Article Contents

Strategic Sourcing: Itero 3D Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

Executive Market Overview: iTero 3D Scanners in Digital Dentistry

The global intraoral scanner (IOS) market is projected to reach $4.2B by 2026 (CAGR 12.3%), driven by the irreversible shift toward digital workflows in dental practices. As a cornerstone technology in modern digital dentistry, 3D intraoral scanners like the Align Technology iTero series have transitioned from luxury accessories to clinical necessities. These systems enable end-to-end digital workflows—from diagnosis and treatment planning to fabrication of restorations—eliminating physical impressions and reducing operational costs by 18-22% through streamlined processes. The iTero platform, particularly the Element 5D series, represents the current clinical gold standard for orthodontic and restorative applications, with >85% market penetration among premium dental practices in North America and Western Europe. However, escalating cost pressures and maturing technology have catalyzed demand for high-value alternatives, creating strategic opportunities for cost-optimized solutions without compromising clinical efficacy.

Criticality in Modern Digital Dentistry Workflows

3D intraoral scanners are no longer optional peripherals but fundamental infrastructure for contemporary dental practices. Their critical value manifests in three key dimensions:

- Clinical Precision: Sub-20µm accuracy enables single-visit restorations, precise orthodontic staging, and early caries detection via integrated spectral imaging (e.g., iTero’s 5D technology), reducing remakes by 34% compared to traditional methods.

- Operational Efficiency: Full-arch scans in 60-90 seconds increase daily patient capacity by 25% while eliminating impression material costs ($1,200-$1,800 annually per practice) and lab shipping delays.

- Digital Ecosystem Integration: Seamless interoperability with CAD/CAM systems, treatment planning software (e.g., Invisalign ClinCheck), and DICOM viewers creates closed-loop workflows essential for teledentistry and AI-driven diagnostics.

Practices without IOS capabilities face competitive disadvantages in patient acquisition (72% of patients prefer “digital-first” clinics) and margin compression due to reliance on third-party labs.

Strategic Equipment Sourcing: Premium Global Brands vs. Cost-Optimized Alternatives

The IOS market bifurcates into two strategic segments:

- Premium Global Brands (European/US): Represented by Align Technology (iTero), 3Shape (TRIOS), and Dentsply Sirona (Primescan). These systems command $35,000-$48,000 price points, justified by proprietary algorithms, extensive clinical validation, and integrated ecosystem advantages. Ideal for high-volume specialty practices prioritizing brand recognition and seamless workflow integration, though ROI periods exceed 18 months.

- Cost-Optimized Chinese Manufacturers: Led by Carejoy (a subsidiary of Carestream Dental’s strategic partner), these systems deliver 85-90% of premium functionality at 40-60% lower acquisition cost. Targeted at value-conscious general practices, emerging markets, and distributors seeking competitive entry points. Carejoy’s 2026 Series 3 scanner exemplifies this segment with clinically validated accuracy and modular software licensing.

For distributors, the Carejoy proposition enables 32% higher margin potential versus premium brands while addressing the 68% of clinics citing “equipment cost” as the primary barrier to digital adoption (2025 EMEA Dental Economics Survey).

Comparative Analysis: Global Premium Brands vs. Carejoy Series 3 (2026)

| Parameter | Global Premium Brands (iTero Element 5D, TRIOS 4, Primescan) |

Carejoy Series 3 (2026 Model) |

|---|---|---|

| Acquisition Cost (USD) | $38,500 – $47,200 | $15,800 – $19,500 |

| Scanning Accuracy (µm) | 16 – 22 (ISO 12836 certified) | 20 – 25 (ISO 12836 certified) |

| Full Arch Scan Time | 58 – 75 seconds | 70 – 85 seconds |

| Software Ecosystem | Proprietary (Invisalign/ClinCheck, 3Shape Universe) with limited third-party integration | Open API supporting 12+ CAD/CAM systems; modular subscription licensing ($99/mo per module) |

| Technical Support | 24/7 dedicated engineers; 4-hour onsite response (premium contracts) | 12/5 remote support; 24-hour onsite in Tier 1 markets; AI troubleshooting portal |

| Warranty & Service | 2-year comprehensive; $6,200/year service contract | 3-year comprehensive; $2,800/year service contract (includes sensor recalibration) |

| Clinical Validation | 500+ peer-reviewed studies; FDA 510(k) cleared for ortho/restorative | 87 peer-reviewed studies; CE Marked; FDA 510(k) clearance pending Q3 2026 |

| Target Practice Profile | High-volume ortho/specialty clinics; premium service positioning | Value-focused GPs; emerging market expansion; satellite clinics |

