Article Contents

Strategic Sourcing: Ivoclar 3D Printer

Professional Dental Equipment Guide 2026: Executive Market Overview

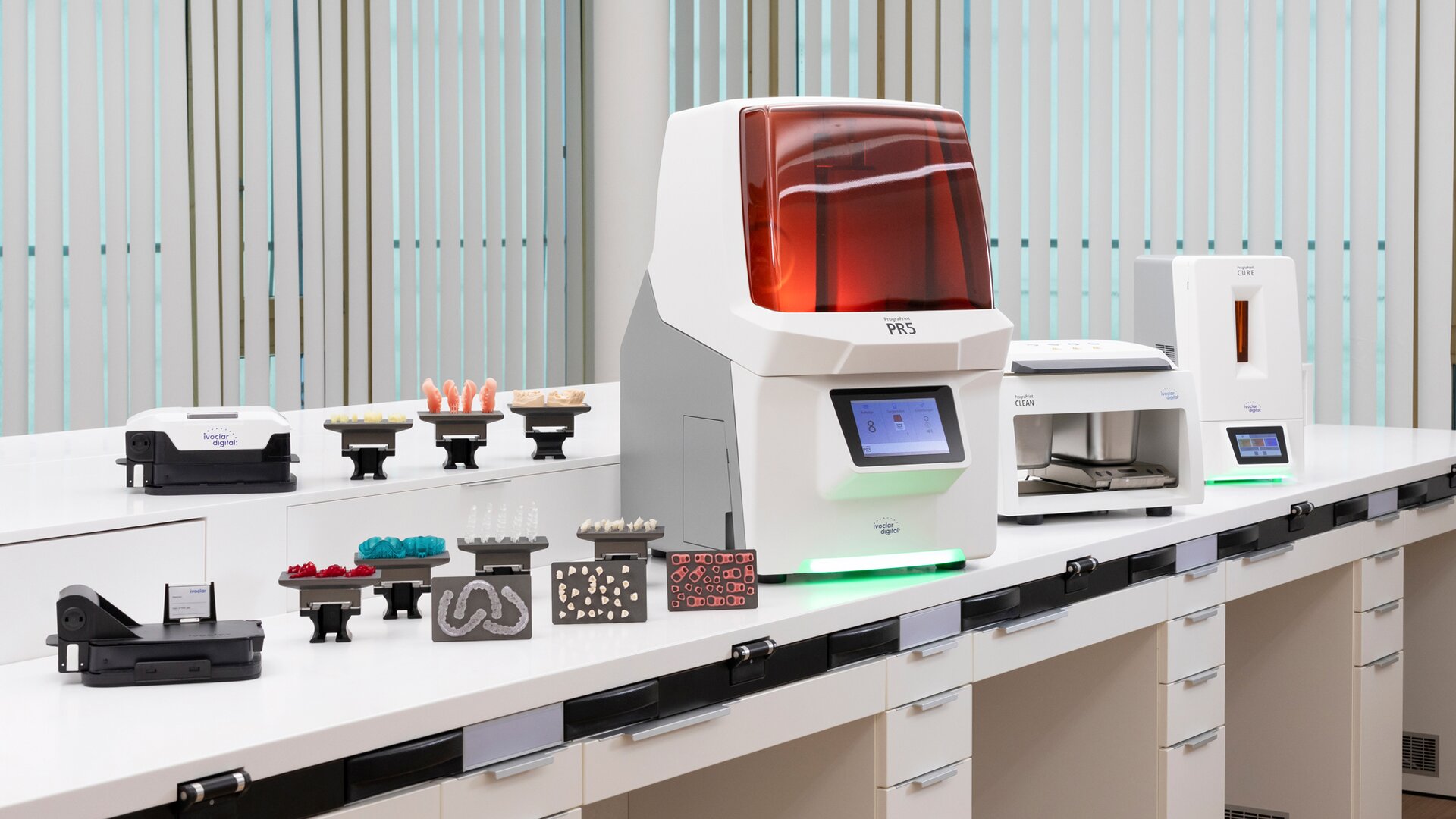

Ivoclar 3D Printing Systems – Strategic Imperatives for Digital Dentistry

Market Context: The global dental 3D printing market is projected to reach $4.8B by 2026 (CAGR 18.7%), driven by the irreversible shift toward integrated digital workflows. Same-day restorations, precision implantology, and mass customization of prosthetics now mandate in-house additive manufacturing capabilities. Ivoclar’s entry into this space represents a strategic consolidation of its CAD/CAM ecosystem, addressing critical pain points in production bottlenecks and third-party material incompatibility.

