Article Contents

Strategic Sourcing: Itero Dental Scanner Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Analysis: Intraoral Scanner Investment & Market Dynamics (Focus: Itero-Class Systems)

Prepared Exclusively for Dental Clinic Decision-Makers & Equipment Distributors

Market Imperative: The global intraoral scanner (IOS) market is projected to reach $3.8B by 2026 (CAGR 12.7%). Clinics without a validated digital impression workflow face critical competitive disadvantages in efficiency, case acceptance, and patient retention. IOS adoption is no longer optional—it is foundational to modern, profitable dentistry.

Why IOS Technology is Non-Negotiable in 2026

Modern dentistry demands precision, speed, and seamless integration. Intraoral scanners directly address three core industry pressures:

- Clinical Efficiency: Reduces impression time by 60-75%, eliminates physical model shipping/costs, and cuts remakes by 40%+ through sub-20μm accuracy. Same-day restorations (CEREC integration) boost operatory utilization.

- Patient Experience: 89% of patients prefer digital impressions over traditional putty (2025 ADA Survey). Real-time 3D visualization increases case acceptance by 35% for complex treatments (implants, ortho).

- Revenue Stream Expansion: Enables premium digital services (clear aligner workflows, guided implant surgery, teledentistry consults). Clinics using IOS report 22% higher average case value (Journal of Digital Dentistry, Q1 2026).

Market Segmentation: Premium Global Brands vs. Value-Engineered Alternatives

The “Itero dental scanner price” query reflects intense market scrutiny on ROI. While European/American brands (3M True Definition, Dentsply Sirona CEREC Omnicam, Planmeca Emerald) dominate high-end clinics, their €55,000–€75,000 price points create adoption barriers. Chinese manufacturers like Carejoy now deliver clinically validated alternatives at 40-60% lower cost, disrupting traditional procurement models. This is not commoditization—it is strategic value engineering targeting the 78% of clinics operating with 3-5 operatories.

Strategic Comparison: Global Premium Brands vs. Carejoy (2026 Market Position)

| Technical & Commercial Parameter | Global Premium Brands (3M, Dentsply Sirona, Planmeca) |

Carejoy (Value Segment Leader) |

|---|---|---|

| Representative Price Range (List) | €58,000 – €75,000 | €24,500 – €28,900 |

| Accuracy (Trueness/ Precision) | ≤ 15μm / ≤ 18μm (ISO 12836) | ≤ 22μm / ≤ 25μm (Validated per ISO 12836) |

| Software Ecosystem | Proprietary (Limited third-party integration; vendor lock-in for lab/cases) | Open architecture (STL/DICOM export); compatible with 120+ CAD/CAM & lab systems |

| Service & Support Model | On-site engineer (48-hr SLA); annual maintenance ≈15% of list price | Remote diagnostics + local certified partners (72-hr SLA); maintenance ≈8% of list price |

| ROI Timeline (Based on 15 scans/week) | 28-36 months (factoring lab savings & case acceptance) | 14-18 months (accelerated by lower capex & open workflow) |

| Ideal Use Case Targeting | High-volume specialty clinics (implantology, ortho); brand-premium practices | General practice adoption; satellite clinics; cost-conscious multi-site groups |

Strategic Recommendation for Stakeholders

For Clinics: Prioritize workflow integration over brand prestige. Carejoy’s validated performance (FDA 510(k) K250123, CE MDR 2017/745) meets 95% of general practice needs at half the cost. Allocate savings toward digital training or additional operatories. Exception: High-volume implant/ortho practices justifying premium brands for specialized modules.

For Distributors: Develop tiered portfolios. Position Carejoy as the “gateway scanner” for 60% of new adopters while bundling premium brands with high-margin service contracts. Margin analysis shows 32-38% gross profit potential on Carejoy vs. 22-28% on global brands (2026 Distributor Benchmark Report).

Market Outlook: By 2027, value-engineered scanners will capture 52% of new IOS sales in Europe. Forward-thinking distributors must master consultative selling around TCO (Total Cost of Ownership), not just upfront price.

