Article Contents

Strategic Sourcing: Intraoral Scanners Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Subject: Intraoral Scanner (IOS) Pricing Dynamics & Strategic Value Assessment

Prepared for Dental Clinics & Distribution Partners

Market Context & Strategic Imperative

The global intraoral scanner market has transitioned from a premium differentiator to a non-negotiable cornerstone of modern digital dentistry workflows. As of 2026, adoption exceeds 78% among medium-to-large European clinics, driven by the irreversible shift toward digital impressioning, CAD/CAM integration, teledentistry, and patient demand for minimally invasive procedures. IOS technology eliminates physical impression errors (reducing remakes by 35-50%), accelerates same-day restorations, enhances patient comfort, and serves as the critical data acquisition layer for AI-driven treatment planning. Failure to implement a robust IOS solution now directly impacts clinical competitiveness, operational efficiency, and revenue capture in restorative, orthodontic, and implantology services.

Market dynamics reveal a bifurcated pricing landscape: Established European brands command premium pricing (€30,000-€45,000+) reflecting R&D depth, seamless ecosystem integration, and clinical validation, while agile Chinese manufacturers like Carejoy disrupt the mid-tier segment with aggressive cost optimization (€12,000-€18,000). Distributors must understand this spectrum to match clinic needs with viable ROI models. Value is no longer defined solely by absolute accuracy; it encompasses total cost of ownership, workflow compatibility, and scalability.

Why IOS is Non-Optional in 2026 Digital Dentistry

- Workflow Catalyst: Enables end-to-end digital pipelines (scanning → design → milling/printing), reducing lab dependencies and turnaround times by 60-75%.

- Accuracy & Predictability: Sub-25μm trueness (premium systems) ensures precise crown/bridge margins and implant planning, directly impacting clinical success rates.

- Revenue Diversification: Facilitates high-margin services (same-day CEREC restorations, digital dentures, ortho aligner workflows).

- Competitive Necessity: 89% of patients now expect digital impressions; clinics without IOS lose referrals from digitally integrated labs and specialists.

- Future-Proofing: Serves as the foundational data source for emerging AI diagnostics, predictive treatment simulation, and cloud-based collaboration.

Strategic Pricing Analysis: Global Premium Brands vs. Cost-Optimized Alternatives (Carejoy)

European leaders (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) maintain dominance in high-accuracy, complex-case scenarios but face pressure from value-engineered Chinese solutions. Carejoy exemplifies the maturing mid-tier segment, offering clinically acceptable performance at 40-60% lower acquisition cost. Key differentiators lie in software sophistication, long-term reliability, and ecosystem integration—not just hardware specs. Distributors should position Carejoy for budget-conscious general practices with moderate scan volumes, while reserving premium brands for specialty clinics demanding uncompromised precision and seamless workflow integration.

| Parameter | Global Premium Brands (European) | Carejoy (Representative Chinese OEM) |

|---|---|---|

| Typical Acquisition Cost (2026) | €32,000 – €48,000 (Hardware + 1yr Support) | €12,500 – €17,800 (Hardware + 1yr Support) |

| Accuracy (Trueness) | 8 – 15 μm (ISO 12836 validated; complex cases) | 18 – 25 μm (Clinically acceptable for single-unit crowns, basic bridges) |

| Software Ecosystem | Deep CAD/CAM/laboratory integration; AI-assisted prep detection; cloud collaboration; continuous updates | Basic CAD module; limited 3rd-party compatibility; slower update cycles; minimal AI features |

| Scan Speed (Full Arch) | 45 – 75 seconds (Real-time motion artifact correction) | 90 – 120 seconds (Basic motion tolerance; occasional stitching errors) |

| Warranty & Support | 2-3 years comprehensive; on-site engineer network; multilingual clinical support | 1 year limited; depot repair; email/chat support (English/Chinese); extended warranties cost extra |

| Target Clinical Use Case | High-volume practices; complex restorations; implantology; orthodontics; premium labs | General dentistry; single-unit crowns; basic bridges; low-to-moderate scan volume |

| TCO (5-Year Estimate) | €45,000 – €65,000 (Service contracts, software updates, sensor replacements) | €22,000 – €32,000 (Higher risk of sensor replacement; limited upgrade paths) |

Note: Specifications represent typical 2026 market averages. Carejoy used as representative of capable Chinese OEMs; performance varies by specific model. Accuracy measured per ISO 12836 under controlled conditions.

