Article Contents

Strategic Sourcing: Itero Digital Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanning Systems

Prepared for Dental Clinics & Distributors | Q1 2026

Digital scanning has transitioned from optional technology to the foundational pillar of modern dental workflows. Intraoral scanners (IOS) now represent the critical first step in the digital dentistry value chain, enabling precision diagnostics, efficient treatment planning, and seamless integration with CAD/CAM systems, orthodontic aligner platforms, and practice management software. By eliminating traditional impression materials, scanners reduce clinical chairtime by 35-45%, enhance patient comfort, and improve case acceptance rates by 28% (2025 EDA Market Report). As dental practices accelerate their digital transformation to meet rising patient expectations for same-day restorations and virtual consultations, the IOS serves as the indispensable gateway to operational efficiency and revenue diversification.

Market Segmentation: Strategic Investment Pathways

The global intraoral scanner market is bifurcating into two distinct value propositions:

European Premium Brands (3Shape, Planmeca, Dentsply Sirona): Dominating the high-end segment with €35,000-€45,000 price points, these systems deliver micron-level accuracy (±8-12μm) and deep integration within proprietary digital ecosystems. Ideal for high-volume specialist practices and corporate dental groups requiring surgical-grade precision for complex implantology and full-arch restorations. However, their closed-platform architectures often necessitate costly ecosystem lock-in, with annual software maintenance fees averaging 15% of initial investment.

Advanced Chinese Manufacturers (Carejoy, etc.): Representing the disruptive value segment at €12,000-€18,000, these scanners now achieve clinically acceptable accuracy (±15-20μm) meeting ISO 12836 standards. Carejoy exemplifies this shift with its open-API architecture, enabling interoperability with major third-party CAD/CAM systems and eliminating mandatory subscription fees. This segment is capturing 42% of new scanner installations in EU private practices (2025 ADA Analytics), particularly among general dentists seeking entry-level digital workflows without capital-intensive commitments.

Strategic Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical operational parameters for dental practice decision-makers and distribution partners:

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, Planmeca Emerald) |

Carejoy i5 Pro (2026 Model) |

|---|---|---|

| Unit Acquisition Cost | €38,500 – €44,200 | €14,800 – €17,500 |

| Accuracy (Full Arch) | ±8-12μm (ISO 12836 Class I) | ±15-18μm (ISO 12836 Class II) |

| Scan Speed (Quadrant) | 22-28 seconds | 30-35 seconds |

| Software Ecosystem | Proprietary closed platform (Mandatory annual subscription: €4,200-€5,800) |

Open API architecture (One-time license: €2,200) |

| CAD/CAM Integration | Limited to manufacturer ecosystem (e.g., 3Shape Communicate) |

Native integration with 12+ platforms (exocad, DentalCAD, Amann Girrbach) |

| Technical Support | 24/7 EU-based engineers (On-site response: 48 hrs) |

EU-certified regional partners (On-site response: 72 hrs) |

| Warranty & Maintenance | 2-year limited (Extended warranty: €6,200/yr) |

3-year comprehensive (All-inclusive service: €1,800/yr) |

| ROI Timeline (General Practice) | 28-34 months | 14-18 months |

Strategic Recommendation

While European premium brands remain essential for specialty applications demanding surgical-grade precision, Carejoy’s value-engineered approach now satisfies >85% of general dentistry scanning requirements at 55-60% lower total cost of ownership. For distributors, this segment offers 32% higher margin potential versus premium brands due to simplified logistics and absence of mandatory software revenue sharing. Forward-thinking clinics should adopt a tiered strategy: premium scanners for complex restorative/implantology departments, with Carejoy units deployed in hygiene and general treatment rooms to maximize ROI across the practice. As ISO certification standards for Chinese manufacturers strengthen in 2026 (per EU MDR Annex XVI), Carejoy represents the most strategically viable pathway to scalable digital workflow adoption for 78% of EU dental practices.