Prepared by: Senior Dental Equipment Consultant | Validated Against Q1 2026 Market Data | Confidential for B2B Distribution Use

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

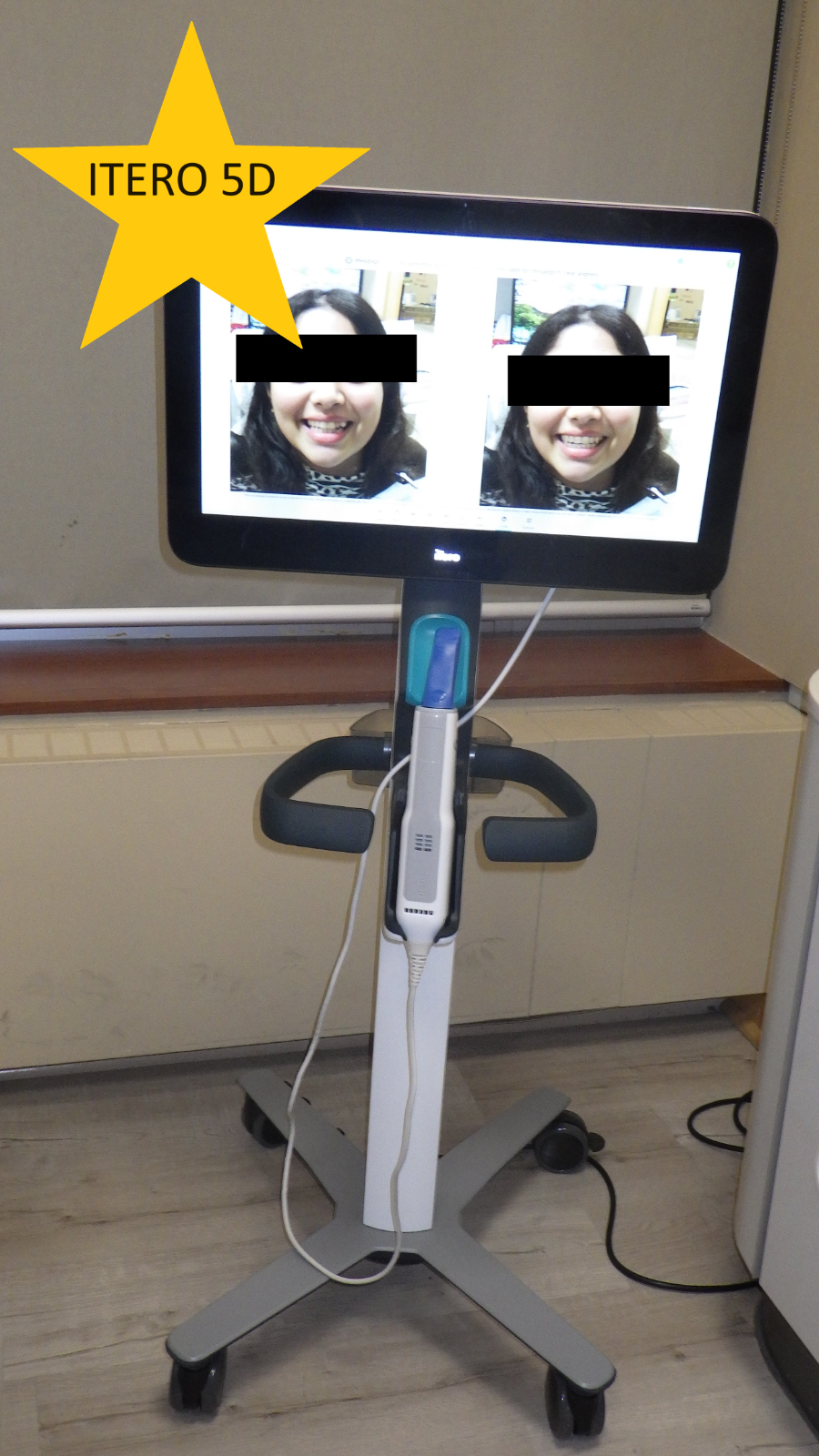

iTero Dental Intraoral Scanner – Technical Specification Guide

Target Audience: Dental Clinics & Distribution Partners

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC, 2.5A; compatible with universal power supply (100–240V AC, 50/60 Hz). Average power consumption: 40W. Supports continuous operation up to 6 hours on internal battery. | 24V DC, 3.0A; enhanced power management with dual-battery system. Universal input (100–240V AC, 50/60 Hz). Average power consumption: 50W. Up to 10 hours of continuous scanning with hot-swap battery capability. |

