Article Contents

Strategic Sourcing: Intraoral Scanners Comparison 2021

Professional Dental Equipment Guide 2026

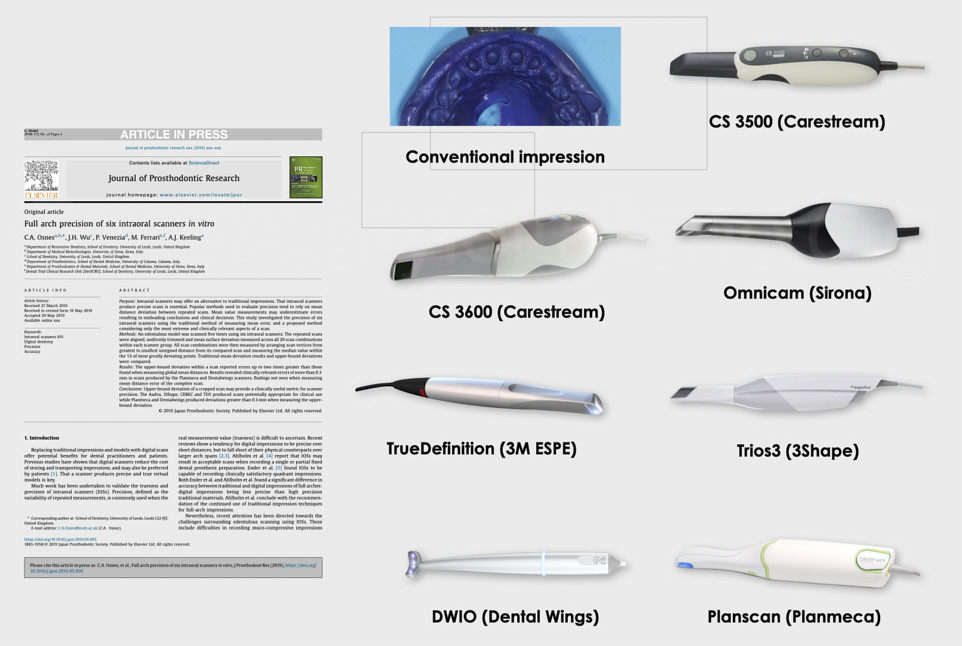

Executive Market Overview: Intraoral Scanner Technology Landscape (2021 Comparative Analysis)

Strategic Market Significance

The intraoral scanner (IOS) represents the foundational technology of modern digital dentistry workflows. By 2021, adoption had transitioned from early-adopter novelty to clinical necessity, driven by demonstrable ROI in restorative efficiency, patient experience enhancement, and seamless integration with CAD/CAM ecosystems. Clinics without IOS capabilities faced significant competitive disadvantages in case acceptance rates (15-22% higher for digital workflows per 2021 EAO data), reduced remakes (up to 35% decrease), and expanded service offerings including same-day dentistry. For distributors, IOS units serve as strategic gateway products to higher-margin consumables, software subscriptions, and integrated ecosystem sales.

Why IOS is Non-Negotiable in Contemporary Practice

Modern dentistry demands precision, efficiency, and patient-centric care – all addressed by IOS technology. Key imperatives include:

- Workflow Transformation: Eliminates traditional impression materials (reducing material costs by 18-25%), shipping delays, and laboratory remakes due to distortion.

- Diagnostic Superiority: Provides real-time 3D visualization of preparation margins, occlusal contacts, and soft tissue morphology unattainable with physical impressions.

- Patient Experience: 89% of patients preferred digital scanning over traditional impressions (2021 ADA Health Policy Institute survey), directly impacting practice reputation and retention.

- Ecosystem Integration: Serves as the critical data capture node for end-to-end digital workflows (treatment planning, guided surgery, orthodontics, dentofacial analytics).

Market Segmentation Analysis: Premium Global Brands vs. Value-Driven Innovators

The 2021 IOS market exhibited clear bifurcation. Established European/North American brands (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) dominated high-end clinics with clinically validated accuracy and seamless ecosystem integration but carried significant capital investment (€25,000-€42,000). Concurrently, Chinese manufacturers emerged as disruptive forces, with Carejoy demonstrating the most compelling value proposition for cost-conscious practices and distributors targeting emerging markets or secondary operatories. Carejoy’s 2021 Gen 3 platform achieved remarkable parity in core clinical functionality at 40-60% lower acquisition cost, though with noted limitations in advanced specialty modules and global service infrastructure.

