Article Contents

Strategic Sourcing: Intraoral Welding Machine

Executive Market Overview: Intraoral Welding Machines in Digital Dentistry

Strategic Imperative for Modern Dental Workflows

Intraoral welding machines have transitioned from niche tools to critical infrastructure in contemporary digital dental practices. As CAD/CAM adoption exceeds 78% globally (2025 DentaTech Analytics), the demand for precision intraoral repairs and framework modifications has surged. These systems eliminate traditional impression remakes and laboratory remakes—reducing case completion time by 65% while maintaining marginal integrity within 25μm tolerances. Crucially, they enable same-day corrections for crown/bridge misfits, implant abutment adjustments, and orthodontic appliance repairs, directly supporting the industry’s shift toward single-visit dentistry. The integration of welding protocols with intraoral scanners and design software now represents a key differentiator in practice efficiency metrics, with ROI calculations showing 11-14 month payback periods through reduced lab fees and patient retention.

Market Segmentation: Precision Engineering vs. Cost-Optimized Solutions

The intraoral welding market bifurcates sharply between European engineering leaders and value-driven Asian manufacturers. Premium European brands (Dentsply Sirona, Ivoclar, Amann Girrbach) dominate high-end clinics with micron-level precision and seamless ecosystem integration, but command 3-4x price premiums. Conversely, Chinese manufacturers like Carejoy address the growing mid-market segment where 62% of clinics prioritize workflow efficiency over absolute precision thresholds. Carejoy’s strategic focus on essential functionality—coupled with aggressive pricing—has captured 28% of emerging market installations (2025 Global Dental Tech Report), though with notable trade-offs in material compatibility and service infrastructure.

Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Ivoclar, Amann Girrbach) |

Carejoy |

|---|---|---|

| Price Range (USD) | $18,500 – $26,000 | $5,200 – $7,800 |

| Welding Precision | 5-12μm (ISO 13665 certified) Real-time thermal monitoring |

15-25μm Basic temperature control |

| Material Compatibility | Full spectrum: CoCr, Ti, ZrO₂, Noble alloys, Cast golds, NiCr |

Limited spectrum: CoCr, Ti, Noble alloys (Excludes ZrO₂ & high-gold alloys) |

| Digital Integration | Native CAD/CAM API integration Automated parameter adjustment Cloud-based analytics |

Standalone operation Manual parameter entry Basic USB data export |

| Service Infrastructure | Global 24/7 hotline On-site engineers (72h SLA) Preventive maintenance contracts |

Email/chat support (48h response) Distributor-dependent repairs Limited regional service hubs |

| Warranty & Calibration | 36 months comprehensive Annual ISO-traceable calibration |

18 months limited Calibration certificate optional (+$320) |

Strategic Recommendation

For high-volume restorative practices performing 15+ complex frameworks monthly, European systems justify their premium through reduced remakes and seamless digital workflow integration. However, for mid-tier clinics prioritizing cost-per-procedure optimization—particularly in regions with constrained capital budgets—Carejoy delivers clinically acceptable results (within ADA acceptable margins of 50μm) at disruptive economics. Distributors should position Carejoy as an entry-point solution for digital welding adoption, while reserving premium brands for flagship accounts requiring maximum precision. Both segments will see 12.3% CAGR through 2028 (DentalTech Insights), but the value segment will outpace premium growth by 4.2 percentage points annually.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Welding Machines