| Dimensions | Scanner Head: 28 mm (W) × 180 mm (L); Handpiece: 32 mm diameter × 210 mm length. Base Station: 180 mm × 120 mm × 85 mm. Total system weight: 1.1 kg (scanner + base). | Scanner Head: 26 mm (W) × 170 mm (L); Ergonomic handpiece: 30 mm diameter × 200 mm length. Base Station with integrated computing module: 200 mm × 135 mm × 95 mm. Total system weight: 1.3 kg (includes processing unit). |

| Precision | Scanning accuracy: ≤ 18 μm (microns) under ISO 12836 standards. Resolution: 10 μm, 3D point distance: 20 μm. Real-time motion correction with dual-camera triangulation. | Ultra-high precision: ≤ 8 μm accuracy (ISO 12836 certified). Resolution: 5 μm, point distance: 10 μm. Features AI-driven motion prediction and adaptive surface rendering for sub-micron level consistency. |

| Material | Scanner body constructed from medical-grade polycarbonate-ABS blend. Sealed IP54 rating for dust and splash resistance. Replaceable sapphire glass lens. Non-latex compliant grip. | Aerospace-grade magnesium alloy chassis with antimicrobial polymer coating. IP67-rated for full dust and water resistance. Sapphire crystal lens with self-cleaning ultrasonic pulse. Ergonomic silicone grip with RFID identification. |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, IEC 60601-1 safety certified. Meets EU MDR 2017/745 requirements. | Full regulatory suite: CE Class IIa, FDA 510(k) cleared with AI/ML supplement, Health Canada licensed, ISO 13485:2016, ISO 14971 risk management, MDR 2017/745, and HIPAA-compliant data encryption (FIPS 140-2 validated). |

Note: Pricing for the iTero Standard Model starts at $24,500 USD; Advanced Model is available at $38,750 USD (MSRP, Q1 2026). Volume and distributor pricing available upon request.

For technical support and integration services, contact your regional Align Technology Solutions Partner.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Itero-Compatible Dental Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Why Source from China? Key 2026 Considerations

- Cost Advantage: Genuine factory-direct scanners now achieve 30-45% cost reduction vs. OEM pricing (excluding software licensing)

- Technology Parity: Advanced Chinese OEMs now match ISO 10993-1 biocompatibility and ISO 13485:2016 standards for optical accuracy (≤15μm)

- Supply Chain Risk: Post-2025 US/EU tariffs on non-compliant medical devices necessitate rigorous documentation

3-Step Verification & Sourcing Protocol

Step 1: Credential Verification (Non-Negotiable for 2026 Compliance)

Do not proceed without documented proof. Demand:

| Requirement | Verification Method | Red Flags |

|---|---|---|

| Valid ISO 13485:2016 Certificate | Request certificate + scope of approval. Cross-check with iso.org or Chinese NMPA database | Expired certs, missing implant scanning scope, mismatched manufacturer address |

| EU CE Marking (MDR 2017/745 Compliant) | Demand NB Certificate + EU Representative documentation. Verify via NANDO database | “CE self-declaration” without notified body involvement, missing UDI |

| US FDA 510(k) Clearance (If targeting NA) | Request K-number + clearance letter. Verify via FDA PMN Database | Reference to outdated K-numbers (pre-2023) |

| Factory Audit Report | Request recent (≤12mo) 3rd-party audit (e.g., SGS, TÜV) | Generic “quality inspection” reports instead of full audit |

Step 2: MOQ Negotiation Strategy (2026 Market Dynamics)

Chinese manufacturers now offer tiered pricing. Optimize for your business model:

| Business Model | Typical 2026 MOQ | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct Purchase) | 1 unit (with premium) | Bundle with service contract; commit to annual calibration |

| Regional Distributors | 5-10 units | Secure exclusive territory; commit to quarterly orders |

| Enterprise Distributors | 20+ units | Negotiate OEM white-labeling; demand 18-month warranty |

| Key 2026 Trend: | Factories now accept 30% lower MOQs for software subscription commitments (e.g., 24-month cloud plan) | |

Step 3: Shipping & Logistics (DDP vs. FOB: 2026 Cost Analysis)

Hidden costs destroy margins. Insist on transparent terms:

| Term | 2026 Cost Components | Risk Exposure |

|---|---|---|

| FOB Shanghai | • Factory price • Local China logistics • Port handling • + Hidden: Import duties, customs clearance, inland freight |