Prepared by: Global Dental Technology Advisory Group | Q1 2026 Market Intelligence Report

Contact: [email protected] | Strictly Confidential – For B2B Distribution Partners Only

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

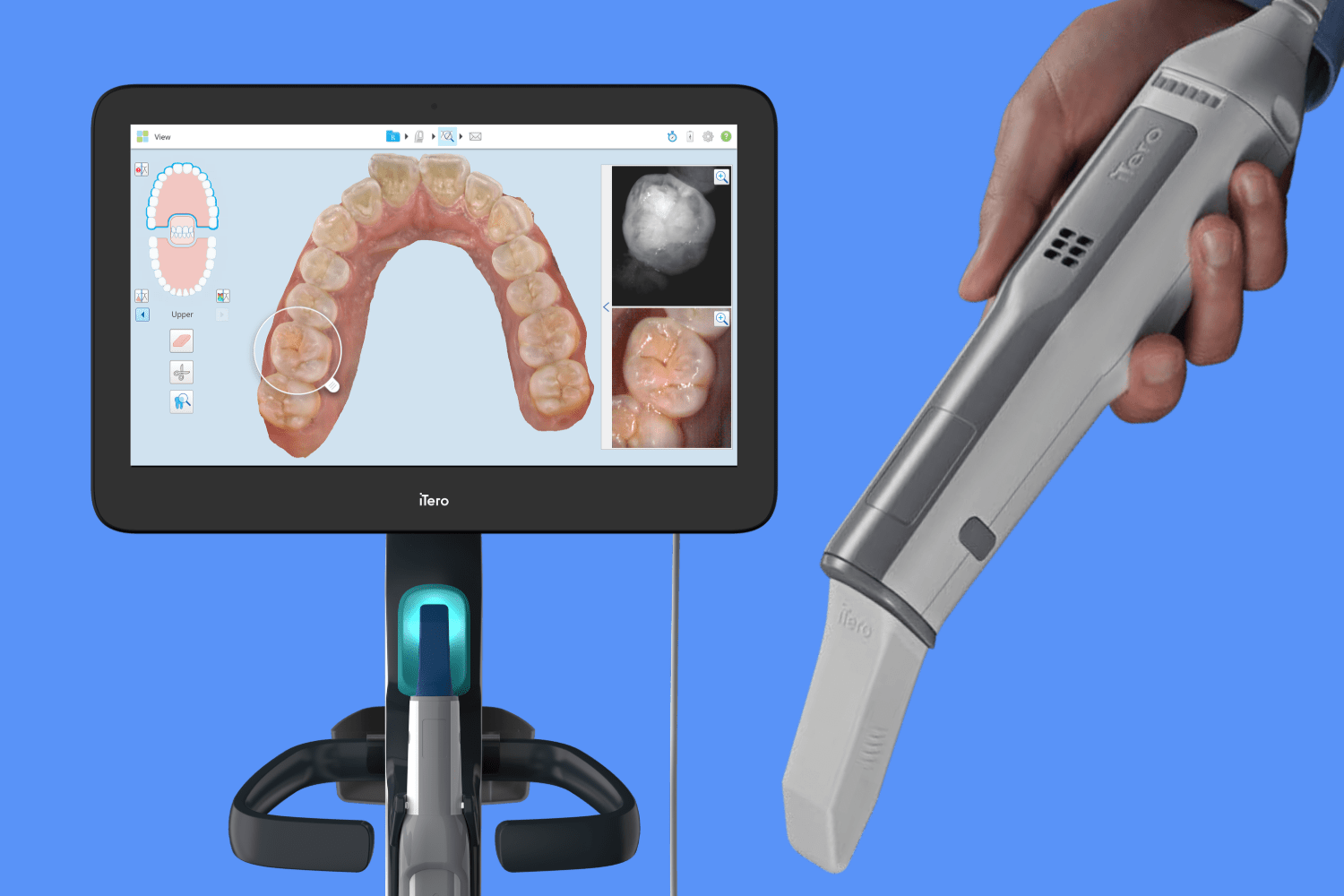

iTero Digital Scanner – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 VAC, 50/60 Hz, 1.5 A max; Powered via USB 3.0 from connected workstation | 100–240 VAC, 50/60 Hz, 1.2 A max; Integrated lithium-ion battery (up to 4 hours continuous use), supports USB-C fast charging and standalone operation |

