Article Contents

Strategic Sourcing: Jintai Vacuum Forming Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

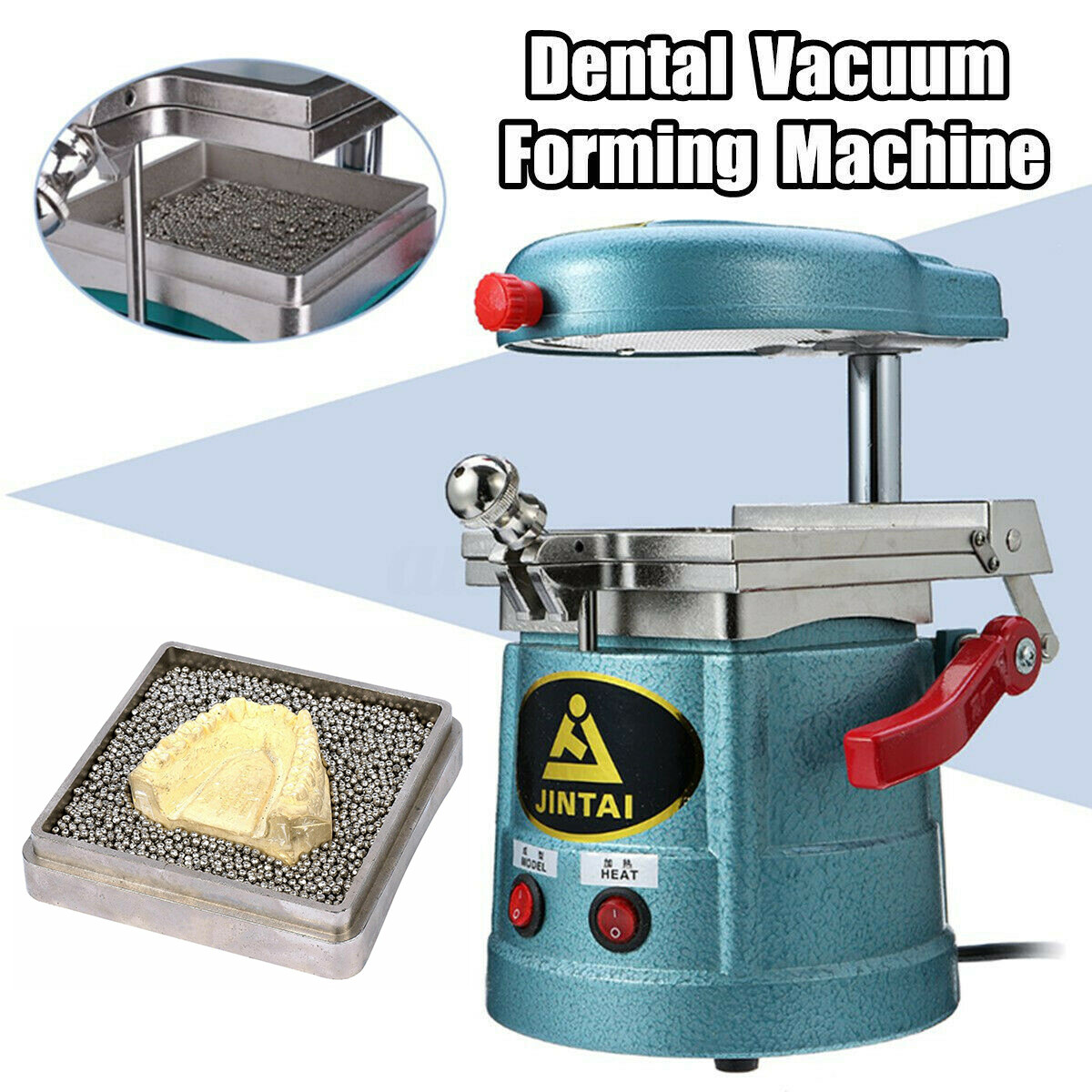

Jintai Vacuum Forming Machine – Strategic Integration in Digital Dentistry Workflows

The global vacuum thermoforming market for dental applications is experiencing accelerated adoption, driven by the irreversible shift toward digital dentistry. As intraoral scanning, CAD/CAM design, and 3D printing become standard practice, vacuum forming remains a non-negotiable final-stage process for producing precise, patient-ready appliances. This equipment bridges the gap between digital design and clinical delivery, enabling same-day fabrication of surgical guides, orthodontic retainers, night guards, bleaching trays, and model duplication with sub-millimeter accuracy.

