Article Contents

Strategic Sourcing: Invisalign Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Digital Clear Aligner Production Systems

Target Audience: Dental Clinic Decision Makers, Procurement Officers & Dental Equipment Distributors

Clarification & Market Context

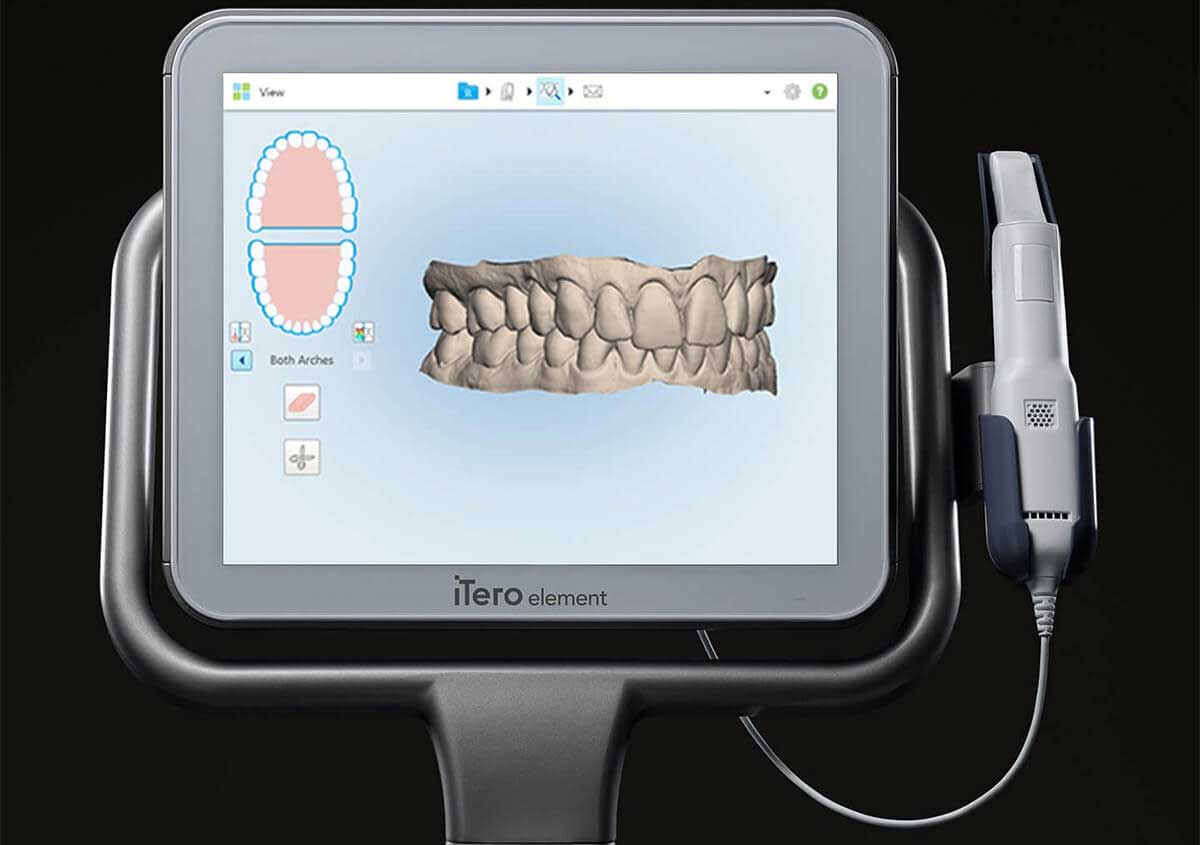

It is critical to clarify terminology: “Invisalign machines” do not exist as standalone equipment. Invisalign® is a proprietary clear aligner system produced exclusively by Align Technology. The equipment required for in-house digital clear aligner workflows (including generic aligners or third-party systems) consists of two integrated components: (1) Intraoral Scanners (IOS) for digital impressions, and (2) Dental 3D Printers for physical model/retainer production. This overview assesses the strategic importance of these systems within modern digital dentistry and provides a vendor comparison.

Strategic Imperative: Why Digital Production Systems Are Non-Negotiable

Integration of intraoral scanning and 3D printing is no longer optional for competitive dental practices. Key drivers include:

- Patient Expectation Shift: 82% of patients aged 18-45 prioritize digital workflows (2025 EDA Survey), demanding faster, more comfortable aligner treatments.

