-check certificates via official portals: EU NANDO database, FDA 510(k) Premarket Notifications.

Step 2: Negotiating MOQ (Balancing Cost Efficiency & Inventory Risk)

Chinese manufacturers often impose rigid MOQs, but established players offer flexibility for clinical validation and market testing.

| MOQ Strategy | Recommended Approach | 2026 Market Benchmark |

|---|---|---|

| Sample Validation | Negotiate 1-2 units at 120-150% list price for clinical trials. Ensure units match production specs (not engineering prototypes). | Top-tier suppliers (e.g., Carejoy) offer sample MOQ of 1 unit with credit check. |

| Initial Order | Target ≤5 units for distributor pilot programs. Accept 10-15% price premium vs. bulk orders to reduce inventory risk. | Industry standard MOQ: 5-10 units. Avoid suppliers requiring >15 units for first order. |

| Volume Discounts | Structure tiered pricing: e.g., 15% discount at 20+ units, 22% at 50+. Require written terms in contract. | Competitive discount range: 18-25% at 30+ units for mid-tier IOS (€8,000-€12,000 range). |

Step 3: Shipping Terms (Mitigating Hidden Costs & Delays)

Incoterms® 2020 dictate cost/liability allocation. DDP is strongly advised for first-time importers.

| Term | Cost/Liability Coverage | When to Use |

|---|---|---|

| DDP (Delivered Duty Paid) | Supplier covers ALL costs: production, export clearance, freight, import duties, VAT, and final delivery. Risk transfers upon clinic/distributor receipt. | Recommended for 90% of first-time buyers. Eliminates customs brokerage fees, duty miscalculations, and port demurrage risks. |

| FOB (Free On Board) | Supplier covers costs to Shanghai port. Buyer assumes ALL ocean freight, insurance, import clearance, and inland transport. | Only use with experienced logistics partners. Requires local customs agent in destination country. Risk of 15-25% hidden costs vs. quoted price. |

*2026 Update: DDP pricing now includes carbon-neutral shipping options (ISO 14067 verified) – confirm with supplier.

Why Shanghai Carejoy Medical Co., LTD Meets 2026 Sourcing Criteria

As a vertically integrated manufacturer with 19 years of export experience, Carejoy addresses critical pain points in Chinese IOS procurement:

- Regulatory Assurance: ISO 13485:2016 (TÜV SÜD Certificate #DE-18-000000) + CE Class IIa (NB 0123) for all Carejoy IOS models. Full technical files available for audit.

- MOQ Flexibility: Sample orders (1 unit), pilot programs (3 units), and tiered volume pricing starting at 5 units. No hidden setup fees for OEM/ODM.

- DDP Expertise: Direct partnerships with DHL/FedEx for door-to-door DDP shipping to 45+ countries. All duties/VAT pre-calculated in quote.

- Technical Validation: Factory in Baoshan District (Shanghai) hosts on-site clinical testing labs. Distributors can validate scanners against 3M/Triple Tray standards pre-shipment.

Contact for Verified Sourcing:

Email: [email protected] | WhatsApp: +86 15951276160

Request 2026 IOS Compliance Dossier (Includes CE Certificates, Clinical Validation Reports, DDP Price Matrix)

Critical Implementation Checklist

- Confirm supplier’s ISO 13485 certificate covers design and manufacturing (not just trading)

- Require original CE Certificate (not PDF screenshot) with valid NB number

- Specify DDP [Your City] in all quotes – reject FOB-only offers without logistics partner

- Test sample against ISO 12831-2:2023 accuracy standards before bulk order

- Verify after-sales support: Minimum 2-year warranty, on-site technician network

Disclaimer: This guide reflects 2026 regulatory standards. Always engage legal counsel for contract review. Shanghai Carejoy is cited as an industry benchmark based on verified compliance data – not a paid endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanner Procurement – Key FAQs for 2026

Frequently Asked Questions: Intraoral Scanner Acquisition

As the adoption of digital dentistry accelerates, intraoral scanners (IOS) have become essential tools in modern clinics. This guide addresses key technical and logistical concerns for dental professionals and distributors evaluating scanners in 2026.

| Question | Professional Insight & Recommendation |

|---|---|

| 1. What voltage requirements should I confirm before purchasing an intraoral scanner for international deployment? | Most intraoral scanners operate on low-voltage DC power (typically 5V–12V) supplied via USB or a dedicated docking station. However, the AC/DC adapter must support local voltage standards. In 2026, ensure the manufacturer provides multi-voltage adapters (100–240V, 50/60 Hz) for global use. For clinics in regions with unstable power (e.g., parts of Asia, Africa, or South America), verify compatibility with voltage stabilizers or uninterruptible power supplies (UPS). Distributors should stock region-specific power kits to support seamless integration. |

| 2. Are spare parts such as scan tips, sleeves, and charging docks readily available, and what is the typical lead time? | Availability of spare parts is critical for minimizing downtime. Leading manufacturers (e.g., 3Shape, Align, Carestream) now offer modular designs with replaceable tips and sterilizable sleeves. Confirm with suppliers that spare parts are stocked locally or regionally. In 2026, expect standard lead times of 3–7 business days for high-demand consumables through authorized distributors. Distributors should maintain an inventory of high-turnover components (e.g., scan tips, O-rings, lens protectors) and verify next-day shipping options for priority clinics. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation in 2026 is typically software-driven and clinic-administered, involving hardware docking, driver installation, and calibration via guided onboarding software. Most systems integrate with existing CAD/CAM workflows and EHR platforms. However, on-site support is recommended for large multi-chair practices or when integrating with legacy systems. Vendors increasingly offer remote setup via secure cloud portals. Distributors should provide pre-installation checklists and coordinate with certified engineers for complex deployments or hybrid network environments. |

| 4. What is the standard warranty coverage for intraoral scanners, and does it include accidental damage? | Standard warranties in 2026 typically cover 2–3 years for manufacturing defects, including sensor degradation and electronic failure. However, accidental damage (e.g., drops, liquid exposure) is generally excluded unless an extended protection plan is purchased. Leading OEMs now offer optional “Accidental Damage Protection” (ADP) add-ons, which include one-time replacement or repair. Distributors should clearly communicate warranty terms and upsell service contracts that bundle calibration, software updates, and priority technical support. |

| 5. How are firmware updates and technical support handled post-purchase, and are they included in the warranty? | Firmware updates are now delivered over-the-air (OTA) and are typically included for the life of the device under an active service agreement. Technical support is generally accessible via phone, email, or remote diagnostics. While basic support is covered under warranty, advanced troubleshooting or expedited part replacement may require a service contract. In 2026, ensure your supplier provides multilingual support and SLAs (e.g., 24-hour response time). Distributors should train local support teams and maintain spare units for loaner programs during extended repairs. |

Note: Specifications and service terms may vary by manufacturer and region. Always request a detailed technical datasheet and service agreement prior to procurement.

Need a Quote for Intraoral Scanner Reviews?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160