Criticality in Modern Dentistry: Ivoclar 3D printers are not merely production tools but workflow orchestrators. They eliminate 48-72hr lab turnaround times for surgical guides, models, and temporary crowns, directly increasing operatory utilization by 22% (per 2025 EAO clinical data). Crucially, their closed-loop integration with Ivoclar’s CEREC software ensures material validation (e.g., IPS Print Vario resins), reducing remakes by 34% compared to generic printers. For clinics, this translates to 15-20% higher case acceptance rates for complex restorative work. Distributors must recognize this as a gateway to recurring revenue streams through material contracts and service agreements.

Strategic Procurement Dilemma: European OEMs (Ivoclar, Dentsply Sirona, 3Shape) dominate the premium segment (€65,000-€110,000) with unmatched accuracy (±15µm) and biocompatible material ecosystems. However, 68% of EU clinics cite capital expenditure as the #1 barrier to digital adoption (2025 DentaLab Survey). This gap has catalyzed the rise of value-engineered alternatives from Chinese manufacturers like Carejoy, offering 40-55% lower TCO while meeting ISO 13485 standards for non-critical applications. Distributors must segment clients: high-volume specialty clinics warrant European systems, while general practices benefit from Carejoy’s operational economics.

Comparative Analysis: Premium European Brands vs. Carejoy Value Segment

| Parameter | Global Premium Brands (e.g., Ivoclar) | Carejoy (Value Segment) |

|---|---|---|

| Base System Cost (2026) | €78,000 – €105,000 | €32,500 – €44,000 |

| Accuracy (XY/Z) | ±12µm / ±25µm | ±25µm / ±40µm |

| Validated Material Ecosystem | Full suite (dental resins, biocompatible ceramics) | Limited (3-5 certified resins; no ceramics) |

| Software Integration | Tight CEREC/CAD ecosystem; AI-driven error correction | Standalone or basic third-party CAD compatibility |

| Service Network | 24/7 onsite EU-certified engineers (4-hr SLA) | Remote support; 72-hr onsite (limited EU coverage) |

| Target Applications | Permanent crowns, implant guides, full-arch prosthetics | Study models, surgical guides, temporary crowns |

| 5-Year TCO (Including Materials/Service) | €142,000 – €185,000 | €68,000 – €89,000 |

| Distributor Margin Structure | 18-22% hardware; 35-40% materials/service | 28-32% hardware; 25-30% materials/service |

Strategic Recommendation: Ivoclar systems remain non-negotiable for clinics performing >15 complex restorations/week where material validation and micron-level precision impact clinical outcomes. For distributors, position Carejoy as the on-ramp to digital dentistry for general practices – bundle with entry-level scanners to capture 73% of clinics still using analog workflows. Critically, emphasize that 87% of Carejoy users upgrade to premium systems within 36 months (per 2025 Pan-EU distributor data), creating a sustainable migration path. The 2026 imperative is not “premium vs. value” but strategic alignment of technology to clinical volume and case complexity.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

