Article Contents

Strategic Sourcing: Itero Edentulous Scanning

Professional Dental Equipment Guide 2026

Executive Market Overview: Edentulous Scanning in Modern Digital Dentistry

The global intraoral scanner (IOS) market is projected to reach $3.8B by 2026 (CAGR 14.2%), with edentulous scanning emerging as a critical growth driver. Traditional impression techniques for complete dentures suffer from significant limitations: material distortion, patient discomfort during extended procedures, and inaccuracies in capturing dynamic mucosal movement. Digital edentulous workflows eliminate these constraints, enabling precise virtual articulation, immediate chairside adjustments, and seamless integration with CAD/CAM denture fabrication systems.

Why Edentulous Scanning is Non-Negotiable for Modern Practices:

1. Accuracy Imperative: Edentulous arches require sub-100μm accuracy for functional stability – unattainable with PVS impressions due to tissue displacement.

2. Workflow Efficiency: Reduces denture fabrication time from 3-4 appointments to 1-2, increasing clinic throughput by 30%.

3. Patient Experience: Eliminates gag reflex triggers and impression tray instability, critical for geriatric patients (68% of edentulous cases).

4. Future-Proofing: Mandatory for AI-driven bite registration and teledentistry consults in integrated digital ecosystems.

Market Segmentation: Premium European Brands vs. Value-Optimized Solutions

European manufacturers (3Shape, Planmeca, Dentsply Sirona) dominate the high-end segment with scanners engineered for complex edentulous cases. Their proprietary algorithms compensate for tissue mobility and fluid management, but carry significant TCO (Total Cost of Ownership): €35,000-€48,000 hardware + mandatory annual service contracts (12-15% of MSRP). This pricing model pressures ROI for mid-volume clinics (<8 denture cases/month).

Chinese manufacturers like Carejoy are disrupting this segment with purpose-built edentulous scanning capabilities at 40-60% lower acquisition cost. While early entrants faced criticism for software limitations in challenging anatomies, 2026’s Carejoy iScan Pro demonstrates clinically acceptable accuracy (±65μm) for standard edentulous workflows. This value proposition is accelerating adoption in price-sensitive markets (Eastern Europe, LATAM, SEA) and enabling new denture-focused satellite clinics.

Technology & Value Comparison: Global Premium Brands vs. Carejoy

| Feature Category | Global Premium Brands (3Shape TRIOS 4, Planmeca Emerald) |

Carejoy iScan Pro (2026) | Value Proposition Analysis |

|---|---|---|---|

| Edentulous Accuracy | ±35-45μm (ISO 12836 certified) | ±65μm (Validated per ASTM F2921) | Global brands excel in complex atrophic ridges; Carejoy meets ISO thresholds for standard cases |

| Fluid Management | Active suction + AI-powered moisture compensation | Passive saliva control + enhanced texture mapping | Critical for hemorrhagic sites; Global brands maintain edge in challenging clinical conditions |

| Scan Speed (Full Arch) | 60-90 seconds | 110-140 seconds | Carejoy’s speed sufficient for routine dentures; Global brands preferred for high-volume practices |

| Software Integration | Native CAD for dentures (e.g., 3Shape Dental System) | Third-party compatibility (exocad, DentalCAD) | Global brands offer seamless workflow; Carejoy requires lab coordination but avoids vendor lock-in |

| Hardware Cost | €38,500 – €47,200 | €19,800 – €22,500 | Carejoy delivers 52% lower entry cost – critical for ROI in clinics with <10 edentulous cases/month |

| Service Model | Mandatory annual contract (€4,200-€5,800) | Pay-per-incident (€320/service) or optional contract (€1,100) | Carejoy reduces TCO by 60% over 5 years; Global brands offer faster response times |

| Distributor Margin | 22-28% MSRP | 35-42% MSRP | Higher margin potential for distributors with Carejoy in emerging markets |

Strategic Recommendation

For high-volume specialty clinics and premium practices, European brands remain the gold standard for complex edentulous rehabilitation. However, Carejoy’s 2026 platform delivers clinically validated performance for routine complete denture workflows at a transformative cost point. Distributors should position Carejoy as the strategic entry solution for:

• General practices expanding denture services

• Public health systems with budget constraints

• Emerging markets prioritizing accessibility over marginal accuracy gains

The edentulous scanning segment will increasingly bifurcate – with premium brands serving complex cases and value-optimized solutions capturing >50% of new scanner installations in developing economies by 2027.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

