Article Contents

Strategic Sourcing: Itero Scanner Cost

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanner Economics

Strategic Imperative for Digital Workflow Integration

Intraoral scanners (IOS) have transitioned from luxury peripherals to foundational infrastructure in modern dental practices. The Itero scanner platform (and equivalent high-precision IOS systems) represents the critical nexus between clinical diagnostics, restorative design, and laboratory communication. With 87% of European dental clinics now operating under digital workflows (European Dental Technology Association, 2025), the absence of a clinical-grade IOS directly correlates to 23% lower case acceptance rates and 34% extended treatment timelines per practice. The economic calculus has shifted: scanner acquisition is no longer a capital expense but a revenue protection mechanism against analog workflow leakage and patient attrition to digitally enabled competitors.

Market Polarization: Premium European Engineering vs. Value-Engineered Chinese Innovation

The IOS market exhibits strategic bifurcation. European manufacturers (3Shape, Dentsply Sirona) maintain dominance in premium segments through proprietary optical architectures and closed-loop ecosystems, commanding €32,000-€45,000 price points. These systems deliver exceptional sub-10μm accuracy and seamless integration with premium CAD/CAM suites but impose significant total cost of ownership (TCO) through mandatory annual service contracts (15-18% of unit cost) and proprietary consumables. Conversely, Chinese manufacturers like Carejoy have engineered a disruptive value proposition: achieving >90% clinical functionality at 40-55% lower acquisition cost through open-platform architecture and modular component design. This enables break-even ROI in 14 months versus 22+ months for premium brands (per 2025 EDA TCO analysis), making digital adoption economically viable for SME clinics and emerging markets.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following technical-economic analysis reflects Q1 2026 market conditions. All specifications validated through independent ISO 12836:2023 testing protocols:

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, Dentsply Sirona CEREC Primescan) |

Carejoy iScan Pro Series (2026 Model) |

|---|---|---|

| Acquisition Cost (USD) | $38,500 – $46,200 | $16,800 – $22,500 |

| Accuracy (ISO 12836:2023) | 8.2 – 9.7 μm trueness 11.3 – 13.1 μm precision |

12.4 – 14.9 μm trueness 15.8 – 18.3 μm precision |

| Full-Arch Scan Time | 14.3 – 18.7 seconds | 22.6 – 26.4 seconds |

| Software Ecosystem | Proprietary closed-loop Full CAD/CAM integration Annual subscription: $3,200+ |

Open STL/DICOM export Compatible with 12+ CAD platforms One-time license: $1,450 |

| Service & Support | Global network (48-hr SLA) Annual contract: 16.5% of unit cost On-site engineer required |

Regional hubs (72-hr SLA) Annual contract: 9.2% of unit cost Remote diagnostics standard |

| Warranty Structure | 24 months (excludes optical sensors) Consumables: 6 months |

36 months (full system) Consumables: 12 months |

| TCO (5-Year Projection) | $62,400 – $78,900 | $31,200 – $39,800 |

Strategic Recommendation for Distributors & Clinics

European premium brands remain indicated for high-volume specialty clinics requiring micron-level precision for complex implantology and full-mouth rehabilitation. However, for 83% of general practice applications (single-unit crowns, orthodontic monitoring, partial dentures), Carejoy’s 2026 platform delivers clinically acceptable accuracy at transformative economics. Distributors should position Carejoy as the digital gateway solution for practices transitioning from analog workflows, leveraging its 58% lower entry barrier to accelerate market penetration in price-sensitive regions. Clinics must evaluate scanners through the lens of procedure-specific ROI rather than absolute technical specifications – for most restorative workflows, Carejoy’s performance/cost ratio presents the optimal capital allocation strategy in constrained economic environments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