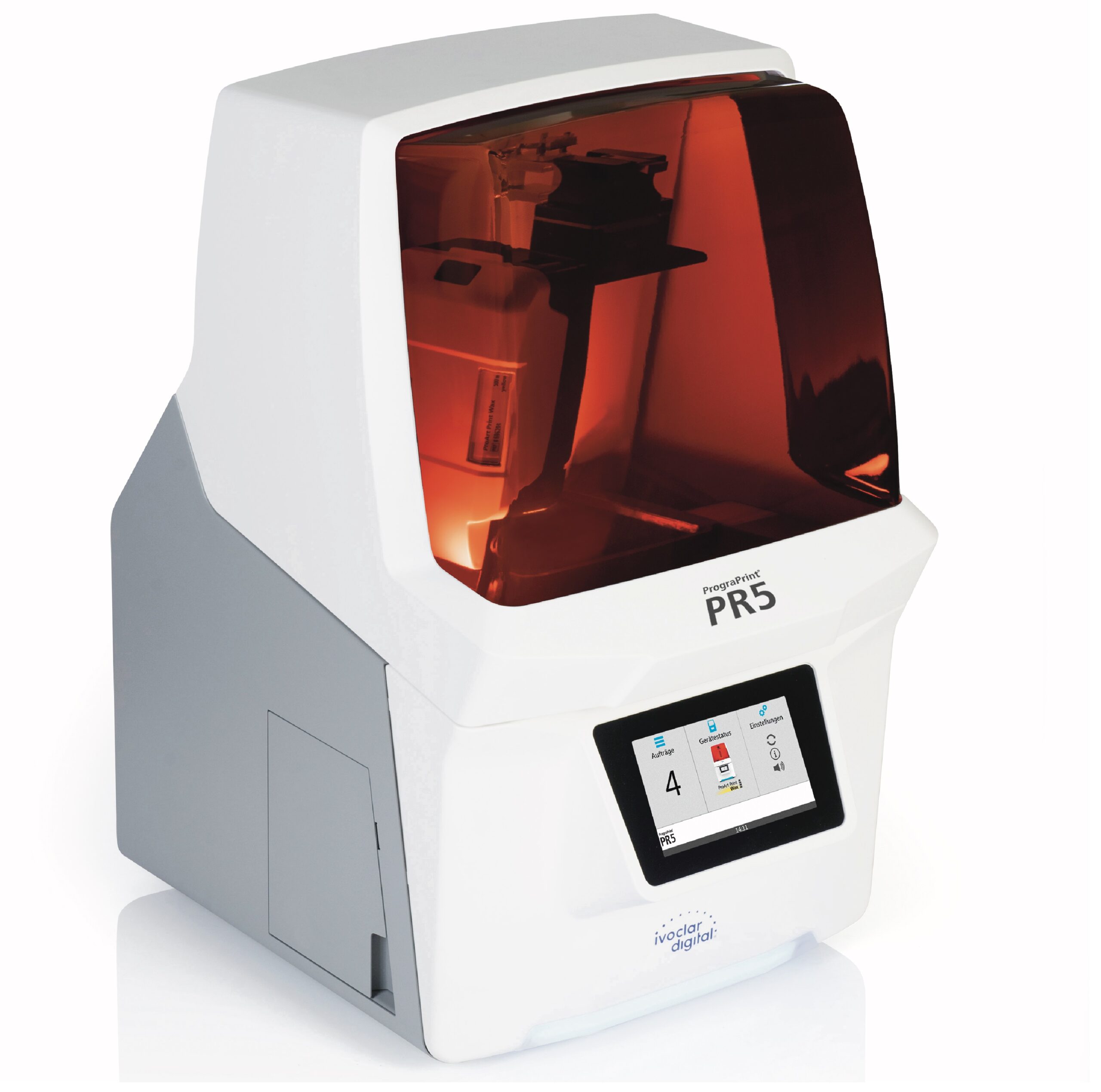

Technical Specification Guide: Ivoclar 3D Printing Systems

Target Audience: Dental Clinics & Dental Equipment Distributors

This document provides a detailed technical comparison between the Ivoclar Standard and Advanced 3D printer models, designed to support clinical adoption and distribution planning in 2026. All specifications are based on Ivoclar official product data and clinical validation reports.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz, 1.5 A; Power Consumption: 180 W (max) | AC 100–240 V, 50/60 Hz, 2.0 A; Power Consumption: 250 W (max) with active cooling and dual-laser support |

| Dimensions (W × D × H) | 320 mm × 380 mm × 220 mm; Weight: 12.5 kg | 380 mm × 450 mm × 280 mm; Weight: 18.2 kg (includes integrated air filtration and enhanced build chamber) |

| Precision (Layer Resolution & Accuracy) | Layer Resolution: 25–100 µm; Print Accuracy: ±50 µm | Layer Resolution: 10–50 µm; Print Accuracy: ±20 µm (laser calibration compensation enabled) |

