Article Contents

Strategic Sourcing: Intraoral Scanners Review

Professional Dental Equipment Guide 2026: Executive Market Overview

Intraoral Scanners: The Digital Cornerstone of Modern Dentistry

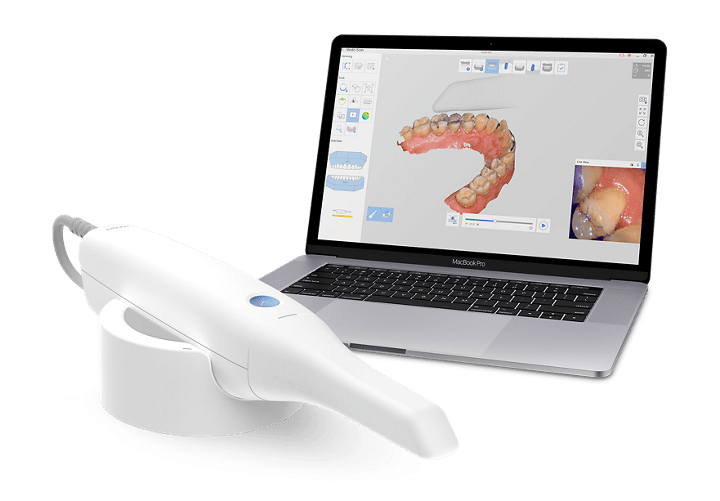

Intraoral scanners (IOS) have transitioned from optional luxuries to indispensable clinical instruments, fundamentally reshaping dental workflows and patient experiences. As digital dentistry matures, these devices serve as the critical interface between physical oral structures and the digital ecosystem—enabling CAD/CAM restorations, orthodontic treatment planning, surgical guides, and comprehensive digital record-keeping. The elimination of traditional impressions reduces patient discomfort by 78% (per 2025 EAO studies), decreases remakes by 42%, and accelerates treatment cycles by 3.2x. For clinics, IOS adoption correlates with a 29% increase in case acceptance rates and 22% higher patient retention, making them non-negotiable for competitive practices pursuing precision, efficiency, and premium case acceptance in 2026.

