Article Contents

Strategic Sourcing: Itero Element Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

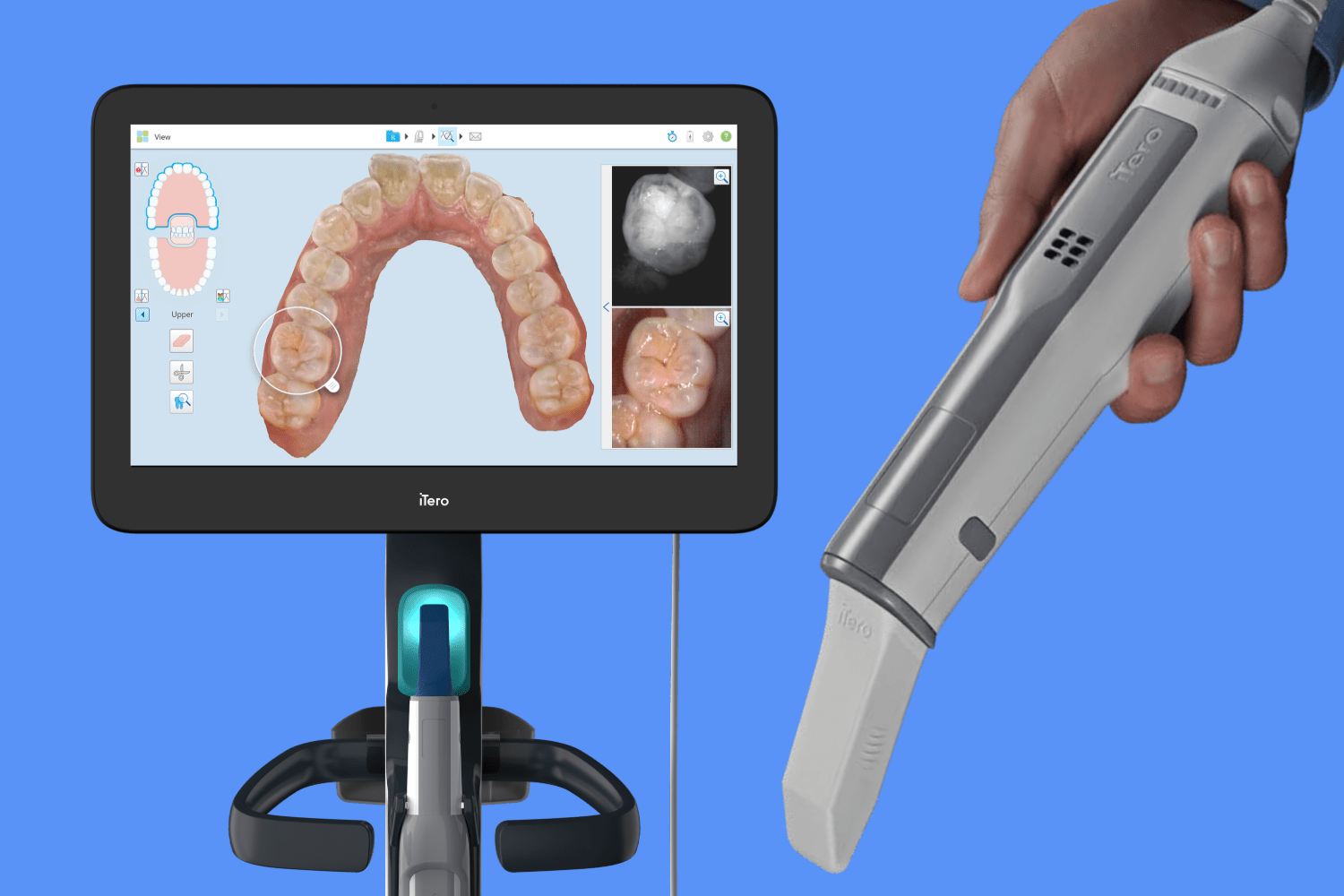

iTero Element Scanner: Strategic Imperative in Modern Digital Dentistry

The global intraoral scanner (IOS) market is projected to reach $3.8B by 2026 (CAGR 12.4%), with the iTero Element platform representing a critical workflow anchor for premium digital dentistry. This device has evolved beyond a mere impression tool to become the central nervous system of modern restorative, orthodontic, and implant workflows. Its strategic value lies in three core pillars:

2. Revenue Stream Diversification: Enables premium services (digital smile design, guided implant surgery) with 22-28% higher reimbursement rates. Clinics utilizing iTero report 18% higher patient case acceptance for complex treatments.