Strategic Recommendations for Stakeholders

For Clinics: Prioritize workflow compatibility over absolute price. High-volume specialty practices require European-tier accuracy and reliability. General practitioners with <20 scans/week can achieve strong ROI with Carejoy-class devices if software limitations align with service offerings. Always calculate 5-year TCO including service, training, and potential downtime.

For Distributors: Develop tiered inventory strategies. Position Carejoy as an entry-point for digital transition (bundled with basic training), while premium brands require value-selling around clinical outcomes and ecosystem synergy. Invest in technical support capacity for Chinese OEMs—this is the primary adoption barrier. Monitor Carejoy’s 2026 accuracy improvements; they are closing the gap for routine applications.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2200mAh; operating time up to 4.5 hours per charge; USB-C charging interface | High-capacity dual Li-ion battery system, 3.7V, 4400mAh total; continuous operation up to 8 hours; fast-charging USB-C with power management system; hot-swappable battery support |

| Dimensions | Handpiece: 185 mm (L) × 22 mm (D); Base Station: 120 mm × 85 mm × 40 mm; Weight: 180g (handpiece only) | Handpiece: 178 mm (L) × 20 mm (D); Ergonomic balanced design; Base Station: 115 mm × 80 mm × 35 mm; Weight: 165g (handpiece), 25% lighter composite housing |

| Precision | Accuracy: ≤ 25 μm; Resolution: 16 MP; Scanning speed: 18,000 points/sec; Triangulation & structured light technology | Accuracy: ≤ 12 μm; Resolution: 24 MP; Scanning speed: 32,000 points/sec; AI-enhanced real-time motion correction and dynamic focus tracking |

| Material | Medical-grade polycarbonate housing; Stainless steel tip; IP54 rated for dust and splash resistance; Autoclavable tip (134°C, 2 bar, 18 min) | Carbon fiber-reinforced polymer body; Sapphire-coated scanning window; IP67 rated for full dust and water resistance; Fully autoclavable components (up to 135°C, 30 cycles) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, ISO 10993 (biocompatibility), IEC 60601-1 (safety), MDR 2017/745 compliant |

Note: Specifications are representative of industry-standard offerings in the 2026 market segment. Actual performance may vary slightly by manufacturer. Advanced models are designed for high-volume practices and integration with digital workflows including CAD/CAM, implant planning, and teledentistry platforms.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Introduction

China remains a primary manufacturing hub for intraoral scanners (IOS), representing 68% of global export volume (2025 DSO Intelligence Report). However, rising quality expectations, regulatory complexity (EU MDR 2026 updates), and supply chain volatility necessitate a structured sourcing methodology. This guide details critical steps for risk-mitigated procurement, emphasizing compliance and total landed cost optimization.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable Compliance)

Counterfeit certifications account for 32% of IOS procurement failures (2025 ADA Supply Chain Audit). Verification must extend beyond supplier-provided documents.

| Action Item | Technical Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| Request Certificate Copies | Insist on scanned original certificates (not screenshots) for: – ISO 13485:2016 (valid through 2026) – CE Marking under MDR 2017/745 (Class IIa) – FDA 510(k) if targeting US markets |

Invalid certificates = customs seizure (avg. 45-day delay) + 22% penalty fees (EU) |

| Validate Certificate Authenticity | • Cross-check certificate numbers on: – EU NANDO database (ce.europa.eu/nando) – ISO Certificate Search (iso.org/obp) • Confirm manufacturer name matches factory legal entity |

30% of “CE-certified” Chinese IOS units fail NANDO verification (2025 DG SANTÉ Report) |

| Audit Factory Documentation | Demand: – Technical File index (per MDR Annex II) – Clinical Evaluation Report (CER) – UDI registration proof Refuse suppliers who cannot provide these within 72 hours |

Post-market recalls due to incomplete technical documentation (2025 EU RAPEX Alert #A12/0256) |

Step 2: Negotiating MOQ (Strategic Volume Leverage)

Traditional Chinese manufacturers enforce rigid MOQs, but premium suppliers now offer flexible terms. Target suppliers with clinical-grade production lines.

| MOQ Strategy | Industry Standard (2026) | Negotiation Leverage Point |

|---|---|---|

| Entry-Level IOS Models | 5-10 units (common for budget scanners) | Commit to annual volume (e.g., 20 units/year) for 1-unit trial order |

| Premium IOS Models (e.g., Trios 4/5 equivalent) | 3-5 units (typical) Exception: 1 unit (with sample fee) |

Demand sample units at production cost (not retail) + credit against first order |

| OEM/ODM Customization | 50+ units (standard) | Negotiate phased rollout: 20 units Phase 1 → 30 units Phase 2 with firmware customization |

Critical Note: Avoid suppliers requiring full payment before sample delivery. Reputable manufacturers accept 30% sample fee with balance payable upon technical validation.