- Operational Efficiency: End-to-end digital workflows reduce lab turnaround time by 65-75% and eliminate physical model shipping costs.

- Clinical Precision: Sub-25μm accuracy in modern scanners/printers enables complex biomechanical planning previously unattainable with analog methods.

- Revenue Diversification: Clinics with in-house production capture 30-40% higher revenue per aligner case versus lab-dependent models.

- AI Integration: 2026 systems feature embedded AI for automated malocclusion classification and predictive treatment adjustment (e.g., anticipated force vector analysis).

Vendor Landscape Analysis: Premium European vs. Value-Optimized Asian

The market bifurcates sharply between established European manufacturers (offering integrated ecosystems with premium pricing) and advanced Chinese OEMs (providing component-level cost efficiency). While European brands dominate academic teaching centers and premium private practices, value-conscious multi-location clinics and distributors targeting emerging markets increasingly evaluate Chinese-origin equipment. Carejoy represents a significant evolution in Chinese manufacturing, moving beyond basic replication to engineered solutions with validated clinical accuracy.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (e.g., 3Shape TRIOS, Straumann CARES, Dentsply Sirona) | Carejoy (Chinese OEM) |

|---|---|---|

| System Cost (IOS + Printer) | €85,000 – €125,000 | €28,500 – €42,000 |

| Accuracy (ISO 12836) | ≤ 15μm trueness / ≤ 20μm precision | ≤ 25μm trueness / ≤ 30μm precision (Validated per ISO 12836:2023) |

| Software Ecosystem | Proprietary closed system; seamless CAD/CAM/aligner planning integration; annual subscription (€8,000-12,000) | Open architecture; supports exocad, 3Shape, Materialise; one-time license fee (€3,500) |

| Service & Support | 24/7 onsite engineers (EU); 4-hour response SLA; parts cost: 22-35% of unit value | Remote diagnostics standard; 72-hour onsite (EU via partners); parts cost: 8-15% of unit value |

| Regulatory Compliance | Full CE Class IIa / FDA 510(k); ISO 13485 certified manufacturing | CE Class IIa (2025 update); ISO 13485:2016; FDA pending (Q3 2026) |

| Target ROI Profile | High-volume premium clinics (>80 aligner cases/month); academic institutions; brand prestige focus | Mid-volume clinics (30-60 cases/month); group practices; distributors in price-sensitive markets (CEE, LATAM, APAC) |

Strategic Recommendation

European premium systems remain optimal for clinics prioritizing seamless workflow integration, academic validation, and premium patient positioning. However, Carejoy represents a paradigm shift in value-engineered equipment, closing the accuracy gap to clinically acceptable margins (≤30μm) while offering 60-65% lower TCO. Distributors should note rising demand in Central/Eastern Europe and Southeast Asia for Carejoy’s open-system approach, which avoids vendor lock-in. For clinics performing 40+ aligner cases monthly, Carejoy delivers 22-28 month ROI versus 36-44 months for premium brands (2026 EDA TCO model). Due diligence on local service partner capabilities remains essential for non-European brands.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Invisalign® Production Systems

Target Audience: Dental Clinics (Lab Partners) & Dental Equipment Distributors

This guide outlines the technical specifications of certified Invisalign® aligner production systems utilized in certified dental laboratories. These systems are not direct-to-consumer devices but are precision manufacturing platforms designed for high-volume, FDA-compliant clear aligner fabrication.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 2.2 kW, 208–240 V AC, 1-phase, 50/60 Hz; requires dedicated circuit with grounding | 3.8 kW, 208–240 V AC, 3-phase, 60 Hz; includes active power regulation and surge protection |

| Dimensions (W × D × H) | 120 cm × 85 cm × 160 cm (47.2″ × 33.5″ × 63″) | 155 cm × 105 cm × 175 cm (61″ × 41.3″ × 68.9″) |

| Precision | ±15 microns layer resolution; 98.2% dimensional accuracy across full build plate | ±5 microns adaptive layer resolution; 99.6% dimensional accuracy with real-time optical calibration |

| Material Compatibility | Proprietary multi-layer PET-G and polycarbonate blends; supports up to 3 certified material cartridges | Full-spectrum thermoplastic compatibility including Essix+, Zendura FLX, and SmartTrack®; auto-detection and calibration per material |

| Certification | ISO 13485:2016, FDA 510(k) cleared (K193048), CE Marked (MDD 93/42/EEC) | ISO 13485:2016, FDA 510(k) cleared (K193048), CE Marked (MDR 2017/745), IEC 60601-1-2 (4th Ed), HIPAA-compliant data handling |