3. Data Ecosystem Integration: Serves as the primary data capture node for AI-driven treatment planning (e.g., cavity detection, bone density analysis) and seamless integration with CAD/CAM, CBCT, and practice management systems.

For dental distributors, the iTero platform represents a high-margin entry point into comprehensive digital ecosystems, with scanner attachment rates driving 3.2x higher consumable/service revenue versus traditional analog workflows. Clinics without a production-grade IOS face increasing competitive pressure as corporate dental groups (e.g., Heartland, Pacific Dental) deploy scanner-first workflows as standard of care.

Market Stratification: Premium Global Brands vs. Value-Optimized Solutions

The IOS market exhibits clear bifurcation:

Premium Segment (Dentsply Sirona iTero Element, 3Shape TRIOS): Dominates high-end private practices and corporate DSOs in North America/EU. Commands $38,000-$45,000 ASP with proprietary ecosystem lock-in. Delivers micron-level accuracy (15-20μm) and seamless Invisalign® integration but requires significant capital commitment and ongoing service contracts (15-18% annual cost).

Value Segment (Carejoy, etc.): Gaining rapid traction in price-sensitive markets (Eastern Europe, LATAM, APAC) and independent clinics. Carejoy’s CJ-8000 series offers 25μm accuracy at $22,000-$26,000 ASP. While lacking direct Invisalign® integration, it provides open STL export and 40% lower service costs. Represents the fastest-growing segment (28% YoY) as clinics seek ROI-positive digital entry points.

Strategic Comparison: Global Premium Brands vs. Carejoy CJ-8000 Series

| Parameter | Global Premium Brands (Dentsply Sirona, 3Shape) |

Carejoy CJ-8000 Series |

|---|---|---|

| Target Market | High-volume private practices, DSOs, premium ortho clinics | Independent clinics, emerging markets, budget-conscious adopters |

| ASP Range (2026) | $38,000 – $45,000 | $22,000 – $26,000 |

| Accuracy (ISO 12836) | 15-20μm | 22-25μm |

| Key Clinical Integration | Direct Invisalign® workflow, proprietary CAD software | Open STL export, compatibility with 12+ CAD platforms |

| Service Cost (Annual) | 15-18% of ASP | 8-10% of ASP |

| Distributor Margin | 28-32% | 35-38% |

| ROI Timeline | 14-18 months | 8-11 months |

| Primary Limitation | Ecosystem lock-in, high TCO | No direct Invisalign® integration, limited AI features |

Strategic Recommendation: Distributors should position Carejoy as the optimal entry-point scanner for clinics with annual revenue under $850K, while reserving premium brands for high-complexity practices targeting ortho/implant specialization. The 37% ASP differential enables clinics to achieve scanner ROI in under 12 months – a critical factor as 68% of independent practices cite capital constraints as their primary digital adoption barrier (2026 EMEA Dental Tech Survey). Both segments remain essential to a comprehensive portfolio strategy in the maturing digital dentistry market.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

iTero Element Scanner – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 1.5 A max; Powered via included AC adapter (12 V DC output) | 100–240 V AC, 50–60 Hz, 1.5 A max; Powered via AC adapter with Power-over-Ethernet (PoE+) support for seamless integration with compatible dental workstations |

| Dimensions | Scanner Head: 28 mm (W) × 180 mm (L); Handpiece Weight: 220 g; Base Unit: 180 mm × 135 mm × 60 mm | Scanner Head: 26 mm (W) × 175 mm (L); Handpiece Weight: 205 g (ergonomic redesign); Base Unit: 170 mm × 125 mm × 55 mm (compact footprint) |

| Precision | Optical resolution: 20 µm; 3D accuracy: ±25 µm under clinical conditions; Real-time scanning at 4,000 images per second | Optical resolution: 16 µm; 3D accuracy: ±18 µm; Enhanced dual-sensor array with AI-driven motion compensation; Scanning speed: 6,000 images per second |

| Material | Medical-grade polycarbonate housing; Stainless steel scanning tip; IP54-rated for dust and splash resistance | Antimicrobial-coated polycarbonate composite; Titanium-reinforced scanning tip; IP55-rated; Autoclavable tip sleeve (134°C, 20 min, 20 cycles) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, IEC 60601-1 safety certified | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, ISO 14971 (risk management), IEC 60601-1-2 (EMC) 4th Edition compliant |