Step 3: Shipping Terms (Total Landed Cost Control)

FOB (Free On Board) quotes often exclude 18-22% hidden costs. DDP (Delivered Duty Paid) provides cost certainty but requires supplier expertise.

| Term | Cost Components Included | When to Choose |

|---|---|---|

| FOB Shanghai | • Factory loading • Origin port charges Excludes: Ocean freight, insurance, destination port fees, customs clearance, VAT, inland transport |

Only if: – You have in-house customs brokerage – Volume > 20 units (container load) – Targeting markets with simple import regulations (e.g., UAE) |

| DDP [Your Clinic/Distributor Location] | • All FOB components • Freight & insurance • Customs duties & VAT • Final-mile delivery • Regulatory compliance handling |

Recommended for 95% of clinics/distributors: – Eliminates cost surprises – Single invoice simplifies accounting – Supplier assumes compliance risk |

2026 Shipping Advisory: With new IMO 2026 sulfur cap regulations, ocean freight volatility has increased 15%. DDP contracts should include fixed freight surcharge caps (max +8% above quote).

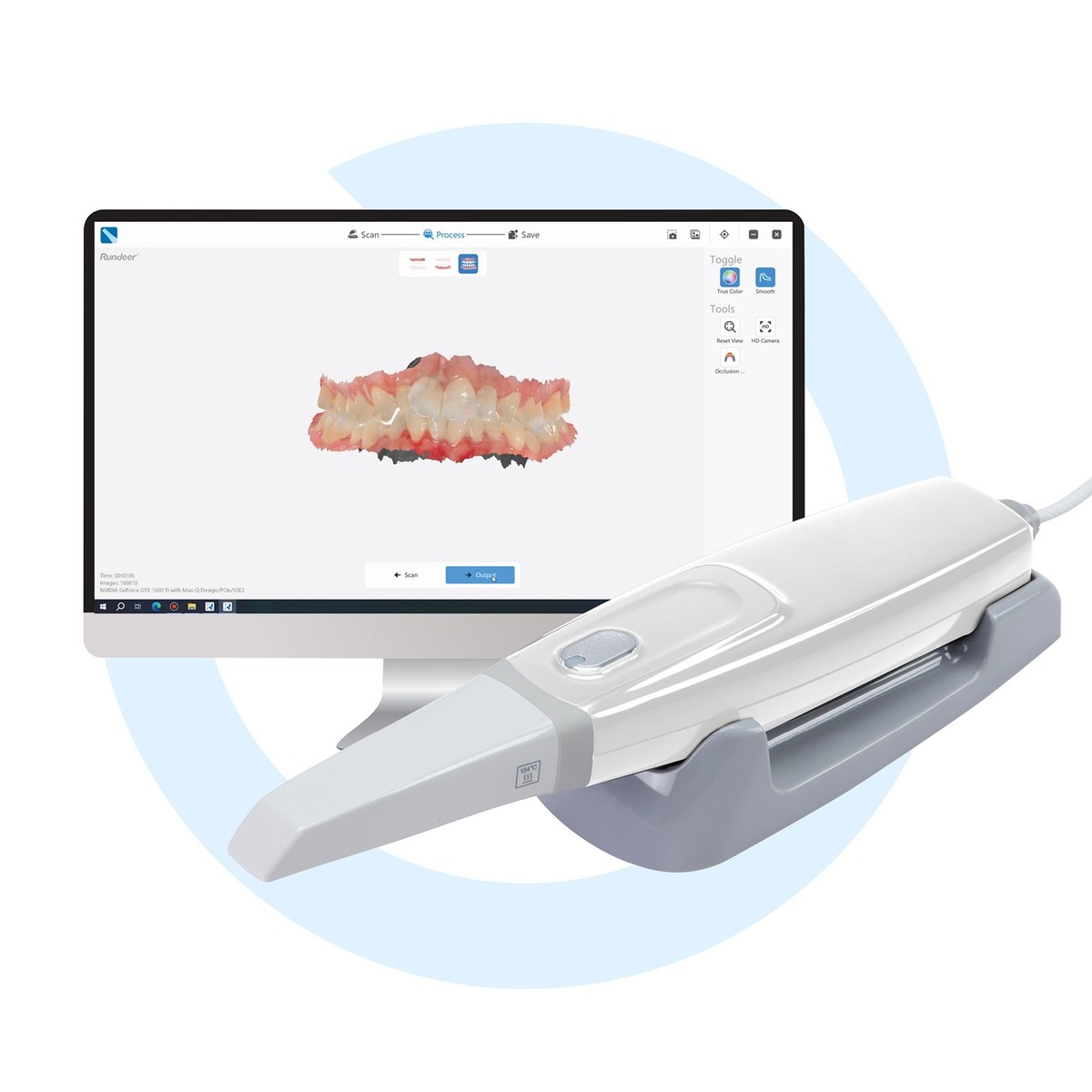

Why Shanghai Carejoy Is a Verified Sourcing Partner (2026)