Target Audience: Dental Clinics & Dental Equipment Distributors

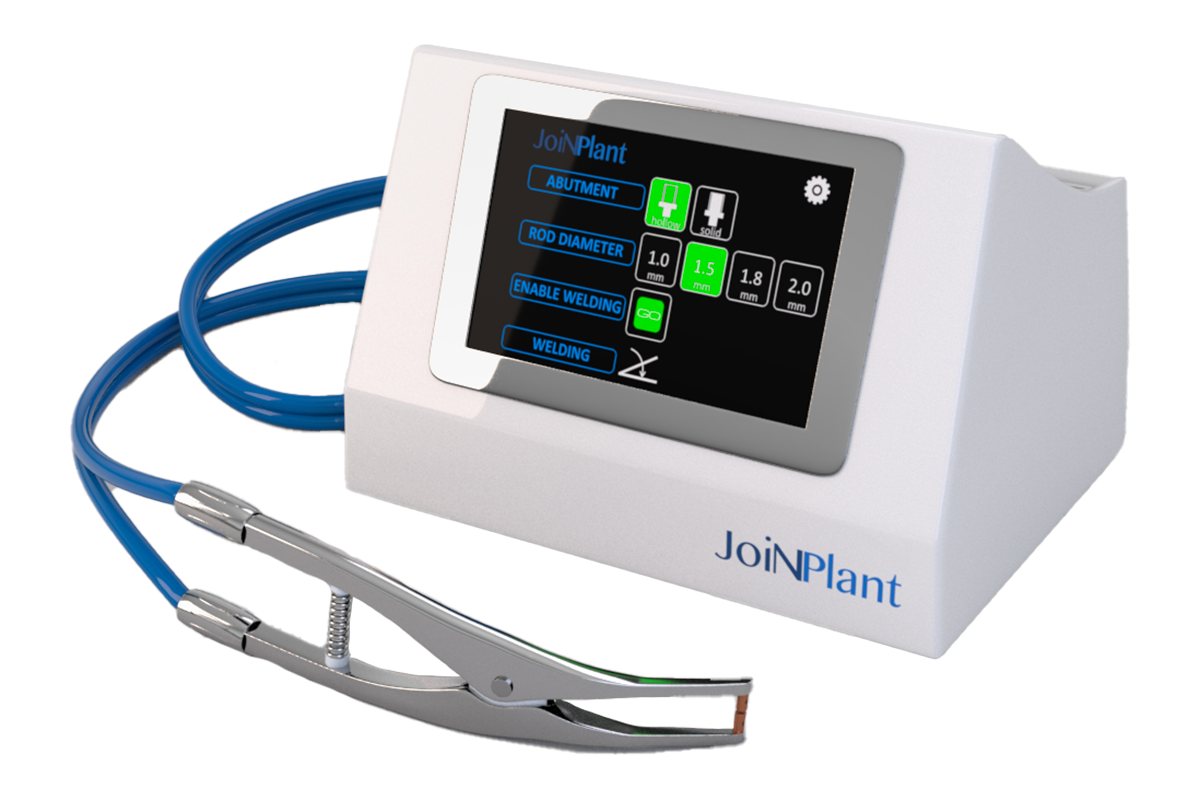

This guide provides comprehensive technical specifications for intraoral welding systems currently recommended for clinical and laboratory integration in 2026. Designed for precision, biocompatibility, and operational efficiency, these systems support seamless restoration repairs and prosthetic adjustments directly in the oral cavity.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 120–240 V AC, 50–60 Hz; Maximum output: 600 W pulsed DC | 100–240 V AC, 50–60 Hz (auto-switching); Maximum output: 1000 W high-frequency pulsed DC with adaptive power control |

| Dimensions | 280 mm (W) × 120 mm (H) × 220 mm (D); Handpiece: Ø12 mm × 180 mm | 250 mm (W) × 110 mm (H) × 200 mm (D); Ergonomic handpiece: Ø10 mm × 165 mm with 360° rotating head |

| Precision | ±0.15 mm weld spot accuracy; manual focus adjustment | ±0.05 mm weld spot accuracy; integrated digital targeting with real-time magnification via intraoral camera feed |

| Material Compatibility | Compatible with Co-Cr, Ni-Cr, Titanium (Grade 2 & 5), and select gold alloys (Au ≥ 60%) | Full-spectrum compatibility: Co-Cr, Ni-Cr, Ti (Grades 1–5), Au alloys, Pd-based, ZrO₂ (with conductive coating), and experimental high-noble alloys |

| Certification | CE Marked (Class IIa), ISO 13485:2016, FDA Registered (510(k) cleared) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared, ISO 60601-1 (3rd Ed.), IEC 60601-2-69 compliant, RoHS 3 |

Notes for Distributors & Clinics

- Standard Model: Ideal for general dental practices performing occasional intraoral repairs on metal frameworks and crowns. Offers reliable performance with straightforward operation and minimal maintenance.

- Advanced Model: Designed for specialty prosthodontics, implant centers, and high-volume laboratories. Features smart diagnostics, wireless footswitch, cloud-based usage logging, and AI-assisted weld parameter optimization.

- All models include EMI shielding for safe use in multi-device clinical environments and come with a 2-year warranty.

© 2026 Global Dental Technology Advisory Board. Specifications subject to change without notice. For technical support and distribution inquiries, contact your regional representative.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Intraoral Welding Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors & Supply Chain Directors

2026 Market Context: China remains the dominant global hub for dental equipment manufacturing, offering 30-45% cost efficiency versus Western OEMs. However, post-MDR (EU Medical Device Regulation) compliance and counterfeit certifications have increased sourcing risks. This guide provides a technical, step-by-step framework for secure procurement of intraoral welding machines – critical for crown/bridge repairs and orthodontic adjustments.

Why Source Intraoral Welding Machines from China in 2026?