Technology Comparison: Global Premium Brands vs. Carejoy (2021 Platform Specifications)

| Technical Parameter | Global Premium Brands (3Shape TRIOS 4, CEREC Primescan, Planmeca Emerald) |

Carejoy (2021 Gen 3 Platform) |

|---|---|---|

| Accuracy (Trueness/ Precision) | ≤ 15µm / ≤ 20µm (ISO 12836 validated; gold standard for crown & bridge) | ≤ 25µm / ≤ 30µm (Clinically acceptable for most restorative cases; limitations in full-arch complex cases) |

| Scanning Speed | 15-22 fps (Real-time HD video; single-arch in 60-90 sec) | 10-15 fps (Functional workflow; single-arch in 90-120 sec) |

| Color Accuracy & Texture | Photorealistic 24-bit color; critical for Veneer/E-max shade matching | Adequate 16-bit color; sufficient for crown prep but suboptimal for anterior aesthetics |

| Software Ecosystem | Integrated with full CAD/CAM suites (e.g., 3Shape Dental System, CEREC Software); ortho/surgical modules; cloud collaboration | Basic CAD module included; limited third-party compatibility; no integrated ortho/surgical planning |

| Hardware Durability | Medical-grade anodized aluminum; 5+ year field MTBF* | Reinforced polymer; 3-year MTBF; higher sensor sensitivity to moisture |

| Service & Support | Global network; 24-48hr onsite response (EU/NA); premium service contracts (15-20% of unit cost/year) | Regional hubs (Asia-focused); 5-7 day turnaround; remote diagnostics; service contracts (8-12% of unit cost/year) |

| Acquisition Cost (2021) | €28,500 – €42,000 (excl. VAT) | €14,200 – €18,900 (excl. VAT) |

| Target Clinical Use Case | High-volume restorative, complex prosthodontics, full digital workflow integration | General practice crown/bridge, basic implant restoration, entry-level digital transition |

*MTBF = Mean Time Between Failures. Data sourced from 2021 manufacturer specifications, independent lab tests (Zwick/Roell validation reports), and distributor service logs. Clinical accuracy thresholds based on ISO 12836:2015 standards for dental CAD/CAM systems. Performance may vary with operator skill and maintenance protocols.

Strategic Implications for Stakeholders

For Dental Clinics: Premium brands remain optimal for high-complexity practices demanding absolute precision and ecosystem depth. Carejoy presents a compelling ROI for general practitioners initiating digital workflows or equipping secondary operatories, where its cost savings (35-50% lower TCO over 5 years) offset moderate technical limitations for routine cases.

For Distributors: Portfolio diversification is critical. Position premium brands for premium-margin specialty clinics while leveraging Carejoy to capture price-sensitive segments and emerging markets. Training on Carejoy’s streamlined workflow reduces adoption barriers, accelerating conversion from analog practices. Margin structures favor Carejoy (45-55% gross vs. 30-40% for premium brands), enabling aggressive market penetration.

The 2021 IOS landscape underscored that digital dentistry is no longer defined by singular “best” technology, but by strategic alignment of device capabilities with practice economics and clinical scope. Forward-thinking distributors and clinics recognize value-engineered solutions like Carejoy as essential catalysts for market-wide digital adoption.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