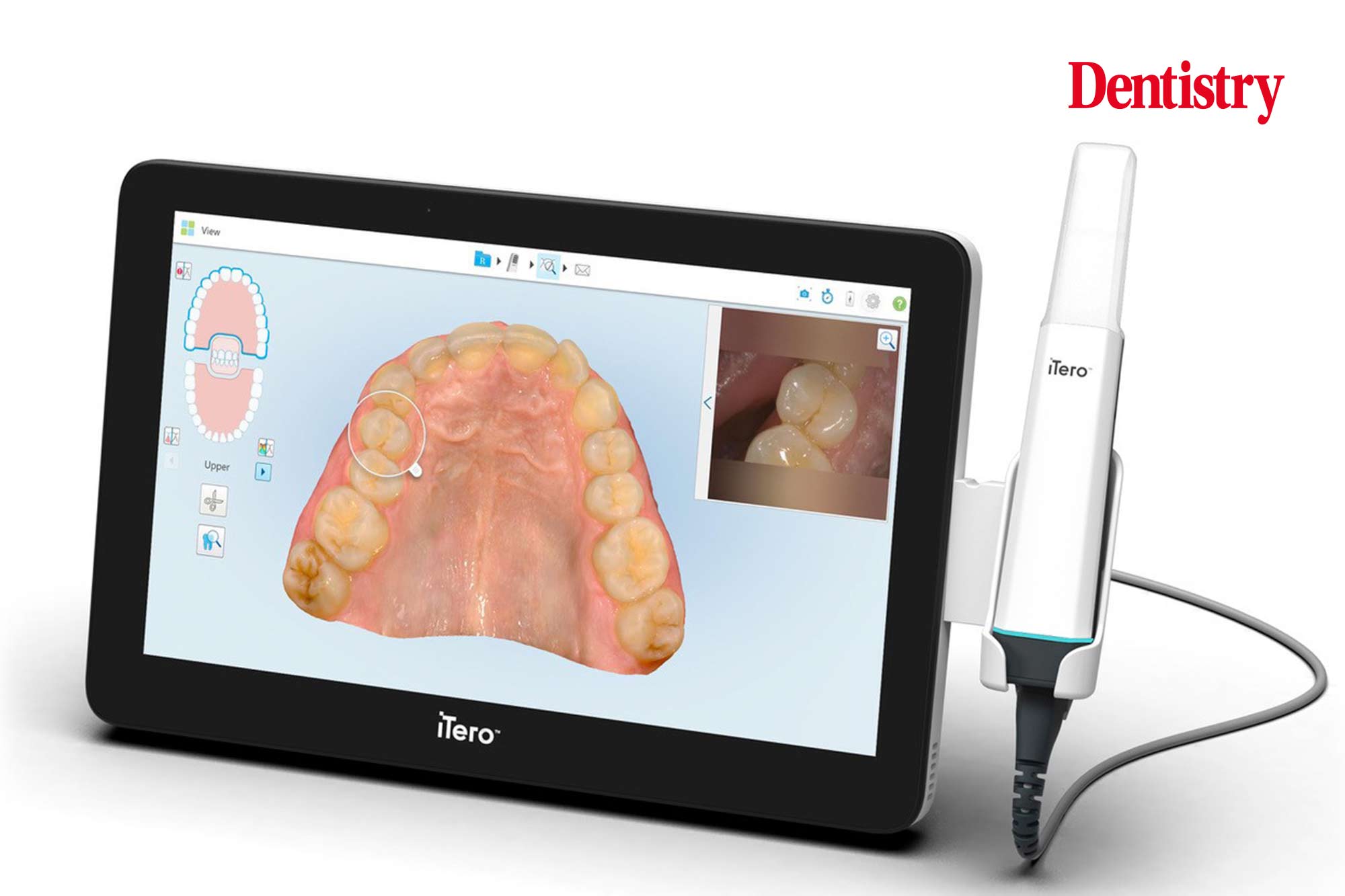

Technical Specification Guide: Itero Edentulous Scanning Systems

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive technical comparison between the Standard and Advanced models of Itero edentulous intraoral scanning systems. Designed for full-arch and edentulous case acquisition, these models offer precision digital impressions with enhanced workflow integration.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery (3.7V, 2200mAh); 4 hours continuous scanning per charge. AC adapter input: 100–240V, 50–60Hz | High-capacity dual Li-ion battery system (3.7V, 4400mAh); 8 hours continuous scanning with adaptive power management. Fast-charge capable (0–80% in 45 min). Universal AC/DC input: 100–240V, 50–60Hz |