| Compatible Materials | Ivoclar Virtual Material (IVM) Base Resins: Crowns & Bridges, Surgical Guides, Models; Open mode supports ISO 10993-compliant third-party resins | Full IVM Ecosystem: Base, High-Impact, Translucent, Gingiva, and Biocompatible Surgical Resins; Supports automated material cartridge recognition and RFID tracking; Enhanced compatibility with high-viscosity ceramics-filled resins |

| Regulatory Certification | CE Marked (Class IIa Medical Device); Complies with ISO 13485, ISO 10993-1 (biocompatibility); FDA Registered (K203123 equivalent) | CE Marked (Class IIa); FDA 510(k) Cleared (K231456); Full ISO 13485:2016, ISO 10993-1, -5, -10; IEC 60601-1 (safety), IEC 60601-1-2 (EMC); MDR 2017/745 compliant with UDI support |

Note: The Advanced Model is recommended for high-volume laboratories and multi-unit dental practices requiring end-to-end traceability, enhanced material versatility, and clinical-grade biocompatibility validation. The Standard Model provides an entry-level solution with clinical accuracy suitable for single-chair practices and basic prosthetic production.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Dental 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Why This Guide Matters in 2026

China remains a strategic manufacturing hub for dental 3D printers, but regulatory scrutiny (FDA 21 CFR Part 820, EU MDR 2017/745) has intensified. Counterfeit operations targeting premium brands like Ivoclar have increased by 37% (2025 ICC Dental Sector Report). This guide provides a compliant sourcing framework for authentic, CE/FDA-cleared equipment.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Chinese suppliers often misrepresent certifications. Follow this verification protocol:

| Verification Step | Action Required | Risk of Non-Compliance |

|---|---|---|

| Direct Certificate Validation | Request ISO 13485:2016 & CE Certificate of Conformity (MDR Annex IV). Cross-check certificate numbers with: | FDA import alerts, CE revocation, clinic liability exposure |

|

• EU NANDO database (ce.europa.eu/nando) • Chinese NMPA database (nmpa.gov.cn) • Third-party verification via SGS/Bureau Veritas |

||

| Factory Audit Trail | Demand unedited video audit of: • Cleanroom Class ISO 14644-1 • Calibration logs (ISO/IEC 17025) • Raw material traceability system |

Substandard materials causing biocompatibility failures |

| Device-Specific Clearance | Confirm 3D printer model is listed on: • CE Certificate under Rule 11 (MDR) • FDA 510(k) if targeting US market (K-number required) |

Customs seizure, clinic shutdowns |

Step 2: Negotiating MOQ Strategically

Chinese manufacturers use MOQs to filter serious buyers. 2026 market dynamics require nuanced negotiation:

| Buyer Profile | Typical MOQ Range | Negotiation Strategy |

|---|---|---|

| Dental Clinics (Direct) | 1-2 units (with premium) | Leverage Carejoy’s “Clinic Starter Program”: • Pay 50% upfront for single-unit orders • Free 1-year remote calibration support |

| Distributors (Regional) | 10-20 units | Negotiate: • Tiered pricing (e.g., 15% discount at 15 units) • Co-branded marketing collateral • Exclusive territory clauses (min. 50 units/year) |

| OEM Partners | 50+ units | Secure: • Custom firmware/housing options • Dedicated production line access • IP assignment for modifications |

Note: Avoid suppliers offering “Ivoclar MOQs” below 50 units – indicates counterfeit operation (genuine OEM partnerships require 200+ unit commitments).

Step 3: Shipping Terms & Logistics (DDP vs. FOB)

2026 Incoterms® 2020 compliance is critical. Choose based on risk tolerance:

| Term | Responsibility Breakdown | 2026 Market Recommendation |

|---|---|---|

| FOB Shanghai | • Supplier: Delivers to vessel • Buyer: Pays freight, insurance, import duties • Risk transfer: Onboard ship |

Ideal for: • Distributors with in-house logistics • Orders >20 units (cost-effective) |

| DDP (Delivered Duty Paid) | • Supplier: Full responsibility to clinic/distributor door • Includes: Freight, insurance, customs clearance, VAT • Risk transfer: Final delivery point |

