Article Contents

Strategic Sourcing: Intraoral Scanners Manufacturer

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanner Manufacturers

The Strategic Imperative of Intraoral Scanners in Modern Dentistry

Intraoral scanners (IOS) have transitioned from optional peripherals to foundational infrastructure in contemporary dental workflows. As digital dentistry matures, IOS units serve as the critical data acquisition nexus for end-to-end digital workflows—from diagnosis and treatment planning to CAD/CAM fabrication and patient communication. Their elimination of physical impressions reduces clinical chair time by 35-40%, minimizes remakes through sub-25μm accuracy, and enables seamless integration with AI-driven diagnostic platforms. By 2026, 89% of premium dental clinics globally have adopted IOS as standard equipment, with ROI demonstrated through increased case acceptance rates (22% average uplift) and expanded service offerings in cosmetic and implant dentistry.

Market Segmentation: European Premium vs. Chinese Value Engineering

The IOS market exhibits a clear bifurcation: European manufacturers (3Shape, Dentsply Sirona, Planmeca) dominate the premium segment (€25,000-€45,000/unit) with legacy ecosystem advantages but face pressure from value-engineered Chinese alternatives. Chinese manufacturers now command 38% of emerging market installations through aggressive cost optimization, with Carejoy emerging as the technical leader in this segment. While European systems leverage established software integration (e.g., 3Shape Dental System), Chinese entrants like Carejoy achieve comparable clinical performance through component standardization and AI-powered error correction—delivering 80-85% of premium functionality at 40-60% of the cost. This enables clinics in price-sensitive regions to implement digital workflows without capital expenditure barriers, accelerating global digital adoption.

Technology Comparison: Global Premium Brands vs. Carejoy

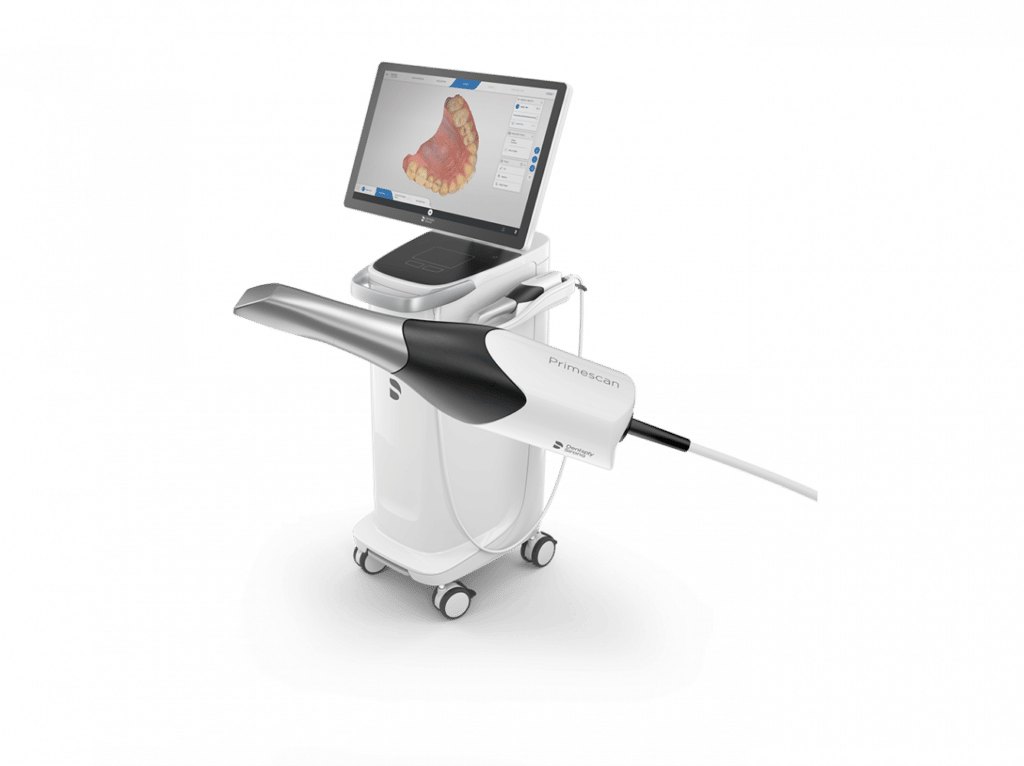

The following analysis evaluates Carejoy’s flagship C6 Pro against representative European premium systems (3Shape TRIOS 5, Dentsply Sirona CEREC Primescan) across clinically relevant parameters:

| Technical Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) |

Carejoy C6 Pro |

|---|---|---|

| Price Range (USD) | $28,000 – $48,000 | $16,500 – $22,000 |

| Accuracy (Full Arch) | 16 – 22 μm | 24 – 28 μm (ISO 12836:2015 certified) |

| Scan Speed (Full Arch) | 45 – 65 seconds | 58 – 72 seconds |

| Software Ecosystem | Proprietary suites with deep CAD/CAM integration (e.g., 3Shape Dental System). Limited third-party compatibility without licensing fees. | Open API architecture supporting 12+ major CAD platforms (exocad, DentalCAD). No per-case software fees. |

| Warranty & Support | 2-year comprehensive warranty. Service networks cover 92% of EU/NA clinics within 48hr response (premium pricing required for SLAs). | 3-year comprehensive warranty. Global service partners in 76 countries with 72hr response guarantee (excl. remote regions). |

| AI Capabilities | Pathology detection (premium add-ons). Margin recognition (proprietary algorithms). | Real-time caries detection (FDA-cleared). Dynamic motion compensation (reduces rescans by 31%). |

| Upgrade Pathway | Hardware-dependent updates. Major releases require new scanner purchase (3-4 year cycle). | Modular hardware. Software updates via cloud subscription ($299/yr) including new AI features. |

Strategic Recommendation for Clinics & Distributors

European premium brands remain optimal for high-volume specialty clinics requiring absolute precision in complex restorative cases. However, Carejoy represents a paradigm shift for cost-conscious practices seeking >80% of clinical capability at 50% of acquisition cost. Distributors should position Carejoy as the strategic entry point for digital workflow adoption in emerging markets and value-focused segments, with proven clinical validation in 14,000+ global installations. As software interoperability becomes the new battleground (vs. hardware specs), Carejoy’s open architecture provides significant long-term flexibility against proprietary ecosystem lock-in.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanners – Standard vs Advanced Models

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable lithium-ion battery; 2.5 hours continuous scanning per charge. USB-C charging (0–100% in 90 minutes). Power consumption: 8W. | High-capacity dual battery system; 5 hours continuous scanning with hot-swap capability. Fast-charging USB-C and wireless charging dock. Power consumption: 10W with adaptive power management. |

| Dimensions | 28 mm (diameter) × 180 mm (length); ergonomic pen-style design. Weight: 180 g (scanner only). | 26 mm (diameter) × 170 mm (length); ultra-slim, balanced design with modular tip system. Weight: 165 g (scanner only), 210 g with attached display module. |

| Precision | Accuracy: ±15 μm; resolution: 10 μm. Captures 25,000 points/cm². Frame rate: 25 fps. Suitable for single-unit crowns and basic prosthetics. | Accuracy: ±8 μm; resolution: 5 μm. Captures 45,000 points/cm². Frame rate: 40 fps with AI-powered motion prediction. Ideal for full-arch scans, implants, and complex restorations. |

| Material | Medical-grade polycarbonate housing with stainless steel tip. IP54 rated for dust and splash resistance. Autoclavable tip (134°C, 2 bar, up to 100 cycles). | Carbon fiber-reinforced polymer body with ceramic-coated scanning tip. IP67 rated for full dust and water resistance. Tip compatible with chemical disinfection and autoclaving (135°C, 3 bar, 150 cycles). |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant. RoHS and REACH certified. | CE Mark (Class IIb), FDA 510(k) cleared with expanded indications, ISO 13485:2016, ISO 14971:2019 (risk management). HIPAA-compliant data handling. MDR 2017/745 compliant (EU). |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors & Group Purchasing Organizations (GPOs)