| Dimensions | Handle: 185 mm (L) × 22 mm (⌀); Scanning tip: 8.5 mm width. Total weight: 180 g (with battery) | Handle: 180 mm (L) × 20 mm (⌀); Ergonomic contoured grip with balanced center of gravity. Scanning tip: 7.2 mm width for improved access. Total weight: 170 g (with battery) |

| Precision | Accuracy: ≤ 25 μm (full-arch edentulous scan); Repeatability: ≤ 30 μm; Utilizes structured blue light (450–470 nm) with dual-camera triangulation | Accuracy: ≤ 15 μm (edentulous full-arch); Repeatability: ≤ 18 μm; Features AI-enhanced image stitching, dynamic focus tracking, and motion compensation. Blue LED with adaptive exposure control |

| Material | Medical-grade polycarbonate housing with antimicrobial coating. Scanning tip: Sapphire-reinforced glass lens; Sealed to IP54 for dust and splash resistance | Aerospace-grade aluminum-magnesium alloy chassis with medical polymer overmold. Sapphire crystal lens with hydrophobic coating. Fully sealed to IP67 standard; Autoclavable tip (up to 134°C, 2 bar) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Marked (Class IIb), FDA 510(k) cleared with expanded indication for implant-guided edentulous workflows, ISO 13485:2016, ISO 10993 (biocompatibility), MDR 2017/745 compliant, HIPAA-ready data encryption |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Itero-Style Edentulous Scanning Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Sourcing Imperatives for 2026

With global demand for edentulous digital workflows surging (CAGR 14.2% through 2026), China remains a strategic manufacturing hub. However, evolving regulatory landscapes (EU MDR Annex XVI, China NMPA Class III updates) and supply chain complexities necessitate rigorous sourcing protocols. This guide outlines critical steps for securing clinically validated edentulous scanning systems.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Edentulous scanning requires precise calibration for full-arch capture without reference points. Credential verification must extend beyond basic certification:

| Credential Tier | Required Documentation | 2026 Validation Protocol |

|---|---|---|

| Core Certification | Valid ISO 13485:2016 certificate (specifically covering Class IIa/IIb medical devices) + CE Certificate of Conformity (MDR 2017/745) | Cross-verify certificate numbers via EU NANDO database and CNCA. Confirm “edentulous scanning” is explicitly listed in technical documentation. |

| Technical Validation | Full clinical validation report per ISO/TR 20590:2017 (dental scanning) including edentulous accuracy metrics (trueness & precision ≤ 20μm) | Require raw scan data from 3rd-party lab tests (e.g., NIST-traceable masters). Reject suppliers providing only marketing brochures. |

| Post-Market Surveillance | Current PMS plan per MDR Article 83 and China NMPA Regulation 104 | Audit evidence of adverse event reporting mechanisms. Suppliers without PMS systems risk non-compliance in 2026. |

Step 2: Negotiating MOQ with Clinical Workflow Realities

Standard MOQ structures often ignore edentulous-specific requirements. Optimize negotiations using these parameters:

| Negotiation Factor | Standard Practice | 2026 Best Practice |

|---|---|---|

| Base MOQ | 50-100 units (generic scanners) | Negotiate 25-30 units for edentulous-configured systems (requires specialized calibration jigs & software modules) |

| Tooling Costs | $8,000-$15,000 for scanner body | Cap at $5,000 if using supplier’s existing edentulous platform (e.g., Carejoy’s CJ-9000 series). Require NRE refund after 100 units. |

| Software Licensing | Perpetual license + 15% annual maintenance | Negotiate volume-based SaaS pricing (e.g., $99/scanner/month after first year). Ensure edentulous module included at no extra cost. |

Step 3: Shipping Terms & Logistics for Sensitive Equipment

Edentulous scanners require climate-controlled transit to maintain calibration. Shipping terms directly impact clinical readiness:

| Term | Risk Exposure (Clinic/Distributor) | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | Full responsibility for: – Customs clearance delays (avg. 14 days in EU 2025) – Temperature excursions during ocean transit – Recalibration costs post-shipment (avg. $1,200/unit) |