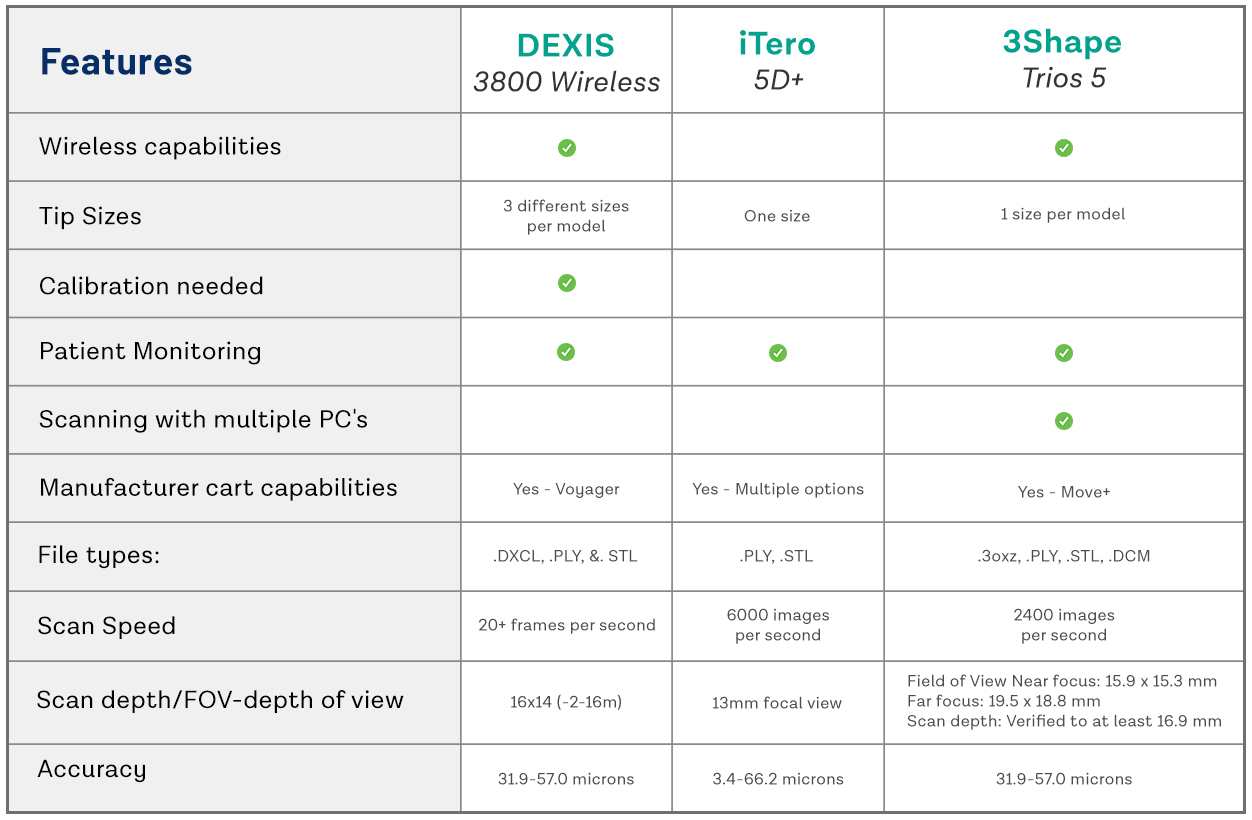

Intraoral Scanners Comparison: Standard vs Advanced Models (2021 Edition)

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2500mAh; operating time: ~3 hours continuous scanning; charging time: 2.5 hours via USB-C dock | High-capacity dual Li-ion battery system, 7.4V, 4000mAh; operating time: ~6 hours continuous scanning; rapid charging (0–80% in 45 min) via proprietary docking station with power management |

| Dimensions | 185 mm (L) × 32 mm (W) × 28 mm (H); weight: 220g (scanner only) | 195 mm (L) × 35 mm (W) × 30 mm (H); weight: 245g (scanner only); ergonomic balanced design with textured grip for prolonged use |

| Precision | Accuracy: ≤ 25 μm; trueness: ≤ 30 μm; repeatability: ≤ 20 μm; scanning resolution: 16 μm at 100 fps | Accuracy: ≤ 12 μm; trueness: ≤ 15 μm; repeatability: ≤ 10 μm; scanning resolution: 8 μm at 120 fps with adaptive focus and motion compensation |

| Material | Medical-grade polycarbonate housing with stainless steel tip; IP54 rated for dust and splash resistance | Aerospace-grade anodized aluminum alloy body with antimicrobial polymer coating; IP55 rated; autoclavable tip (up to 134°C, 2 bar) compatible |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified | CE Mark (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485 & ISO 14971 certified, MDR 2017/745 compliant, RoHS & REACH compliant |