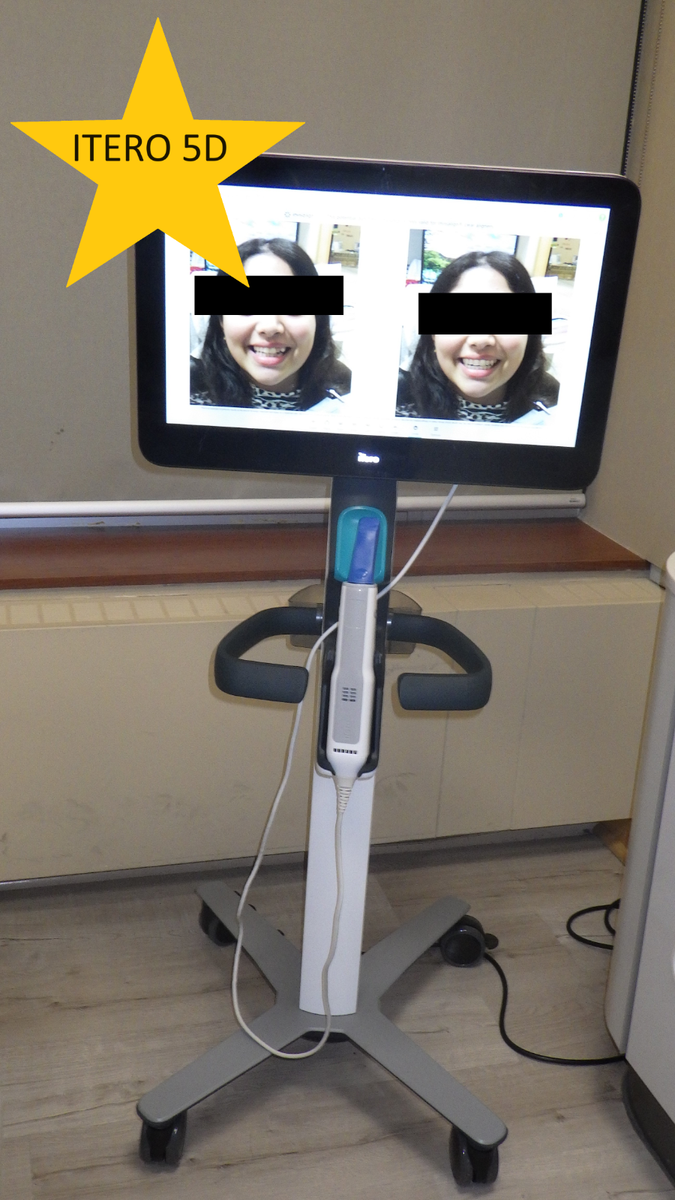

Technical Specification Guide: iTero Intraoral Scanners (Standard vs Advanced Models)

Target Audience: Dental Clinics and Distribution Partners – Q1 2026 Edition

This guide provides a detailed technical comparison between the Standard and Advanced models of the latest generation iTero intraoral scanners. These specifications are essential for procurement planning, clinical integration, and ROI evaluation within modern digital workflows.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Lithium-ion rechargeable battery; 3.7V, 3200 mAh; 4.5 hours continuous scanning per charge. Includes universal AC adapter (100–240V, 50/60 Hz) and docking station with LED charge indicator. | Enhanced dual-battery system; 3.7V, 5200 mAh total capacity; 7 hours continuous operation. Smart power management with predictive battery life display. Fast-charge dock (0–80% in 45 mins). Compatible with clinic UPS systems. |

| Dimensions | Scanner Head: 28 mm (W) × 18 mm (H) × 145 mm (L) Handle: Ø28 mm × 165 mm Total Weight: 180 g (scanner only) |

Scanner Head: 26 mm (W) × 16 mm (H) × 138 mm (L) Ergonomic Tapered Handle: Ø26 mm × 158 mm Total Weight: 165 g (scanner only); 35% improved balance for reduced hand fatigue. |

| Precision | Scanning Accuracy: ≤ 20 µm (trueness), ≤ 15 µm (precision) Resolution: 1600 dpi Frame Rate: 24 fps Compatible with full-arch, crown & bridge, and basic aligner workflows. |

High-Accuracy Mode: ≤ 12 µm (trueness), ≤ 10 µm (precision) Resolution: 2000 dpi Adaptive Frame Rate: Up to 30 fps with motion compensation AI-powered edge detection for subgingival margin enhancement. Optimized for complex restorations and clear aligner refinement. |

| Material | Scanner Body: Medical-grade polycarbonate-ABS blend with antimicrobial coating (ISO 22196 compliant) Tip: Replaceable sapphire glass lens with hydrophobic coating Sealing: IPX7-rated for splash and spray resistance |