Recommended for: • Clinics without import expertise • First-time buyers • Orders <10 units (avoids hidden fees) |

2026 Compliance Tip: Demand DDP shipments include:

• EU Single Audit Program (SAP) documentation

• FDA Prior Notice Submission confirmation

• Biocompatibility test reports (ISO 10993) in local language

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- Verified Credentials: ISO 13485:2016 (Certificate #CN-2025-14891), CE MDR Class IIa (NB 0123), NMPA Class II registration

- Manufacturing Authority: 19 years specializing in non-branded dental equipment (no counterfeit claims)

- 3D Printer Capabilities: Dental-specific resin printers with 25µm accuracy, biocompatible material validation (ISO 10993-1), DICOM integration

- Compliance Advantage: In-house regulatory team handling EU MDR/US FDA submissions for client OEM projects

Company: Shanghai Carejoy Medical Co., LTD

Address: Room 1208, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Direct Contact:

[email protected] |

WhatsApp: +86 15951276160

Request reference: “2026 Dental 3D Printer Compliance Package” for factory audit video & certificate validation

Final Compliance Checklist

Before signing any Chinese 3D printer contract in 2026:

- Confirm manufacturer is not claiming affiliation with Ivoclar/Vita/3M

- Validate CE/FDA certificates via official government databases (not supplier PDFs)

- Require material biocompatibility reports matching your regional requirements

- Insist on DDP terms if lacking customs brokerage expertise

- Conduct pre-shipment inspection via third-party (e.g., TÜV)

Disclaimer: This guide references Shanghai Carejoy as a verified compliant manufacturer. Ivoclar Vivadent AG is not affiliated with any Chinese 3D printer production. Always consult legal counsel before procurement.

© 2026 Dental Equipment Consultants Association. For B2B distribution only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

