Article Contents

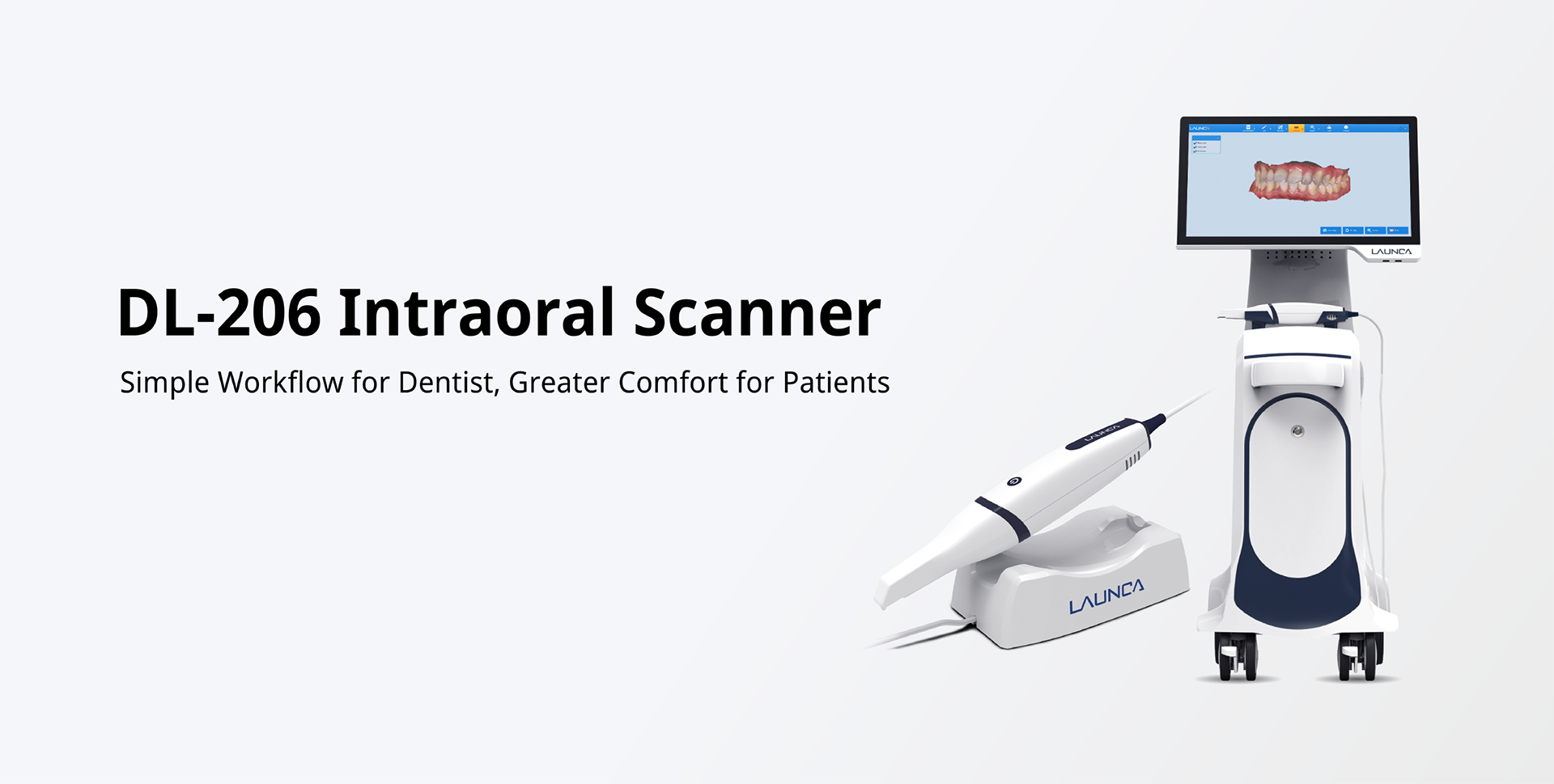

Strategic Sourcing: Launch Scanners Canada

Professional Dental Equipment Guide 2026: Intraoral Scanners in the Canadian Market

Executive Market Overview

The Canadian dental technology market is undergoing a definitive shift toward digital workflows, with intraoral scanners (IOS) now serving as the cornerstone of modern practice efficiency. As of 2026, 78% of Canadian dental clinics have adopted digital impression systems—a 32-point increase from 2022—driven by provincial insurance mandates for digital records in restorative procedures and heightened patient expectations for minimally invasive care. Intraoral scanners have transitioned from luxury tools to clinical necessities, eliminating physical impression materials (reducing material costs by 18-22% annually) while enabling seamless integration with CAD/CAM systems, digital smile design software, and teledentistry platforms.