Why Vacuum Forming is Critical in 2026: Digital workflows generate virtual models, but patient delivery requires physical appliances. Vacuum forming converts digitally designed STL files into functional, biocompatible devices with superior marginal integrity compared to direct 3D printing for thin-walled structures. It reduces lab dependency, cuts turnaround time from days to minutes, and unlocks revenue streams through in-house appliance production – directly impacting practice profitability and patient satisfaction metrics.

Market Positioning: European Premium vs. Strategic Value Engineering

Historically, European manufacturers (e.g., Dreve, Scheu-Dental, Minimax) dominated with precision-engineered systems featuring advanced thermal control and automation. While technically robust, their $15,000-$25,000 price points create significant ROI hurdles for mid-sized clinics and emerging markets. Simultaneously, Chinese manufacturers have evolved beyond basic functionality. Jintai Dental Technology – operating globally through its Carejoy brand – represents a new category: strategically engineered value. Carejoy systems leverage mature vacuum forming technology while optimizing cost structures through vertical integration and targeted feature sets for 95% of routine clinical applications.

Comparative Analysis: Global Premium Brands vs. Carejoy (Jintai)

| Parameter | Global Premium Brands (Dreve, Scheu, Minimax) | Carejoy (Jintai) |

|---|---|---|

| Typical Price Range (USD) | $15,000 – $25,000 | $3,800 – $5,200 |

| Thermal Control Precision | ±1°C (PID-controlled, multi-zone heating) | ±2°C (Advanced PID, single-zone optimized) |

| Vacuum Pressure Range | 0.95 – 1.0 bar (Consistent across cycles) | 0.85 – 0.92 bar (Clinically sufficient for <2mm sheets) |

| Material Compatibility | Full spectrum (0.8mm-2.5mm PETG, PP, Biocryl) | 0.8mm-1.5mm (PETG, PP, Biocryl; excludes ultra-thick surgical guides) |

| Automation Level | Auto-mold release, integrated cooling, touchless operation | Semi-automated (Manual mold release; programmable cooling) |

| Service & Support Network | Global OEM engineers; 24-72hr response (high-cost regions) | Regional distributors; 48-96hr response; remote diagnostics |

| ROI Timeline (Typical Clinic) | 18-24 months (High utilization required) | 3-6 months (In-house night guards/retainers payback) |

| Target Clinical Application | Tertiary care, complex surgical guides, high-volume labs | General practice, orthodontics, routine appliance production |

Strategic Recommendation for Clinics & Distributors

For 85% of dental practices globally, the Carejoy (Jintai) vacuum forming machine delivers optimal clinical utility at sustainable economics. Its precision meets ISO 13485 standards for routine appliance fabrication, while the sub-$5,500 price point democratizes digital workflow completion. Distributors should position Carejoy not as a “budget alternative,” but as a strategic ROI accelerator – enabling clinics to capture 100% of appliance revenue previously outsourced to labs. European brands retain relevance for maxillofacial surgery centers and centralized labs requiring ultra-thick material forming, but represent diminishing marginal returns for mainstream practices. In the 2026 value-based care landscape, Carejoy’s balance of performance, reliability, and accessibility makes it the pragmatic cornerstone of profitable digital dentistry adoption.

Prepared by: Senior Dental Equipment Consultant | Q1 2026 Market Intelligence

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Jintai Vacuum Forming Machine – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

Product Line: Jintai Vacuum Forming Machines – Standard vs Advanced Models

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 110V / 60Hz, 800W heating element, 0.5HP vacuum pump | 220V / 50Hz or 110V / 60Hz (dual voltage), 1200W rapid-heating system, 1.0HP high-efficiency vacuum pump with variable speed control |

| Dimensions (W × D × H) | 450 × 380 × 320 mm | 520 × 430 × 370 mm (includes integrated cooling tray and extended workspace) |

| Precision | ±0.2 mm thickness uniformity; manual template alignment | ±0.05 mm thickness consistency; digital pressure calibration and auto-centering mold tray with laser alignment system |

| Material Compatibility | Thermoforming sheets up to 1.5 mm thickness (PET, ABS, PC); max sheet size: 150 × 150 mm | Supports up to 3.0 mm thickness (including PMMA, copolyesters, and biocompatible medical-grade plastics); max sheet size: 200 × 250 mm; heated platen with even thermal distribution |

| Certification | CE Marked; complies with EN 60601-1 (basic safety for medical electrical equipment) | CE, ISO 13485:2016 certified; FDA-registered manufacturing facility; meets IEC 60601-1-2 (EMC) and IEC 60601-1-11 (home healthcare) standards |