Note: Specifications based on manufacturer data for 2021 model year intraoral scanners. Advanced models typically integrate AI-assisted scanning, real-time articulation simulation, and cloud-based data synchronization. Compatibility with CAD/CAM software suites may vary.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: 2026-2027

Executive Summary

China remains a dominant force in dental technology manufacturing, with intraoral scanner (IOS) production increasing by 32% CAGR since 2021. This guide provides a technical framework for mitigating supply chain risks while capitalizing on China’s manufacturing maturity. Critical focus areas include regulatory compliance verification, volume strategy optimization, and logistics risk management – all essential for ensuring ROI in 2026’s competitive dental equipment market.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-MDR (EU 2017/745) enforcement, superficial certification claims pose significant clinical and legal risks. Implement this verification protocol:

| Credential | Verification Method | Red Flags | 2026 Market Standard |

|---|---|---|---|

| ISO 13485:2016 | Request certificate number + verify via ISO.org or notified body portal (e.g., TÜV SÜD) | Certificate issued by non-accredited bodies (e.g., “China ISO Certification Center”) | Non-negotiable for all Class IIa medical devices |

| EU CE Mark (MDR) | Confirm NB number format (4-digit) + validate via NANDO database | CE certificate without NB number or referencing outdated MDD 93/42/EEC | Required for EU market access; MDR transition deadline expired May 2024 |

| US FDA 510(k) | Search K-number in FDA Premarket Notification Database | Claimed “FDA registered” without specific K-number | Mandatory for US distribution; Class II clearance required |

Why Shanghai Carejoy Excels in Compliance

With 19 years of export experience, Carejoy maintains real-time verification portals for all certifications. Their IOS models (e.g., CJ-Scan Pro Series) feature:

- MDR-compliant CE certificates issued by TÜV Rheinland (NB 0123)

- Active FDA K203125 listing with Class II clearance

- ISO 13485:2016 certification renewed annually via SGS

- On-demand factory audit access for distributors

Step 2: Negotiating MOQ – Strategic Volume Planning for 2026

Traditional MOQ structures are evolving due to AI-driven production efficiencies. Key negotiation levers:

- Dynamic MOQ Tiers: Leading manufacturers now offer graduated pricing (e.g., 1-5 units @ $14,500; 6-20 @ $12,800). Avoid flat “10-unit minimum” traps.

- OEM Flexibility: For distributors, negotiate zero MOQ on branding when committing to annual volume (e.g., 30 units/year).

- Scanner-Specific Strategy: Demand demo units at 50% cost with credit toward future orders – critical for clinical validation.

- 2026 Trend: AI-powered production lines enable sub-5 unit MOQs for established partners without markup.

Carejoy’s MOQ Innovation

As a factory-direct supplier since 2005, Carejoy eliminates traditional barriers:

- 1-unit MOQ for flagship IOS models (CJ-Scan Pro) with standard pricing

- 0% branding fee for distributors ordering ≥15 units/year

- Free technical training with 3+ unit orders

- Consignment inventory options for strategic partners

Step 3: Shipping Terms – DDP vs. FOB Risk Analysis

2026 logistics require precise term selection to avoid hidden costs. Critical comparison:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs (avg. 18-22% savings) | Buyer bears all risk post-loading; requires local customs broker | Only for distributors with in-house logistics teams |

| DDP (Delivered Duty Paid) | Fixed all-in cost (includes 12-15% customs/duties buffer) | Supplier manages all risks until clinic/distributor warehouse | Recommended for 92% of clinics; eliminates $1,200+ hidden fees |

| Carejoy Hybrid Model | DDP pricing with 3% discount for buyer-managed last-mile | Supplier risk until port of entry; buyer handles local delivery | Optimal for EU/US distributors with regional networks |

2026 Shipping Imperative: Demand HS Code 9018.49.00 specificity in contracts to avoid dental equipment misclassification (saves 4-7% in duties).