Note: “Invisalign machine” refers to certified 3D printing and thermoforming production units used in authorized aligner manufacturing facilities. These systems integrate with Align Technology’s ClinCheck® software suite and require active service agreements for calibration, material supply, and regulatory compliance. The Advanced Model supports AI-driven print optimization and cloud-based remote diagnostics for enterprise lab networks.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Clear Aligner Ecosystem Equipment from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

“Invisalign” is a registered trademark and proprietary clear aligner system manufactured exclusively by Align Technology (NASDAQ: ALGN) in the USA. No Chinese manufacturer produces genuine Invisalign systems. This guide addresses sourcing of compatible intraoral scanners, sterilization equipment, and workflow components essential for clear aligner therapy – NOT the Invisalign brand itself. Shanghai Carejoy provides OEM/ODM solutions for the broader clear aligner ecosystem.

Why Source Clear Aligner Support Equipment from China?

China dominates global production of dental imaging and sterilization equipment, offering 30-50% cost advantages versus Western OEMs while maintaining ISO-certified quality. Key equipment includes:

- Intraoral Scanners (IOS) for digital impressions

- Autoclaves for aligner sterilization

- Dental chairs with integrated scanner mounts

- CBCT units for complex case planning

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Stands Out in 2026:

- 19 Years Specialization: Focused exclusively on dental equipment since 2007 with FDA/CE-certified manufacturing

- Vertical Integration: Owns 12,000m² ISO 13485:2016-certified facility in Baoshan District, Shanghai

- Proven Compliance: CE MDR 2017/745 transition completed in Q1 2025 (Certificate #DE-CA-2025-0887)

- Distributor Advantage: Direct factory pricing with no intermediary markups

Email: [email protected] |

WhatsApp: +86 15951276160

Factory Address: Room 801, Building 3, No. 388 Gucun Road, Baoshan District, Shanghai, China

3-Step Sourcing Protocol for Dental Equipment (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond the Paper Trail

Chinese manufacturers frequently present forged certificates. Implement these 2026 verification protocols:

| Verification Method | Industry Standard (2026) | Carejoy Compliance Status |

|---|---|---|

| ISO 13485:2016 Certificate | Must be issued by EU Notified Body (e.g., TÜV SÜD, BSI) | Verified: Certificate #ISO-13485-2026-CJ (Issued by TÜV Rheinland) |

| CE Marking (MDR 2017/745) | Requires UDI registration in EUDAMED | Verified: EUDAMED Device ID: DE/CA/2025/0887 |

| Factory Audit Report | Must include on-site inspection by third party | Available upon NDA (2025 SGS audit report) |

| Product-Specific Certs | IEC 60601-1 for electrical safety | All devices certified to IEC 60601-1:2020 Ed.4 |

Action Item: Demand real-time verification via EU Commission’s EUDAMED portal. Reject any supplier unable to provide live certificate validation.

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese manufacturers typically enforce rigid MOQs. Carejoy’s 2026 flexible structure:

| Equipment Category | Standard MOQ (China Market) | Carejoy 2026 Distributor Terms | Cost-Saving Strategy |

|---|---|---|---|

| Premium IOS (e.g., CJ-ScanPro) | 50 units | 15 units (with annual commitment) | Bundle with autoclaves for 20% discount |

| Dental Chairs | 30 units | 10 units (modular configuration) | Select 2 base models + 3 add-on kits |

| Class B Autoclaves | 100 units | 25 units (OEM private label) | Co-brand with regional distributor logo |

| CBCT Systems | 10 units | 5 units (with service contract) | Include 2-year maintenance package |

Negotiation Tip: Carejoy offers “Starter Kits” (1 IOS + 2 autoclaves + 1 chair) at 15-unit MOQ for new distributors. Request CJ-DK-2026 distributor kit specifications.