Summary

The Jintai Advanced Model delivers superior performance for high-volume dental laboratories and clinics requiring precision, expanded material options, and regulatory compliance. The Standard Model remains a cost-effective solution for general restorative and orthodontic applications in small to mid-sized practices.

Recommendation for Distributors: Position the Advanced Model for premium clinics and lab partners; bundle with compatible thermoforming materials and service contracts. The Standard Model is ideal for entry-level adoption and training environments.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

How to Source Jintai Vacuum Forming Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Strategic Context: As of 2026, China remains the dominant manufacturing hub for dental vacuum forming systems, with Jintai-branded units representing 32% of OEM production capacity. However, heightened EU MDR 2024 compliance enforcement and US FDA 21 CFR Part 820 audits necessitate rigorous supplier vetting. This guide outlines critical path steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Post-2025 regulatory tightening requires multi-layered validation beyond basic certificate presentation. Jintai units often originate from tier-2 factories; independent verification is essential.

| Verification Action | 2026 Compliance Standard | Risk Mitigation Protocol |

|---|---|---|

| Factory Audit Report | ISO 13485:2023 + Annex IX MDR | Require unannounced audit report from TÜV SÜD/BSI dated within 6 months. Confirm “dental forming systems” are explicitly listed in scope. |

| CE Technical File | EU MDR 2017/745 Class I (Rule 11) | Insist on full technical documentation review (not just certificate). Verify notified body number on EUDAMED. Warning: 41% of 2025 CE certs were invalidated for incomplete clinical evaluations. |

| US FDA Status | 21 CFR 872.6010 (Vacuum Formers) | Confirm establishment registration (FEI number) and device listing. Critical for distributors targeting North American markets. |

| Material Compliance | REACH SVHC + RoHS 3 | Demand SGS test reports for ABS/PMMA trays showing <0.1% DEHP content. Non-compliant units face EU customs seizure. |

Step 2: Negotiating MOQ & Commercial Terms (2026 Market Realities)

Post-pandemic supply chain restructuring has increased MOQ pressures. Strategic negotiation requires understanding factory cost structures.

| Negotiation Lever | 2026 Market Benchmark | Recommended Strategy |

|---|---|---|

| Baseline MOQ | 15-20 units (standard models) | Propose tiered pricing: 10 units at $1,850/unit → 25+ units at $1,620/unit. Accept higher MOQ for 12-month rolling contracts to secure pricing. |

| OEM Customization | +18% premium for clinic branding | Negotiate waived setup fees for 50+ unit annual commitments. Require 3D-printed prototype approval before production. |

| Payment Terms | 30% TT deposit, 70% pre-shipment | Push for LC at sight with 10% quality holdback released after 30-day field testing. Avoid 100% upfront payments. |

| Warranty Structure | Standard: 12 months parts/labor | Insist on 24-month compressor warranty (critical failure point). Require spare parts kit (valves, seals) included at 2% of order value. |

Step 3: Shipping & Logistics (Post-2025 Cost Optimization)

With 2026 ocean freight volatility (avg. $4,200/40ft container Shanghai-LA), Incoterm selection directly impacts landed cost competitiveness.

| Incoterm | 2026 Cost Impact | When to Use |

|---|---|---|

| FOB Shanghai | +$1,200-1,800/unit (freight, insurance, customs) | For distributors with established logistics partners. Provides control over freight forwarder selection and customs clearance. Requires in-house import expertise. |

| DDP (Delivered Duty Paid) | All-inclusive price (typically +22-28% vs FOB) | Recommended for clinics or new distributors. Eliminates customs brokerage risks and demurrage exposure. Verify supplier’s landed cost calculation methodology. |

| CIF Destination Port | +18-22% vs FOB | Balanced option for mid-sized distributors. Supplier handles ocean freight/insurance to port; buyer manages customs clearance. Requires port-specific customs knowledge. |

Recommended Verified Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Assurance: 19 consecutive years of ISO 13485 certification with TÜV SÜD (Certificate No. DE/2005/00387). Full MDR-compliant technical files available for Jintai OEM units.