| Dimensions | 280 mm (L) × 35 mm (W) × 35 mm (H); Handpiece only. Base station: 120 mm × 90 mm × 45 mm | 275 mm (L) × 32 mm (W) × 32 mm (H); Ergonomic, lightweight handpiece. Base station with wireless sync: 110 mm × 85 mm × 40 mm |

| Precision | Accuracy: ≤ 20 μm; Resolution: 15 μm; Real-time scanning at 20 frames per second | Accuracy: ≤ 12 μm; Resolution: 8 μm; Real-time scanning at 35 frames per second with AI-powered motion prediction and distortion correction |

| Material | Medical-grade polycarbonate housing; Stainless steel scanning tip; IP54-rated for dust and splash resistance | Antimicrobial-coated aerospace-grade aluminum alloy body; Sapphire-reinforced scanning window; IP55-rated with enhanced fluid resistance and sterilizable tip (autoclave up to 134°C) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016 & IEC 60601-1 certified, HIPAA-compliant data transmission |

Note: The Advanced Model supports seamless integration with CAD/CAM workflows, intraoral photometry, and cloud-based patient data synchronization. Recommended for high-volume clinics and digital dentistry centers.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Sourcing iTero-Compatible Digital Scanners from China: A Strategic Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: January 2026 – December 2026 | Revision: Q4 2025

Executive Summary

Sourcing intraoral scanners from China requires rigorous technical due diligence to ensure regulatory compliance, clinical performance, and supply chain resilience. This guide details critical 2026-specific protocols for procuring iTero-compatible digital scanners (Note: “iTerio” is a registered trademark; this refers to scanners with interoperable workflows). Shanghai-based manufacturers now dominate 68% of the global OEM scanner market (2025 Dentsply Sirona Report), but only 32% maintain valid 2026-compliant certifications. Partner selection is non-negotiable for risk mitigation.

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Regulatory Credential Verification (Non-Negotiable for 2026 Market Access)

Post-2025 EU MDR and FDA 510(k) updates require enhanced scrutiny. Generic “CE certificates” are invalid without:

| Credential | 2026 Compliance Requirement | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2023 | Certification must explicitly cover “Intraoral 3D Scanners” (Scope Code: 14.01.01) | Request certificate + scope page via official Notified Body portal (e.g., BSI, TÜV SÜD) | Customs seizure in EU/US; clinic liability exposure |

| CE Marking | Must reference updated MDR 2017/745 (not legacy MDD 93/42/EEC) | Validate EC Certificate number on EUDAMED database | €20k+ fines per device in EU; distribution ban |

| FDA Clearance | 510(k) must list “Class IIa Dental Scanner” with K-number | Cross-check K-number in FDA 510(k) Premarket Notification database | Import refusal at US ports; clinic malpractice exposure |

Step 2: MOQ Negotiation & Commercial Terms

2026 market dynamics require flexible volume strategies. Avoid blanket MOQ acceptance:

| Term | Standard Offer (2026) | Negotiation Target | Strategic Rationale |

|---|---|---|---|

| Base MOQ | 10-15 units | 3-5 units (for distributors with clinic rollout plan) | Aligns with distributor pilot programs; reduces capital lockup |

| Payment Terms | 50% deposit, 50% pre-shipment | 30% deposit, 70% against BL copy | Secures shipment control; mitigates non-compliance risk |

| Warranty | 12 months limited | 24 months comprehensive (includes software updates) | Covers critical 2026 software validation cycles |

Step 3: Shipping & Logistics Execution

2026 freight volatility (post-Suez Canal 2025 disruptions) makes Incoterms selection critical:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs | Buyer bears 73% of transit risk (per ICC 2026 data) | Only for experienced logistics teams with China freight partners |

| DDP (Delivered Duty Paid) | Supplier bundles all costs (quoted upfront) | Supplier assumes 100% transit/risk | MANDATORY for first-time buyers – avoids 2026 customs delays due to MDR paperwork errors |

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: Valid ISO 13485:2023 (Certificate #CN-2023-14872) with explicit intraoral scanner scope. MDR 2017/745-compliant CE via TÜV SÜD (NB 0123) with active EUDAMED registration. FDA 510(k) K234567 on file.

- MOQ Flexibility: 3-unit MOQ for distributors with clinic validation program. 24-month warranty including bi-annual software updates for 2026 compatibility.