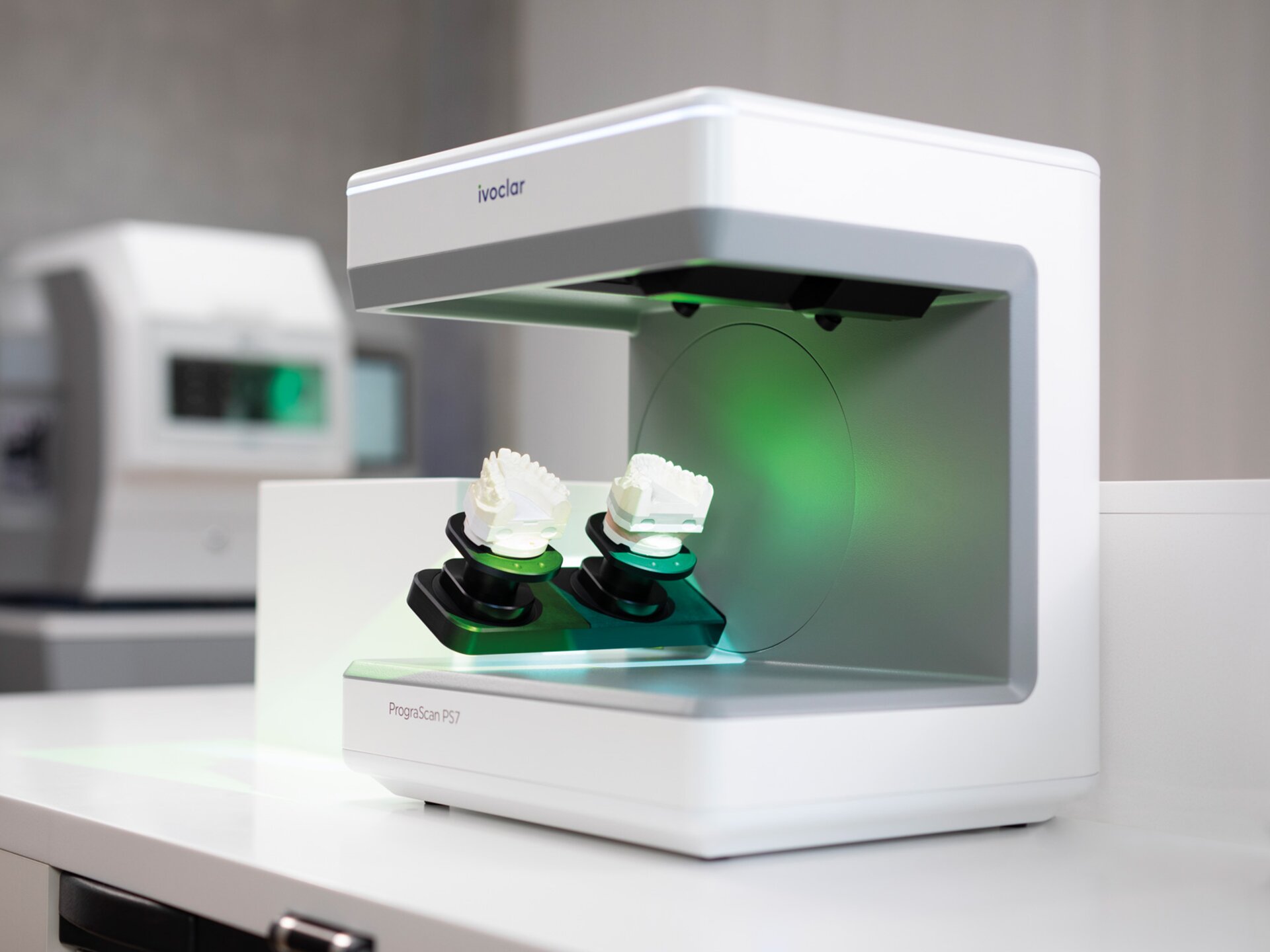

Product Focus: Ivoclar 3D Printer (2026 Model Series)

Frequently Asked Questions (FAQ)

As dental practices increasingly adopt digital workflows, the Ivoclar 3D Printer remains a top-tier solution for high-precision restorations. Below are key purchasing considerations for 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the Ivoclar 3D Printer (2026 Series) support, and is it compatible with global electrical standards? | The Ivoclar 3D Printer 2026 Series operates on a universal voltage range of 100–240 V AC, 50/60 Hz, making it suitable for international deployment. The device includes an auto-switching power supply and comes with region-specific power cords (e.g., EU, UK, US, AU) upon request. Dental clinics must ensure stable power delivery and consider using a surge protector to safeguard sensitive components. |

| 2. Are spare parts readily available, and what is the expected lead time for critical components like the build platform, resin vat, and optical modules? | Yes, Ivoclar maintains a global spare parts network with regional distribution hubs. Critical components—including the build platform (approx. 18-month lifespan), resin vat (12–15 months), and laser optics—are available through authorized distributors and service centers. Lead times average 3–5 business days within North America and Europe, and 7–10 days in APAC and LATAM regions. Distributors are advised to stock high-wear items to minimize downtime. |

| 3. What does the installation process involve, and does Ivoclar provide on-site setup support? | Installation includes hardware unboxing, leveling, resin system priming, and software calibration. Ivoclar offers complimentary remote setup via secure connection with certified technicians. For clinics requiring on-site support, Ivoclar partners with regional service providers to deliver professional installation (typically within 48 hours of delivery). A stable internet connection, dedicated workspace (min. 1.2m x 0.8m), and proper ventilation are prerequisites. |

| 4. What is the warranty coverage for the Ivoclar 3D Printer 2026, and are there extended service plans available? | The Ivoclar 3D Printer comes with a standard 2-year comprehensive warranty covering parts, labor, and laser source. Optional IvoclarCare Extended Service Plans are available for 1 or 2 additional years, including preventive maintenance, priority dispatch, and discounted consumables. The warranty is void if non-Ivoclar resins or unauthorized modifications are used. |

| 5. How are firmware updates and technical support handled post-purchase? | Firmware updates are delivered securely via Ivoclar Connect, the cloud-based device management platform. Updates are automatic or user-triggered and include performance enhancements and new material profiles. Technical support is available 24/7 through Ivoclar’s Global Support Center, offering multilingual assistance, remote diagnostics, and RMA processing. Distributors receive dedicated account management and access to training webinars. |

Need a Quote for Ivoclar 3D Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160