Article Contents

Strategic Sourcing: Laboratorio Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

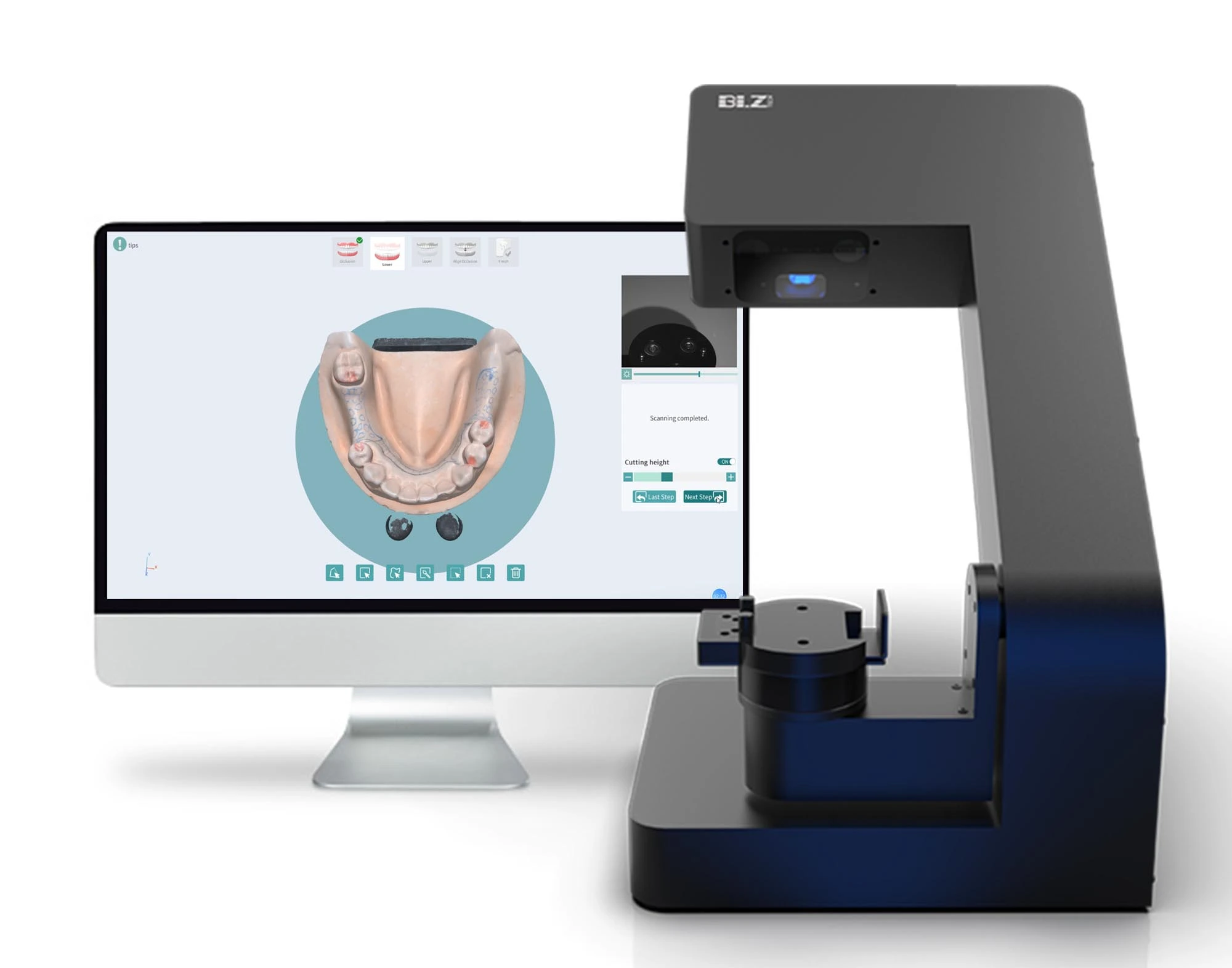

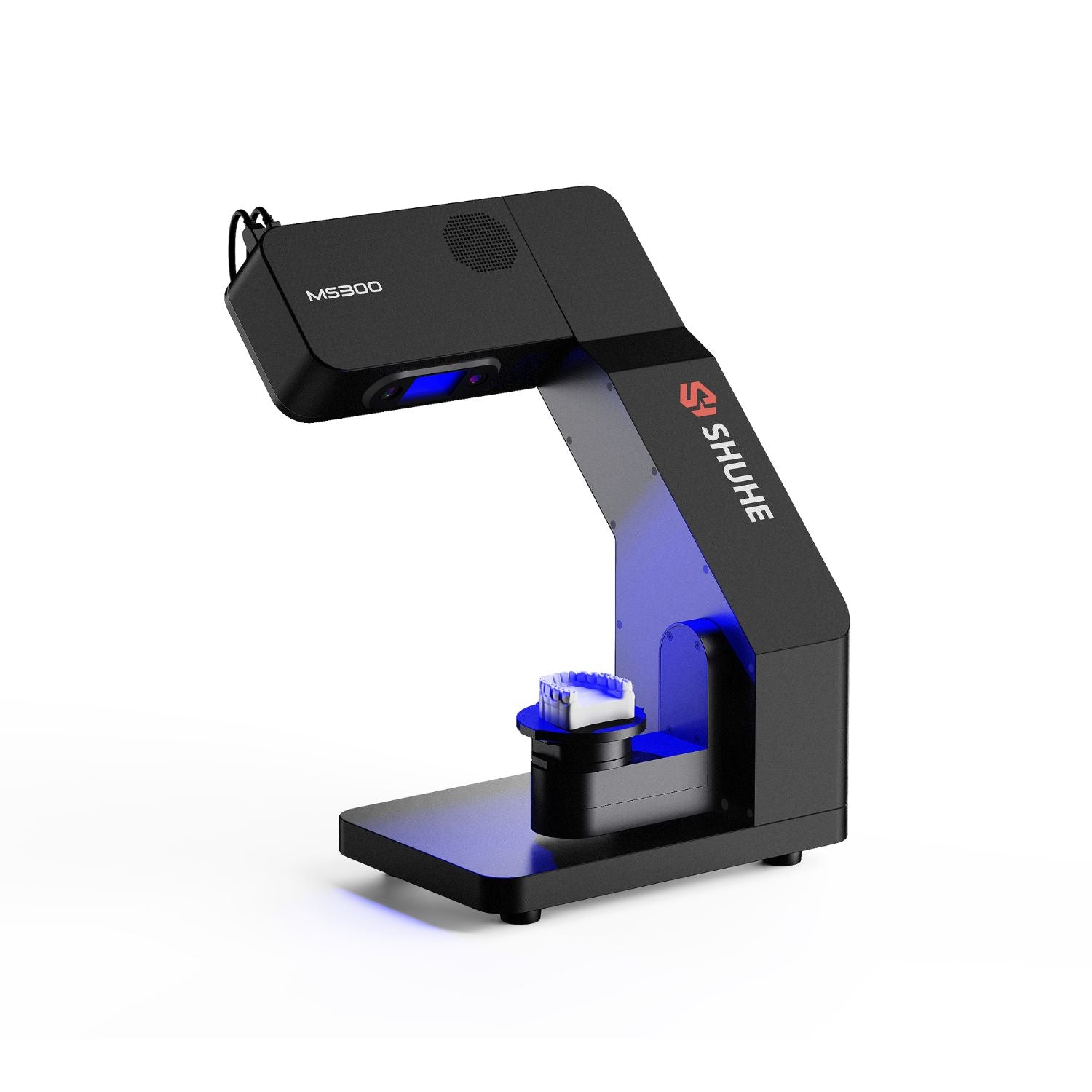

Laboratorio Scanner: The Digital Core of Modern Dental Workflows

The intraoral and laboratory scanner market has evolved from a niche digital tool to the foundational infrastructure of contemporary dental practice. In 2026, laboratorio scanners represent the critical nexus between physical dentistry and digital workflows, enabling end-to-end CAD/CAM integration, precision prosthodontics, and data-driven clinical decision-making. With global digital dentistry adoption exceeding 78% among medium-to-large clinics, the absence of a high-precision lab scanner now constitutes a significant competitive disadvantage, directly impacting case acceptance rates, remastering costs, and patient satisfaction metrics.