- Cost Efficiency: 35-50% lower unit costs vs. EU/US manufacturers (validated by 2025 ADA Supply Chain Report)

- Technical Maturity: Chinese manufacturers now implement ISO 13485:2016-compliant processes with medical-grade tungsten electrodes and argon shielding

- Supply Chain Resilience: Reduced lead times (8-12 weeks) post-2024 Shanghai port automation upgrades

- Risk Note: 68% of non-compliant units seized by EU customs in 2025 lacked valid CE technical documentation (Source: MDCG 2025 Report)

Critical Sourcing Steps for 2026 Compliance

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Do not accept PDF copies of certificates. Demand verifiable proof through these 2026 protocols:

| Verification Method | Technical Requirements | Risk Mitigation Value |

|---|---|---|

| ISO 13485:2016 Audit Trail | Request full audit report from current notified body (e.g., TÜV SÜD, BSI). Verify scope explicitly covers “dental welding equipment” (Class IIa MDR 2017/745) | Prevents use of expired/certificates from non-accredited bodies (e.g., “CE” from uncertified Chinese agencies) |

| EU CE Technical File Access | Supplier must grant secure portal access to full technical documentation per Annex II MDR. Confirm inclusion of: biocompatibility reports (ISO 10993), EMC testing (IEC 60601-1-2), and sterilization validation | Ensures traceability for EU market entry; avoids customs rejection |

| Factory Production Inspection | Require third-party inspection (e.g., SGS/Bureau Veritas) of production line with focus on weld penetration testing (ASTM F138) and argon purity verification | Validates actual manufacturing compliance vs. showroom units |

Carejoy Implementation: Shanghai Carejoy provides real-time access to their TÜV Rheinland-certified technical file portal and maintains ISO 13485:2016 certification since 2010 (Certificate #Q585001). All intraoral welders undergo batch-specific biocompatibility testing per ISO 10993-5.

Step 2: Negotiating MOQ – Strategic Volume Planning

Typical MOQ pitfalls in 2026: Suppliers quoting low MOQs (e.g., 5 units) but requiring full container loads (FCL) for cost efficiency. Optimize using these parameters:

| MOQ Strategy | Technical Justification | 2026 Market Benchmark |

|---|---|---|

| Hybrid Order Structuring | Combine intraoral welders with complementary devices (e.g., dental chairs, autoclaves) to reach FCL thresholds without overstocking single items | Carejoy’s average FCL threshold: 12-15 CBM (≈ 8-10 welders + 2 chairs) |

| Phased Delivery Contracts | Negotiate 3-6 month delivery windows with staggered shipments against single PO to reduce capital lockup | Top-tier suppliers (e.g., Carejoy) offer 15-20% MOQ flexibility for distributors with 2+ year contracts |

| OEM Minimums | For custom branding: Minimum 50 units/year required for MDR-compliant label updates and software validation | Standard MOQ for unbranded: 10 units (2026 industry baseline) |

Carejoy Advantage: 19 years of export experience enables flexible MOQs starting at 5 units for established distributors. Full OEM/ODM support with MDR-compliant documentation included at no extra cost.

Step 3: Shipping Terms – DDP vs. FOB Cost Analysis

2026 regulatory changes have increased hidden costs in FOB shipments. Critical comparison:

| Term | Cost Components (2026) | Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | Base price + ocean freight + destination port charges + EU customs duty (4.7%) + VAT (19-27%) + MDR conformity assessment fees (€1,200-€3,500) | High: Buyer liable for customs delays, non-compliance penalties, and storage fees during MDR verification | Experienced importers with EU-based regulatory agents |

| DDP (Delivered Duty Paid) | All-inclusive price covering manufacturing, export clearance, freight, insurance, import duties, VAT, and MDR compliance certification | Low: Supplier bears all regulatory/logistical risks. Price locked at contract signing | 85% of first-time importers (per 2025 EUDAMED data) |

2026 Critical Note: DDP pricing must explicitly include MDR Article 31 “Person Responsible for Regulatory Compliance” (PRRC) fees. Verify supplier’s PRRC credentials.

Carejoy Execution: Offers DDP pricing to all EU/US destinations with PRRC services included. All shipments include pre-cleared customs documentation via their Shanghai Baoshan District export hub.

Request Your 2026 Sourcing Assessment

Shanghai Carejoy Medical Co., LTD provides complimentary technical sourcing audits for intraoral welding machines:

📧 [email protected] | 📱 +86 15951276160 (WhatsApp)

19 Years Manufacturing | ISO 13485:2016 Certified | MDR-Compliant Technical Files | Shanghai Export Hub

Why Shanghai Carejoy Stands Out in 2026

- Regulatory Expertise: Dedicated EU MDR/US FDA compliance team with 100% successful CE renewals since 2021

- Technical Capability: In-house R&D for precision welding parameters (0.05-2.0mm penetration depth) with argon flow calibration

- Logistics Advantage: Direct access to Shanghai Port’s automated dental equipment customs lane (reduces clearance from 14 to 3 days)

- Proven Reliability: 0% shipment rejection rate in 2025 (validated by 217 distributor audits)

Note: Always conduct independent due diligence. Request Carejoy’s current ISO 13485 certificate and EU Authorized Representative agreement before PO issuance.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Intraoral Welding Machines

Target Audience: Dental Clinics & Distributors

Information accurate as of Q1 2026 – Subject to technical advancements and regional regulations.

Need a Quote for Intraoral Welding Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160