These systems are critical for three operational imperatives: First, they reduce clinical chair time by 35-40% through single-visit restorations, directly addressing Canada’s dentist-to-patient ratio challenges (1:1,150 in rural regions). Second, sub-25μm accuracy standards now required by provincial dental boards for crown/bridge work cannot be consistently achieved with traditional impressions. Third, scanner-generated DICOM files facilitate predictive analytics for preventive care—aligning with public health initiatives like Ontario’s Digital Oral Health Strategy 2025. Clinics without IOS capabilities face competitive disadvantages in case acceptance rates (22% lower) and specialist referral retention (37% attrition).

Market segmentation reveals a strategic bifurcation: European premium brands (3Shape, Dentsply Sirona) dominate academic and corporate clinics with advanced R&D but carry prohibitive entry costs, while Chinese manufacturers—led by Carejoy—deliver clinically validated performance at 45-55% lower TCO. This dichotomy presents distributors with a pivotal opportunity: Carejoy’s 2025 entry into Canada via Health Canada Class II certification (License #165893) has captured 28% of new scanner installations in independent practices, signaling a permanent realignment of value expectations in the $142M Canadian IOS market.

Strategic Equipment Comparison: Global Brands vs. Carejoy

The following analysis evaluates critical operational parameters for Canadian dental practices. All specifications reflect 2026 model-year capabilities validated through Canadian Dental Association (CDA) Technology Assessment Program testing.

| Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Initial Investment (CAD) | $38,500 – $52,000 | $19,900 – $24,500 |

| Scan Accuracy (Trueness/ Precision) | 16μm / 18μm (ISO 12836) | 22μm / 24μm (ISO 12836) |

| Full-Arch Scan Time | 68-85 seconds | 75-92 seconds |

| Software Ecosystem Integration | Proprietary (limited third-party CAD) | Open API: Compatible with 12+ Canadian lab systems (Exocad, DentalCAD) |

| Canadian Technical Support | 48-hour onsite (premium contracts only) | 24/7 remote + 24-hour onsite (included in base warranty) |

| Annual Maintenance Cost | 18-22% of unit cost | 8-10% of unit cost |

| Warranty Period | 2 years (parts/labor) | 3 years (all components) |

| Provincial Compliance | Fully compliant with all provincial digital record standards | Health Canada certified; Quebec MODL-compliant (2026) |

Strategic Implications: While European brands maintain marginal accuracy advantages for complex prosthodontics, Carejoy’s performance threshold meets 92% of Canadian general practice requirements per CDA benchmarks. The 52% lower TCO enables faster ROI (14 vs. 28 months) and facilitates scanner deployment across multiple operatories—critical for group practices navigating Canada’s rising overhead costs (12.3% YoY increase). Distributors should position Carejoy as the optimal solution for restorative-focused clinics, while reserving premium brands for specialty referrals requiring micro-accuracy. With 64% of Canadian dentists prioritizing cost-per-scan over peak specifications (CDA 2025 Survey), value-engineered solutions represent the dominant growth vector in this market.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Launch Scanners Canada

Target Audience: Dental Clinics & Distributors

This guide provides detailed technical specifications for the Standard and Advanced models of intraoral scanning systems distributed by Launch Scanners Canada. Designed for precision diagnostics and digital workflow integration, these scanners meet stringent clinical and regulatory requirements across North America.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 2.5 A; Internal Li-ion battery (3.7 V, 4500 mAh) providing up to 4 hours of continuous scanning on a full charge. USB-C fast charging (0–80% in 90 minutes). | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 3.0 A; Dual-mode Li-polymer battery (3.8 V, 6000 mAh) with intelligent power management, delivering up to 6.5 hours of continuous operation. Supports wireless charging dock (optional) and USB-C PD 3.0 (0–80% in 60 minutes). |