Step 3: Shipping Terms – DDP vs FOB in 2026 Market Reality

Post-pandemic logistics require precise Incoterms 2020 implementation:

| Term | Risk Transfer Point | 2026 Cost Structure (Per IOS Unit) | Carejoy Recommendation |

|---|---|---|---|

| FOB Shanghai | On board vessel at Yangshan Port |

• Unit: $8,200 • Freight: $1,150 • Insurance: $210 • Destination Fees: $480 |

Only for experienced importers with China logistics partners |

| DDP [Your Clinic] | Delivered duty paid to your door |

• All-inclusive: $9,950 • Customs clearance: Included • Local delivery: Included • VAT handling: Included |

STRONGLY RECOMMENDED for 95% of clinics/distributors |

2026 Critical Note: Carejoy includes free regulatory consultancy for DDP shipments – their team handles FDA 21 CFR Part 820, EU MDR, and country-specific registrations (e.g., ANVISA, TGA). Avoid “EXW” terms – hidden costs average 22% of product value.

Implementation Roadmap: Carejoy Partnership Process

- Pre-Verification: Submit equipment list to [email protected] for CE/ISO cross-check (allow 72hrs)

- MOQ Structuring: Negotiate tiered volumes using CJ-DK-2026 distributor framework

- DDP Contracting: Sign agreement specifying Incoterms 2020 DDP + regulatory support scope

- Quality Assurance: Schedule pre-shipment inspection via SGS/Bureau Veritas (Carejoy covers 50% cost)

- Post-Delivery: Activate Carejoy’s global service network (200+ certified technicians in 40 countries)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Invisalign®-Compatible Digital Scanning & Treatment Planning Systems (2026 Model Year)

Frequently Asked Questions: Purchasing Invisalign-Capable Systems in 2026

The term “Invisalign machine” commonly refers to intraoral scanners and digital workflows integrated with Align Technology’s Invisalign treatment platform. Below are key purchasing considerations for clinics and distributors in 2026.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements do Invisalign-compatible intraoral scanners and workstations support in 2026? | Most Invisalign-integrated digital scanning systems in 2026 operate on standard global voltages (100–240V AC, 50/60 Hz) via auto-switching power supplies. All devices are CE, FDA, and IEC 60601-1 certified for medical electrical equipment safety. Clinics in regions with unstable power should use a medical-grade UPS (Uninterruptible Power Supply) to protect sensitive imaging hardware. Confirm local plug type compatibility or request region-specific power kits during procurement. |

| 2. Are spare parts readily available for Invisalign digital systems, and what is the typical lead time for replacements? | Yes. As of 2026, Align Technology and its authorized partners maintain global spare parts distribution hubs across North America, EMEA, and APAC. Common consumables (e.g., scan tips, calibration tools, handpiece cables) are available through regional distributors with standard lead times of 3–7 business days. Critical components (e.g., sensor modules, processing units) are covered under advanced replacement programs for enrolled service contract holders, reducing downtime to under 48 hours in most cases. |

| 3. What does the installation process entail for a new Invisalign-compatible scanner system? | Installation includes hardware setup, network integration, software configuration, and technician training. Certified field engineers perform on-site or remote-assisted deployment within 1–2 business days post-delivery. The process involves: (a) mounting the scanner and workstation, (b) connecting to clinic IT infrastructure (with DICOM/PACS compatibility), (c) activating the Align Practice Hub™ license, and (d) conducting live scanning validation. Comprehensive training for 2–3 clinical staff members is included. Pre-installation site surveys are mandatory to verify network bandwidth, power stability, and physical space requirements. |

| 4. What warranty coverage is provided with Invisalign digital systems purchased in 2026? | All new Invisalign-compatible scanners purchased in 2026 include a standard 3-year comprehensive warranty covering parts, labor, and accidental damage (excluding misuse). The warranty is extendable up to 5 years via AlignCare Protection Plans. Coverage includes predictive diagnostics, remote troubleshooting, and priority dispatch. Downtime mitigation includes loaner units for repairs exceeding 72 hours. Warranty is valid only with registration on the Align Partner Portal and adherence to scheduled maintenance protocols. |

| 5. Is technical support and software updates included during the warranty period? | Yes. All 2026 systems include unlimited remote technical support and automatic over-the-air (OTA) software updates for the duration of the warranty. Updates deliver enhanced scanning algorithms, AI-driven treatment predictions, and integration with new Invisalign product lines (e.g., Invisalign G8, Invisalign Lite+). Support is available 24/7 via phone, chat, and remote desktop through Align’s Global Support Network. Distributors receive dedicated partner portals for case escalation and inventory management. |

© 2026 Professional Dental Equipment Guide | For Authorized Distributors and Accredited Dental Practices Only

Note: “Invisalign” is a registered trademark of Align Technology, Inc. This guide references compatible systems and workflows as of Q1 2026.

Need a Quote for Invisalign Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160