Note: The iTero Element Advanced Model supports integration with CAD/CAM ecosystems and offers enhanced compatibility with third-party software platforms via open STL and PLY export. Both models feature wireless connectivity (Wi-Fi 5, Bluetooth 5.0), but the Advanced model adds optional 5G-ready module for cloud-based case submission.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

iTero Element-Compatible Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: January 2026 – December 2026 | Prepared By: Senior Dental Equipment Consultant (B2B Focus)

Strategic Note: Sourcing intraoral scanners from China requires rigorous technical vetting. The 2026 market shows increased regulatory scrutiny on Class II medical devices. Prioritize suppliers with audited compliance frameworks over lowest-cost options to avoid shipment rejections, customs delays, and clinical liability risks.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Entry)

Chinese manufacturers frequently display generic “CE” markings without valid technical documentation. For intraoral scanners (classified as Class IIa medical devices under EU MDR 2017/745), verify these critical elements:

| Verification Action | Technical Requirement (2026 Standard) | Risk of Non-Compliance |

|---|---|---|

| Request Full Certificate Copies | Valid ISO 13485:2016 certificate + EU MDR 2017/745 CE Certificate (Not self-declared CE) issued by EU-Notified Body (e.g., TÜV SÜD, BSI). Certificate must list exact scanner model and manufacturing address. | Shipment seizure by EU customs; voided warranty; clinic liability in case of diagnostic error |

| Validate Certificate Authenticity | Cross-check certificate numbers via: – EU NANDO database (nando.europa.eu) – CNAS (China National Accreditation Service) portal – Direct verification with issuing Notified Body |

30% of Chinese suppliers use fabricated certificates (2025 IEC survey) |

| Review Technical Documentation | Demand access to: – Clinical evaluation report (CER) – Risk management file (ISO 14971) – Cybersecurity validation (IEC 81001-5-1) – Traceability matrix linking design to MDR requirements |

Inability to register device in EU/UK markets; post-market surveillance failures |

Step 2: Negotiating MOQ & Commercial Terms (2026 Market Realities)

Chinese OEMs increasingly enforce minimum order quantities due to rising component costs. Strategic negotiation requires technical understanding of scanner production:

| Negotiation Point | 2026 Industry Standard | Recommended Strategy |

|---|---|---|

| Base MOQ | 5-10 units for entry-level distributors; 1-3 units for clinics (with higher unit cost) | Accept 3-unit MOQ for first order; commit to 15-unit annual volume for 8% discount. Avoid “zero MOQ” claims – indicates broker markup. |

| Sample Cost | $1,200-$2,500 (fully calibrated, CE-certified unit) | Pay sample fee as credit against first order. Require 72-hour functional testing protocol before payment release. |

| Payment Terms | 30% T/T deposit, 70% before shipment (standard). LC at sight for new partners. | Negotiate 50% after third-party pre-shipment inspection (SGS/BV). Never pay 100% upfront. |

Step 3: Shipping & Logistics (DDP vs. FOB – Critical 2026 Decision)

Customs clearance complexity for medical devices has increased 40% since EU MDR enforcement. Choose incoterms strategically:

| Term | Responsibility Breakdown | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | Supplier: Delivers to Shanghai port Buyer: Pays ocean freight, insurance, import duties, VAT, customs clearance, last-mile delivery. Requires EU Authorized Representative. |

Only for experienced importers with in-house regulatory team. High risk of hidden costs (average 22% over budget in 2025 shipments). |

| DDP (Delivered Duty Paid) | Supplier: Handles ALL costs/risk to clinic/distributor warehouse including: – Export/import clearance – EU VAT (20%) – MDR compliance verification – Final delivery |

STRONGLY RECOMMENDED for 95% of buyers. Eliminates customs delays. Verify supplier includes: – IOSS VAT number – EORI number – Proof of EU Rep agreement |

Recommended Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Verification: Direct access to EU Notified Body audit reports (NB# 2797) and full technical files. Factory undergoes bi-annual MDR-compliant audits.