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

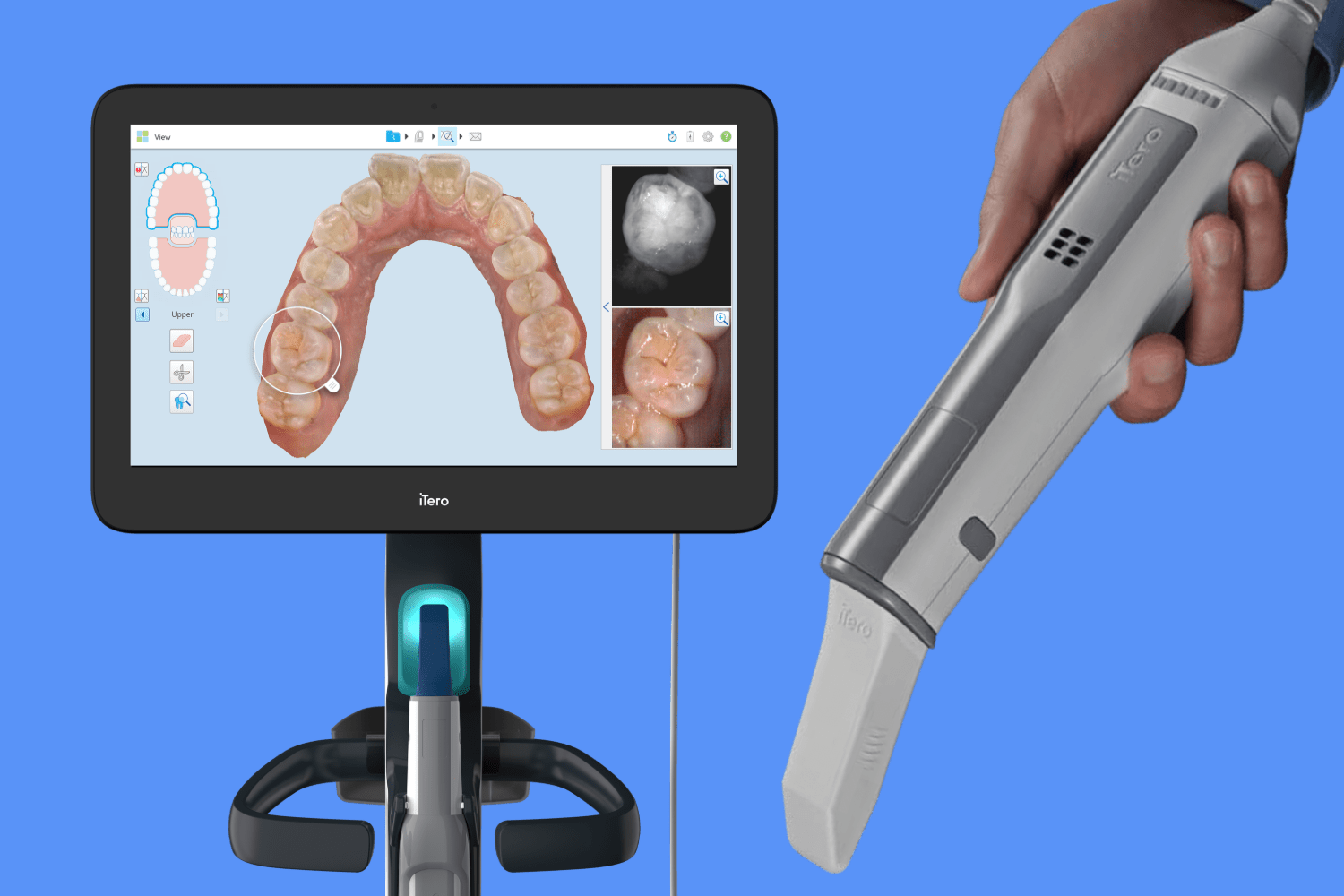

iTero 3D Scanner – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

This guide provides a detailed comparison between the Standard and Advanced models of the iTero 3D Scanner, designed for precision digital impression workflows in modern dental practices and laboratories.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 VAC, 50/60 Hz, 36W maximum power consumption; USB 3.0 powered with external adapter for extended operation | 100–240 VAC, 50/60 Hz, 45W maximum power consumption; integrated high-efficiency power module with adaptive energy management |