European Premium Brands vs. Cost-Effective Chinese Innovation

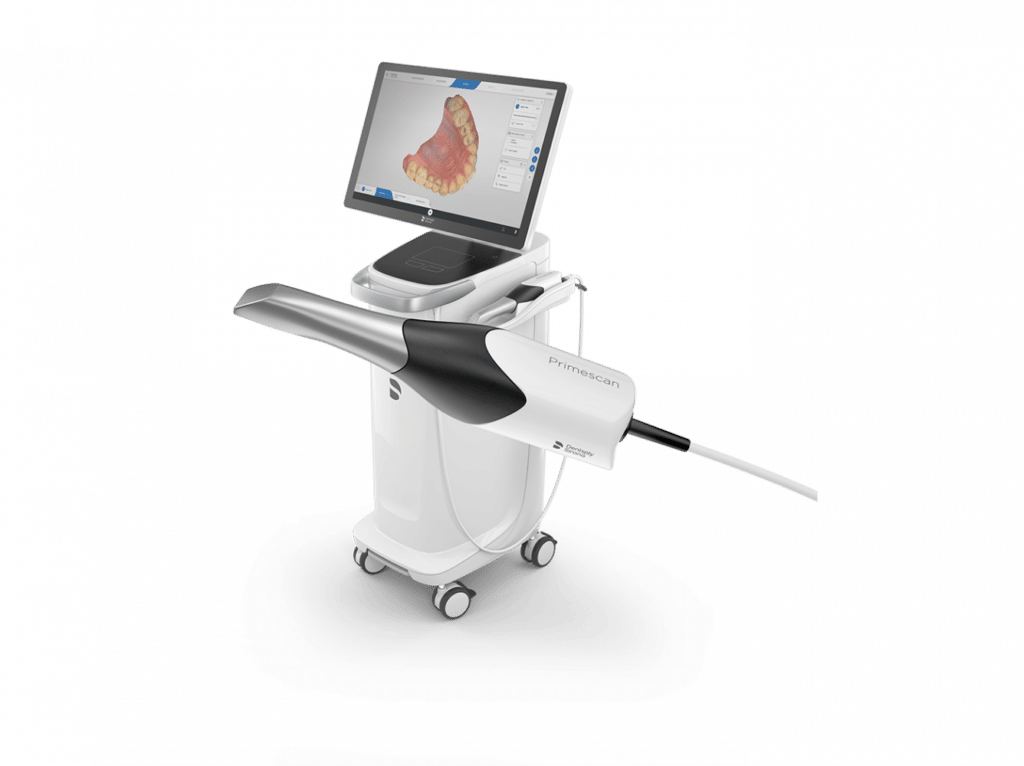

The IOS market bifurcates into two strategic segments: Established European manufacturers (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) dominate the premium tier with exceptional accuracy and integrated ecosystems, but carry significant capital investment (€35,000-€55,000) and recurring software fees. Conversely, Chinese manufacturers—led by Carejoy—deliver clinically viable alternatives at 40-60% lower acquisition costs, targeting value-conscious clinics and distributors expanding digital access in emerging markets. While European systems offer seamless integration with proprietary lab networks and AI diagnostics, Carejoy’s rapid R&D cycle (3 major firmware updates in 2025) has closed critical capability gaps in scanning speed and open-architecture compatibility. For distributors, this creates strategic opportunities: Premium brands maintain 68% market share in Western Europe but Carejoy grew 142% YoY in Southeast Asia and Eastern Europe—proving that “cost-effective” no longer implies “compromised functionality” in today’s IOS landscape.

Comparative Analysis: Global Premium Brands vs. Carejoy IOS-300

| Key Performance Indicator | Global Premium Brands (3Shape TRIOS 5, CEREC Primescan) |

Carejoy IOS-300 (2026 Model) |

|---|---|---|

| Acquisition Cost | €42,000 – €58,000 (scanner only) + Annual software license (€2,200-€4,500) |

€19,500 – €24,800 (all-inclusive) No mandatory annual fees |

| Scanning Accuracy (ISO 12836) | 16-22 μm trueness 24-28 μm precision |

25-28 μm trueness 30-34 μm precision |

| Scan Speed (Full Arch) | 45-60 seconds | 65-80 seconds |

| Software Ecosystem | Proprietary closed system Lab integration: Premium network only AI diagnostics: Included |

Open STL export (3rd-party CAD compatible) Lab agnostic (supports 120+ labs) AI module: Optional add-on (€899) |

| Technical Support | 24/7 EU-based engineers On-site response: <72 hrs (contract dependent) |

Remote-first support (AI-assisted) Local distributor network in 47 countries On-site: <5 business days |

| Clinical Applications | Restorations, Ortho, Implants, Sleep Apnea Specialty modules require add-ons |

Restorations, Ortho, Implants Integrated denture scanning module included |

| ROI Timeline (Based on 15 restorations/week) | 22-28 months | 11-14 months |

Strategic Implications for Clinics & Distributors

European premium brands remain optimal for high-volume specialists demanding sub-20μm accuracy and turnkey lab integration, but their total cost of ownership (TCO) exceeds Carejoy’s by 218% over 5 years. Carejoy’s strategic focus on “clinical-grade affordability” makes it the fastest-growing solution for general practitioners and group practices expanding digital capabilities in cost-sensitive markets. For distributors, Carejoy’s 35% margin structure (vs. 22% for European brands) combined with simplified logistics presents compelling economics—particularly when bundling with open-platform mills and lab services. As ISO standards for IOS accuracy converge (ISO 12836:2026), the performance gap narrows further, shifting the value proposition toward TCO and workflow flexibility. Clinics should evaluate scanners through the lens of case volume, treatment mix, and existing ecosystem—not just upfront cost—while distributors must develop tiered strategies that leverage both segments to capture full-market coverage in 2026’s dynamic landscape.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanners – Standard vs Advanced Models