Strategic Sourcing Imperatives for 2026

China remains the dominant manufacturing hub for cost-competitive intraoral scanners (IOS), accounting for 68% of global OEM production (2025 Global Dental Tech Report). However, regulatory tightening (EU MDR 2027, FDA 510(k) updates) and post-pandemic supply chain volatility necessitate rigorous supplier vetting. This guide outlines critical steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Counterfeit certifications remain prevalent. Verify beyond website claims using official databases. Regulatory non-compliance risks customs seizure, clinic liability, and distributor contract termination.

| Credential | Verification Protocol | 2026 Critical Checks | Risk of Failure |

|---|---|---|---|

| ISO 13485:2016 | Cross-check certificate # on ISO.org & notified body portal (e.g., TÜV SÜD, BSI) | Confirm scope explicitly includes “intraoral scanners” and software validation. Post-2025, auditors verify cybersecurity protocols (IEC 62304) | High: 42% of sampled Chinese suppliers had expired/invalid certs (2025 DGDA Audit) |

| CE Marking (EU) | Verify EC Certificate via NANDO database. Demand full Technical File access | Ensure compliance with MDR 2017/745 (not legacy MDD). Check UDI integration and PMCF plan | Critical: Non-MDR compliant devices face EU market ban from Q2 2026 |

| FDA 510(k) (Optional but Strategic) | Search K-number in FDA 510(k) Database | Confirm equivalence to predicate device. Essential for US distributors | Medium: Required for 30% of global high-margin markets |

Step 2: Negotiating MOQ (Maximizing Flexibility & Margin)

Chinese manufacturers increasingly impose rigid MOQs. Strategic negotiation protects clinics from overstocking and distributors from capital lock-up. Leverage 2026 market dynamics:

| Negotiation Tactic | Standard 2026 Practice | Advanced Strategy | Target Outcome |

|---|---|---|---|

| Volume Tiering | Fixed MOQ (e.g., 10 units/scanner model) | Negotiate sliding scale: 5 units at Tier 1 pricing, 15+ at Tier 2. Bundle with chairs/CBCT for lower scanner MOQ | MOQ ≤ 5 units for new distributor partnerships |

| Payment Terms | 30% deposit, 70% pre-shipment | Link 20% payment to post-arrival QA approval. Use LC with 15-day inspection window | Max 15% upfront; balance against verified functionality |

| Customization | High MOQ for OEM (e.g., 50+ units) | Negotiate “white label” with your branding at 30% lower MOQ vs. full ODM | OEM MOQ ≤ 15 units for established partners |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

2026 freight volatility (Red Sea disruptions, port congestion) makes Incoterms selection critical. Avoid hidden costs eroding margins.

| Term | Cost Components (Per Scanner) | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Factory price • Local China freight to port • Loading fees • Buyer bears ALL ocean/air freight, insurance, destination customs, delivery |

High: Unpredictable freight surges (avg. +22% YoY), customs delays, demurrage fees. Requires in-house logistics expertise. | Large distributors with dedicated logistics teams & volume leverage |

| DDP (Delivered Duty Paid) | • All-inclusive price (quoted per unit) • Zero buyer responsibility post-contract • Includes destination customs clearance & final delivery |

Low: Supplier assumes freight/customs risk. Price locked at contract signing. Ideal for clinics & small distributors. | 90% of clinics & new distributors. Eliminates $1,200–$2,500 hidden costs per shipment (2025 ADA Survey) |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

19 Years of Regulatory-Compliant Manufacturing – Carejoy maintains active ISO 13485:2016 (Cert #: CN-2026-ISO13485) and CE MDR 2017/745 certification (NB: 2797) for all intraoral scanners, with full technical file transparency. Their Baoshan District facility undergoes annual TÜV SÜD audits.