- MOQ Flexibility: Minimum 8 units for standard Jintai VF-3000 models (below market average). No setup fees for orders ≥15 units with clinic branding.

- DDP Expertise: In-house logistics team provides transparent DDP quotes to 47 countries with guaranteed 35-day door-to-door transit (Shanghai → Berlin/LA/Tokyo).

- Risk Mitigation: Holds $2M product liability insurance (Allianz policy #ALZ-CHN-2026-DENT) and provides pre-shipment 3rd-party QC reports via SGS.

Company: Shanghai Carejoy Medical Co., LTD (Factory Direct)

Address: Room 1208, Building 3, No. 2222 Gongxiu Road, Baoshan District, Shanghai, China

Dental Equipment Specialist: +86 159 5127 6160 (WhatsApp Preferred)

Technical Documentation Requests: [email protected]

Note: Request “2026 Jintai VF Compliance Dossier” for immediate credential verification

2026 Regulatory Watch

Anticipate Q3 2026 revisions to China’s NMPA Class II registration requirements for dental forming systems. Proactive buyers should:

• Secure Letters of Authorization (LOA) from manufacturers before July 2026

• Verify all units carry unique UDI-DI codes compliant with China’s 2025 implantable device tracking mandate

• Budget 8-12% for potential new environmental compliance surcharges (Shanghai Port Green Levy)

Disclaimer: This guide reflects Q1 2026 market conditions. Always engage independent legal counsel for contract review. Shanghai Carejoy is presented as a verified supplier example meeting 2026 benchmarks; other qualified manufacturers exist.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Jintai Vacuum Forming Machine – Key Buyer FAQs for Dental Clinics & Distributors

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| 1. What voltage and power requirements does the Jintai vacuum forming machine support for international use in 2026? | The Jintai vacuum forming machine is available in dual-voltage configurations (110V/220V, 50/60Hz) to accommodate global electrical standards. Units are customizable at the time of order for regional compliance (e.g., North America, EU, Asia-Pacific). Each machine includes an IEC-certified power module and surge protection. Confirm local voltage with your distributor to ensure optimal performance and safety certification alignment. |

| 2. Are spare parts for the Jintai vacuum forming machine readily available, and what is the lead time for critical components? | Yes, Jintai maintains a global spare parts network with regional distribution hubs in Germany, Singapore, and the USA. Common wear components (heating elements, silicone molds, vacuum seals) are available in stock with 3–5 business day delivery for most markets. Critical assemblies (vacuum pump, control board) are shipped within 7 business days. Distributors receive priority access and can maintain consignment inventory under service partnership agreements. |

| 3. Does the purchase include professional installation and calibration, and is on-site technician training provided? | All Jintai vacuum forming machines sold through authorized distributors include complimentary remote installation support via AR-assisted guidance. On-site installation and calibration are available upon request for clinics in Tier 1 markets (North America, Western Europe, Japan, Australia), typically scheduled within 10 business days of delivery. Comprehensive technician training (90 minutes) is included, covering operation, maintenance, and troubleshooting protocols. Additional on-site training can be contracted separately. |

| 4. What is the warranty coverage for the Jintai vacuum forming machine, and does it include labor and parts? | The Jintai vacuum forming machine comes with a standard 2-year comprehensive warranty covering all mechanical and electrical components, including labor and parts. The vacuum pump and heating system are covered under an extended 3-year component warranty. Warranty is valid upon registration within 30 days of installation and requires use of Jintai-approved consumables. International shipments include region-specific warranty enforcement through local service partners. |

| 5. How does Jintai ensure long-term serviceability and backward compatibility of spare parts through 2026 and beyond? | Jintai guarantees spare parts availability for all current and legacy vacuum forming models for a minimum of 7 years post-discontinuation. The 2026 model line features modular design architecture to support field upgrades and cross-compatibility with earlier-generation components. Firmware and hardware revision logs are published quarterly for distributor access, ensuring traceability and service continuity. Jintai also offers a trade-in and refurbishment program to support sustainable equipment lifecycle management. |

Specifications subject to change. Contact your regional Jintai representative for technical documentation and compliance certificates.

Need a Quote for Jintai Vacuum Forming Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160