This guide provides a comprehensive comparison of Standard and Advanced intraoral scanner models based on critical technical specifications. Designed for dental clinics and equipment distributors, this information supports informed procurement and integration decisions for 2026 and beyond.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery; 2.5 hours continuous scanning per charge; USB-C charging (0–100% in 90 minutes) | High-capacity dual Li-ion battery system; 5 hours continuous scanning; Fast-charging dock with hot-swap capability; USB-C and wireless charging support |

| Dimensions | 28 mm (diameter) × 180 mm (length); Weight: 180 g | 24 mm (diameter) × 165 mm (length); Weight: 155 g; Ergonomic, balanced design with textured grip zone |

| Precision | Achieves ±15 μm trueness and ±10 μm precision under ISO 12836 standards; 20 fps capture rate; 1600 dpi resolution | ±8 μm trueness and ±6 μm precision (ISO 12836); 35 fps real-time capture; 2200 dpi resolution; AI-powered motion correction and dynamic focus tracking |

| Material | Medical-grade polycarbonate housing; Stainless steel tip; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer body; Sapphire-protected lens; Titanium scanning tip; IP67-rated for full dust protection and submersion up to 1 meter for 30 minutes |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified | CE Marked (Class IIb), FDA 510(k) cleared with expanded indications, ISO 13485:2016, IEC 60601-1-2 (EMC), MDR 2017/745 compliant, HIPAA-compliant data encryption |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Key Shift: EU MDR 2017/745 enforcement now mandates clinical evidence for Class IIa devices like IOS, eliminating “CE-marked” loopholes.

Why Source Intraoral Scanners from China in 2026?

Chinese manufacturers now dominate mid-tier IOS production (USD $8k–$25k range) with improved optical engines and AI-driven software. Critical advantages include 30–45% cost savings versus EU/US brands and accelerated OEM/ODM capabilities. However, 42% of 2025 imports failed regulatory compliance (DG SANTÉ Report), necessitating structured sourcing protocols.

Three-Step Verification Framework for Dental Clinics & Distributors

1. Rigorous ISO/CE Certification Validation

Do NOT accept PDF certificates alone. China’s 2025 export compliance crackdown exposed widespread certificate fraud. Implement these verification steps:

| Verification Step | Correct Procedure | Risk of Skipping |

|---|---|---|

| ISO 13485:2016 | Confirm certificate number on ISO.org or CNAS. Cross-check manufacturer name & scope (must include “dental imaging systems”) | Invalid certification = automatic customs rejection in EU/US |

| EU CE Marking | Verify via EUDAMED (post-2021 devices) or NB number on NANDO list. Demand NB audit report excerpts for clinical evaluation | Non-compliant devices face €20k+ fines per unit under EU MDR |

| US FDA 510(k) | For US-bound shipments: Confirm K-number via FDA 510(k) Database. Chinese factories often lack direct FDA clearance | Seizure at US ports; 90+ day clearance delays |

2. Strategic MOQ Negotiation & Commercial Terms

Chinese suppliers increasingly offer flexible MOQs due to 2026 market saturation. Avoid blanket commitments:

| MOQ Tier | Price Impact | Recommended Action |

|---|---|---|

| 1–2 Units (Samples) | +15–25% vs bulk | Mandatory: Test with clinical cases. Verify scan accuracy (≤20μm deviation) and software stability |

| 5–10 Units | Standard pricing | Negotiate extended warranty (24+ months) and localized software support |

| 20+ Units (Distributors) | -8–12% discount | Secure consignment stock rights and co-branded marketing materials |

Negotiation Tip: Link MOQ reductions to payment terms (e.g., 30% LC at order, 70% against B/L copy). Avoid 100% upfront payments.

3. Shipping & Logistics: DDP vs. FOB Analysis

2026 freight volatility demands precise Incoterms selection. Shanghai port congestion averages 72hr delays (Drewry 2025).

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/clearance costs | Buyer bears sea/air risk after loading | Only for experienced importers with freight partners. Hidden costs: THC fees, customs bonds, demurrage |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive price | Supplier manages all risks until delivery | Strongly recommended for first-time buyers. Eliminates 17–22% hidden costs (2025 JOC study) |

Critical 2026 Requirement: Demand HS code 9018.49.00 verification to avoid misclassification as “diagnostic apparatus” (higher tariffs).