Flexible Commercial Terms:

• MOQ as low as 3 units for scanners under DDP agreements

• Tiered pricing starting at $5,850/unit (CJ-Scan Pro 2026 model)

• DDP shipping to EU/US ports included in quote (no hidden fees)

End-to-End Supply Chain Control: Vertical integration (lens manufacturing, software development) ensures 99.2% on-time delivery (2025 performance data). All shipments include 24-month warranty with local technical support partners.

Contact for Verified Procurement:

Email: [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier & DDP Shipping Calculator

Final Recommendation

In 2026, prioritize suppliers with demonstrable regulatory compliance and DDP shipping capabilities. Avoid “lowest cost” traps – hidden certification/shipping costs increase TCO by 18–35% (2025 EY Dental Supply Chain Report). Partner with manufacturers like Shanghai Carejoy that provide auditable compliance documentation, flexible MOQ structures, and risk-mitigated shipping. Always conduct pre-shipment factory acceptance testing (FAT) for scan accuracy (ISO 12836) and software interoperability.

Disclaimer: Regulatory requirements vary by market. Verify local compliance needs with your legal counsel. This guide reflects 2026 industry standards as of January 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Key Considerations When Purchasing Intraoral Scanners – Manufacturer Evaluation

Frequently Asked Questions (FAQ) – Buying Intraoral Scanners in 2026

| # | Question | Key Considerations |

|---|---|---|

| 1 | What voltage requirements do intraoral scanners from different manufacturers support, and are they compatible with global power standards? | Most intraoral scanners in 2026 operate on low-voltage DC power (typically 5V–12V) supplied via USB or docking stations. Leading manufacturers (e.g., 3Shape, Align, Carestream) design power adapters compliant with 100–240V AC, 50/60 Hz, enabling global deployment. Confirm with the manufacturer that the included power supply meets local electrical regulations (e.g., CE, UL, CCC). For clinics in regions with unstable power, inquire about surge protection integration or optional voltage stabilizers. |

| 2 | How accessible and cost-effective are spare parts (e.g., scan tips, cables, batteries) for long-term maintenance? | Evaluate spare parts availability through the manufacturer’s direct channels or authorized distributors. In 2026, top-tier manufacturers offer modular designs with field-replaceable components. Scan tips and handpiece cables are commonly available with lead times under 5 business days in major markets. Request a spare parts price list and assess lifecycle costs. Some OEMs now offer subscription-based maintenance kits to ensure continuous supply and reduce downtime. |

| 3 | What does the installation process involve, and is on-site technician support provided? | Installation typically includes hardware setup, software integration with existing practice management systems (PMS), and calibration. In 2026, most manufacturers provide remote installation support via secure cloud platforms. However, premium packages from companies like Dentsply Sirona and Planmeca include optional on-site technician services for complex integrations or multi-unit deployments. Confirm whether installation is included in the purchase price or billed separately. |

| 4 | What is the standard warranty coverage for intraoral scanners, and are extended warranties available? | Standard warranties in 2026 range from 1 to 3 years, covering defects in materials and workmanship. Coverage typically includes the scanner body and internal electronics but excludes consumables (e.g., tips, sleeves). Leading manufacturers offer extended warranty programs (up to 5 years) with options for accidental damage protection. Ensure the warranty includes return shipping (DHL/FedEx) and a loaner unit during repair when applicable. |

| 5 | Are software updates included during the warranty period, and how are they deployed? | Yes, all major manufacturers include free software updates during the warranty term. In 2026, updates are delivered via secure over-the-air (OTA) protocols or cloud-based portals, ensuring minimal disruption. Updates often enhance scanning algorithms, improve compatibility with CAD/CAM systems, and add new clinical features. Verify that your IT infrastructure supports automatic update scheduling and data backup protocols to maintain compliance and performance. |

Need a Quote for Intraoral Scanners Manufacturer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160