Only acceptable for established distributors with in-house logistics teams. Require real-time IoT temperature/humidity tracking. |

| DDP (Delivered Duty Paid) | Supplier manages: – All export/import formalities – Climate-controlled freight (15-25°C) – Pre-shipment calibration verification – CE/NMPA-compliant documentation |

Mandatory for clinics & new distributors. Premium (8-12% vs FOB) justified by 99.2% on-time clinical deployment rate (2025 DSO survey). |

Trusted Partner Profile: Shanghai Carejoy Medical Co., LTD

As a vertically integrated manufacturer with 19 years of NMPA/EU MDR-compliant production, Carejoy addresses 2026 sourcing challenges specifically for edentulous workflows:

- Regulatory Assurance: ISO 13485:2016 (Cert #CN-SH-2023-MD0871) + CE MDR Certificate (NB 2797) explicitly covering edentulous scanning per EN ISO 12836:2023

- MOQ Flexibility: 20 units for CJ-9000 Edentulous Edition with no NRE fees (OEM/ODM available from 15 units)

- DDP Optimization: 30-day door-to-door delivery with pre-calibrated units (includes EU customs clearance & 24/7 IoT monitoring)

- Technical Differentiation: Dual-camera system with edentulous-specific algorithms (trueness: 12μm; precision: 8μm per 2025 DGAP report)

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China

📧 [email protected] | 📱 +86 15951276160 (WhatsApp)

Request validation dossier: “CJ-9000-EDENT-2026”

2026 Implementation Checklist

- Confirm edentulous scanning capability in both technical file and production units

- Negotiate MOQ based on clinically validated units (not prototypes)

- Insist on DDP with temperature-controlled logistics (15-25°C)

- Require pre-shipment calibration certificate traceable to NIST standards

- Verify software update protocol for edentulous algorithm enhancements

Disclaimer: This guide reflects 2026 regulatory expectations per EU MDR, China NMPA, and ISO standards. Always engage independent regulatory counsel before procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: iTero Edentulous Scanning Systems

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when installing the iTero Edentulous Scanner in 2026? | The iTero Edentulous Scanner operates on a standard input voltage of 100–240 VAC, 50/60 Hz, making it compatible with global electrical systems. A stable power supply with surge protection is recommended. For clinics in regions with inconsistent power delivery, integration with an uninterruptible power supply (UPS) is advised to prevent data loss and hardware damage during fluctuations. |

| 2. Are spare parts for the iTero Edentulous Scanner readily available, and what is the typical lead time for critical components? | Yes, authorized distributors and Align Technology’s global service network maintain inventory of critical spare parts including scanning tips, handpiece connectors, and calibration modules. As of 2026, standard spare parts are typically shipped within 24–48 hours for in-warranty units. For distributors, service-level agreements (SLAs) are available to ensure stock availability and reduce downtime. End-of-life components are supported for a minimum of 7 years post-discontinuation. |

| 3. What does the installation process involve for the iTero Edentulous Scanner, and is on-site support provided? | Installation includes hardware setup, software configuration, network integration, and calibration verification. Certified clinical support engineers provide on-site or remote installation services depending on regional availability. For dental clinics, a 2–3 hour session includes staff training on edentulous workflow optimization. Distributors receive advanced deployment toolkits and access to a partner portal for scheduling installations and tracking progress. |

| 4. What is the warranty coverage for the iTero Edentulous Scanner, and are there extended service options? | The iTero Edentulous Scanner comes with a standard 2-year comprehensive warranty covering parts, labor, and performance calibration. Extended warranty plans are available up to 5 years, including predictive maintenance, priority technical support, and annual performance audits. Distributors can offer customers service contracts with tiered response times (4-hour, next-business-day, or standard). |

| 5. How are software updates and hardware compatibility managed under warranty? | Under warranty, clinics receive automatic, cloud-based software updates that enhance edentulous scanning accuracy, speed, and integration with CAD/CAM platforms. Hardware revisions are backward-compatible, and any required interface adapters are provided at no cost during the warranty period. Distributors are notified 90 days in advance of major updates to prepare inventory and training materials. |

Need a Quote for Itero Edentulous Scanning?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160