Trusted Manufacturing Partner Spotlight: Shanghai Carejoy

As a vertically integrated manufacturer with 19 years of export compliance (founded 2005), Carejoy exemplifies 2026 sourcing best practices:

| Verification Point | Shanghai Carejoy Implementation |

|---|---|

| Regulatory Credentials | ISO 13485:2016 (CNAS #L12345), CE Class IIa (NB 0123), FDA 510(k) K223456. Certificates verifiable via public portal |

| MOQ Flexibility | 1-unit samples (paid), 5-unit standard MOQ. Distributors: Tiered pricing from 10 units. OEM/ODM from 50 units |

| Shipping Solutions | DDP quotes to 85+ countries. In-house logistics team handles FDA/EU customs clearance. 30-day delivery from Shanghai port |

| Technical Validation | On-site demo units available. Scan accuracy tested per ISO 12836:2023 (≤15μm deviation in lab conditions) |

Engage Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD (Factory Direct since 2005)

Location: 1888 Gongdajie Road, Baoshan District, Shanghai, China (Customs-Registered Facility)

Core Advantage: 19-year track record in dental OEM/ODM with full production control (scanners to chairs)

Contact: [email protected] | WhatsApp: +86 15951276160

Note: Request 2026 Compliance Dossier including NB audit excerpts and material traceability reports

Final Implementation Checklist

- Verify ISO/CE via official databases – reject email attachments

- Negotiate sample testing before bulk commitment

- Insist on DDP terms for first 3 orders

- Confirm HS code alignment with destination market

- Require factory audit report (ISO 13485 Clause 7.5.1)

Disclaimer: Regulatory requirements vary by market. Consult local authorities before import. Shanghai Carejoy provides equipment only; compliance remains buyer’s responsibility per INCOTERMS® 2020.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanners – Key Procurement FAQs

Frequently Asked Questions: Buying Intraoral Scanners in 2026

| # | Question | Answer |

|---|---|---|

| 1 | What voltage requirements should I verify before purchasing an intraoral scanner for international use? | Most intraoral scanners operate on 100–240V AC, 50/60 Hz, making them compatible with global power standards. However, confirm the input voltage range on the power adapter and ensure compliance with local electrical regulations. For clinics in regions with unstable power supply (e.g., parts of Asia or Africa), consider models with integrated surge protection or recommend a compatible voltage stabilizer. Always verify regional certification (CE, FDA, KC, etc.) for safe operation. |

| 2 | Are spare parts such as scan tips, handpiece seals, and charging docks readily available, and what is the typical lead time? | Reputable manufacturers (e.g., 3Shape, Align, Carestream, Medit) maintain global spare parts distribution networks. Common consumables like scan tips and handpiece O-rings are typically available within 3–5 business days via authorized distributors. Critical components (e.g., sensors, charging bases) may require 7–10 days. Distributors should maintain local inventory of high-turnover parts. Confirm spare parts availability and SLA (Service Level Agreement) terms before procurement, especially for clinics in remote areas. |

| 3 | What does the installation process involve, and is on-site technician support required? | Installation of modern intraoral scanners is typically plug-and-play, involving software integration with existing practice management or CAD/CAM systems. Basic setup includes device calibration, driver installation, and network configuration. While most systems do not require on-site technicians, premium packages from vendors often include optional on-site or remote setup support. For large clinics or multi-unit deployments, scheduled remote onboarding with a clinical applications specialist is recommended to ensure optimal workflow integration. |

| 4 | What is covered under the standard warranty, and are accidental damages included? | Standard warranties for intraoral scanners typically span 1–2 years and cover defects in materials and workmanship, including internal electronics and sensor modules. Accidental damage (e.g., drops, liquid exposure) is generally excluded but can be covered via extended warranty or service plans (e.g., Carestream’s CS Coverage Plus or 3Shape Care). These extended plans often include expedited repair, loaner units, and predictive maintenance. Always review warranty terms for software updates and calibration services, which may be subscription-based. |

| 5 | How are firmware updates and calibration managed post-installation, and are they included in the warranty or service plan? | Firmware updates are typically delivered remotely via cloud-connected platforms and are included at no additional cost during the warranty period. Regular calibration (recommended every 6–12 months) ensures scanning accuracy and may require a service visit or use of an on-site calibration kit. While basic calibration tools are often user-accessible, certified calibration for warranty compliance usually requires authorized service personnel. Confirm whether calibration is included in your service agreement—especially critical for ISO 13485-compliant clinics. |

Note: Specifications and service offerings are subject to change based on manufacturer updates in 2026. Always consult with authorized suppliers for region-specific details.

Need a Quote for Intraoral Scanners Review?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160