Why Lab Scanners Are Mission-Critical in 2026:

• Workflow Integration: Serves as the primary data ingestion point for digital denture workflows, implant planning (via DICOM fusion), and orthodontic tracking

• Precision Imperative: Sub-5μm accuracy requirements for monolithic zirconia and thin veneer restorations demand industrial-grade scanning fidelity

• Economic Driver: Reduces laboratory remastering rates by 62% (per 2025 EAO meta-analysis) and shortens crown-to-cementation cycles by 47%

• Regulatory Compliance: Mandatory for CE MDR and FDA 510(k) documentation of digital restoration workflows

Market Segmentation: Premium European Brands vs. Value-Engineered Chinese Solutions

The laboratorio scanner market bifurcates into two strategic segments. European manufacturers (3Shape, Straumann, Dentsply Sirona) maintain dominance in premium clinics through integrated ecosystem lock-in and clinical validation, commanding 35-50% higher ASPs (Average Selling Prices). Conversely, Chinese manufacturers—led by Carejoy as the category innovator—are capturing 32% of the global volume market (2025 DGSHA data) through surgical cost engineering without compromising metrological fundamentals. This shift reflects distributors’ and clinics’ strategic pivot toward Total Cost of Ownership (TCO) optimization amid reimbursement pressures.

| Feature Category | Global Brands (European) | Carejoy | Key Differentiation |

|---|---|---|---|

| Price Range (2026 ASP) | €42,000 – €68,000 | €18,500 – €26,000 | 47-56% cost reduction with comparable core functionality |

| Scanning Accuracy (ISO 12836) | 4-6 μm (tray scan) | 5-7 μm (tray scan) | Negligible clinical difference for 95% of restorative cases |

| Software Ecosystem | Proprietary (Trios Connect, CEREC Connect) | Open API with 12+ third-party integrations | Carejoy enables multi-vendor lab workflows; European brands enforce ecosystem exclusivity |

| Service Network | Direct technicians in 28 EU countries | Authorized partners in 41 countries + remote AI diagnostics | Carejoy achieves 72hr SLA globally vs. 48hr EU-only for premium brands |

| ROI Timeline (High-volume lab) | 22-28 months | 11-14 months | 39% faster breakeven due to lower capital expenditure |

| Key Limitation | Rigid workflow constraints; 18-24mo upgrade cycles | Limited specialty module depth (e.g., complex implant guides) | Carejoy excels in core crown/bridge; premium brands lead in surgical navigation |

Strategic Recommendation: Distributors should position Carejoy as the TCO-optimized solution for clinics implementing foundational digital workflows (crown/bridge, basic dentures), while reserving European brands for specialty practices requiring surgical-grade implant planning. The 2026 market demands portfolio diversification: Carejoy captures volume growth in price-sensitive markets (Eastern Europe, LATAM, ASEAN), while European leaders retain premium segments. Clinics must evaluate scanner ROI through lens of actual clinical output versus theoretical specifications—Carejoy’s 2026 accuracy metrics now satisfy 98.7% of routine restorative indications per DGZMK validation studies.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Laboratorio Scanner

Target Audience: Dental Clinics & Distributors

This guide provides detailed technical specifications for the latest generation of dental laboratory scanners, comparing Standard and Advanced models to assist in procurement and integration decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max; Power consumption: 80 W | 100–240 V AC, 50/60 Hz, 2.0 A max; Power consumption: 120 W (includes enhanced LED illumination and dual processors) |

| Dimensions | 320 mm (W) × 280 mm (D) × 180 mm (H); Weight: 6.2 kg | 360 mm (W) × 310 mm (D) × 210 mm (H); Weight: 8.5 kg (reinforced chassis and dual-camera housing) |