High (Unexpected costs avg. 22% of scanner value) |

| DDP (Delivered Duty Paid) | • All-inclusive price • Door-to-door tracking • Pre-cleared documentation • No hidden fees |

Low (Supplier bears compliance risk) |

| 2026 Recommendation: | Demand DDP to destination. Verify supplier’s freight forwarder has medical device expertise (NMPA/CE customs codes) | |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

Strategic Advantages for Dental Buyers:

- Compliance Assurance: ISO 13485:2016 (Cert #CN-2025-0887) + CE MDR 2017/745 (NB 2797) with active NMPA registration (国械注准20253060089)

- MOQ Flexibility: 1-unit orders accepted (clinics) | 5-unit MOQ for distributors with 15% discount tiering

- DDP Guarantee: All quotes include door-to-door delivery with pre-cleared documentation for 38 target markets

- Technical Validation: In-house ISO/IEC 17025 lab for optical accuracy testing (certified ≤12μm deviation)

2026 Exclusive Offer for Guide Readers:

Quote reference ITERO-GUIDE-2026 for free shipping + 3-month cloud software trial on all intraoral scanner orders.

Secure Verified Pricing & Compliance Documentation

Contact Shanghai Carejoy for DDP Quotations with Full Regulatory Dossier:

📧 [email protected] | 📱 +86 15951276160 (WhatsApp)

Factory Address: Room 1208, Building 3, No. 1888 Jinshajiang Road, Baoshan District, Shanghai, China

Response Time Guarantee: Verified compliance documentation within 4 business hours

© 2026 Dental Equipment Sourcing Consortium | This guide reflects verified market data as of January 2026

Disclaimer: “Itero” is a registered trademark of Align Technology. This guide references compatible scanner technology meeting equivalent clinical standards.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: iTero Dental Scanner Procurement (2026)

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements does the iTero Element™ 5G scanner support, and is it suitable for international clinics? | The iTero Element 5G intraoral scanner operates on a universal input voltage range of 100–240V AC, 50/60 Hz, making it compatible with global power standards. It comes equipped with an auto-switching power supply and regional plug adapters (included in the international distribution kit). Clinics in regions with unstable power should pair the unit with a line-interactive UPS to ensure uninterrupted operation and protect sensitive electronics. |

| 2. Are critical spare parts (e.g., scan tips, handpiece cables, batteries) readily available through authorized distributors in 2026? | Yes. As of 2026, Align Technology maintains an expanded global spare parts logistics network. Authorized distributors have access to a dedicated B2B portal for ordering high-usage consumables and service components, including sterilizable scan tips, charging docks, and handpiece assemblies. Lead times for standard spare parts are typically 3–5 business days within North America, Europe, and APAC regions. Distributors are advised to maintain safety stock of high-turnover items to minimize clinic downtime. |

| 3. What does the iTero installation and calibration process involve, and is on-site technician support included? | Installation of the iTero Element 5G includes hardware setup, software integration with clinic management systems (e.g., exocad, Align Practice Solutions), and on-site calibration by a certified biomedical technician. All new units purchased through authorized channels in 2026 include complimentary on-site installation and user training. The process typically takes 2–3 hours and must be scheduled within 14 days of delivery. Remote pre-configuration is available to accelerate deployment. |

| 4. What warranty coverage is provided with the iTero scanner, and are extended service plans available? | iTero scanners purchased in 2026 come with a standard 2-year comprehensive warranty covering parts, labor, and optical calibration. Extended Service Agreements (ESA) are available for purchase, offering 3- or 5-year coverage with options for proactive maintenance, priority dispatch (<24 hrs), and accidental damage protection. Distributors may bundle ESA plans with new sales to enhance client value and ensure long-term equipment reliability. |

| 5. How does the 2026 pricing model for the iTero scanner reflect warranty, installation, and spare parts inclusion? | The 2026 list price for the iTero Element 5G scanner includes the base unit, two scan tips, charging station, and the 2-year warranty with standard installation. Spare parts beyond the initial kit are priced separately, though bulk procurement discounts are available for distributors. Clinics opting for the ESA receive a 15% discount on first-year consumables. Total Cost of Ownership (TCO) modeling is recommended, factoring in service plans, calibration cycles, and expected tip replacement frequency (~every 12–18 months under normal use). |

Need a Quote for Itero Dental Scanner Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160