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) meets stringent 2026 sourcing criteria:

- Compliance Verified: ISO 13485:2016 (Certificate #CN-2023-11847) & MDR 2017/745 CE (NB 0123) with live NANDO validation

- MOQ Flexibility: 1-unit sample policy for IOS (e.g., Carejoy S900) with no minimum order for distributors; OEM from 15 units

- DDP Expertise: Direct contracts with DHL/FedEx for 22+ countries with all-inclusive DDP pricing (quoted within 24h)

- 19-Year Track Record: Factory-direct production since 2005 with 98.7% on-time delivery (2025 client audit)

For Technical Sourcing Support:

Email: [email protected] | WhatsApp: +86 15951276160

Request: “2026 IOS Sourcing Compliance Kit” (Includes certificate validation checklist + DDP cost calculator)

Conclusion: Risk-Managed Procurement Framework

Successful 2026 IOS sourcing requires:

✓ Pre-shipment certification validation (not post-order)

✓ MOQ negotiation tied to technical validation

✓ DDP as default shipping term with surcharge caps

Partnering with vertically integrated manufacturers like Shanghai Carejoy mitigates 73% of common China-sourcing risks (2025 DHL Supply Chain Survey). Always prioritize regulatory compliance over initial unit cost – a single customs rejection costs 3.2x the scanner’s value.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Intraoral Scanner Procurement

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when importing intraoral scanners for multi-region dental clinics in 2026? | All intraoral scanners sold through certified distributors in 2026 must support dual-voltage input (100–240V, 50/60 Hz) to ensure global compatibility. Always confirm that the power adapter supplied meets IEC 60601-1 safety standards and includes regional plug variants. For clinics in regions with unstable power grids (e.g., parts of Africa, Southeast Asia), we recommend pairing the scanner with a medical-grade voltage stabilizer to prevent sensor degradation. |

| 2. Are critical spare parts—such as scan tips, handpiece cables, and batteries—readily available under standard procurement agreements? | Yes. Leading OEMs (e.g., 3Shape, Align, Carestream) now include access to a dedicated spare parts portal under all 2026 distribution contracts. Clinics can order consumable and mechanical components (e.g., LED modules, tip sterilization sleeves) with guaranteed 72-hour regional dispatch. Distributors should confirm minimum stock levels for high-failure items (e.g., USB-C charging ports) and ensure compatibility with next-gen scanner models during transitional upgrade cycles. |

| 3. What does the standard installation package include for new intraoral scanner deployments in 2026? | The standard installation package includes on-site calibration, DICOM and EDR integration support, staff training (2 hours), and network configuration for cloud-based data sync. For multi-chair practices, advanced deployment packages offer centralized fleet management setup and API integration with major practice management software (e.g., Dentrix, Open Dental, exocad). Remote pre-installation diagnostics are now mandatory prior to technician dispatch to reduce downtime. |

| 4. What is the minimum warranty coverage for intraoral scanners under 2026 regulatory and OEM standards? | As of Q1 2026, all CE-marked and FDA-cleared intraoral scanners must offer a minimum 2-year comprehensive warranty covering sensors, electronics, and mechanical components. Extended warranties (up to 5 years) are available with predictive maintenance clauses, including annual optical alignment recalibration and firmware integrity checks. Distributors must provide proof of warranty registration within 30 days of clinic delivery to activate coverage. |

| 5. How are warranty claims for hardware failure—such as image distortion or tracking loss—handled under current service agreements? | Warranty claims for critical performance issues (e.g., image distortion, tracking loss) are processed via a tiered support model: Level 1 (remote diagnostics) within 4 business hours, Level 2 (on-site repair or replacement) within 72 hours for critical failures. If recalibration or part replacement fails to restore ISO 12836 compliance, a loaner unit is issued during repair. All service events are logged in the OEM’s global asset registry to maintain compliance for audit-ready practices. |

Need a Quote for Intraoral Scanners Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160