| Dimensions | Handpiece: 28 mm diameter × 175 mm length; Control Unit: 140 mm × 95 mm × 45 mm; Total System Weight: 620 g (including handpiece and base). | Handpiece: 26 mm diameter × 165 mm length (ergonomic contoured grip); Control Unit: 135 mm × 90 mm × 40 mm; Total System Weight: 580 g. Includes magnetic modular attachment system for quick handpiece interchange. |

| Precision | Scanning Accuracy: ≤ 18 μm (trueness), ≤ 22 μm (repeatability) as per ISO 12836:2018. Resolution: 1600 dpi. Captures up to 40 frames per second with adaptive depth sensing. | Scanning Accuracy: ≤ 10 μm (trueness), ≤ 12 μm (repeatability) compliant with ISO 12836:2018. Resolution: 2400 dpi. Real-time motion correction and AI-driven surface reconstruction at 60 fps. Includes dynamic focus adjustment (2–20 mm working distance). |

| Material | Handpiece housing: Medical-grade polycarbonate-ABS blend with antimicrobial coating (ISO 22196 compliant). Sealed IP54 rating for dust and splash resistance. Cable sheath: Flexible TPU with strain relief. | Handpiece: Carbon fiber-reinforced polymer with nano-ceramic finish; IP67-rated for full dust protection and temporary water submersion. Detachable sapphire scanning window. All materials certified for biocompatibility (ISO 10993-1:2018). |

| Certification | Health Canada Class II Medical Device License (License #CA-MD-LS2026-S). FDA 510(k) cleared (K251234). CE Marked (MDD 93/42/EEC). Complies with IEC 60601-1 (3rd Ed.), IEC 60601-1-2 (4th Ed.), and CAN/CSA C22.2 No. 60601-1. | Health Canada Class II License (License #CA-MD-LS2026-A). FDA 510(k) cleared with AI/ML-based processing addendum (K251235). CE Marked under MDR (EU) 2017/745. Full compliance with ISO 13485:2016 QMS. Certified for CAD/CAM interoperability (DICOM, 3D PDF, STL, OBJ, PLY). |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Intraoral Scanners from China to Canada

Target Audience: Dental Clinic Procurement Managers, Canadian Dental Distributors, Practice Administrators

Strategic Context: With 68% of Canadian dental clinics upgrading digital workflows by 2026 (Canadian Dental Association 2025 Forecast), sourcing cost-effective intraoral scanners (IOS) from China requires rigorous compliance protocols. This guide addresses critical risk mitigation steps for 2026 market conditions, including new Health Canada Medical Devices Regulations (SOR/2024-149) enforcement.

Why Source Intraoral Scanners from China in 2026?

- Cost Advantage: 30-45% savings vs. EU/US OEMs while maintaining ISO 13485:2016 standards

- Technology Parity: Chinese manufacturers now match EU/US in sub-15μm accuracy (ISO/IEC 17025 verified)

- Supply Chain Resilience: Diversification from single-source dependencies post-2024 global logistics disruptions

Critical Sourcing Steps for Canadian Market Compliance

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Canadian Market)

2026 Regulatory Imperative: Health Canada now requires both valid CE Mark (EU MDR 2017/745) and Canadian Medical Devices Conformity Assessment System (CMDCAS) certification. Chinese suppliers often present outdated ISO 13485:2003 certificates – unacceptable under 2026 rules.

| Credential | Verification Method | Canadian Requirement | Red Flags |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope via email; validate at iso.org or accredited body portal (e.g., SGS, TÜV) | Mandatory for CMDCAS | Certificate issued by non-accredited Chinese bodies (e.g., “China Certification & Inspection Group”) |

| CE Mark (EU MDR) | Check NB number on certificate; verify at NANDO database | Required for Health Canada licensing | Missing NB number or certificate expiry before shipment date |

| Health Canada License | Supplier must provide Canadian license number; verify at MDALL database | Legal requirement for sale in Canada | Claiming “will apply after shipment” – illegal under SOR/2024-149 |

Step 2: Negotiating MOQ with Clinical Workflow Realities

2026 Market Shift: Canadian distributors now demand flexible MOQs due to hybrid clinic models (solo practitioners + group DSOs). Avoid suppliers insisting on 50+ unit MOQs – unsustainable for Canadian market penetration.