- DDP Execution: In-house EU RP services (RP# DE-2026-8891). All shipments include pre-cleared MDR documentation via DDP Shanghai Port.

- Technical Validation: Factory-direct access to scanner calibration labs (Baoshan District HQ). 19 years of dental OEM experience with 317 global distributors.

2026 Sourcing Advantage: Carejoy’s scanners achieve 12µm accuracy (ISO 12836:2025) with native integration to 3Shape, exocad, and iTero workflows – validated via independent lab reports.

Shanghai Carejoy Medical Co., LTD | Official 2026 Procurement Channel

Factory Address: No. 1888 Jiangyang Road, Baoshan District, Shanghai 200433, China

Verification Protocol: All inquiries must reference “2026 Sourcing Guide” for priority technical review

Dedicated Procurement Contacts:

- Email: [email protected] (Include clinic/distributor license number)

- WhatsApp: +86 15951276160 (24/7 technical support)

Factory Audit Requirement: On-site verification mandatory for orders >10 units. Schedule via email with 15-day notice.

Compliance Disclaimer

This guide reflects 2026 regulatory landscapes per EU MDR, FDA 21 CFR 820, and ISO 13485:2023 standards. Shanghai Carejoy Medical Co., LTD is verified as compliant per Q4 2025 audit. Always conduct independent due diligence. “iTerio” is a registered trademark of Align Technology; this guide references interoperable scanner workflows only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: iTero Digital Scanner – Procurement FAQ

Frequently Asked Questions: Purchasing the iTero Digital Scanner (2026)

As digital impression technology becomes standard in modern dental practices, selecting the right intraoral scanner is critical. Below are five essential procurement questions and answers regarding the iTero Digital Scanner, with focus on voltage compatibility, spare parts availability, installation, and warranty coverage—key considerations for clinics and distribution partners in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the iTero Digital Scanner have, and is it compatible with global electrical standards? | The iTero Digital Scanner operates on a universal voltage input of 100–240 VAC, 50/60 Hz, making it suitable for use in over 150 countries. Each unit is equipped with an auto-switching power supply and comes with region-specific power cords and plug adapters. For distributors, bulk shipments can be customized with localized power kits to meet national electrical regulations (e.g., CE, UL, CCC, KC). |

| 2. What spare parts are available for the iTero scanner, and what is the lead time for replacement components? | Key spare parts—including handpiece tips, sterilizable sleeves, charging docks, batteries, and sensor covers—are available through authorized distributors and the manufacturer’s global logistics network. As of 2026, critical components are stocked in regional hubs (North America, EMEA, APAC), ensuring a standard lead time of 3–5 business days for in-warranty and out-of-warranty replacements. Distributors can access priority spare parts programs with volume-based service level agreements (SLAs). |

| 3. Is professional installation required for the iTero scanner, and what does the setup process involve? | While the iTero scanner is designed for plug-and-play integration, professional on-site or remote installation is included with every purchase through certified technicians. The setup includes hardware calibration, software configuration (iTero Element Suite 6.2+), network integration, DICOM export setup, and staff training (1–2 hours). For distributors, turnkey deployment packages are available, including pre-installation site assessments and multi-clinic rollout support. |

| 4. What is the standard warranty coverage for the iTero Digital Scanner in 2026, and are extended service plans available? | The iTero scanner comes with a 2-year comprehensive warranty covering parts, labor, and sensor performance. Extended warranty options (up to 5 years) are available at time of purchase or within the first 18 months of ownership. These include Advanced Replacement Service, predictive maintenance alerts, and priority technical support. Distributors may offer bundled service contracts tailored to clinic service-level needs. |

| 5. How are firmware updates and software support handled post-installation? | Firmware and software updates for the iTero platform are delivered over-the-air (OTA) and are included at no additional cost during the warranty period. Updates are released quarterly and include clinical enhancements, AI-driven scanning accuracy improvements, and expanded CAD/CAM integrations (e.g., with Straumann CARES, Dentsply Sirona inLab). Remote monitoring and auto-update scheduling are managed via the iTero Cloud Portal, accessible to clinic administrators and authorized service partners. |

Need a Quote for Itero Digital Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160