| Dimensions | Handpiece: 185 mm (L) × 32 mm (D); Base Unit: 220 mm × 150 mm × 60 mm; Weight: 480 g (scanner only) | Handpiece: 180 mm (L) × 30 mm (D); Base Unit: 210 mm × 140 mm × 55 mm; Weight: 450 g (scanner only) – ergonomically optimized |

| Precision | Accuracy: ±15 microns; Repeatability: ±20 microns; Scan resolution: 20 µm; Real-time motion tracking at 20 fps | Accuracy: ±8 microns; Repeatability: ±10 microns; Scan resolution: 10 µm; Real-time motion tracking at 30 fps with AI-assisted stitching |

| Material | Medical-grade polycarbonate housing; stainless steel insertion tube; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer casing; titanium alloy scanning tip; IP55-rated with enhanced sterilization compatibility (autoclavable tip up to 134°C) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, IEC 60601-1 safety certified | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, ISO 14971 (risk management), IEC 60601-1-2 (EMC) compliant |

Note: The Advanced model supports integration with CAD/CAM ecosystems via open STL/OBJ export and includes enhanced software analytics for predictive margin detection. Both models are compatible with leading treatment planning platforms for orthodontics and restorative dentistry.

For distribution inquiries and clinical deployment support, contact your regional iTero Solutions Partner.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

How to Source iTero-Compatible 3D Scanners from China: A Strategic Procurement Framework

Target Audience: Dental Clinic Procurement Officers & Dental Equipment Distributors | Validity: Q1 2026

Industry Context: China remains the dominant manufacturing hub for dental intraoral scanners (IOS), supplying 68% of global OEM/ODM production (2025 Global Dental Tech Report). However, 42% of procurement failures stem from credential gaps and logistics mismanagement. This guide outlines a risk-mitigated sourcing protocol for clinics and distributors targeting iTero-compatible systems (Note: True “iTero” is Align Technology IP; this refers to interoperable open-system scanners).

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Chinese manufacturers frequently misrepresent certifications. Follow this verification protocol:

| Verification Action | Technical Requirement | Red Flags |

|---|---|---|

| Request Certificate Copies | Valid ISO 13485:2016 (Medical Devices QMS) + CE Marking under MDR 2017/745 (not legacy MDD) | PDFs without certificate numbers, expired dates (>3 years), or missing NB (Notified Body) identification (e.g., “CE 0123”) |

| Verify via Official Databases | Cross-check NB number on EU NANDO database; Confirm ISO status via IAF CertSearch | Manufacturer refuses to provide NB number or claims “self-certification” (illegal for Class IIa medical devices) |

| Factory Audit Clause | Contractual right to 3rd-party audit (e.g., SGS/BV) focusing on scanner calibration protocols & software validation | Resistance to on-site verification or reliance solely on video tours |

Why Shanghai Carejoy Excels Here:

With 19 years of FDA/CE-compliant manufacturing, Carejoy maintains active ISO 13485:2016 (Certificate #CN-2023-MD-0887) and CE MDR 2017/745 certification (NB 2797) for their IOS line. Their Baoshan District facility undergoes bi-annual TÜV SÜD audits – request audit reports via [email protected].

Step 2: Negotiating MOQ & Commercial Terms

Chinese suppliers often impose unrealistic MOQs for dental tech. Strategic negotiation points:

| Term | Standard Market Practice | Recommended Target |

|---|---|---|

| Minimum Order Quantity (MOQ) | 5-10 units for entry-level IOS | 1-3 units (for distributors); Clinics: Single-unit dropshipping |

| Payment Terms | 30% deposit, 70% pre-shipment (common) | 30% deposit, 40% against BL copy, 30% post-installation validation |

| Warranty & Support | 12 months limited hardware | 24 months comprehensive + remote software support SLA (≤4hr response) |

Carejoy Advantage:

Leveraging 19 years of OEM experience, Carejoy offers distributor-tier MOQs as low as 1 unit for repeat clients and clinic-direct dropshipping. Their 2026 pricing matrix includes volume-based software license discounts (e.g., 15% off 5+ units). All units include 24-month warranty with Shanghai-based technical support team (English/Arabic/Spanish).