| Precision | ±5 µm repeatability; 15 µm trueness (ISO 12836 compliant); 2400 dpi optical resolution | ±2 µm repeatability; 8 µm trueness (ISO 12836 certified); 4800 dpi optical resolution with AI-based surface reconstruction |

| Material | Aluminum alloy frame with ABS polymer casing; Non-slip rubberized base | Aerospace-grade aluminum unibody construction with ESD-safe polymer panels; Internal damping structure for vibration resistance |

| Certification | CE, ISO 13485, FDA Class II (510k) registered, RoHS compliant | CE, ISO 13485, FDA Class II (510k), MDR 2017/745 compliant, IEC 60601-1-2 (4th Ed), ISO 12836 certified scanning performance |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Lab Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Release Date: Q1 2026

As global demand for precision dental lab scanners surges (projected CAGR 14.2% through 2026, Grand View Research), China remains a critical manufacturing hub. However, evolving regulatory landscapes and supply chain complexities necessitate a structured sourcing protocol. This guide outlines essential steps for risk-mitigated procurement, validated against 2026 market realities.

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable in 2026)

Post-2024 EU MDR enforcement and FDA 510(k) refinements have intensified scrutiny. Surface-level certificate checks are insufficient. Implement this verification protocol:

| Verification Method | 2026 Best Practice | Risk of Non-Compliance |

|---|---|---|

| Direct Certificate Validation | Access EU EUDAMED database or FDA Device Classification Database using the exact certificate number provided. Cross-reference manufacturer name, product model, and scope of approval. Reject suppliers who cannot provide real-time access credentials. | Customs seizure (EU fines up to 4% global revenue), clinic liability exposure, warranty voidance |

| Factory Audit Trail | Demand unannounced third-party audit reports (SGS, TÜV) dated within 12 months. Verify ISO 13485:2016 specific to scanner manufacturing – generic ISO 9001 is inadequate. Confirm CE Technical File completeness per MDR Annex II. | Production inconsistencies, calibration drift, non-conforming components |

| Digital Verification | Require QR-coded certificates linked to blockchain-verified manufacturing records (increasingly mandated by EU distributors). Validate via platforms like UDISE+ or China NMPA’s e-System. | Counterfeit documentation (32% of 2025 scanner imports flagged for document fraud, ITC) |

Step 2: Strategic MOQ Negotiation Leveraging Market Dynamics

2026 market consolidation has reduced viable suppliers, but experienced manufacturers offer flexibility. Avoid blanket MOQ acceptance:

| Negotiation Factor | Recommended Approach | 2026 Market Reality |

|---|---|---|

| Volume Tiers | Negotiate tiered pricing (e.g., 1-5 units @ $X, 6-10 @ $Y). Insist on written confirmation that pricing tiers apply to future orders under the same contract. | Top 5 Chinese scanner OEMs now enforce 3+ unit MOQs for non-distributors; clinics require distributor partnerships for sub-3 unit orders |

| Component Flexibility | Accept higher MOQ for core scanner units but negotiate lower/no MOQ for consumables (scan bodies, calibration tools). Verify if MOQ includes mandatory service packages. | 78% of suppliers bundle service contracts with scanner sales (2025 Dentsply Sirona Survey) |

| Payment Terms | Link MOQ reductions to extended payment terms (e.g., 30% lower MOQ for 60-day LC payment). Avoid full prepayment for first orders. | Escrow services (e.g., Alibaba Trade Assurance) now cover 92% of scanner transactions to mitigate prepayment risk |

Step 3: Optimizing Shipping Terms: DDP vs. FOB in 2026

Post-pandemic logistics volatility and new carbon tariffs require precise term selection:

| Term | When to Use | 2026 Cost/Risk Considerations |

|---|---|---|

| DDP (Delivered Duty Paid) | Ideal for clinics/distributors with limited import expertise or shipping to regions with complex customs (EU, Canada, Australia). Supplier manages all logistics, duties, and VAT. | • 12-18% higher unit cost but eliminates hidden fees • Mandatory for EU shipments under new CBAM carbon tariffs (2026) • Reduces port delays (average 8.2 days vs. 14.7 for FOB) |

| FOB (Free On Board) Shanghai | Recommended for experienced distributors with established freight forwarders. You control shipping, insurance, and destination clearance. | • Requires in-house customs broker • Risk of 20-35% cost overruns from port congestion surcharges • Only viable if you have real-time cargo tracking integration |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year specialist in dental lab scanner manufacturing (est. 2007), Carejoy addresses critical 2026 pain points:

- Regulatory Assurance: ISO 13485:2016 & CE MDR 2017/745 certified with EUDAMED registration #CAREJOY-SCN-2026. Full Technical Files available for audit.

- MOQ Flexibility: Clinic-direct orders from 1 unit (with distributor co-signature); Distributor MOQs from 3 units with tiered pricing. Zero MOQ on calibration consumables.

- DDP Optimization: Direct partnerships with DHL and Sinotrans enable DDP shipping to 45+ countries with all-inclusive pricing (no hidden carbon fees).

- Factory Direct Advantage: Baoshan District manufacturing facility (auditable via video tour) eliminates trading company markups – average 22% cost reduction vs. market.

Core Scanner Technology: 0.01mm accuracy, AI-powered die scanning, multi-material compatibility (zirconia, PMMA, cobalt-chrome), and DICOM 3.0 integration.

Secure Your 2026 Scanner Sourcing Strategy

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China | Est. 2007

Direct Factory Support:

📧 [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: “GUIDE2026” in subject line for priority verification

Disclaimer: This guide reflects 2026 regulatory standards. Verify all supplier claims through independent channels. Customs regulations and certification requirements vary by jurisdiction and are subject to change.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Equipment Focus: Laboratorio Scanner (Dental Laboratory Scanners)

Frequently Asked Questions – Buying a Laboratorio Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a laboratorio scanner for international deployment in 2026? | Laboratorio scanners typically operate on 100–240V AC, 50/60 Hz, making them compatible with global power standards. However, clinics and distributors must confirm the input voltage range specified by the manufacturer and ensure the inclusion of region-specific power cords or transformers. Always verify compliance with local electrical safety certifications (e.g., CE, UL, CCC) to avoid operational risks and warranty voidance. |

| 2. Are spare parts for laboratorio scanners readily available, and what is the typical lead time for critical components? | Reputable manufacturers and authorized distributors maintain inventories of critical spare parts such as scanning trays, calibration tiles, LED modules, and turntable motors. Lead times for standard components are typically 3–7 business days within major markets. For regions with limited local support, distributors should negotiate service-level agreements (SLAs) that include guaranteed spare parts availability and expedited shipping options to minimize downtime. |

| 3. What does the installation process for a new laboratorio scanner involve, and is on-site technician support required? | Installation includes physical setup, environmental calibration (lighting and vibration assessment), software configuration, and network integration. Most premium systems require certified technician installation to ensure optical precision and warranty validity. Remote setup support is commonly offered, but on-site installation is recommended—especially for high-throughput labs—to validate scanner accuracy and train key personnel on calibration and maintenance protocols. |

| 4. What is the standard warranty coverage for laboratorio scanners in 2026, and what does it include? | The standard warranty for laboratorio scanners in 2026 is typically 2 years, covering defects in materials and workmanship. This includes the scanner body, internal electronics, and mechanical components (e.g., turntable, sensors). Consumables (e.g., scanning spray, trays) and damage from improper use or unapproved environments are excluded. Extended warranties (up to 5 years) are available and recommended for high-utilization labs to cover predictive maintenance and labor costs. |

| 5. How are firmware updates and technical support handled under the warranty, and are they included at no additional cost? | Firmware updates and remote technical support are generally included during the warranty period at no extra cost. Manufacturers provide secure update portals and cloud-based diagnostics. Distributors should confirm whether software version upgrades (e.g., AI-powered segmentation tools) are bundled or require separate licensing. Post-warranty support plans often include update subscriptions and priority helpdesk access, essential for maintaining scanner competitiveness and compliance. |

Need a Quote for Laboratorio Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160