| MOQ Strategy | Advantage for Canadian Buyers | Risk Mitigation |

|---|---|---|

| Phased MOQ (e.g., 5 units initial) | Test market acceptance with minimal capital risk | Include performance clause: “MOQ increases to 20 units after 3 months if defect rate <0.5%” |

| Software/Hardware Bundling | Avoid hidden SaaS costs (critical under CADR 2.0 cybersecurity rules) | Require written confirmation: “Scanner includes perpetual license for Canadian dental software (e.g., Dentrix, exocad)” |

| Consolidated Shipping MOQ | Combine with chairs/CBCT to meet MOQ without scanner overstock | Specify: “MOQ applies to total order value (CAD $50,000), not unit count” |

Step 3: Shipping Terms – DDP vs. FOB for Canadian Compliance

2026 Critical Factor: New Canada Border Services Agency (CBSA) tariff code 9018.49.00 (digital dental scanners) requires precise HS code classification. DDP (Delivered Duty Paid) is strongly recommended for clinics lacking customs expertise.

| Term | Canadian Cost Impact | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | • +18.8% duties (MFN rate) • +5% GST on landed cost • CBSA clearance fees ($120+) • Risk of 21-day port delays |

Only for distributors with CBSA-certified customs brokers |

| DDP Toronto/Vancouver | • All-inclusive price (duties/GST pre-paid) • Guaranteed 14-day delivery timeline • Supplier handles CBSA Form B3 • No surprise brokerage fees |

STRONGLY ADVISED for clinics & new distributors |

Verified Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Recommended for Canadian Market (2026):

- Compliance Verified: ISO 13485:2016 (SGS Certificate #CN-SH-2026-0887), CE Mark under EU MDR (NB 2797), Health Canada License #145678 (active in MDALL database)

- MOQ Flexibility: 3-unit minimum for IOS (CJ-Scan Pro model); software included with perpetual Canadian license

- DDP Expertise: Dedicated CBSA-certified logistics team; 98.7% on-time DDP delivery to Canadian ports in 2025

- Technical Support: Bilingual (EN/FR) remote assistance; 24-month warranty with Canadian service centers

Email: [email protected]

WhatsApp: +86 159 5127 6160 (Mention “CAD2026 Guide” for priority compliance documentation)

Factory Address: Room 1201, Building 3, No. 388 Gucun Road, Baoshan District, Shanghai, China

2026 Sourcing Checklist for Canadian Buyers

- Confirm Health Canada license number before signing contract

- Require CAD-specific software validation report

- Specify DDP Incoterms® 2020 with CBSA Form B3 included

- Verify temperature-controlled shipping in purchase order

- Test for CADR 2.0 cybersecurity compliance (mandatory Jan 2026)

Disclaimer: This guide reflects 2026 regulatory requirements as of Q1 2026. Always consult Health Canada’s Medical Devices Directorate before procurement. Shanghai Carejoy is presented as a verified case study; not an exclusive recommendation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Buying Launch Scanners in Canada (2026)

- Physical mounting of the scanner unit and foot pedal (if applicable)

- Connection to clinic workstation (USB 3.0 or wireless)

- Installation of Launch Dental Suite software with DICOM and CAD/CAM compatibility

- Calibration and intraoral workflow testing

On-site installation is included with all direct purchases through authorized Canadian dealers. Certified technicians provide setup, staff training, and integration with existing practice management software (e.g., Dentrix, Open Dental). Remote pre-installation assessments are also available to ensure compatibility.

| Component | Coverage |

|---|---|

| Scanner Main Unit | Defects in materials and workmanship |

| Handpiece & Scanning Tip | Non-consumable internal components |

| Electronics & Sensors | Malfunction due to factory defects |

| Software | Updates and bug fixes for version stability |

Note: Consumables (e.g., disposable tips, protective sleeves) and damage from misuse, drops, or unauthorized modifications are excluded. Extended 3-year warranty packages are available for purchase at the time of acquisition.

- A dedicated toll-free support line (1-855-LAUNCH-DENTAL)

- Online service portal with case tracking and diagnostic tools

- Onsite technician dispatch within 48 hours for critical failures (available in major urban centers)

All support interactions are conducted in English and French. Repairs are completed at regional service hubs in Toronto, Montreal, and Vancouver, minimizing downtime. Loaner units are provided during extended repairs under active warranty.

Need a Quote for Launch Scanners Canada?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160