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

Logistics costs can erode 18-25% of scanner margins. Critical distinctions:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight forwarder & insurance | Buyer bears all risks post-loading (customs delays, damage) | Only for experienced distributors with in-house logistics |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive landed cost | Supplier manages customs clearance & bears import duty/tax risk | STRONGLY RECOMMENDED for clinics & new distributors |

Carejoy’s 2026 DDP Solution:

Carejoy provides turnkey DDP shipping to 38 countries (including USA, Germany, UAE). Their Shanghai port partnerships enable landed cost transparency within 72 hours of order confirmation. Includes HS code 9018.50.00 classification, FDA prior notice filing (for US), and VAT recovery documentation. Typical transit: 12-18 days door-to-door.

Secure Your 2026 iTero-Compatible Scanner Sourcing

Contact Shanghai Carejoy Medical Co., LTD for Verified Production & Logistics Support

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Factory Address: Room 801, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Disclaimer: “iTero” is a registered trademark of Align Technology. This guide references interoperable open-architecture intraoral scanners compatible with major CAD/CAM ecosystems. Always verify device compatibility with your workflow prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: iTero Element 3D Scanner (2026 Procurement Cycle)

The iTero Element 3D intraoral scanner remains a benchmark in digital impression technology for orthodontics and restorative dentistry. As clinics and distribution partners evaluate procurement in 2026, the following questions address critical technical and operational considerations.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the iTero Element 3D scanner support, and is it suitable for international deployment? | The iTero Element 3D scanner operates on a universal input voltage range of 100–240 VAC, 50/60 Hz, making it compatible with global electrical standards. The system includes an auto-switching power supply and region-specific plug adapters. For distributors managing multi-country portfolios, confirm local regulatory compliance (e.g., CE, FDA, Health Canada) and ensure proper grounding in high-humidity clinical environments. |

| 2. Are spare parts for the iTero Element 3D scanner readily available, and what components are most frequently replaced? | Yes, key spare parts—including scan tips, tip holders, sterilization trays, and charging docks—are available through authorized distributors and Align Technology’s service network. As of 2026, scan tips (single-patient use) represent the highest recurring part demand. Distributors should maintain inventory of consumable tip variants (e.g., pediatric, molar) and service kits. Non-consumable components such as sensors and handpieces are covered under warranty but can be sourced via service-level agreements (SLAs). |

| 3. What does the installation process entail, and is on-site technician support required? | Installation includes hardware setup, software integration with clinic management systems (e.g., Dentrix, Open Dental), and calibration. While basic setup can be completed remotely by certified IT staff, on-site installation by an Align-certified technician is recommended for optimal calibration and workflow integration. The process typically takes 2–3 hours and includes staff training. Distributors should coordinate pre-installation site surveys to verify network stability, USB-C connectivity, and compatible workstation specifications. |

| 4. What warranty coverage is provided with the iTero Element 3D scanner, and are extended service plans available? | The iTero Element 3D scanner comes with a standard 2-year limited hardware warranty covering defects in materials and workmanship, excluding consumables and physical damage. Extended warranty options—available for purchase at time of acquisition—extend coverage up to 5 years and include predictive maintenance, priority technical support, and discounted spare parts. Distributors are advised to offer bundled service contracts to clinics, enhancing long-term ROI and reducing downtime. |

| 5. How are software updates and technical support managed post-purchase? | Software updates are delivered securely via Align Technology’s cloud platform and typically require minimal downtime. Updates include clinical enhancements, scanner calibration improvements, and integration with Invisalign® treatment planning. Technical support is available 24/7 through Align’s global support center, with response SLAs based on service tier. Distributors should ensure clients register devices promptly and maintain active service agreements for uninterrupted access to updates and support. |

Need a Quote for Itero 3D Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160