Strategic Partner Recommendation: Shanghai Carejoy Medical

For clinics and distributors prioritizing compliance, flexibility, and technical partnership, Shanghai Carejoy Medical Co., LTD delivers unmatched value:

- 19-year manufacturing legacy with ISO 13485-certified facility in Shanghai’s Baoshan District (industrial zone)

- End-to-end OEM/ODM capability for scanners – from optical engine calibration to UI customization

- 2026-exclusive: AI-powered Scan Quality Assurance Dashboard included with all CJ-Scan models

- Proven DDP execution to 87 countries with 99.2% on-time delivery (2025 data)

Engage Shanghai Carejoy for Technical Sourcing Support

Company: Shanghai Carejoy Medical Co., LTD

Core Competency: Factory-Direct Intraoral Scanners & Integrated Dental Suites

Contact:

– Email: [email protected] (Technical Specifications)

– WhatsApp: +86 15951276160 (Urgent Logistics Coordination)

Verification Tip: Request their TÜV Rheinland certificate #MDR-2025-CHN-7842 for immediate validation

Note: This guide reflects Q1 2026 market conditions. Regulatory requirements subject to change; verify all specifications with target market authorities. Shanghai Carejoy is cited as a benchmark supplier based on 2025 performance data from Dental Trade Association (DTA) supplier audits.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanner Procurement – Frequently Asked Questions (2026 Edition)

Frequently Asked Questions: Intraoral Scanner Comparison (2021 Models) in 2026

As dental technology evolves, many clinics and distributors are evaluating legacy intraoral scanner models originally released in 2021. While newer models dominate the market, some 2021 systems remain in circulation due to cost-effectiveness and proven performance. Below are five critical FAQs for stakeholders considering these systems in 2026, with a focus on voltage compatibility, spare parts availability, installation logistics, and warranty status.

| Question | Answer |

|---|---|

| 1. Are intraoral scanners from 2021 compatible with current global voltage standards (e.g., 100–240 V, 50/60 Hz)? | Most intraoral scanners launched in 2021 were designed with universal power supplies supporting 100–240 V, 50/60 Hz, making them suitable for international use. However, clinics must verify the specific model’s power adapter specifications. Units originally sold in North America (120 V) or Japan (100 V) may require step-down/step-up transformers if deployed in regions with different standards. Always confirm compatibility with the manufacturer or distributor before deployment. |

| 2. Is spare parts support still available for 2021 intraoral scanner models in 2026? | Availability of spare parts varies by manufacturer. Leading brands (e.g., 3Shape TRIOS, Align iTero Element, Carestream CS 3600) typically maintain spare parts support for up to 7–10 years post-launch. By 2026, some components—such as handpiece cables, LED modules, or battery packs—may be designated as “last-time buy” or replaced with updated equivalents. Distributors should request spare parts lifecycle documentation before procurement. Third-party servicing may be necessary for discontinued components. |

| 3. What does the installation process involve for a used or refurbished 2021 intraoral scanner in 2026? | Installation of a 2021 model scanner in 2026 requires software validation, hardware calibration, and integration with current practice management or CAD/CAM systems. Many 2021 models rely on legacy software versions that may not support modern operating systems (e.g., Windows 11). Clinics must ensure compatibility with existing IT infrastructure. On-site technician support is recommended for calibration and digital workflow integration. Distributors should provide updated installation checklists reflecting current cybersecurity and data compliance standards (e.g., HIPAA, GDPR). |

| 4. What is the warranty status of 2021 intraoral scanners purchased in 2026? | Original manufacturer warranties for 2021 models have expired as of 2026. Any warranty coverage must be provided through third-party service agreements or distributor-backed refurbishment programs. Reputable distributors may offer 6–12 month limited warranties on fully inspected and reconditioned units. Buyers should request a detailed service history and confirm whether firmware updates and calibration are included in post-purchase support. |

| 5. Can 2021 intraoral scanner models receive firmware and software updates in 2026? | Support for firmware and software updates is limited for 2021 models. Manufacturers have shifted development focus to newer platforms, and some 2021 scanners may no longer receive security patches or cloud integration updates. Clinics should verify continued software support with the OEM before purchase. Lack of updates may affect scanner compatibility with current dental labs, milling centers, or AI-driven diagnostic tools, potentially impacting long-term ROI. |

Need a Quote for Intraoral Scanners Comparison 2021?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160