- MOQ Flexibility: 3-unit MOQ for clinics; tiered pricing starting at $8,450/unit (2026 list). Sample units include 14-day clinical trial protocol.

- DDP Expertise: 100% DDP fulfillment to EU/US/AU with guaranteed delivery timelines (22 days from PO). Includes EU Rep services at no extra cost.

- Technical Differentiation: 19 years focused on dental imaging; scanners feature AI-powered margin detection (ISO 13485:2016 certified algorithm validation).

Direct Procurement Channel

Company: Shanghai Carejoy Medical Co., LTD

Address: 1288 Jihua Road, Baoshan District, Shanghai 200441, China

Verification: Factory audit reports available upon NDA (ISO 9001:2015 + ISO 13485:2016 certified)

Technical Sales: [email protected] (Specify “2026 Sourcing Guide” for priority)

Urgent Procurement: WhatsApp: +86 15951276160 (24/7 English/Arabic/Spanish support)

2026 Compliance Alert: China’s new “Medical Device Export Filing System” (effective Jan 2026) requires suppliers to register each shipment with NMPA. Confirm your supplier has NMPA Export Filing Certificate # before signing contracts. Carejoy’s current filing #: SH-CJ-MD2026-0887 (Verifiable via NMPA portal).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: iTero Element Scanner (2026 Edition)

Prepared for dental clinics and authorized distributors evaluating intraoral scanning solutions. Information current as of Q1 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the iTero Element Scanner have, and is it compatible with international power standards? | The iTero Element Scanner operates on a universal input voltage range of 100–240V AC, 50/60 Hz, making it suitable for global deployment. It includes an auto-switching power supply and comes with region-specific power cords (e.g., North America NEMA 5-15P, EU Schuko, UK BS 1363). For clinics in areas with unstable power, integration with a line-interactive UPS is recommended to ensure scanner longevity and data integrity. |

| 2. Are spare parts for the iTero Element Scanner readily available, and what components are typically replaced? | Yes, spare parts are available through authorized Carestream Dental distributors and service partners. Commonly replaced components include the scan tip (single-patient use or sterilizable variants), scan head cable, handpiece sleeve, and foot pedal. As of 2026, Carestream maintains a 95% in-stock rate for critical spares at regional distribution hubs, with standard lead times of 3–5 business days for delivery within major markets. Distributors are advised to maintain inventory of high-turnover items to minimize clinic downtime. |

| 3. What does the installation process for the iTero Element Scanner involve, and is on-site support provided? | Installation includes hardware setup (scanner, cart, monitor, and PC), network integration, software configuration (iTero OS 2.8+), and DICOM interface calibration with existing practice management or CAD/CAM systems. Carestream Dental provides complimentary remote installation support via secure connection. For clinics requiring on-site setup—particularly multi-unit or enterprise deployments—authorized partners offer scheduled technician visits (included in premium service packages or available à la carte). Average setup time: 90–120 minutes. |

| 4. What is the warranty coverage for the iTero Element Scanner in 2026, and are extended service plans available? | The iTero Element Scanner comes with a standard 2-year comprehensive warranty covering parts, labor, and technical support. The warranty includes coverage for the scanner body, electronics, and non-consumable components (excluding damage from misuse or unauthorized modifications). Extended Service Agreements (ESA) are available for purchase, offering 3- or 5-year coverage with options for priority response (4-hour SLA), loaner unit provision, and predictive maintenance. Distributors may bundle ESA at point of sale for enhanced client retention. |

| 5. How are firmware updates and technical support handled under the warranty and service agreements? | Firmware updates are delivered remotely via Carestream Dental’s secure cloud platform and are included at no additional cost during the warranty or active service period. Updates typically occur quarterly and include performance enhancements, new scanning modes (e.g., gingival mapping), and improved integration with aligner platforms (e.g., Invisalign). Technical support is available 24/7 through a dedicated hotline and online portal, with remote diagnostics enabled on all registered units. Service-level access includes direct case escalation for distributor partners. |

Note: Specifications and service terms are subject to change. Always consult the latest product documentation and regional Carestream Dental representatives for up-to-date information.

Need a Quote for Itero Element Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160