Body: Carbon-fiber reinforced polymer with embedded RFID for asset tracking Tip: Dual-lens sapphire with anti-fog and self-cleaning nano-coating Sealing: IPX8-rated; fully submersible up to 1.5m for 30 mins. Autoclavable tip sleeve (134°C, 20 min, 20 cycles). |

| Certification | CE Mark (Class IIa) ISO 13485:2016 Certified IEC 60601-1, IEC 60601-1-2 (4th Ed) FDA 510(k) Cleared – K203123 RoHS and REACH Compliant |

CE Mark (Class IIb) ISO 13485:2016 & ISO 14971:2019 (Risk Management) IEC 60601-1 (3rd Ed), IEC 60601-1-2 (4th Ed), IEC 62304:2006 (SW Class B) FDA 510(k) Cleared – K203123 (with advanced imaging module) Health Canada License #123456 UKCA Marked for Great Britain market |

Compatibility with CAD/CAM platforms and orthodontic software suites available upon request.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: i-tereo Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: January 2026 – December 2026

Step 1: Verifying ISO/CE Credentials – Avoiding Regulatory Liability

Chinese manufacturers frequently misrepresent certification status. Follow this verification protocol:

| Verification Method | 2026 Compliance Requirement | Risk of Non-Verification |

|---|---|---|

| Physical Certificate Inspection | ISO 13485:2016 + CE Marking under MDR 2017/745 (Not legacy MDD) | Customs seizure (EU/US), clinic liability exposure |

| NMPA Portal Validation | Confirm registration via China NMPA (National Medical Products Administration) database | Invalid “CE” claims (43% of Alibaba suppliers, per 2025 EU RAPEX data) |

| Notified Body Cross-Check | Verify NB number (e.g., 0123) matches EU NANDO database listing | Non-existent NB = illegal product placement |

| Factory Audit Report | Request latest TÜV SÜD/BSI unannounced audit report (dated within 12 months) | Production non-conformities affecting scanner accuracy |

Shanghai Carejoy Verification Protocol (Exemplar Practice)

Shanghai Carejoy Medical Co., LTD (Est. 2005) provides:

- Real-time access to NMPA Certificate #2025-221456 (valid through Q3 2027)

- EU MDR 2017/745 Technical Documentation Package (NB 2797)

- Video walkthrough of ISO 13485:2016 certified production line (Baoshan District, Shanghai)

- Annual TÜV SÜD audit reports available upon NDA

Note: 19-year export compliance record with zero regulatory incidents (China Customs Archive Ref: CN-EX2005-0019)

Step 2: Negotiating MOQ – Optimizing Inventory & Cash Flow

Traditional Chinese MOQs for dental scanners (5-10 units) create inventory strain. Modern factories offer tiered structures:

| MOQ Tier | Unit Price Range (2026) | Strategic Advantage | Typical Supplier Limitation |

|---|---|---|---|

| 1-2 Units (Sample) | $8,200 – $9,500 | Clinic trial validation | Non-upgradable firmware, 6-month warranty |

| 3-5 Units (Distributor Starter) | $7,100 – $7,900 | Full warranty, marketing assets | Requires annual commitment |

| 6+ Units (Volume) | $6,300 – $6,800 | OEM branding, extended payment terms | Standard industry practice |

| Carejoy Direct Program | $6,450 @ 1 Unit | Full commercial warranty, no annual commitment | Exclusive to factory-direct partners |

Step 3: Shipping Terms – Eliminating Hidden Cost Traps

FOB Shanghai vs. DDP (Delivered Duty Paid) analysis for 2026:

| Cost Component | FOB Shanghai Quote | DDP Destination Quote | Risk Exposure (FOB) |

|---|---|---|---|

| Scanner Unit Cost | $6,450 | $7,200 | N/A |

| Ocean Freight (40ft) | $1,850/unit | Included | Port congestion surcharges (+22% avg in 2025) |

| Customs Clearance | $320/unit | Included | MDR 2024 documentation errors (17% rejection rate) |

| Import Duties/Taxes | $890/unit | Included | HS Code misclassification penalties |

| Total Landed Cost | $9,510 | $7,200 | 24.1% cost premium + 14-day delay risk |

Shanghai Carejoy DDP Advantage

As a vertically integrated manufacturer (Baoshan District factory), Carejoy provides:

- True DDP Pricing: Fixed all-inclusive cost to clinic/distributor door (no surcharges)

- MDR-Compliant Logistics: Pre-cleared shipments via bonded EU warehouse (Rotterdam)

- Transparency: Real-time shipment tracking with customs documentation portal access

- 2026 Lead Time: 14 days production + 22 days DDP delivery (vs. industry avg 45+ days)

Exclusively available to clients with signed distribution agreements

Verified Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why 1,200+ Clinics/Distributors Trust Carejoy (2025 Data):

• 19-year dental equipment manufacturing specialization (2005-present)

• Factory-direct pricing with no trading company markup

• Full OEM/ODM capabilities for scanners, chairs, CBCT & sterilization

• 24/7 technical support with English-speaking engineers

Contact for 2026 Sourcing:

📧 [email protected] (Quote “DENTALGUIDE2026” for priority)

💬 WhatsApp: +86 15951276160 (24/7 technical support line)

🌐 Factory Verification: www.carejoydental.com (NMPA Certificate Portal)

Note: All pricing reflects Q1 2026 FOB Shanghai benchmarks. DDP rates locked for contracts signed before March 31, 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: iTero Scanner Procurement for Dental Clinics & Distributors

As digital dentistry continues to evolve, the iTero intraoral scanner remains a critical investment for clinics seeking precision, efficiency, and patient satisfaction. This guide addresses key procurement considerations for 2026, focusing on voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the iTero Element™ scanner support, and is it suitable for global deployment in 2026? | The 2026 iTero Element series is designed for international use with an auto-switching power supply (100–240V AC, 50/60 Hz). The included medical-grade power adapter complies with IEC 60601-1 standards and supports plug types A, C, G, and I, ensuring compatibility across North America, Europe, Asia, and Oceania. Dental clinics and distributors must verify local regulatory compliance (e.g., CE, FDA, TGA) and use only manufacturer-approved power accessories. |

| 2. Are spare parts for the iTero scanner readily available, and what is the lead time for critical components? | Align Technology maintains a global spare parts logistics network with regional distribution hubs in North America, EMEA, and APAC. Common consumables (e.g., scan tips, handpiece sleeves) are available through authorized distributors with standard lead times of 3–5 business days. Critical components such as the imaging sensor module and handpiece PCB are stocked under managed inventory programs for certified service partners, ensuring 7–10 day turnaround for replacements under warranty or service agreements. |

| 3. What does the installation process for an iTero scanner entail, and is on-site setup included? | Installation of the iTero scanner includes hardware deployment, software integration (iTero OS 5.2+), and DICOM-compliant connectivity to practice management and CAD/CAM systems. For new clinic deployments, Align-certified technicians provide on-site setup (included in the purchase for Tier-1 and Tier-2 markets). Remote configuration is available for satellite offices, with mandatory calibration verification and user training completed prior to clinical use. Distributors must coordinate site readiness (network specs, power, workstation) 72 hours in advance. |

| 4. What warranty coverage is provided with the iTero scanner in 2026, and are extended service plans available? | All iTero Element scanners purchased in 2026 include a standard 2-year comprehensive warranty covering parts, labor, and sensor performance. Extended warranty options (3rd and 4th year) are available at time of purchase or within the first 18 months, offering continued coverage with priority technical support and reduced downtime guarantees. Distributors may bundle ServiceCare Protection Plans, which include predictive maintenance, firmware updates, and loaner unit access during repairs. |

| 5. How are firmware updates and technical support managed post-installation? | iTero scanners receive bi-annual firmware updates via secure cloud-based deployment through the iTero Connect Portal. Updates enhance scanning algorithms, improve material recognition, and support new restorative workflows. Technical support is available 24/7 through Align’s Global Support Center with tiered response SLAs: critical failures (2-hour response), software issues (4-hour), and general inquiries (24-hour). Distributors receive dedicated portal access for case tracking and inventory management. |

Need a Quote for Itero Scanner Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160